ZTE's Operations Shutdown Stymies Major Phone Customers

May 10 2018 - 9:36AM

Dow Jones News

By Dan Strumpf in Hong Kong and Wayne Ma in Shenzhen, China

Customers of ZTE Corp. world-wide are reassessing their ties

with the hobbled Chinese telecommunications firm, concerned that

supplies of phones and networking gear will soon run short after

assembly lines were shut down.

Telstra Corp., Australia's biggest telecom carrier, said

Thursday it would no longer carry its own-branded smartphones

manufactured by ZTE because it couldn't guarantee supply. AT&T,

the major U.S. distributor of ZTE phones, and MTN, one of Africa's

biggest networks, said they were assessing the impact of a U.S. ban

on component sales to the Chinese company.

ZTE said Wednesday it had halted major operations, though

employees at its Shenzhen, China, headquarters showed up to work as

usual Thursday. As hundreds of workers streamed in and out of a

nearby cafeteria during lunchtime, some said they had little to do

since production was shut down in late April. Others said they were

working as usual.

Concerns about ZTE's ability to deliver shipments of

smartphones, routers and other telecoms gear have heightened after

the company's announcement, which didn't specify which operations

were most affected. The telecoms firm has warned for weeks that it

faces a fight for survival following a Commerce Department order

banning American companies from selling to ZTE as punishment for

the Chinese company violating a 2017 settlement to resolve its

breach of U.S. sanctions against Iran and North Korea.

A ZTE spokeswoman declined to comment."

ZTE relies heavily on foreign components, particularly U.S.

microchips for its smartphones. Qualcomm Inc. supplied chipsets for

84% of phones shipped by ZTE in the first quarter, according to

Canalys, highlighting the vulnerability of the global supply chain

as technology firms get caught up in the escalating trade fight

between the U.S. and China.

Telstra Corp. said its move to axe ZTE was a "difficult but

necessary step given ZTE's decision to cease major operating

activities." ZTE was the eighth biggest smartphone vendor in

Australia, well behind other vendors, according to Canalys.

AT&T Corp., one of ZTE's biggest U.S. distributors, said in

a statement that it is still carrying ZTE phones but is "evaluating

the effects of the government order." Rob Shuter, chief executive

of MTN Group Ltd., one of Africa's biggest telecommunications

operators, this week told investors the company was assessing the

impact and contingency planning given its "exposure to ZTE in our

networks."

ZTE employs about 75,000 people around the world, including in

factories in China and India, and five research-and-development

offices in the U.S. Though 60% of its revenue comes from China, it

has struggled to sell smartphones in its home market.

It is a different story in the U.S, where ZTE is the only

Chinese company to build a substantial smartphone business. There,

among its most recognizable phones is the Axon M, an unusual

dual-screen smartphone that folds in half. ZTE ranked No. 4 in the

U.S. smartphone market in the first quarter, according to Canalys,

accounting for nearly three-fourths of ZTE's smartphone sales last

year.

Beyond phones, an array of U.S. high-tech firms supply

components for its base stations and other networking gear. They

include Maynard, Mass.-based Acacia Communications, a manufacturer

of parts known as optical components, used in networking equipment.

The company's chief executive told investors this week that it was

no longer expecting any revenue from ZTE.

At ZTE's sprawling headquarters in the high-tech Nanshan

district of Shenzhen, employees said they were continuing to report

to work and collect their salaries as usual, though factory work

had ceased last month.

One 21-year-old factory employee who said he worked on

electrical components said his work had stopped around April 20,

just days after the Commerce Department order. He now attends

training sessions in the mornings and rests in a company dorm

during his free time.

A second factory worker who sat on a bench during his break in a

nearby park said he used to work on communications equipment, but

his work stopped last month as well. He said he wasn't upset at the

U.S. because it would force China to innovate and develop its own

technology.

Among top executives at the company, many were hopeful that a

cool-down in trade tensions would lead to a reversal of the ban, a

person familiar with the matter said. The company last weekend said

it submitted an official request with the Commerce Department to

suspend the ban, which the department said it was reviewing.

ZTE said it "maintains sufficient cash" despite the business

shutdown. The company said it had 23.67 billion yuan ($3.73

billion) in cash and cash equivalents as of March 31.

Write to Dan Strumpf at daniel.strumpf@wsj.com and Wayne Ma at

wayne.ma@wsj.com

(END) Dow Jones Newswires

May 10, 2018 09:21 ET (13:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

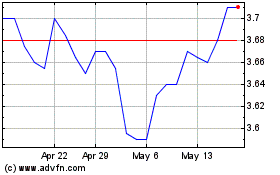

Telstra (ASX:TLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

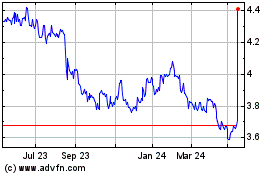

Telstra (ASX:TLS)

Historical Stock Chart

From Dec 2023 to Dec 2024