ARB Surges Nearly 10% As Franklin Templeton Launches Fund on Arbitrum

August 09 2024 - 4:00AM

NEWSBTC

Financial asset manager giant Franklin Templeton is the latest

merging legacy financial mechanisms with blockchain technology.

This leading global asset management firm expanded its digital

asset integrations by launching its OnChain US Government Money

Fund (FOBXX) on the Arbitrum network. Following this debut,

Arbitrum network native token ARB has seen a significant surge in

market price, adding to the overall bullish crypto prices today.

Related Reading: Arbitrum Attracts Over 48% Of Assets From

Ethereum: Why Is ARB Down 68% In 7 Months? Government Money Fund On

Arbitrum As reported in a press release, Franklin Templeton’s

latest collaboration with the Arbitrum Foundation aims to harness

the “enhanced scalability and efficiency” of Arbitrum, currently

one of the largest Ethereum Layer 2 solutions by total value

locked. With $2.6 billion in deposits and a 34% market share,

Arbitrum is a leader in the Layer 2 space, particularly for its

high number of daily active addresses compared to its competitors.

This partnership, as reported, highlights Franklin Templeton’s

efforts to “leverage blockchain technology to enhance asset

management capabilities, offering clients innovative avenues for

investment.” Franklin Templeton’s @FTI_DA OnChain U.S. Government

Money Fund is now available on Arbitrum! We’re excited to have

access to the BENJI platform and see a major financial institution,

Franklin Templeton, build on Arbitrum!https://t.co/CRWCFyz3NM

pic.twitter.com/yrlwflYOow — Arbitrum (💙,🧡) (@arbitrum) August 8,

2024 The fund represented digitally via the BENJI token, is placed

to expose investors to US government securities through a

blockchain-enabled platform. The Benji Investments platform

facilitates transactions within digital wallets, promoting an

integration of traditional and digital investment practices.

Franklin Templeton Head of Digital Assets Roger Bayston

particularly noted: Expanding into the Arbitrum ecosystem is an

important step on our journey to empower our asset management

capabilities with blockchain technology. We are enthusiastic about

the opportunities this will unlock for our firm and our clients.

According to the report, maintaining a stable share price of $1 and

focusing primarily on government securities, FOBXX aims to deliver

“considerable” returns while incorporating the “security and

stability” associated with government-backed assets. ARB Surges

Nearly 10% So far, ARB has increased 9.3% in the past 24 hours

following the news. The asset trades for $0.53 at the time of

writing, marking a notable surge from its lower price of $0.43 on

Monday. According to data from CoinGecko, not only ARB’s price has

increased, the asset’s market cap valuation has also seen a more

than $100 billion boost over the past day. Related Reading:

Arbitrum Prints TD Buy Signal: Trend About To Flip? Interestingly,

despite this notable development, ARB’s 24-hour trading volume

hasn’t increased much, given the weight of the news. In the past

day, this metric has only increased from roughly $270,927 to

$288,552 at the time of writing. Featured image created with

DALL-E, Chart from TradingView

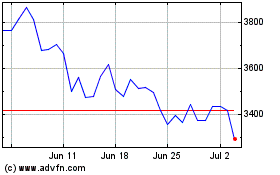

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jul 2024 to Aug 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Aug 2023 to Aug 2024