Analysts Say Now Is the Time to Re-Accumulate Bitcoin—Here’s Why

August 30 2024 - 5:30PM

NEWSBTC

Bitcoin (BTC), after briefly reclaiming the $61,000 price mark

yesterday has now fallen below it continuing its bearishness as of

today. Amid this negative price action, the asset’s hash price, a

key metric reflecting miners’ profitability, has reached

historically low levels. According to a recent analysis by

Woominkyu, a CryptoQuant analyst, this significant drop in hash

price might signal a prime buying opportunity for investors.

Related Reading: Bitcoin Reclaims $61,000: Key Levels To Watch For

Continuous Surge Understanding The Hash Price And Its Relation To

Buying Opportunity Woominkyu revealed in his analysis that the hash

price, which measures the relationship between Bitcoin’s price and

the revenue miners generate per unit of computational power, has

shown a consistent pattern. When this metric falls to lower levels,

it often coincides with Bitcoin’s price bottoming out. Woominkyu’s

further shared a chart highlighting that the blue-shaded sections

on the chart represent periods where the hash price dipped,

corresponding to times when Bitcoin’s price was at or near its

lowest points. The historical data suggests that these periods have

been followed by significant price recoveries. Woominkyu believes

that the current low hash price could indicate that Bitcoin is near

a bottom, presenting a potential buying opportunity for long-term

investors. Lowest Bitcoin Hash Price Indicating the Buy Opportunity

“The highlighted sections in the chart indicate periods where the

Hash Price dropped to lower levels, corresponding to times when

#Bitcoin prices were also at or near their lowest points.” – By

@Woo_Minkyu Link 👇… pic.twitter.com/ZPf0cSTnNN — CryptoQuant.com

(@cryptoquant_com) August 30, 2024 Another Analyst Points To

Re-Accumulation Bitcoin Phase Echoing Woominkyu’s sentiment,

another renowned crypto analyst known as Moustache shared insights

on the Puell Multiple, a metric used to assess Bitcoin’s market

cycles. The Puell Multiple, which compares the daily issuance of

Bitcoin to its historical average, is currently at a level that

Moustache believes offers the second-best “re-accumulation”

opportunity since 2022. In a post uploaded on X earlier today,

Moustache emphasized that Bitcoin’s current market position is

comparable to previous significant periods in 2012, 2016, and 2020.

Related Reading: Bitcoin’s Momentum at Risk? NVT Golden Cross Sends

Warning Signals These were times when the market was primed for

substantial upward movements following a phase of consolidation.

#Bitcoin – The Puell Multiple I call it here: This is your second

best chance after 2022 to re-accumulate before the next wave

starts.$BTC is where it was in 2012, 2016 and 2020. Even if it

doesn’t feel like it, I think we’ve some incredibly exciting months

ahead of us. pic.twitter.com/lpVXQOXvtC — 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲

(@el_crypto_prof) August 30, 2024 Moustache suggested that despite

the current sentiment, the next few months could bring “incredibly

exciting” developments for Bitcoin. Featured image created with

DALL-E, Chart from TradingView

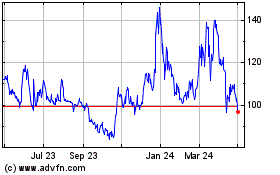

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

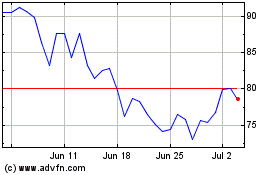

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024