Ethereum Liquid Staking Protocols Hit New Milestone Following Massive Inflows

September 26 2023 - 9:30AM

NEWSBTC

Ethereum liquid staking platforms are making waves in the

decentralized finance (DeFi) ecosystem. Recent on-chain reports

have revealed that liquid staking protocols have recorded a new

milestone in the number of Ether (ETH) staked, reaching a

staggering 12 million ETH mark in just a few days. Ethereum

Liquid Staking Gains Momentum With Ethereum 2.0 thriving, liquid

staking protocols in the DeFi ecosystem have been growing rapidly

despite recent market volatility. Research data from DeFi TVL

aggregator, Defillama, revealed on Monday, September 25, the

tremendous growth of Ethereum holdings in liquid staking platforms.

According to the data, the ETH in liquid staking protocols has

risen to approximately 12.31 million and may continue rising.

Related Reading: Number Of Ethereum Addresses Losing Money Just

Reached A New All-Time High Reports uncovered that a staggering

370,000 ETH were staked in just five days, allowing liquid staking

protocols to reach their current 12 million mark. Liquid staking

platforms like Lido, Rocket Pool, Coinbase, and Binance are among

the list of prominent protocols that led to the recent upsurge in

Ether staking. According to Defillama TVL rankings, Lido

holds the top spot for the amount of Ethereum staked with a TVL of

$13.997 billion in liquid staking. The protocol secured over 8

million Ether on September 20, and another 30,000 after that. Lido

Finance dominates ETH liquid staking | Source: DeFiLlama Coinbase

is presently ranked second in Defillama’s TVL rankings, holding

approximately $2.155 billion, a significant gap from Lido’s

TVL. Coinbase has about 1.3 million Ether presently in its

reserve. Whereas, Rocket Pool holds the third position in TVL

rankings and has increased its Ether holdings from 940,496 to

945,402. Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driving force behind

the recent spike in ether influx in liquid staking protocols in the

DeFi ecosystem. According to reports, Binance added a

startling amount of ether to its already substantial ether

reserves. The liquid staking platform which previously recorded

445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105

ETH. Research data have revealed that Binance amassed a

considerable amount of ETH tokens to support its staking token,

Wrapped Beacon ETH (WBETH). Related Reading: Crypto Analyst Says

Prepare For 100% Increase In Bitcoin Price As Historical Pattern

Forms In the last three months, the DeFi ecosystem recorded a

liquid staking valuation above $20 billion evaluating various

protocols in the DeFi ecosystem. Following this, Defillama’s

September data revealed liquid staking protocols now hold $20.5

billion in assets, increasing by a staggering 293% from previous

lows in June 2022. Although the key protocols steering the

surge are Lido, Binance, and Rocket Pool. Other upcoming liquid

staking protocols like Davos and InQubeta are persisting, driven by

the Ethereum 2.0 upgrade and investors desire to maximize their

earnings through Ethereum staking. ETH price at $1,587 as liquid

staking surges | Source: ETHUSD on Tradingview.com Featured image

from iStock, chart from Tradingview.com

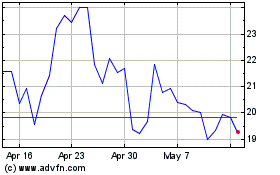

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

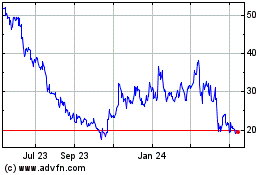

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024