Stacks (STX) Skyrockets Over 43% And Smashes $2 Threshold, Setting Sights On New All-Time Highs

February 14 2024 - 12:00AM

NEWSBTC

Stacks (STX) has garnered significant attention in the

cryptocurrency industry as it emerges as a leading altcoin

contender. With an impressive performance surpassing all top

100 tokens, except for Dymension (DYM), Stacks has witnessed a

remarkable surge in the past 24 hours, catapulting its value well

above the $2 mark and inching closer to its all-time high (ATH) of

$2.492. This surge can be attributed to various factors,

including its positioning as a Bitcoin layer for smart contracts,

the recent surge in Bitcoin’s price, and the token’s adoption and

growth rate. Stacks Climbs The Market Cap Rankings As outlined in

the project’s white paper, Stacks serves as a Bitcoin layer for

smart contracts, enabling trustless utilization of Bitcoin as an

asset in smart contracts and facilitating transaction settlements

on the Bitcoin blockchain. Related Reading: Expert Who

Predicted 2021 Bitcoin Peak Expects $600,000 By 2026 The recent

surge in Bitcoin’s price over the past few weeks has also acted as

a catalyst for Stacks’ price surge. Currently trading at $2,156,

Stacks has experienced a significant recovery from its low of

$1,241 during a market downturn that bottomed on January 23.

Notably, this recovery coincided with Bitcoin’s price rebound from

$38,500 to $43,000, highlighting the correlation between the two

assets. Market expert Trover.btc, known on X (formerly Twitter),

has noted Stacks’ impressive ascent in the market cap rankings.

From being ranked around 60, Stacks has climbed to the 34th

position within a year, surpassing well-known projects. With

the Bitcoin Layer 2 narrative gaining prominence and Layer 1

network fees reaching all-time highs, expectations are high for

Stacks to enter the top 20 rankings around the halving, according

to Trevor.btc. STX Sets All-Time High Total Value

Locked A key metric to consider is its market capitalization

(fully diluted) to gauge Stacks’ adoption and growth rate.

According to Token Terminal data, Stacks’ market cap has

experienced a notable surge of 187% in the past 90 days and an

impressive increase of over 527% year-to-date, aligning with the

token’s price surge. Moreover, data from on-chain analytics

aggregator DefiLlama reveals that Stacks’ total value locked (TVL)

has reached an all-time high of $70.41 million. This

represents a significant increase of over 400% in just four months,

highlighting the growing confidence and demand for Stacks within

the decentralized finance (DeFi) ecosystem. Related Reading:

Ethereum ETF: Franklin Templeton Enters The Fray As ETH Rallies As

the demand and interest in the protocol and its native token

continue to grow, whether Stacks will surpass its previous all-time

high or experience a correction remains to be seen. The

notable correlation between STX and BTC suggests that Bitcoin’s

retracement from its current two-year high could also impact the

price of STX. However, the token has significant interest, as

reflected in the highlighted metrics above. With the anticipated

bull run gaining momentum leading up to the Bitcoin halving event,

STX has the potential to reach even higher levels and climb the

crypto rankings within the industry. Observing how the STX price

reacts in the coming days and weeks will be interesting. While

uncertainties exist, the token’s current high level of interest

suggests a positive outlook for its future performance. Featured

image from Shutterstock, chart from TradingView.com

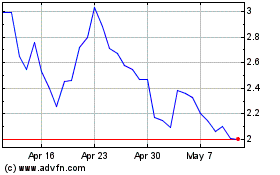

Stacks (COIN:STXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

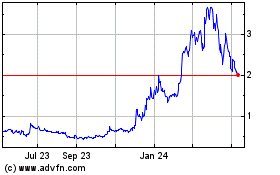

Stacks (COIN:STXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024