Short-Term Bitcoin Sellers Retreat—Could This Spark a Market Comeback?

February 21 2025 - 6:00AM

NEWSBTC

Bitcoin’s price remains below the $100,000 mark, trading at $98,000

at the time of writing. While this positions its daily performance

in positive territory, the larger picture suggests continued

bearish pressure. Over the past month, Bitcoin has declined by 6%,

and its current price represents a 10% decrease from the all-time

high above $109,000 recorded last month. This prolonged downturn

has led market participants to closely examine on-chain metrics for

clues about what might come next. Related Reading: Bears In

Trouble? Bitcoin Liquidity Signals A Brutal Squeeze To $111,000

Short-Term Bitcoin Sellers Are Fading One key indicator, the

Short-Term Holder Spent Output Profit Ratio (STH SOPR), has gained

attention recently from a CryptoQuant Analyst. The analyst known as

Burak Kesmeci in a recent upload on the QuickTae platform revealed

that STH SOPR which measures whether short-term holders—those who

have held their coins for less than 155 days—are selling at a

profit or a loss appears to now be fading. A value above 1.00

indicates profit-taking, while a value below 1.00 suggests losses.

In 2025 so far, this metric has shown that short-term holders have

sold at a loss during three notable corrections. According to the

analyst, on January 8, Bitcoin’s price dropped from $104K to $92K,

driving STH SOPR down to 0.987. Similarly, on January 27, a

correction from $106K to $102K pushed the ratio to 0.990, and on

February 2, a plunge from $104K to $91K brought it to 0.984.

Short-Term Holders and Future Market Sentiment Kesmeci revealed

that Bitcoin appears to be consolidating between $94K and $97K,

with STH SOPR at 0.998. This near-neutral level suggests that

short-term holders are no longer selling at significant losses,

indicating that the fear-driven selling seen earlier in the year

may be subsiding. This shift is quite noteworthy because sentiment

among short-term holders often plays a critical role in the

market’s overall trajectory. When short-term holders start turning

a profit, they are more likely to share positive experiences,

potentially encouraging new investors to enter the market. This

dynamic can help accelerate upward momentum, laying the groundwork

for the next bullish phase. The recent stabilization of STH SOPR,

along with Bitcoin’s steady price range, may set the stage for a

stronger rally in the months ahead. However, while it is still

early to determine the direction of the next major market move, the

near-neutral STH SOPR suggests that selling pressure from

short-term holders has overall diminished. This could pave the way

for a more stable price environment, and if positive sentiment

continues to grow, Bitcoin may see renewed interest and an eventual

return to higher price levels. Featured image created with DALL-E,

Chart from TradingView

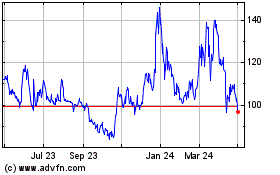

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

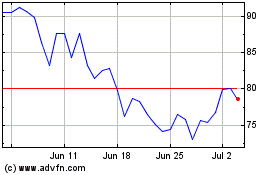

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025