Dogecoin Price Consolidates In Symmetrical Expanding Triangle, What’s Next For DOGE?

February 19 2025 - 9:00AM

NEWSBTC

Dogecoin (DOGE) is once again making waves in the crypto

market. This time, it’s due to a fascinating technical pattern

forming on its price chart: a symmetrical expanding triangle. Known

for signaling periods of heightened volatility and potential

breakout opportunities, this pattern has traders and investors on

the edge of their seats, wondering what’s next for DOGE. The

symmetrical expanding triangle is a rare and dynamic formation,

marked by its widening price range and converging trendlines. For

Dogecoin, this pattern reflects a tug-of-war between bulls and

bears, with neither side gaining a clear upper hand yet. As the

triangle continues to develop, the likelihood of a decisive price

movement grows, setting the stage for an explosive breakout or

breakdown. Analyzing Dogecoin’s Current Price Action Within The

Expanding Triangle Dogecoin’s price action within the symmetrical

expanding triangle suggests heightened market indecision as both

bulls and bears attempt to assert dominance. The widening nature of

the triangle indicates increasing volatility, with each price swing

becoming more extreme. Related Reading: Dogecoin (DOGE) Stuck In

Limbo—What’s Holding Back The Recovery? Currently, DOGE is

oscillating between the upper resistance trendline and the lower

support trendline of the expanding triangle. Each swing is becoming

more pronounced, with a higher high of $0.2923 and a lower low of

$0.2403, reflecting increasing market uncertainty and aggressive

trading activity. These key support and resistance trendlines

will determine the next major move. If buyers push the price toward

the upper boundary, a breakout could signal a bullish continuation.

Conversely, a drop toward the lower trendline hints at a possible

bearish breakdown. Volume trends and technical indicators

like RSI will provide further confirmation of market sentiment as

DOGE approaches a decisive move. A rising RSI toward the 50%

threshold may indicate a strengthening upside momentum, whereas a

continued downward move might reinforce the bearish outlook.

Furthermore, an uptick in volume alongside a price surge would

support a sustained rally while declining volume leads to weakening

conviction among market participants. Key Levels To Watch For A

Confirmed Breakout As DOGE continues to trade within a symmetrical

expanding triangle, identifying key levels for a confirmed breakout

is crucial for traders and investors. When a bullish or bearish

breakout occurs, it could signal the start of a new trend, making

it essential to monitor these levels closely. Related Reading:

Dogecoin Rally To $0.35 Could Trigger Massive Short Squeeze

Specifically, a strong close above the upper boundary of the

pattern near $0.2923, coupled with a notable surge in trading

volume, would confirm an upward breakout. This move will probably

pave the way for further growth, driving the price toward $0.3563

or beyond. However, If DOGE fails to hold support near $0.2403,

selling pressure could intensify, pushing the price down to $0.1800

or lower. A sustained bearish move below this level points to a

deeper correction, bringing historical support zones into focus.

Featured image from Adobe Stock, chart from Tradingview.com

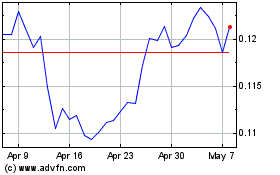

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025