Bitcoin Tumbles Following Higher Than Anticipated US Core Inflation Data

September 11 2024 - 12:09PM

NEWSBTC

The higher-than-anticipated US core Consumer Price Index (CPI)

reading was followed by a decline in Bitcoin (BTC) price as it

tumbled almost 1.5% to $56,168 at press time. US Headline CPI

Matches Forecast, Core CPI Exceeds It US headline CPI, the metric

typically used to assess the inflation rate in the country, came in

according to expectations at 0.2% month-over-month (MoM), and 2.5%

year-over-year (YoY) for August 2024. However, core CPI (MoM)

printed 0.3%, slightly higher than the 0.2% forecasted by

economists. For the uninitiated, the difference between the

headline CPI and core CPI is the constituents of the basket of

items they assess. While the headline CPI measures all item

categories, including housing, transportation, services, medical

care, food, and energy, core CPI excludes food and energy prices to

give a more stable view of underlying inflation trends. By removing

the price of volatile items from its calculation, core CPI is often

considered a more accurate indicator of long-term inflation.

Following the unexpected core CPI print, BTC witnessed a quick

decline in price as it fell from around $57,000 to $56,168 at the

time of writing. The wider crypto market displayed similar trends

as Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and Ripple

(XRP), which are down by 2.1%, 1.3%, 4.6%, and 2.4%, respectively.

With the CPI data for August 2024 released, it seems all but

certain that the US Federal Reserve (Fed) will begin its rate-cut

cycle with a 25 basis points (bps) cut in September. In a note,

Capital Economics’ Paul Ashworth said: On balance, we still think

the Fed will begin its rate cutting cycle with a more modest 25 bps

cut. The 3.2% annual core CPI was mostly due to a 5.2% increase in

shelter prices, while the three-month annualized core CPI rebounded

only to 2.1% from a weak 1.6%. Related Reading: How Will The US

Upcoming Fed Rate Cut Impact Bitcoin? QCP Analysts Weigh In Indeed,

following the CPI data release, the probability of the Fed slashing

rates by 25 bps next week has jumped to 83%, per data from CME

FedWatch. Assuming the Fed reduces rates by 25 bps, it should

instill some confidence in crypto and stock

markets, fearing a 50 bps cut could signal the Fed not

being fully confident in its ability to tackle inflation. What Lies

Ahead For Bitcoin? As BTC remains loosely range-bound between

$52,000 to $70,000 on the daily chart, analysts are speculating on

the future trajectory the leading digital asset’s price could take.

Some analysts opine that BTC’s current price action is reminiscent

of a similar price consolidation in 2023. If the same scenario

plays out in 2024, we could see a new Bitcoin all-time-high (ATH)

price. It will also be interesting to see the impact of the US

Presidential Elections scheduled to happen in November 2024.

Interestingly enough, some election-agnostic analysts have stated

that no matter who wins the election later this year, BTC is slated

to win in the long term. Related Reading: Ripple Co-Founder

Endorses Kamala Harris’ Campaign Ahead Of Presidential Debate At

the time of writing, Bitcoin trades at $56,168 while the total

cryptocurrency market cap sits at $1.94 trillion, down 2.3% in the

past 24 hours. Featured Image from Unsplash.com, Charts from

cmegroup.com and TradingView.com

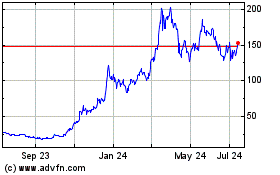

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024