‘Crypto Has Already Won’, Regardless Of Trump Or Harris Win: Bitwise CIO

November 05 2024 - 3:30PM

NEWSBTC

Matt Hougan, Chief Investment Officer of Bitwise Asset Management,

declared in an investor note today that the crypto industry has

secured its place in the financial world, irrespective of the

outcome of today’s US presidential election between President

Donald Trump and Senator Kamala Harris. In his note titled “Crypto

Has Already Won,” Hougan stated, “There is nothing left to say

about Tuesday’s election.” He provided a succinct assessment for

investors: “Short-term, a Trump victory is better than a Harris

victory. Long-term, Bitcoin, Ethereum, and stablecoins will thrive

regardless of who wins. Altcoins have more regulatory risk in a

Harris regime than a Trump regime.” Hougan cautioned that the only

unfavorable scenario for crypto would be a Democratic sweep. “It

would embolden the fringe element of the Democratic Party that is

overtly hostile to crypto. But even in that scenario, I’d buy the

dip,” he wrote. Reflecting on the industry’s resilience over the

past four years, Hougan emphasized, “If there’s one thing the past

four years has taught me, it’s this: Washington can’t stop crypto.

It can alter the trajectory. It can speed things up or slow things

down. It can bring more confusion or new clarity. But it can’t stop

it.” Related Reading: Crypto Expert Discloses ‘Hidden Altcoin Gem’

With 1,900% Upside According to the Bitwise CIO, the presidential

election serves as a milestone to evaluate the crypto sector’s

growth since November 2020. Despite a combative regulatory

environment—including “Operation Choke Point 2.0,” numerous SEC

lawsuits, and a host of contradictory or ambiguous statements—the

progress made is remarkable. Hougan noted, “We focus so much in

crypto on the moment-by-moment movement of prices that we often

lose sight of the long-term trends. The presidential election

provides a nice opportunity to step back and see how far we’ve

come.” ‘Crypto Has Already Won’ He presented compelling statistics

comparing November 2020 to November 2024. Bitcoin’s price increased

from $13,677 to $69,492, a 408% rise. Ethereum went from $388 to

$2,492, marking a 552% increase. Solana experienced a meteoric rise

from $1.49 to $165.12, an increase of 10,982%. In terms of trading

volume, the CME Bitcoin Futures Open Interest in October surged

from $0.57 billion to $10.58 billion, a 1,756% increase. The

seven-day moving average of crypto daily exchange volume expanded

from $9.68 billion to $39.32 billion, a 306% increase.

Decentralized exchange volume in October soared from $12.6 billion

to $156.5 billion, reflecting an 11,142% increase. Assets under

management also saw significant growth. The Bitcoin spot ETF assets

under management, nonexistent in November 2020, reached $71.46

billion by November 2024. Stablecoin assets under management

dramatically increased from $3.87 billion to $177.83 billion, a

4,495% rise. The total value locked in decentralized finance

platforms increased from $9.57 billion to $139.3 billion, a growth

of 1,356%. Related Reading: Top Crypto Analyst Unveils Best

Altcoins For The 2025 Bull Run Network activity showed substantial

increases as well. Monthly transactions on the Bitcoin network grew

from 9.28 million to 20.48 million, a 121% increase. Monthly

transactions considering Ethereum and Layer 2 solutions saw a

massive rise from 33.3 million to 385.8 million, a 1,059% increase.

Mainstream adoption indicators also highlighted crypto’s

integration into traditional finance and politics. The number of

top 20 asset managers with tokenized funds increased from none in

2020 to three in 2024. BlackRock’s adoption of Bitcoin and

Ethereum, nonexistent in 2020, is one of the biggest stories in

2024. Because of all that, Hougan expressed strong confidence in

the continuation of these positive trends. “The question to ask

yourself as you look at the above statistics is whether they will

continue. From my seat, the answer is a resounding yes,” he

affirmed. He outlined several key expectations: spot crypto ETF

inflows will continue; stablecoins will continue to grow rapidly;

institutions will continue to ‘get off zero’ and add allocations to

Bitcoin and crypto; Wall Street will continue to embrace

tokenization and real-world assets; blockchains will continue to

get faster and cheaper; and real-world applications like Polymarket

will continue to break through and gain mainstream adoption. While

acknowledging the election’s significance, Hougan minimized its

long-term impact on Bitcoin’s and crypto’s trajectory. “Make no

mistake: What happens in Tuesday’s election matters, particularly

in the short term. But as I see it, over the long term, Tuesday

will prove to be something between a speed bump and a wind gust.

Neither is going to stop this train,” he concluded. At press time,

Bitcoin traded at $68,932. Featured image from YouTube, chart from

TradingView.com

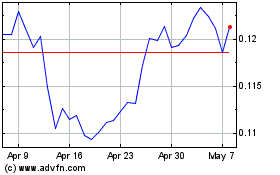

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024