XRP Breakout: Analyst Targets $6 In Short Term, $60 Long Term If This Level Is Cleared

February 23 2025 - 2:30PM

NEWSBTC

XRP’s price action has taken a step back over the past week, with

momentum slowing down amid broader market consolidation. After

starting the previous week around $2.75, XRP has struggled with a

pullback as sellers controlled most of the just-concluded trading

week. Related Reading: Dogecoin Whales Go On A 110-Million

Memecoin Buying Spree—What’s Next For DOGE? Interestingly, crypto

analyst Egrag Crypto has outlined opti mistic scenario where the

XRP price could enter a bullish trajectory that sets up short-term

targets of $4–$6 and long-term projections as high as $60. Critical

Resistance Around $3 Holding Back XRP’s Rally At the time of Egrag

Crypto’s analysis, XRP was trading at $2.67 on a brief extension of

its losses from $2.75. As the analyst noted, XRP has been facing

heavy resistance around the $2.75 to $3.00 range. This zone has

historical significance, as it marks a psychological threshold from

the altcoin’s previous all-time highs levels around $3.40. As such,

Egrag Crypto noted that a monthly close above $3.00 would translate

into a strong bullish momentum, while a rejection could cascade

into a pullback towards support levels. Should XRP manage to

clear $3.00, the next major resistance levels align with Fibonacci

extensions at $4.30 and $6.40. What this essentially means is that

a strong monthly close above $3 will give XRP the free reign tp

push above its current all-time high and it most likely will not

meet a strong resistance level until it reaches $4.30 or $6.40.

Beyond the short-term resistance at $3.00, Egrag’s analysis

suggests that XRP is forming a Parabolic ARC pattern with three

distinct phases. These three phases each have their own price

targets of $33, $50, and $60 depending on the path it follows.

These paths are highlighted in the XRP price chart below. The

breakout sequence follows a structured roadmap in the event of a

breakout above the Fib 1.618 extension level at $6.40. If

surpassed, this could open XRP to a long-term price rally to $8,

$13, $27, and even $67 based on Fibonacci extension levels.

Rejection At $3 Could Derail XRP’s Price Breakout Despite the

promising setup, there are still risks of a rejection at $3. A

failure to reclaim $3 could force XRP into an extended period of

sideways movement or, worse, a retracement toward $1.90–$2.00. If

market sentiment weakens further and XRP breaks below $1.90, it

could indicate a shift toward a deeper correction, with $1.00, or

even as the next downside risk level. This extreme case is

currently unlikely, though, except there’s something that the

analyst calls a ‘Black Swan’ across the entire crypto market.

Related Reading: Dogecoin $3 Dream: Whale Activity Hints At A

Surge—Details However, the current market trajectory suggests that

the overall bullish structure remains intact, provided XRP holds

above key levels, and volume confirms momentum in the coming weeks.

At the time of writing, XRP is trading at $2.57. Featured image

from Haberler, chart from TradingView

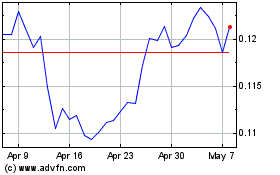

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025