Sims Metal Management Market Update for Fiscal Year Ended 30 June 2012

August 14 2012 - 6:42PM

Business Wire

Sims Metal Management Limited (the “Company”) (ASX: SGM)(NYSE:

SMS) expects, subject to the completion of its audit and board

approval, that underlying earnings before interest, tax,

depreciation, and amortisation (EBITDA) before significant items

for the fiscal year ended 30 June 2012 as presented in the attached

reconciliation to be circa $253 million. Results were impacted by

difficult operating conditions, particularly in North America, as

indicated in the earnings update that was released to the market on

25 May 2012. These conditions and certain significant items

adversely impacted operating margins and equity accounted profits

particularly in June. Statutory net loss after tax is expected to

be circa $521 million for Fiscal 2012 after $594 million of

non-cash goodwill (after-tax) impairment, all of which was recorded

in the first half result. Revenue for Fiscal 2012 is expected to be

circa $9 billion.

Scrap intake and shipments in Fiscal 2012 were each circa 14.4

million tonnes. Net debt as of 30 June 2012 was circa $293 million

representing 11 percent of total capital.

The Company will release its final results to the market on 23

August 2012.

Cautionary Statements Regarding Forward-Looking

Information

This release may contain forward-looking statements, including

statements about Sims Metal Management’s financial condition,

results of operations, earnings outlook and prospects.

Forward-looking statements are typically identified by words such

as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project” and other similar words and

expressions.

These forward-looking statements involve certain risks and

uncertainties. Our ability to predict results or the actual effects

of our plans and strategies is subject to inherent uncertainty.

Factors that may cause actual results or earnings to differ

materially from these forward-looking statements include those

discussed and identified in filings we make with the Australian

Securities Exchange and the United States Securities and Exchange

Commission (“SEC”), including the risk factors described in the

Company’s Annual Report on Form 20-F, which we filed with the SEC

on 14 October 2011.

Because these forward-looking statements are subject to

assumptions and uncertainties, actual results may differ materially

from those expressed or implied by these forward-looking

statements. You are cautioned not to place undue reliance on these

statements, which speak only as of the date of this release.

All subsequent written and oral forward-looking statements

concerning the matters addressed in this release and attributable

to us or any person acting on our behalf are expressly qualified in

their entirety by the cautionary statements contained or referred

to in this release. Except to the extent required by applicable law

or regulation, we undertake no obligation to update these

forward-looking statements to reflect events or circumstances after

the date of this release.

All references to currencies, unless otherwise stated, reflect

measures in Australian dollars.

About Sims Metal Management

Sims Metal Management is the world’s largest listed metal

recycler with approximately 270 facilities and 6,600 employees

globally. Sims’ core businesses are metal recycling and electronics

recycling. Sims Metal Management generated approximately 88 percent

of its revenue from operations in North America, the United

Kingdom, Continental Europe, New Zealand and Asia in Fiscal 2012.

The Company’s ordinary shares are listed on the Australian

Securities Exchange (ASX: SGM) and its ADRs are listed on the New

York Stock Exchange (NYSE: SMS). Please visit our website

(www.simsmm.com) for more information on the Company and recent

developments.

Reconciliation of Expected Unaudited Statutory Results to

Expected Unaudited Underlying Results for Fiscal 2012

EBITDA

EBIT

Net Profit

(Loss) After tax

(in A$

millions)

Expected Unaudited Statutory Results $ 230 $ (515 ) $ (521 )

Significant

Items:

Non-Cash Goodwill Impairment N/A1 557 543

Impairment of

Non-Cash Goodwill in Joint Ventures N/A1 58 51

Impairment of

Other Identified Intangibles N/A1 1 1

Inventory Adjustments

to Net Realisable Value 21 21 14

Redundancies 10 10 7

Settlement of a Dispute with a Third Party 13 13 8

Final

Settlement on a Business Arrangement 8 8 5

Credit Loss Due

to Bankruptcy of Customer 4 4 3

Pension Plan Special

Charges 3 3 2

Transaction and Other Acquisition Costs 3

3 2

Commercial Settlement (1 ) (1 ) (1 )

Gain on Sale of

a Business by a Joint Venture (36 ) (36 ) (36 )

Formation

Gain on the Acquisition of a Joint Venture (2 )

(2 ) (1 )

Expected Unaudited Underlying Results $ 253

$ 124 $ 77

1 N/A indicates that EBITDA is calculated to exclude impairment

of goodwill and other identified intangible assets in the

presentation of both the expected statutory and expected underlying

results.

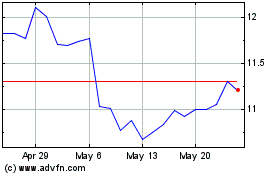

Sims (ASX:SGM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sims (ASX:SGM)

Historical Stock Chart

From Feb 2024 to Feb 2025