Inverse Head And Shoulders Breakout Suggests Bitcoin Price Is Headed To $300,000

March 04 2025 - 6:00PM

NEWSBTC

The Bitcoin price action is showing strong bullish signals, as a

rare Inverse Head and Shoulder pattern has just broken out and

retested its neckline. This technical setup suggests that Bitcoin

could be gearing up for a mega rally to $300,000 soon. Analyst

Forecasts Bitcoin Price Reversal On Monday, crypto analyst Gert van

Lagen took to X (formerly Twitter) to forecast an imminent Bitcoin

price surge to $300,000. The analyst presented a detailed price

chart depicting the formation of an Inverse Head and Shoulder

pattern, showcasing its left shoulder, head, right shoulder, and

neckline. Related Reading: Bitcoin $166,000 Target Still In

Play? The Extension That Determines Where Price Goes Next Based on

his analysis on X, Lagen highlights that Bitcoin has successfully

broken above the neckline of this technical pattern, confirming a

possible bullish reversal. Specifically, the Inverse Head and

Shoulder pattern is a classic technical indicator that signals a

shift from a bearish trend to a bullish trend. The left shoulder of

the pattern highlights a price decline followed by a temporary

recovery. The head suggests a deep drop, marking the lowest point

of the trend. The right shoulder indicates a smaller decline

followed by a breakout above the neckline. Bitcoin broke above the

pattern’s neckline around the $86,972 price point. Lagen has

pointed out that a successful retest of this neckline could

solidify Bitcoin’s bullish move. This is because, historically,

once this pattern is confirmed, cryptocurrencies tend to witness

significant upside momentum. Based on the measured move of

the Inverse Head and Shoulder, Lagen predicts that Bitcoin is on

track to reach $300,000 this bull cycle. This would represent a

whopping 258.4% increase from its current market price. The analyst

also highlights a sell line between $340,000 and $380,000; here,

traders are likely to exit or take profits. Supporting this

bullish outlook is a parabolic step-like formation on the Bitcoin

price chart. Lagen revealed that this follows a series of

formations from Base 1 to 4 before triggering an explosive price

rally. Currently, Bitcoin has completed Base 3 and is entering its

final parabolic phase. This technical formation aligns with the

Elliott Wave theory that suggests that a strong Wave 5 could result

in a significant price surge. While the analyst is confident

in his $300,000 Bitcoin price projection, he warns that it could be

completely invalidated if BTC drops below $72,900 in the weekly

timeframe. Furthermore, a break below this threshold could signal a

deeper price correction and delay the rally. Update On BTC’s Price

Analysis While analysts remain optimistic about Bitcoin’s future

outlook, the cryptocurrency experiences bearish momentum. In just

24 hours, Bitcoin lost virtually all the price gains it had

accumulated since President Donald Trump announced plans for a

crypto reserve. Related Reading: Bitcoin Flag Pole Pattern Puts

Price At $120,000, Analyst Explains The Roadmap The cryptocurrency

was trading above $92,000 the previous day. However, Bitcoin has

been down 9.18% in the last 24 hours and a whopping 16% over the

past month, according to CoinMarketCap. This severe price decline

has pushed the value of Bitcoin down to $83,699 as of writing.

Featured image from Adobe Stock, chart from Tradingview.com

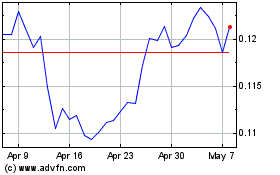

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025