FISCAL 2019 THIRD QUARTER KEY FINANCIAL

HIGHLIGHTS

- Revenues were $2.46 billion, a 17%

increase compared to $2.09 billion in the prior year, reflecting

the consolidation of Foxtel and continued strength at the Book

Publishing segment

- Net income was $23 million compared

to a net loss of ($1.1) billion, which included non-cash impairment

charges and write-downs of $1.2 billion in the prior year

- Total Segment EBITDA was $247

million compared to $181 million in the prior year

- Reported EPS were $0.02 compared to

($1.94) in the prior year – Adjusted EPS were $0.04 compared to

$0.06 in the prior year

- Digital-only subscribers for The

Wall Street Journal grew 19% in the quarter to a new record of

approximately 1.8 million

- HarperCollins demonstrated another

robust financial performance with 29% Segment EBITDA growth, driven

by impressive new releases and strong backlist sales

- New Foxtel expanded its over-the-top

services with 714,000 total paying OTT subscribers, which includes

Kayo Sports and Foxtel Now, growing over 80% since the beginning of

the calendar year

- Digital Real Estate Services segment

posted healthy growth in its Real estate revenues despite the

volatility in the U.S. and Australian property markets and foreign

currency headwinds

News Corporation (“News Corp” or the

“Company”)(NASDAQ:NWS)(NASDAQ:NWSA)(ASX:NWS)(ASX:NWSLV) today

reported financial results for the three months ended March 31,

2019.

Commenting on the results, Chief Executive Robert Thomson

said:

“News Corp reaped rewards from our digital strategy this

quarter, underscored by a robust rise in digital subscriptions

across our media properties, a sharp increase in digital audio book

sales and continued expansion at our digital real estate businesses

despite volatile conditions in property markets.

For the third quarter, the Company saw 17% revenue growth and a

36% increase in profitability, reflecting the consolidation of

Foxtel and the sterling performance overall at HarperCollins. And

for the nine months, our revenues were 20% higher and profitability

was 29% higher compared to the prior year.

At the News and Information Services segment, digital paid

subscriptions continued their ebullient expansion, with growth of

over 19% to nearly 1.8 million at The Wall Street Journal. Dow

Jones has also been bolstered by its Professional Information

Business, particularly in Risk and Compliance, where we have had

nine straight quarters of revenue growth above 20%.

At Move, revenues increased in a challenging housing market

earlier this year, and we are confident that there are signs of

improvement in U.S. economic activity that should surely bode well

for the market. Encouragingly, realtor.com® achieved record

audience in April of 69.4 million uniques, and 209 million visits,

and audience numbers have accelerated recently.

HarperCollins delivered a particularly strong result, with

profitability increasing 29%, highlighted by 30% revenue growth in

digital audio books and increased revenue from its comprehensive

backlist and a strong suite of new releases, which are generating

much momentum.

Within our Subscription Video Services segment, the recently

launched over-the-top subscription service, Kayo Sports, showed

much promise, gathering 239,000 subscribers since its launch late

last year, 209,000 of which were paying, as of May 8. Since the

beginning of this calendar year, the number of our total paying OTT

subscribers has increased more than 80% to 714,000.”

THIRD QUARTER RESULTS

The Company reported fiscal 2019 third quarter total revenues of

$2.46 billion, a 17% increase compared to $2.09 billion in the

prior year period. The growth reflects the impact from the

consolidation of Foxtel’s results following the combination of

Foxtel and FOX SPORTS Australia (the “Transaction”) into a new

company (“new Foxtel”) and continued strong performance at the Book

Publishing segment, partially offset by a $90 million negative

impact from foreign currency fluctuations and lower print

advertising revenues at the News and Information Services segment.

The results also include $17 million of lower revenues as a result

of the adoption of the new revenue recognition standard. Adjusted

Revenues (which exclude the foreign currency impact, acquisitions

and divestitures as defined in Note 1) increased 2%.

Net income for the quarter was $23 million compared to a net

loss of ($1.1) billion in the prior year, reflecting the absence of

the non-cash impairment charges and write-downs of $1.2 billion

recognized in the third quarter of fiscal 2018, and higher Total

Segment EBITDA, as discussed below, partially offset by higher

depreciation and amortization expense.

The Company reported third quarter Total Segment EBITDA of $247

million, a 36% increase compared to $181 million in the prior year,

also reflecting the Transaction and continued strength in the Book

Publishing segment. The growth was partially offset by lower

contribution from the News and Information Services segment and

higher costs associated with the Opcity acquisition in the Digital

Real Estate Services segment. Adjusted Total Segment EBITDA (as

defined in Note 1) decreased 4%.

Net income per share available to News Corporation stockholders

was $0.02 as compared to a net loss per share of ($1.94) in the

prior year.

Adjusted EPS (as defined in Note 3) were $0.04 compared to $0.06

in the prior year.

SEGMENT REVIEW

For the three months ended For the nine

months ended March 31, March 31, 2019 2018 % Change

2019 2018 % Change (in millions)

Better/(Worse)

(in millions)

Better/(Worse)

Revenues: News and Information Services $ 1,224 $

1,286 (5 ) % $ 3,729 $ 3,825 (3 ) % Subscription Video Services 539

129 ** 1,666 394 ** Book Publishing 421 398 6 % 1,335 1,268 5 %

Digital Real Estate Services 272 279 (3 ) % 876 842 4 % Other

1 1 - 2

2 -

Total Revenues $ 2,457

$ 2,093 17 % $ 7,608 $ 6,331 20

%

Segment EBITDA: News and Information

Services $ 73 $ 87 (16 ) % $ 309 $ 302 2 % Subscription Video

Services 98 16 ** 295 76 ** Book Publishing 53 41 29 % 209 167 25 %

Digital Real Estate Services 74 88 (16 ) % 300 302 (1 ) % Other(a)

(51 ) (51 ) - (138 ) (90

) (53 ) %

Total Segment EBITDA $ 247 $ 181 36

% $ 975 $ 757 29 % ** - Not

meaningful

(a)

Other Segment EBITDA for the nine months ended March 31,

2018 included a $46 million benefit from the reversal of certain

previously accrued net liabilities for the U.K. Newspaper Matters

as a result of an agreement reached with the relevant tax authority

related to certain employment taxes.

News and Information Services

Revenues in the quarter decreased $62 million, or 5%, as

compared to the prior year, reflecting a $52 million, or 4%,

negative impact from foreign currency fluctuations. Within the

segment, Dow Jones revenues grew 1%, while revenues at News UK and

News America Marketing each declined 8% and News Corp Australia

revenues declined 7%. Adjusted Revenues for the segment decreased

1% compared to the prior year.

Advertising revenues declined 9% compared to the prior year, of

which $23 million, or 4%, was related to the negative impact from

foreign currency fluctuations. The remainder of the decline was

driven by weakness in the print advertising market and lower home

delivered revenues, which include free-standing insert products, at

News America Marketing. Advertising revenues at Dow Jones declined

8% in the quarter.

Circulation and subscription revenues were relatively flat,

including a $22 million, or 4%, negative impact from foreign

currency fluctuations. Circulation and subscription revenues again

benefited from a healthy contribution from Dow Jones, which saw a

7% increase in its circulation revenues, reflecting 19% digital

paid subscriber growth and subscription price increases at The Wall

Street Journal, as well as the continued growth in its Risk &

Compliance products. Dow Jones’ consumer products reached

approximately 3.3 million total subscribers, reflecting a 12%

increase compared to the prior year. Cover price increases at other

mastheads also contributed to the revenue improvement. These

increases were partially offset by lower print volume in Australia

and the U.K.

Segment EBITDA decreased $14 million in the quarter, or 16%, as

compared to the prior year, primarily due to lower contribution

from News America Marketing. Adjusted Segment EBITDA (as defined in

Note 1) decreased 15%.

Digital revenues represented 31% of News and Information

Services segment revenues in the quarter, compared to 29% in the

prior year. For the quarter, digital revenues for Dow Jones and the

newspaper mastheads represented 36% of their combined revenues, and

at Dow Jones, digital accounted for 55% of its circulation

revenues. Digital subscribers and users across key properties

within the News and Information Services segment are summarized

below:

- The Wall Street Journal average daily

digital subscribers in the three months ended March 31, 2019 were

1,775,000, compared to 1,490,000 in the prior year (Source:

Internal data)

- Closing digital subscribers at News

Corp Australia’s mastheads as of March 31, 2019 were 493,200,

compared to 409,000 in the prior year (Source: Internal data)

- The Times and Sunday Times closing

digital subscribers as of March 31, 2019 were 286,000, compared to

230,000 in the prior year (Source: Internal data)

- The Sun’s digital offering reached more

than 84 million global monthly unique users in March 2019, compared

to 84 million in the prior year, based on ABCe (Source:

Omniture)

Subscription Video Services

Revenues and Segment EBITDA in the quarter increased $410

million and $82 million, respectively, compared to the prior year,

primarily due to the inclusion of Foxtel. Adjusted Revenues and

Adjusted Segment EBITDA, which exclude the impact of foreign

currency fluctuations, acquisitions and divestitures, increased 4%

and declined 88%, respectively.

On a pro forma basis, reflecting the Transaction, segment

revenues in the quarter decreased $84 million, or 13%, compared

with the prior year, of which $53 million, or 9%, was due to the

negative impact from foreign currency fluctuations. The remainder

of the revenue decline was driven by the impact from lower

broadcast subscribers and the changes in the subscriber package

mix, partially offset by higher revenues from Foxtel Now and Kayo

Sports.

As of March 31, 2019, new Foxtel’s total closing subscribers

were 2.896 million, which was higher than the prior year, primarily

due to the launch of Kayo Sports, subscriber growth at Foxtel Now

and the inclusion of commercial subscribers of FOX SPORTS Australia

beginning in the first quarter of fiscal 2019, partially offset by

lower broadcast subscribers. 2.4 million of the total closing

subscribers were broadcast and commercial subscribers, and the

remainder consisted of Foxtel Now and Kayo Sports subscribers. As

of May 8, 2019, there were 239,000 Kayo Sports subscribers, of

which 209,000 were paying subscribers. For the same period, there

were 567,000 Foxtel Now subscribers, of which 505,000 were paying

subscribers. Broadcast subscriber churn in the quarter was 17.7%

compared to 15.3% in the prior year, reflecting the impact of the

price increase implemented in October. Broadcast churn improved to

16.2% in March and 15.1% in April. Broadcast ARPU for the quarter

declined 1% compared to the prior year to over A$79 (US$57), as the

impact from the price increase was more than offset by a negative

impact related to the adoption of the new revenue recognition

standard.

Pro forma Segment EBITDA in the quarter decreased $29 million,

or 23%, compared with the prior year, primarily due to lower

revenues as discussed above, $25 million of higher sports

programming and production costs related to Cricket Australia and

higher marketing costs related to Kayo Sports, partially offset by

the $45 million positive impact on expenses from foreign currency

fluctuations and lower non-programming costs.

Book Publishing

Revenues in the quarter increased $23 million, or 6%, compared

to the prior year, of which foreign currency fluctuations had a

negative impact of $9 million, or 2%. The revenue growth was

primarily due to higher sales in Christian publishing, driven by

the success of new titles such as Girl, Stop Apologizing by Rachel

Hollis and We are the Gardeners by Joanna Gaines, as well as the

continued success of backlist titles such as Girl, Wash Your Face

by Rachel Hollis. HarperCollins’ U.K. business also contributed to

the revenue growth with its successful release of Fing by David

Walliams. Revenue growth was partially offset by $17 million of

lower revenues as a result of the adoption of the new revenue

recognition standard. Digital sales increased 5% compared to the

prior year and represented 21% of Consumer revenues for the

quarter, driven by the growth in downloadable audiobook sales.

Segment EBITDA for the quarter increased $12 million, or 29%, from

the prior year, primarily due to the higher revenues noted

above.

Digital Real Estate Services

Revenues in the quarter declined $7 million, or 3%, compared to

the prior year, of which foreign currency fluctuations had a

negative impact of $16 million, or 6%. Segment EBITDA in the

quarter declined $14 million, or 16%, compared to the prior year,

primarily due to higher costs associated with further investment in

Opcity following the acquisition and the $9 million negative impact

from foreign currency fluctuations. Adjusted Revenues and Adjusted

Segment EBITDA increased 3% and 9%, respectively.

In the quarter, revenues at REA Group decreased 4% to $151

million from $158 million in the prior year, as an increase in

Australian residential depth revenue, driven by pricing increases,

improved penetration and favorable product mix, was more than

offset by the negative impact from foreign currency fluctuations,

as mentioned above, and softness in listing volumes.

Move’s revenues in the quarter increased 5% to $121 million from

$115 million in the prior year, primarily due to 14% growth in its

real estate revenues, partially offset by planned declines in

advertising revenues. The increase in real estate revenues, which

represent 79% of total Move revenues, reflect higher yield per lead

and the acquisition of Opcity. Realtor.com® continued to migrate

leads from its ConnectionsSM Plus product to its performance-based

Opcity product, as it further evolves and scales its platform.

Based on Move’s internal data, average monthly unique users of

realtor.com®’s web and mobile sites for the fiscal third quarter

grew 7% year-over-year to approximately 65 million, with mobile

representing more than half of all unique users.

REVIEW OF EQUITY LOSSES OF

AFFILIATES

For the three months ended For the nine months

ended March 31, March 31, 2019 2018 2019 2018

(in millions)

(in millions) Foxtel(a) $ - $ (970 ) $ - $ (974 ) Other

equity affiliates, net (4 ) (4 ) (13 )

(28 ) Total equity losses of affiliates $ (4 ) $ (974 ) $ (13 ) $

(1,002 )

(a)

The Company amortized $17 million and $49 million related to

excess cost over the Company’s proportionate share of its

investment’s underlying net assets allocated to finite-lived

intangible assets during the three and nine months ended March 31,

2018, respectively. Such amortization is reflected in Equity losses

of affiliates in the Statement of Operations.

Equity losses of affiliates for the third quarter was ($4)

million compared to ($974) million in the prior year. The

improvement was primarily due to the absence of the $957 million

non-cash write-down of the carrying value of the Company’s

investment in Foxtel in the third quarter of fiscal 2018. The

Company began consolidating the results of Foxtel in the fourth

quarter of fiscal 2018 as a result of the Transaction.

CASH FLOW

The following table presents a reconciliation of net cash

provided by operating activities to free cash flow available to

News Corporation:

For the nine months endedMarch 31,

2019 2018 (in millions) Net cash provided by

operating activities $ 661 $ 465 Less: Capital expenditures

(417 ) (200 ) 244 265 Less: REA Group free cash flow (164 )

(144 ) Plus: Cash dividends received from REA Group 69

63 Free cash flow available to News

Corporation $ 149 $ 184

Net cash provided by operating activities improved $196 million

for the nine months ended March 31, 2019 as compared to the prior

year period, primarily due to higher Total Segment EBITDA as noted

above, partially offset by $59 million in higher cash paid for

interest.

Free cash flow available to News Corporation in the nine months

ended March 31, 2019 was $149 million compared to $184 million in

the prior year period. The decline was primarily due to higher

capital expenditures, of which $223 million was related to new

Foxtel, partially offset by higher cash provided by operating

activities. New Foxtel’s total capital expenditures in fiscal 2019

are now expected to be higher than fiscal 2018 by approximately $25

million compared to the prior guidance of more than $50

million.

Free cash flow available to News Corporation is a non-GAAP

financial measure defined as net cash provided by operating

activities, less capital expenditures (“free cash flow”), less REA

Group free cash flow, plus cash dividends received from REA

Group.

The Company considers free cash flow available to News

Corporation to provide useful information to management and

investors about the amount of cash that is available to be used to

strengthen the Company’s balance sheet and for strategic

opportunities including, among others, investing in the Company’s

business, strategic acquisitions, dividend payouts and repurchasing

stock. The Company believes excluding REA Group’s free cash flow

and including dividends received from REA Group provides users of

its consolidated financial statements with a measure of the amount

of cash flow that is readily available to the Company, as REA Group

is a separately listed public company in Australia and must declare

a dividend in order for the Company to have access to its share of

REA Group’s cash balance. The Company believes free cash flow

available to News Corporation provides a more conservative view of

the Company’s free cash flow because this presentation includes

only that amount of cash the Company actually receives from REA

Group, which has generally been lower than the Company’s unadjusted

free cash flow. A limitation of free cash flow available to News

Corporation is that it does not represent the total increase or

decrease in the cash balance for the period. Management compensates

for the limitation of free cash flow available to News Corporation

by also relying on the net change in cash and cash equivalents as

presented in the Company’s consolidated statements of cash flows

prepared in accordance with GAAP which incorporates all cash

movements during the period.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income available to

News Corporation stockholders, Adjusted EPS and free cash flow

available to News Corporation are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2

and 3 and the reconciliation of net cash provided by operating

activities to free cash flow available to News Corporation is

included above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:00pm EDT on May 9, 2019. To listen to the call, please visit

http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management’s views and

assumptions regarding future events and business performance as of

the time the statements are made. Actual results may differ

materially from these expectations due to changes in global

economic, business, competitive market and regulatory factors. More

detailed information about these and other factors that could

affect future results is contained in our filings with the

Securities and Exchange Commission. The “forward-looking

statements” included in this document are made only as of the date

of this document and we do not have any obligation to publicly

update any “forward-looking statements” to reflect subsequent

events or circumstances, except as required by law.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content. The

company comprises businesses across a range of media, including:

news and information services, subscription video services in

Australia, book publishing and digital real estate services.

Headquartered in New York, News Corp operates primarily in the

United States, Australia, and the United Kingdom, and its content

is distributed and consumed worldwide. More information is

available at: www.newscorp.com.

NEWS CORPORATION CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited; in millions, except per share

amounts)

For the three monthsended

For the nine monthsended

March 31, March 31, 2019 2018 2019 2018

Revenues: Circulation and subscription $ 1,025 $ 659 $ 3,088 $

1,947 Advertising 670 702 2,052 2,101 Consumer 403 381 1,281 1,220

Real estate 218 208 693 633 Other 141 143

494 430 Total Revenues

2,457 2,093 7,608 6,331 Operating expenses (1,400 ) (1,151 )

(4,224 ) (3,439 ) Selling, general and administrative (810 ) (761 )

(2,409 ) (2,135 ) Depreciation and amortization (168 ) (100 ) (494

) (297 ) Impairment and restructuring charges (34 ) (246 ) (71 )

(273 ) Equity losses of affiliates (4 ) (974 ) (13 ) (1,002 )

Interest (expense) income, net (14 ) 2 (45 ) 9 Other, net 3

30 30 9 Income

(loss) before income tax expense 30 (1,107 ) 382 (797 ) Income tax

expense (7 ) (3 ) (112 ) (292 ) Net

income (loss) 23 (1,110 ) 270 (1,089 ) Less: Net income

attributable to noncontrolling interests (13 ) (18 )

(64 ) (54 ) Net income (loss) attributable to News

Corporation stockholders $ 10 $ (1,128 ) $ 206 $ (1,143 ) Less:

Adjustments to Net income (loss) attributable to News Corporation

stockholders – Redeemable preferred stock dividends -

- - (1 ) Net income (loss)

available to News Corporation stockholders $ 10 $ (1,128 ) $

206 $ (1,144 ) Weighted average shares outstanding:

Basic 585 583 585 583 Diluted 589 583 587 583 Net income

(loss) available to News Corporation stockholders per share - basic

$ 0.02 $ (1.94 ) $ 0.35 $ (1.96 ) Net income (loss) available to

News Corporation stockholders per share - diluted $ 0.02 $ (1.94 )

$ 0.35 $ (1.96 )

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS (in millions)

As of March 31,2019

As of June 30,2018

(unaudited) (audited)

ASSETS Current assets: Cash and cash

equivalents $ 1,648 $ 2,034 Receivables, net 1,631 1,612 Inventory,

net 404 376 Other current assets 564 372

Total current assets 4,247 4,394

Non-current assets: Investments 347 393 Property, plant and

equipment, net 2,557 2,560 Intangible assets, net 2,514 2,671

Goodwill 5,223 5,218 Deferred income tax assets 257 279 Other

non-current assets 913 831 Total assets

$ 16,058 $ 16,346

LIABILITIES AND

EQUITY Current liabilities: Accounts payable $ 432 $ 605

Accrued expenses 1,364 1,340 Deferred revenue 460 516 Current

borrowings 678 462 Other current liabilities 745

372 Total current liabilities 3,679

3,295 Non-current liabilities: Borrowings 868

1,490 Retirement benefit obligations 237 245 Deferred income tax

liabilities 321 389 Other non-current liabilities 495 430

Commitments and contingencies Redeemable preferred stock -

20 Equity: Class A common stock 4 4 Class B common stock 2 2

Additional paid-in capital 12,229 12,322 Accumulated deficit (1,927

) (2,163 ) Accumulated other comprehensive loss (1,019 )

(874 ) Total News Corporation stockholders' equity 9,289

9,291 Noncontrolling interests 1,169 1,186

Total equity 10,458 10,477 Total

liabilities and equity $ 16,058 $ 16,346

NEWS CORPORATION CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited; in millions)

For the nine months ended March 31, 2019 2018

Operating

activities: Net income (loss) $ 270 $ (1,089 )

Adjustments to reconcile net income (loss) to cash provided by

operating activities: Depreciation and amortization 494 297 Equity

losses of affiliates 13 1,002 Cash distributions received from

affiliates 30 2 Impairment charges 9 225 Other, net (30 ) (9 )

Deferred income taxes and taxes payable 22 182 Change in operating

assets and liabilities, net of acquisitions: Receivables and other

assets 37 (86 ) Inventories, net (74 ) (14 ) Accounts payable and

other liabilities (110 ) (45 ) Net cash provided by

operating activities 661 465

Investing activities: Capital expenditures (417 ) (200 )

Acquisitions, net of cash acquired (187 ) (62 ) Investments in

equity affiliates and other (36 ) (42 ) Proceeds from property,

plant and equipment and other asset dispositions 99 137 Other, net

18 23 Net cash used in investing

activities (523 ) (144 )

Financing

activities: Borrowings 450 - Repayment of borrowings (801 ) (93

) Dividends paid (102 ) (99 ) Other, net (48 ) (42 )

Net cash used in financing activities (501 ) (234 )

Net change in cash and cash equivalents (363 ) 87 Cash and

cash equivalents, beginning of period 2,034 2,016 Exchange movement

on opening cash balance (23 ) 9 Cash and cash

equivalents, end of period $ 1,648 $ 2,112

NOTE 1 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”) and foreign currency

fluctuations (“Adjusted Revenues,” “Adjusted Total Segment EBITDA”

and “Adjusted Segment EBITDA,” respectively) to evaluate the

performance of the Company’s core business operations exclusive of

certain items that impact the comparability of results from period

to period such as the unpredictability and volatility of currency

fluctuations. The Company calculates the impact of foreign currency

fluctuations for businesses reporting in currencies other than the

U.S. dollar by multiplying the results for each quarter in the

current period by the difference between the average exchange rate

for that quarter and the average exchange rate in effect during the

corresponding quarter of the prior year and totaling the impact for

all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three and nine months ended March 31, 2019

and 2018.

Revenues Total Segment EBITDA For the

three months ended For the three months ended March 31, March 31,

2019 2018 Difference 2019 2018

Difference (in millions) (in millions)

As reported $

2,457 $ 2,093 $ 364 $ 247 $ 181 $ 66 Impact of acquisitions

(432 ) - (432 ) (81 ) - (81 ) Impact of divestitures (2 )

(12 ) 10 1 2 (1 ) Impact of foreign currency fluctuations 90

- 90 9 - 9 Net impact of U.K. Newspaper Matters - - - 2 2 -

As adjusted $ 2,113 $ 2,081

$ 32 $ 178 $ 185 $ (7 ) Revenues

Total Segment EBITDA For the nine months ended For the nine months

ended March 31, March 31, 2019 2018 Difference 2019 2018 Difference

(in millions) (in millions)

As reported $ 7,608 $

6,331 $ 1,277 $ 975 $ 757 $ 218 Impact of acquisitions

(1,323 ) - (1,323 ) (218 ) - (218 ) Impact of divestitures

(14 ) (38 ) 24 - 3 (3 ) Impact of foreign currency

fluctuations 206 - 206 33 - 33 Net impact of U.K. Newspaper

Matters - - - 8 (38 ) 46

As adjusted $

6,477 $ 6,293 $ 184 $ 798 $ 722

$ 76

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three and nine months ended March 31, 2019 and 2018 are as

follows:

For the three months ended March 31, 2019

2018 % Change (in millions) Better/(Worse)

Adjusted Revenues: News and Information Services $ 1,265 $

1,279 (1 ) % Subscription Video Services 134 129 4 % Book

Publishing 430 398 8 % Digital Real Estate Services 283 274 3 %

Other 1 1 -

Adjusted

Total Revenues $ 2,113 $ 2,081 2 %

Adjusted Segment EBITDA: News and Information Services $ 74

$ 87 (15 ) % Subscription Video Services 2 16 (88 ) % Book

Publishing 53 41 29 % Digital Real Estate Services 98 90 9 % Other

(49 ) (49 ) -

Adjusted Total Segment

EBITDA $ 178 $ 185 (4 ) %

For the nine months ended March 31, 2019 2018

% Change (in millions) Better/(Worse)

Adjusted

Revenues: News and Information Services $ 3,817 $ 3,803 -

Subscription Video Services 407 394 3 % Book Publishing 1,354 1,268

7 % Digital Real Estate Services 897 826 9 % Other 2

2 -

Adjusted Total Revenues $

6,477 $ 6,293 3 %

Adjusted Segment

EBITDA: News and Information Services $ 314 $ 301 4 %

Subscription Video Services 62 76 (18 ) % Book Publishing 209 167

25 % Digital Real Estate Services 343 306 12 % Other (130 )

(128 ) (2 ) %

Adjusted Total Segment EBITDA $ 798

$ 722 11 %

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended March 31, 2019 and 2018.

For the three months ended March 31, 2019 As Reported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

As Adjusted (in millions)

Revenues: News and

Information Services $ 1,224 $ (9 ) $ (2 ) $ 52 $ - $ 1,265

Subscription Video Services 539 (418 ) - 13 - 134 Book Publishing

421 - - 9 - 430 Digital Real Estate Services 272 (5 ) - 16 - 283

Other 1 - - -

- 1

Total Revenues $ 2,457 $

(432 ) $ (2 ) $ 90 $ - $ 2,113

Segment EBITDA:

News and Information Services $ 73 $ - $ 1 $ - $ - $ 74

Subscription Video Services 98 (96 ) - - - 2 Book Publishing 53 - -

- - 53 Digital Real Estate Services 74 15 - 9 - 98 Other (51

) - - - 2 (49 )

Total Segment EBITDA $ 247 $ (81 ) $ 1 $ 9 $ 2

$ 178 For the three months ended March

31, 2018 As Reported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

As Adjusted (in millions)

Revenues: News and

Information Services $ 1,286 $ - $ (7 ) $ - $ - $ 1,279

Subscription Video Services 129 - - - - 129 Book Publishing 398 - -

- - 398 Digital Real Estate Services 279 - (5 ) - - 274 Other

1 - - - - 1

Total Revenues $ 2,093 $ - $ (12 ) $ - $ - $

2,081

Segment EBITDA: News and Information

Services $ 87 $ - $ - $ - $ - $ 87 Subscription Video Services 16 -

- - - 16 Book Publishing 41 - - - - 41 Digital Real Estate Services

88 - 2 - - 90 Other (51 ) - - -

2 (49 )

Total Segment EBITDA $ 181 $ -

$ 2 $ - $ 2 $ 185

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the nine months ended March 31, 2019 and 2018.

For the nine months ended March 31, 2019 As Reported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

As Adjusted (in millions)

Revenues: News and

Information Services $ 3,729 $ (14 ) $ (12 ) $ 114 $ - $ 3,817

Subscription Video Services 1,666 (1,289 ) - 30 - 407 Book

Publishing 1,335 - - 19 - 1,354 Digital Real Estate Services 876

(20 ) (2 ) 43 - 897 Other 2 - -

- - 2

Total Revenues $

7,608 $ (1,323 ) $ (14 ) $ 206 $ - $ 6,477

Segment EBITDA: News and Information Services $ 309 $ - $ -

$ 5 $ - $ 314 Subscription Video Services 295 (236 ) - 3 - 62 Book

Publishing 209 - - - - 209 Digital Real Estate Services 300 18 - 25

- 343 Other (138 ) - - -

8 (130 )

Total Segment EBITDA $ 975 $

(218 ) $ - $ 33 $ 8 $ 798 For

the nine months ended March 31, 2018 As Reported

Impact ofAcquisitions

Impact ofDivestitures

Impact ofForeignCurrencyFluctuations

Net Impactof U.K.NewspaperMatters

As Adjusted (in millions)

Revenues: News and

Information Services $ 3,825 $ - $ (22 ) $ - $ - $ 3,803

Subscription Video Services 394 - - - - 394 Book Publishing 1,268 -

- - - 1,268 Digital Real Estate Services 842 - (16 ) - - 826 Other

2 - - - -

2

Total Revenues $ 6,331 $ - $ (38 ) $

- $ - $ 6,293

Segment EBITDA: News and

Information Services $ 302 $ - $ (1 ) $ - $ - $ 301 Subscription

Video Services 76 - - - - 76 Book Publishing 167 - - - - 167

Digital Real Estate Services 302 - 4 - - 306 Other (90 )

- - - (38 ) (128 )

Total Segment EBITDA $ 757 $ - $ 3 $ - $ (38 )

$ 722

NOTE 2 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net and income tax (expense) benefit.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following table reconciles net income

(loss) to Total Segment EBITDA.

For the three months ended March 31, 2019 2018

Change % Change (in millions) Net income (loss) $ 23

$ (1,110 ) $ 1,133 ** Add: Income tax expense 7 3 4 ** Other, net

(3 ) (30 ) 27 90 % Interest expense (income), net 14 (2 ) 16 **

Equity losses of affiliates 4 974 (970 ) (100 ) % Impairment and

restructuring charges 34 246 (212 ) (86 ) % Depreciation and

amortization 168 100 68

68 % Total Segment EBITDA $ 247 $ 181 $ 66

36 % ** - Not meaningful For the nine

months ended March 31, 2019 2018 Change % Change (in millions)

Net income (loss) $ 270 $ (1,089 ) $ 1,359 ** Add: Income

tax expense 112 292 (180 ) (62 ) % Other, net (30 ) (9 ) (21 ) **

Interest expense (income), net 45 (9 ) 54 ** Equity losses of

affiliates 13 1,002 (989 ) (99 ) % Impairment and restructuring

charges 71 273 (202 ) (74 ) % Depreciation and amortization

494 297 197 66 % Total

Segment EBITDA $ 975 $ 757 $ 218 29 %

** - Not meaningful

NOTE 3 – ADJUSTED NET INCOME (LOSS) AVAILABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) available to News Corporation

stockholders and diluted earnings per share (“EPS”) excluding

expenses related to U.K. Newspaper Matters, impairment and

restructuring charges and “Other, net”, net of tax, recognized by

the Company or its equity method investees, as well as the

settlement of certain pre-Separation tax matters and the impact of

the U.S. Tax Cut and Jobs Act (“adjusted net income (loss)

available to News Corporation stockholders” and “adjusted EPS,”

respectively), to evaluate the performance of the Company’s

operations exclusive of certain items that impact the comparability

of results from period to period, as well as certain

non-operational items. The calculation of adjusted net income

(loss) available to News Corporation stockholders and adjusted EPS

may not be comparable to similarly titled measures reported by

other companies, since companies and investors may differ as to

what type of events warrant adjustment. Adjusted net income (loss)

available to News Corporation stockholders and adjusted EPS are not

measures of performance under generally accepted accounting

principles and should not be construed as substitutes for

consolidated net income (loss) available to News Corporation

stockholders and net income (loss) per share as determined under

GAAP as a measure of performance. However, management uses these

measures in comparing the Company’s historical performance and

believes that they provide meaningful and comparable information to

investors to assist in their analysis of our performance relative

to prior periods and our competitors.

The following tables reconcile reported net income (loss)

available to News Corporation stockholders and reported diluted EPS

to adjusted net income available to News Corporation stockholders

and adjusted EPS for the three and nine months ended March 31, 2019

and 2018.

For the three months ended For the three months ended

March 31, 2019 March 31, 2018 (in millions, except per share data)

Net incomeavailable tostockholders

EPS

Net (loss)income availableto

stockholders

EPS

Net income (loss) $ 23 $ $ (1,110 ) $

Less: Net income attributable to noncontrolling interests

(13 ) (18 )

Net income (loss) available to News Corporation stockholders

$ 10 $ 0.02 $ (1,128 ) $ (1.94 ) U.K. Newspaper Matters 2 -

2 - Impairment and restructuring charges(a) 34 0.05 246 0.42

Other, net (3 ) - (30 ) (0.05 ) Equity losses of

affiliates(b) - - 957 1.65 Tax impact on items above (15 )

(0.03 ) (14 ) (0.02 ) Impact of noncontrolling interest on

items included above (2 ) - - -

As adjusted $ 26

$ 0.04 $ 33 $ 0.06

(a)

During the three months ended March 31, 2018, the Company

recognized $165 million and $41 million of non-cash impairment

charges at News America Marketing and FOX SPORTS Australia,

respectively.

(b)

During the three months ended March 31, 2018, the Company

recognized a $957 million non-cash write-down of its investment in

Foxtel. For the nine months ended For the nine

months ended March 31, 2019 March 31, 2018 (in millions, except per

share data)

Net incomeavailable tostockholders

EPS

Net (loss)income availableto

stockholders

EPS

Net income (loss) $ 270 $ $

(1,089 ) $ Less: Net income attributable to noncontrolling

interests (64 ) (54 ) Less: Redeemable preferred stock dividends

- (1 )

Net

income (loss) available to News Corporation stockholders $ 206

$ 0.35 $ (1,144 ) $ (1.96 ) U.K. Newspaper Matters (a) 8

0.01 (38 ) (0.07 ) Impairment and restructuring charges (b)

71 0.12 273 0.47 Other, net (30 ) (0.05 ) (9 ) (0.02 )

Equity losses of affiliates (c) - - 970 1.66 Tax

impact on items above (25 ) (0.05 ) (8 ) (0.01 ) Impact of

U.S. Tax Cut and Jobs Act (d) - - 174 0.30 Impact of

noncontrolling interest on items included above (4 ) - (8 ) (0.01 )

As adjusted $ 226 $ 0.38 $ 210

$ 0.36

(a)

During the nine months ended March 31, 2018, the Company

recorded a $46 million benefit from the reversal of certain

previously accrued net liabilities for the U.K. Newspaper Matters

as a result of an agreement reached with the relevant tax authority

related to certain employment taxes.

(b)

During the nine months ended March 31, 2018, the Company recognized

$165 million and $41 million of non-cash impairment charges at News

America Marketing and FOX SPORTS Australia, respectively.

(c)

During the nine months ended March 31, 2018, the Company recognized

a $957 million non-cash write-down of its investment in Foxtel as

well as $13 million in non-cash write-downs of certain equity

method investments’ carrying values.

(d)

During the nine months ended March 31, 2018, the Company recorded a

$174 million provisional charge as a result of the U.S. Tax Cut and

Jobs Act.

NOTE 4 – PRO FORMA

The following supplemental unaudited pro forma information for

the three and nine months ended March 31, 2018 reflects the

Company’s results of operations as if the Transaction had occurred

on July 1, 2016. The Company believes that the presentation of this

supplemental information enhances comparability across the

reporting periods. The information was prepared in accordance with

Article 11 of Regulation S-X and is based on historical results of

operations of News Corp and Foxtel, adjusted for the effect of any

Transaction-related accounting adjustments, as described below. Pro

forma adjustments were based on available information and

assumptions regarding impacts that are directly attributable to the

Transaction, are factually supportable, and are expected to have a

continuing impact on the combined results. In addition, the pro

forma information is provided for supplemental and informational

purposes only, and is not necessarily indicative of what the

Company’s results of operations would have been, or the Company’s

future results of operations, had the Transaction actually occurred

on the date indicated. As only the financial results for the

Subscription Video Services segment were adjusted due to the

presentation of this pro forma supplemental information, the

Company is only providing pro forma supplemental information for

this segment below, under “Subscription Video Services”. The

unaudited pro forma information should be read in conjunction with

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and our unaudited consolidated financial

statements and related notes included in the Company’s Quarterly

Report on Form 10-Q for the quarter ended March 31, 2019 that will

be filed with the Securities and Exchange Commission.

The following tables set forth the Company’s unaudited reported

and pro forma results of operations for the three and nine months

ended March 31, 2019 and 2018, respectively.

For the three months ended March 31, 2019 2018

Change % Change (in millions, except %) As reported

Pro forma Better/(Worse) Revenues: Circulation and

subscription $ 1,025 $ 1,097 $ (72 ) (7 ) % Advertising 670 744 (74

) (10 ) % Consumer 403 381 22 6 % Real estate 218 208 10 5 % Other

141 157 (16 ) (10 ) % Total Revenues

2,457 2,587 (130 ) (5 ) % Operating expenses (1,400 ) (1,423

) 23 2 % Selling, general and administrative (810 ) (872 ) 62 7 %

Depreciation and amortization (168 ) (168 ) - - Impairment and

restructuring charges (34 ) (1,205 ) 1,171 97 % Equity losses of

affiliates (4 ) (2 ) (2 ) (100 ) % Interest expense, net (14 ) (21

) 7 33 % Other, net 3 29 (26 ) (90 ) %

Income (loss) before income tax expense 30 (1,075 ) 1,105 ** Income

tax expense (7 ) (6 ) (1 ) (17 ) % Net income

(loss) 23 (1,081 ) 1,104 ** Less: Net income attributable to

noncontrolling interests (13 ) (10 ) (3 ) (30

) % Net income (loss) attributable to News Corporation $ 10

$ (1,091 ) $ 1,101 **

** - Not meaningful

For the nine months ended March 31, 2019

2018 Change % Change (in millions, except %)

As reported Pro forma Better/(Worse) Revenues: Circulation

and subscription $ 3,088 $ 3,307 $ (219 ) (7 ) % Advertising 2,052

2,242 (190 ) (8 ) % Consumer 1,281 1,220 61 5 % Real estate 693 633

60 9 % Other 494 469 25 5

% Total Revenues 7,608 7,871 (263 ) (3 ) % Operating

expenses (4,224 ) (4,284 ) 60 1 % Selling, general and

administrative (2,409 ) (2,470 ) 61 2 % Depreciation and

amortization (494 ) (501 ) 7 1 % Impairment and restructuring

charges (71 ) (1,235 ) 1,164 94 % Equity losses of affiliates (13 )

(23 ) 10 43 % Interest expense, net (45 ) (67 ) 22 33 % Other, net

30 7 23 ** Income

(loss) before income tax expense 382 (702 ) 1,084 ** Income tax

expense (112 ) (300 ) 188 63 %

Net income (loss) 270 (1,002 ) 1,272 ** Less: Net income

attributable to noncontrolling interests (64 ) (80 )

16 20 % Net income (loss) attributable to News

Corporation $ 206 $ (1,082 ) $ 1,288 **

** - Not meaningful

Pro Forma (unaudited) For the three months

ended March 31, 2018

News CorpHistorical(a)

FoxtelHistorical(b)

TransactionAdjustments

Pro Forma (in millions, except per share amounts)

Revenues: Circulation and subscription $ 659 $ 531 $ (93 ) (c)(d) $

1,097 Advertising 702 42 - 744 Consumer 381 - - 381 Real estate 208

- - 208 Other 143 14 -

157 Total Revenues 2,093 587 (93 ) 2,587

Operating expenses (1,151 ) (370 ) 98 (c)(e) (1,423 ) Selling,

general and administrative (761 ) (113 ) 2 (f) (872 ) Depreciation

and amortization (100 ) (69 ) 1 (g)(h)(i) (168 ) Impairment and

restructuring charges (246 ) (2 ) (957 ) (j) (1,205 ) Equity

(losses) earnings of affiliates (974 ) 2 970 (j) (2 ) Interest

income (expense), net 2 (23 ) - (21 ) Other, net 30

(1 ) - 29 (Loss) income before

income tax expense (1,107 ) 11 21 (1,075 ) Income tax expense

(3 ) (3 ) - (k) (6 ) Net (loss)

income (1,110 ) 8 21 (1,081 ) Less: Net (income) loss attributable

to noncontrolling interests (18 ) 1 7

(l) (10 ) Net (loss) income attributable to News

Corporation $ (1,128 ) $ 9 $ 28 $ (1,091 )

Basic and diluted loss per share: Net loss available to News

Corporation stockholders per share $ (1.94 ) $ (1.87 )

Pro Forma (unaudited) For the nine months ended March

31, 2018

News CorpHistorical(a)

FoxtelHistorical(b)

TransactionAdjustments

Pro Forma (in millions, except per share amounts)

Revenues: Circulation and subscription $ 1,947 $ 1,638 $ (278 )

(c)(d) $ 3,307 Advertising 2,101 141 - 2,242 Consumer 1,220 - -

1,220 Real estate 633 - - 633 Other 430 39

- 469 Total Revenues 6,331 1,818

(278 ) 7,871 Operating expenses (3,439 ) (1,136 ) 291 (c)(e)

(4,284 ) Selling, general and administrative (2,135 ) (340 ) 5 (f)

(2,470 ) Depreciation and amortization (297 ) (187 ) (17 )

(g)(h)(i) (501 ) Impairment and restructuring charges (273 ) (5 )

(957 ) (j) (1,235 ) Equity (losses) earnings of affiliates (1,002 )

5 974 (j) (23 ) Interest income (expense), net 9 (76 ) - (67 )

Other, net 9 (2 ) - 7

(Loss) income before income tax expense (797 ) 77 18 (702 )

Income tax expense (292 ) (13 ) 5 (k)

(300 ) Net (loss) income (1,089 ) 64 23 (1,002 ) Less: Net

(income) loss attributable to noncontrolling interests (54 )

1 (27 ) (l) (80 ) Net (loss) income

attributable to News Corporation $ (1,143 ) $ 65 $ (4 ) $

(1,082 ) Basic and diluted loss per share: Net loss

available to News Corporation stockholders per share $ (1.96 ) $

(1.86 )

(a)

Reflects the historical results of operations of News

Corporation. As the acquisition of a controlling interest in Foxtel

was completed on April 3, 2018, Foxtel is reflected in our

historical Statements of Operations from April 3, 2018 onwards.

(b)

Reflects the historical results of operations of Foxtel to the date

of the Transaction. From April 3, 2018 onwards, Foxtel is included

in the historical results of operations of News Corporation. The

Statements of Operations of Foxtel are derived from its historical

financial statements for the three and nine months ended March 31,

2018. The Statements of Operations for the three and nine months

ended March 31, 2018 reflect Foxtel's Statements of Operations on a

U.S. GAAP basis and translated from Australian dollars to U.S.

dollars, the reporting currency of the combined group, using the

quarterly average rates for each period presented. Additionally,

certain balances within Foxtel’s historical financial information

were reclassified to be consistent with the Company’s presentation.

(c)

Represents the impact of eliminating transactions between Foxtel

and the consolidated subsidiaries of News Corporation, which would

be eliminated upon consolidation as a result of the Transaction.

(d)

Reflects the reversal of revenue recognized in Foxtel's historical

Statements of Operations resulting from the fair value adjustment

of Foxtel's historical deferred installation revenue in the

preliminary purchase price allocation for the Transaction.

(e)

Reflects the adjustment to amortization of program inventory

recognized in Foxtel’s historical Statements of Operations related

to the fair value adjustment of Foxtel's historical program

inventory in the preliminary purchase price allocation.

(f)

Reflects the removal of transaction expenses directly related to

the Transaction that are included in News Corp’s historical

Statements of Operations for the three and nine months ended March

31, 2018. These costs are considered to be non-recurring in nature,

and as such, have been excluded from the pro forma Statements of

Operations.

(g)

Reflects the adjustment to amortization expense resulting from the

recognition of amortizable intangible assets in the preliminary

purchase price allocation.

(h)

Reflects the adjustment to depreciation and amortization expense

resulting from the fair value adjustment to Foxtel's historical

fixed assets in the preliminary purchase price allocation, which

resulted in a step-up in the value of such assets.

(i)

Reflects the reversal of amortization expense included in News

Corp’s historical Statements of Operations from the Company's

settlement of its pre-existing contractual arrangement between

Foxtel and FOX SPORTS Australia, which resulted in a write-off of

its channel distribution agreement intangible asset at the time of

the Transaction.

(j)

Represents the impact to equity losses of affiliates as a result of

the Transaction, as if the Transaction occurred on July 1, 2016.

Historically News Corp accounted for its investment in Foxtel under

the equity method of accounting. As a result of the Transaction,

Foxtel became a majority-owned subsidiary of the Company, and

therefore, the impact of Foxtel on the Company’s historical equity

losses of affiliates was eliminated. In addition, during the three

and nine months ended March 31, 2018, News Corp recorded an

impairment to its investment in Foxtel within equity losses of

affiliates which is reflected in News Corp’s historical results. As

this impairment is non-recurring in nature and is not directly

attributable to the Transaction, such amount has not been

eliminated and has been reclassified in the pro forma Statements of

Operations from equity losses of affiliates into impairment and

restructuring charges.

(k)

In determining the tax rate to apply to our pro forma adjustments

we used the Australian statutory rate of 30%, which is the

jurisdiction in which the business operates. However, in certain

instances, the effective tax rate applied to certain adjustments

differs from the statutory rate primarily as a result of certain

valuation allowances on deferred tax assets, based on the Company’s

historical tax profile in Australia.

(l)

Represents the adjustment, as a result of the Transaction, to

reflect the non-controlling interest of the combined company on a

pro forma basis.

Pro Forma Segment Analysis

The following table reconciles unaudited reported and pro forma

Net income (loss) to unaudited reported and pro forma Total Segment

EBITDA for the three and nine months ended March 31, 2019 and 2018,

respectively:

For the three months endedMarch 31,

For the nine months endedMarch 31,

2019 2018 2019 2018 (in millions) As reported Pro

forma As reported Pro forma Net income (loss) $ 23 $

(1,081 ) $ 270 $ (1,002 ) Add: Income tax expense 7 6 112 300

Other, net (3 ) (29 ) (30 ) (7 ) Interest expense, net 14 21 45 67

Equity losses of affiliates 4 2 13 23 Impairment and restructuring

charges 34 1,205 71 1,235 Depreciation and amortization 168

168 494 501 Total

Segment EBITDA $ 247 $ 292 $ 975 $ 1,117

The following tables set forth the Company’s reported Revenues

and Segment EBITDA for the three and nine months ended March 31,

2019 and pro forma Revenues and Segment EBITDA for the three and

nine months ended March 31, 2018:

For the three months ended March 31, 2019 2018

Segment Segment Revenues EBITDA Revenues EBITDA (in

millions) As reported Pro forma News and Information

Services $ 1,224 $ 73 $ 1,286 $ 87 Subscription Video Services 539

98 623 127 Book Publishing 421 53 398 41 Digital Real Estate

Services 272 74 279 88 Other 1 (51 ) 1

(51 )

Total $ 2,457 $ 247 $ 2,587 $ 292

For the nine months ended March 31, 2019 2018

Segment Segment Revenues EBITDA Revenues EBITDA (in

millions) As reported Pro forma News and Information

Services $ 3,729 $ 309 $ 3,825 $ 302 Subscription Video Services

1,666 295 1,934 436 Book Publishing 1,335 209 1,268 167 Digital

Real Estate Services 876 300 842 302 Other 2 (138 )

2 (90 )

Total $ 7,608 $ 975 $ 7,871 $

1,117

Subscription Video Services

For the three months ended March 31, For the

nine months ended March 31, 2019 2018 % Change 2019

2018 % Change (in millions, except %) As reported Pro

forma Better/(Worse) As reported Pro forma Better/(Worse)

Revenues: Circulation and subscription $ 474 $ 547 (13 ) % $ 1,455

$ 1,687 (14 ) % Advertising 50 60 (17 ) % 162 201 (19 ) % Other

15 16 (6 ) % 49 46

7 %

Total Revenues 539 623 (13 ) % 1,666 1,934

(14 ) % Operating expenses (374 ) (374 ) - (1,109 ) (1,129 ) 2 %

Selling, general and administrative (67 ) (122 ) 45

% (262 ) (369 ) 29 %

Segment

EBITDA $ 98 $ 127 (23 ) % $ 295 $ 436

(32 ) %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190509005940/en/

Investor RelationsMichael

Florin212-416-3363mflorin@newscorp.com

Leslie Kim212-416-4529lkim@newscorp.com

Corporate CommunicationsJim

Kennedy212-416-4064jkennedy@newscorp.com

Ilana Ozernoy212-416-3364iozernoy@newscorp.com

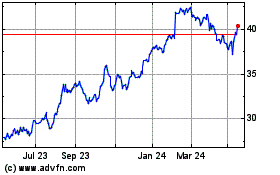

News (ASX:NWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

News (ASX:NWS)

Historical Stock Chart

From Nov 2023 to Nov 2024