Ethereum Forms A Bullish Pattern – Expert Reveals Short-Term Price Target

February 17 2025 - 10:00AM

NEWSBTC

Ethereum has been trading below the $2,800 mark for the past two

weeks as selling pressure at this critical level continues to

exhaust bullish momentum. Investors remain cautious amid heightened

volatility, fearing that Ethereum could extend its losses if it

fails to reclaim key levels. Despite the uncertainty, some analysts

see a potential breakout on the horizon. Related Reading: Dogecoin

Pulls Back To ‘The Golden Ratio’ – Analyst Expects A Bullish

Reversal Top crypto investor Carl Runefelt shared a technical

analysis on X, revealing that ETH is currently trading within a

4-hour symmetrical triangle. This pattern suggests that a decisive

move is coming, and if Ethereum manages to break out to the upside,

it could reclaim key supply levels and push toward $3,000. However,

if ETH fails to hold current levels and breaks down from the

triangle, further declines could follow. Ethereum has struggled to

gain momentum compared to Bitcoin and some other altcoins, raising

concerns about its relative weakness in this cycle. Traders are

closely monitoring price action, looking for confirmation of the

next major move. Whether ETH will break out or see further downside

remains uncertain, but the next few trading sessions will likely

determine its short-term trajectory. Ethereum Price Testing Crucial

Supply Ethereum is attempting to push above the $2,700 mark and

hold it as support to confirm the start of a recovery phase.

However, the real challenge lies ahead, as the key levels to

reclaim remain between $2,800 and $3,000. Analysts warn that if ETH

fails to recover these critical supply zones soon, a deeper

correction could follow. The market is currently waiting for

confirmation in either direction as Ethereum struggles to gain

bullish momentum. Carl Runefelt shared a technical analysis

highlighting that ETH is trading within a 4-hour symmetrical

triangle. This pattern signals an impending breakout, though the

direction remains uncertain. Runefelt states that if Ethereum

manages to break out to the upside, the immediate target will be

the $3,000 resistance level. A breakout above $2,800 would

strengthen the bullish case and signal a potential reversal of the

recent downtrend. Ethereum has been trading below $3,000 since

early February, with selling pressure preventing a breakout.

Investor sentiment remains mixed, as some expect ETH to reclaim its

bullish trend, while others fear further downside. Volatility

remains a major concern, and traders are looking for technical

signals to anticipate the next move. Related Reading: Ethereum

Historical Indicator Flashes Long-Term Buy Signal – Is History

Repeating? The coming days will be crucial for Ethereum as it tries

to regain strength. If ETH successfully reclaims the $2,800 mark

soon, a bullish breakout into the $3,000 zone becomes inevitable.

Traders are closely monitoring price action, looking for

confirmation of the next major move. Whether Ethereum will reclaim

its bullish momentum or face another leg down remains to be seen.

ETH Price Action Details: Technical Levels Ethereum is trading at

$2,750 after days of attempting to reclaim the $2,700 level. Bulls

are fighting to hold this critical support, as maintaining it could

provide the momentum needed for a breakout. If ETH holds above

$2,700 and manages to push past the $2,800 mark, it could trigger a

bullish surge into higher levels, with $3,000 being the next major

target. A move above this level would confirm a reversal of the

recent bearish trend and strengthen investor confidence. However,

uncertainty remains as selling pressure continues to weigh on ETH.

If the price fails to hold above $2,700, bears could regain control

and drive the price lower. A breakdown below this level would

likely lead to further selling pressure, pushing ETH toward lower

support zones. Investors are closely watching for a decisive move,

as failure to maintain current levels could result in more pain for

holders. Related Reading: Avalanche Holds Key Demand Zone – Analyst

Sets $30 Target If Momentum Holds The next few days will be

critical in determining Ethereum’s short-term trajectory. A

successful reclaim of $2,800 would pave the way for a bullish

recovery, while losing $2,700 could lead to a deeper correction.

Traders remain cautious, waiting for a clear signal before making

their next move. Featured image from Dall-E, chart from TradingView

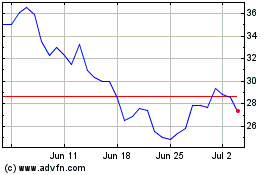

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

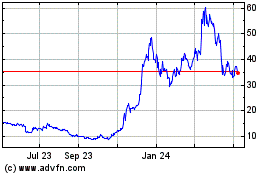

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025