Bitcoin Buying Pressure Wanes—Chart Reveals 60-Day Downtrend

February 19 2025 - 6:00PM

NEWSBTC

Analysts reported that the crypto community is witnessing a decline

in the buying pressure for Bitcoin, pushing the firstborn

cryptocurrency into negative territory. However, some market

observers noted that not all is lost in the recent slide of

Bitcoin, saying what seems to be an unfavorable condition offers

opportunities for long-term investors. Related Reading: Dogecoin To

$1.35? Analyst Predicts Milestone ‘Within 70 Days’ Downward Trend

Analysts said that a weakening buying pressure on Bitcoin might be

a cue that the crypto is entering a downward trend phase with some

observers saying that BTC is already within the negative pressure

zone. “Bitcoin’s buying pressure has decreased over the last 60

days, allowing room for selling pressure,” Joao Wedson, Founder

& CEO of Alphractal, said in a post. Bitcoin’s buying pressure

has decreased over the last 60 days, allowing room for selling

pressure. Negative regions present two opportunities: 🔸Favoring

short positions 🔸They signal that the downtrend may continue or has

occurred, creating an opportunity to accumulate BTC.

pic.twitter.com/dApRsS9Ihf — Joao Wedson (@joao_wedson) February

17, 2025 Crypto analysts noted that this condition might lead to a

decline in price which could be both good and bad for digital

assets traders. Data shows that Bitcoin is having a hard time

maintaining a bullish momentum as its price hovers around $95,912

per coin. Two Opportunities Wedson said that BTC has been

experiencing a decline in buying pressure in the last two months,

noting that the market shift could offer something positive to its

investors. “Negative regions present two opportunities,” the CEO

noted. He enumerated that among the opportunities is “favoring

short positions” which could be a good sign for traders. Another

bright spot is the weakened buying pressure that indicates the

“downtrend may continue or has occurred, creating an opportunity to

accumulate BTC.” In other words, the current condition of Bitcoin

could give investors a chance to build their BTC portfolio by

buying more coins. The Buy/Sell Pressure Delta Chart In a post,

Wedson presented two charts of the Buy/Sell Pressure Delta to

illustrate the shifting dynamics between buying and selling

activity in Bitcoin, which has been going on in the past 60 days.

Wedson explained that if the market is dominated by sell pressure,

investors can take advantage of the downward momentum by entering

short positions. According to historical data, negative pressure

zones usually align with a continued decrease in price, a

potentially profitable opportunity for traders betting on further

price declines. Meanwhile, the Alphractal executive showed in the

graph that a high sell pressure commonly indicates a bearish

sentiment, adding that this is a great opportunity for long-term

traders to increase their BTC holdings. Analysts explained

accumulating more Bitcoin during this period allows long-term

investors to position themselves for a future recovery. “The

decrease in buying pressure is a significant factor to consider.

While short positions might seem attractive in a downtrend, the

potential for accumulation also presents a compelling long-term

strategy,” a crypto investor commented on Wedson’s post. Related

Reading: Bitcoin Whales Accumulate—Will This Push BTC Toward $100K?

Bitcoin might continue to be at risk of further decline if the

buying pressure remains weak. Featured image from The Independent,

chart from TradingView

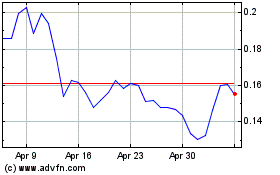

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025