Enel Net Income Fell in 2019; Confirms 2020 Targets

March 19 2020 - 2:15PM

Dow Jones News

By Giulia Petroni

Enel SpA said Thursday that net income fell in 2019 due to

impairment on a number of coal-fired plants and confirmed its

objectives for 2020.

The Rome-based energy company said net income for the year fell

to 2.17 billion euros ($2.38 billion) from EUR4.79 billion the

previous year. On an adjusted basis, net income came in at EUR4.77

billion.

Earnings before interest, tax, depreciation and amortization

came in at EUR17.70 billion from EUR16.35 billion the previous

year.

Revenue for the year was up 6.3% to EUR80.33 billion euros. The

rise was attributed to positive performance in the company's

infrastructure and networks division, especially in Latin America,

as well as its thermal-generation and trading division in

Italy.

Enel reported a net debt of EUR45.18 billion for the period, a

9.9% increase from the previous year as a result of investments and

accounting effects.

Overall capital expenditure in 2019 was EUR9.95 billion, of

which more than 50% was allocated toward decarbonisation, according

to the company.

Enel said it increased its renewables capacity by about 3

gigawatts and registered a reduction of 4.1 gigawatts in coal

generation.

The company said it would propose a dividend increase to

EUR0.328 a share for 2019.

Enel met all its strategic goals for 2019, it said, and

confirmed the targets outlined in the 2020-2022 strategic plan.

"With regards to the possible consequences of the coronavirus

pandemic, the group has implemented a series of preventive

measures," according to Enel. "In light of the first results of the

measures implemented, no significant impact on 2020 financial

results are expected."

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

March 19, 2020 14:00 ET (18:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

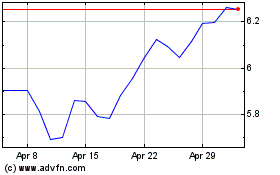

Enel (BIT:ENEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enel (BIT:ENEL)

Historical Stock Chart

From Nov 2023 to Nov 2024