Bitcoin Taker Sell Volume Plunges: Is BTC Gearing Up for a Major Rebound?

January 27 2025 - 3:00PM

NEWSBTC

Bitcoin has experienced a rollercoaster start to the week, briefly

dipping below the $100,000 mark in the early hours of Monday before

recovering slightly. This correction came after Bitcoin achieved a

new all-time high above $109,000 last week, marking a milestone in

the cryptocurrency’s ongoing bull run. At the time of writing,

Bitcoin’s price has climbed back above $100,000, leaving investors

speculating whether the asset will resume its upward trajectory or

enter a prolonged consolidation phase. Amid this, Burak Kesmeci, a

contributor to CryptoQuant’s QuickTake Platform. Kesmeci recently

highlighted intriguing trends in Bitcoin’s trading volume on

Binance, suggesting that current selling pressure may be “easing.”

Related Reading: Bitcoin’s Latest ATH: Is The Top Finally In Or

Just Getting Started? Taker Sell Volume Shows Signs of

Stabilization Kesmeci’s analysis focuses on the Taker Sell Volume

metric on Binance, which has shown a noticeable uptick in recent

sessions. Historically, Taker Sell Volume spikes have signaled

heightened selling activity, eventually giving way to buying

momentum. Kesmeci notes that these episodes often coincide with

local bottoms as sell orders are completed and new buy orders start

to flow in. However, in the past week, hourly data shows a pattern

of lower highs in Taker Sell Volume, indicating a gradual decline

in selling pressure. This trend suggests that as major sell orders

are fulfilled, the influence of sellers is waning, potentially

paving the way for renewed buying interest. According to the

analyst, if this pattern holds, Bitcoin could be poised for another

rally, contingent on sustained buyer engagement at current price

levels. What The Stablecoin Market Current Stance Signal For

Bitcoin While Kesmeci’s analysis offers a promising outlook, other

factors contribute to a more cautious market environment. A

separate post by analyst Avocado Onchain highlights the shifting

dynamics of stablecoin flows. USDC deposits into exchanges have

surged, potentially signaling increased interest in digital assets.

However, this influx coincided with Bitcoin’s price falling back

below $100,000. Avocado also points to a negative Coinbase Premium,

a metric that reflects US-led buying momentum. With this indicator

showing weakness, the expected strong support from US investors has

yet to materialize. Meanwhile, market sentiment has been influenced

by speculation over a potential bubble in US AI tech stocks, as

well as concerns about broader corrections in risk assets. Related

Reading: Bitcoin Sudden Breakdown: Price Falls Below $100,000

Support Under these conditions, Avocado highlighted that Bitcoin

may face an extended consolidation period before resuming its

upward climb. The analyst wrote: Bitcoin is more likely to undergo

a substantial consolidation period before showing signs of

recovery, rather than rebounding in the short term. Thus, it is

important to approach the market with a long-term perspective

rather than a short-term one. I remain optimistic about Bitcoin셲

long-term outlook. Featured image created with DALL-E, Chart from

TradingView

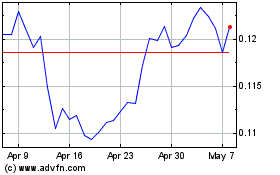

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025