If Ethereum Holds $2,200 Price Could Recover Fast – Analyst Sets Price Target

March 02 2025 - 9:00AM

NEWSBTC

Ethereum is trading below the $2,300 mark after failing to hold key

demand levels last week. The price has faced intense selling

pressure, fueling concerns among investors that ETH may not see a

strong bull market ahead. Market sentiment remains uncertain as

Ethereum struggles to reclaim lost ground, with analysts divided on

whether the correction will continue or if a recovery is on the

horizon. Related Reading: Whales Add 190,000 Ethereum In The Last

24 Hours – The Accumulation Continues A technical perspective

suggests that ETH may still have a chance to bounce back. Crypto

analyst Ali Martinez shared an analysis on X, noting that if

Ethereum holds above the $2,200 level, it could set up for a

rebound toward $2,500. Martinez highlights that Ethereum is trading

near a crucial support level, which historically has triggered

strong upward moves. Bulls must defend the $2,200 mark to prevent

further declines, while reclaiming $2,500 would signal strength and

a potential trend reversal. However, continued weakness could lead

to another wave of selling pressure, pushing ETH even lower.

Investors remain cautious as they await confirmation of Ethereum’s

next move in this volatile market. Ethereum Faces A Critical Test

Ethereum has been struggling under heavy selling pressure and

negative sentiment, leading to extreme speculative activity

favoring bearish futures positions. The uncertainty surrounding

ETH’s price action has fueled doubts about its ability to recover

in the short term. Related Reading: Dogecoin Holds Critical Support

Level – Can Bulls Reclaim $0.25? Since late December, Ethereum has

lost 49% of its value, and investor sentiment remains in despair as

the price fails to reclaim key resistance levels. Many traders have

started to position themselves for further downside, reinforcing

the bearish outlook in the market. However, some analysts still

believe that Ethereum could soon stage a rapid recovery. Ethereum

is approaching a critical inflection point where a decisive move

could determine the asset’s next trend. This perspective aligns

with the few optimistic analysts who argue that Ethereum’s rally,

when it starts, will be aggressive. Historically, ETH has exhibited

sharp rebounds following prolonged periods of downside pressure,

and if the broader market conditions improve, the same could happen

again. For now, investors remain cautious, closely watching

Ethereum’s ability to defend the $2,200 support level and looking

for signs of renewed strength. Price Struggles Below $2,500

Ethereum is trading at $2,222 after struggling for days to reclaim

higher prices. The price has been under intense selling pressure,

and investor sentiment remains bearish as ETH fails to establish a

strong support zone. ETH bulls lost control last Monday when the

price started to decline rapidly, leading to a sharp 26% correction

in less than five days. This sell-off wiped out key support levels,

leaving Ethereum in a vulnerable position. For Ethereum to regain

momentum, bulls must push the price above the $2,500 level.

Reclaiming this mark would signal strength and potentially trigger

a recovery rally. However, without a strong push from buyers, ETH

could remain stuck in a slow consolidation phase below $2,500. This

would likely lead to prolonged indecision in the market, making it

difficult for traders to establish clear positions. Related

Reading: Is Solana In A Macro Trend Move? Charts Show Potential

Shift If ETH fails to reclaim $2,500 soon, the market could see

continued weakness, with sellers dominating price action. On the

other hand, if Ethereum manages to hold above the $2,200 mark and

build support, the possibility of a strong rebound remains on the

table. The next few days will be crucial as investors watch for

signs of a potential trend reversal or further downside movement.

Featured image from Dall-E, chart from TradingView

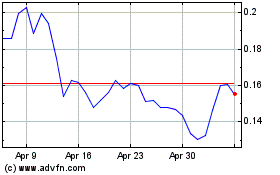

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025