Bitcoin Spot-Perpetual Gap Points To Continued Selling Pressure – Analyst

August 17 2024 - 7:00AM

NEWSBTC

The month of August has been largely uneventful for Bitcoin so far,

with the premier cryptocurrency having struggled to reclaim the

$65,000 price mark since August 2. Currently, Bitcoin is slightly

below $60,000 as the bulls and bears seek to grab control in what

has been a range-bound market for the past week. Interestingly,

CryptoQuant analyst XBTManager has shared revelations that indicate

the BTC market is likely to maintain its current bearish form for

the time being. Related Reading: Bitcoin Bears in Control? Record

Low Funding Rates on Binance Signal Market Shift Wide

Spot-Perpetual Gap Spells Trouble For Bitcoin On August 16,

XBTManager reported that Bitcoin’s Spot-Perpetual Price Gap, as

tracked on the Binance exchange, is continually in a negative form

indicating that the asset may record more price loss due to a

sustained selling pressure. For context, a Spot-Perpetual

Price gap occurs when there is a difference between the valuation

of Bitcoin on the spot market which deals with the asset’s actual

price, and on the perpetual markets which allow traders to deal in

speculations of the Bitcoin’s future price. When the perpetual

price is lower than the spot price as in the current case of

Bitcoin, it indicates traders are massively offloading the asset in

the perpetual futures market as they believe there could be an

incoming price fall. Expectedly, XBTManager predicts this

negative spot-perpetual gap will translate into a heightened

selling pressure in the spot market as several traders will look to

sell their assets and buy in the perpetual market thus taking

advantage of the arbitrage to gain some profit. In the advent

of such a reaction, deep liquidation hunts might occur i.e. where a

large number of leverage positions are forcefully closed down,

leading to a larger negative Spot-Perpetual Gap, and increased

selling activity. However, XBTManager has noted a potential

positive for Bitcoin in this uncanny situation. The analyst states

that high selling pressure will likely result in an accumulation of

multiple short portions on Bitcoin. Therefore, the instance of

a sudden price gain might force these positions to close leading to

some significant buying activity that could reduce the current

negative Spot-Perpetual Price gap. Related Reading: Bitcoin Still

At Risk Of Further Correction, CryptoQuant Head Says BTC Price

Overview At the time of writing, Bitcoin trades at $58,981 with a

2.28% gain in the past day. However, the token’s daily trading

volume is down by 16.37% and is valued at $29.5 billion. On larger

time frames, Bitcoin also remains in the red zone with a loss of

2.92% and 8.76% over the last seven and thirty days

respectively. Featured image from The Economic Times, chart

from Tradingview

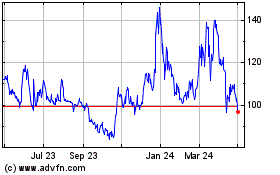

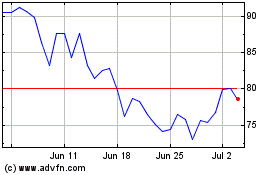

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024