By Eric Sylvers, Ben Foldy

Fiat Chrysler Automobiles NV and Peugeot maker PSA Group are

stopping almost all car production in Europe while Volkswagen AG

has shut factories in Italy and Spain, as global manufacturers try

to protect workers from the spread of the new coronavirus outbreak

and as supply lines start to break down.

Meanwhile, some of Italy's biggest companies -- suddenly on the

front lines of the outbreak -- are rethinking their assembly lines

and other manufacturing processes to stay open. Similar

re-evaluations are just now getting under way in the U.S., as the

outbreak spreads rapidly there now, too.

EssilorLuxottica SA, the French-Italian designer-eyewear

manufacturer of brands such as Ray-Ban and Oakley, said over the

weekend it is shutting its factories in northern Italy for several

days to implement new worker-protection measures negotiated with

labor unions. The company will be largely adopting Italian

government guidelines aimed at minimizing staff and spacing workers

at greater distances from one another in manufacturing sites and

along assembly lines.

Factory employees will also have to wear masks and get their

temperatures taken when entering the factory, among other measures,

the company said.

In the U.S., executives and industry analysts are also now

starting to think about how to adjust production schedules and

experiment with changes. In Chattanooga, Tenn., Volkswagen is

closing down its factory on Monday to allow workers to make

arrangements amid closed schools.

"We will also take time to augment the already increased

sanitary and deep-cleaning measures undertaken at our facility," a

spokesman said. Production will resume Tuesday.

Ford Motor Co. said Monday it would extend a previously planned

three-day shut down this week at its Valencia, Spain plant to the

entire week and then reassess the situation before resuming

production. The company said that three cases of coronavirus

infection have been confirmed within a 24-hour period. One of those

confirmed affected a person who didn't enter the plant.

"We are taking quick action to follow the established protocol,

including the identification and self-isolation of all employees

who had close contact with the affected workers. We will take all

other appropriate steps to ensure that risk from this situation is

minimized," Ford said in an email.

The United Auto Workers union and the three Detroit car makers

-- Fiat Chrysler, Ford Motor and General Motors Co. -- said Sunday

they were putting together a taskforce to adopt new procedures at

their U.S. factories to better protect workers. Those include

stricter visitor screening, additional social-distancing measures

and increased cleaning of common areas.

"This is a fluid and unprecedented situation, and the task force

will move quickly to build on the wide-ranging preventive measures

we have put in place," the UAW and the car companies said in a

joint statement.

Fiat Chrysler last week said it would also space out employees

at workstations at its Italian plants, a move that it said would

lower daily production rates. Monday morning, it took the more

drastic step of closing down almost all manufacturing in Europe for

two weeks.

The car maker said it would close six Italian factories that

assemble Fiat, Jeep, Maserati and Alfa Romeo branded vehicles. The

company is also shutting down a factory in Poland and one in Serbia

that make Fiats. The company, which has about 65,000 employees in

Europe, didn't say how many workers would be staying home due to

the closures.

Like all companies in Italy, and in many other parts of Europe,

Fiat Chrysler has most of its office-based employees already

working from home. The factory workers forced to miss work due to

the closings will get most of their salary through a largely

government-funded scheme for companies in difficulty.

Fiat Chrysler last month temporarily halted production in its

Serbian factory because it couldn't get parts from China. The

factory closings announced Monday aren't linked to an inability to

get parts, according to a person familiar with the situation. It is

keeping open some smaller factories in Italy that make motors and

other parts because in those plants it is easier to make

adjustments to respect the minimum-distance requirement.

The factories being closed include one in the south making the

Jeep Renegade that are exported to North America. Fiat Chrysler

imported a total of 98,429 vehicles from Italy to the U.S. in 2019,

according to the International Trade Administration.

PSA, the Peugeot maker, said its plants in Madrid, Spain and

Mulhouse in the east of France would close on March 16. The rest of

the car maker's plants in Europe would shut temporarily by Thursday

at the latest. The French car maker has plants in Germany, Poland,

Portugal, Slovakia and the U.K., as well as France and Spain.

Ferrari NV and Lamborghini, the luxury-car maker owned by

Volkswagen, both closed their own factories in Italy over the

weekend. Ferrari said it was experiencing supply line issues, while

Lamborghini's chief executive said in a statement that shuttering

his plant was "an act of social responsibility."

Volkswagen, the world's biggest auto maker by sales, said Monday

that it is becoming difficult to maintain production in its

European factories because of disruptions to suppliers and national

governments declaring emergencies. It said, however, that as the

situation darkens in Europe, its production base is improving in

China, where 31 of its 33 factories are now back online after weeks

of being closed as the coronavirus pandemic gripped that

country.

"While the situation in China is stabilizing, it is becoming

more difficult in Europe," said Jörn Roggenbuck, a Volkswagen

spokesman. "It is becoming more complicated to maintain supply

chains."

Volkswagen's Lamborghini and Bugatti plants in Italy have halted

production. In the wake of the Spanish government's declaration of

a state of emergency Volkswagen factories in Martorell and Navarra

have shut down. The plants produce vehicles for SEAT and other

Volkswagen passenger car brands.

As the coronavirus spread takes hold in the U.S., executives and

analysts are considering changes, there, too. Retooling assembly

lines drastically, though, is especially tough for the U.S. auto

industry, where there is very little redundant capacity, said Brian

Collie, director of automotive practice at Boston Consulting

Group.

"Most vehicle manufacturers tend to manufacture a given model

line on one line. Most suppliers for a given vehicle program tend

to manufacture that out of one facility," he said, adding: "So the

question is what happens at that plant if somebody then gets the

coronavirus? How do you then work through that?"

He says some manufacturers are limiting the number of visitors

to sites, including suppliers. Paul Sura, vice president of

business operations at Cypress Semiconductor Corp., which supplies

electronic components to the industry, said the company is

restricting factory visits.

"We're basically turning away any visitors. If customers want to

come and audit us, which is a normal thing on a weekly basis, none

of that is happening," he said. "It's all postponed at least two to

three months. We're just not letting anybody in unless you have to

be there to keep that factory going."

Write to Eric Sylvers at eric.sylvers@wsj.com and Ben Foldy at

Ben.Foldy@wsj.com

(END) Dow Jones Newswires

March 16, 2020 11:06 ET (15:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

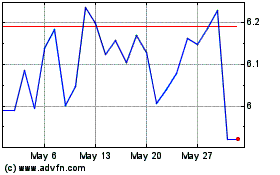

Pirelli & C (BIT:PIRC)

Historical Stock Chart

From Jan 2025 to Feb 2025

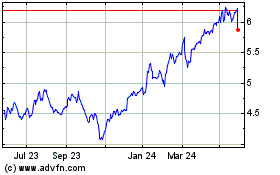

Pirelli & C (BIT:PIRC)

Historical Stock Chart

From Feb 2024 to Feb 2025