By Ari I. Weinberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 4, 2019).

The investing world is awash in indexes.

Originally built to benchmark stock, bond, commodity, real

estate and currency performance, indexes now form the basis of

funds and other investment products and strategies with more than

$13 trillion in assets under management globally, according to

Pensions & Investments, a provider of news and research to

institutional money managers.

While investors in recent years have enthusiastically embraced

passive investments designed to track indexes, actively managed

mutual funds run by human stock pickers have had to fight to

justify themselves. So how much do you know about the companies and

methodologies behind securities indexes? Here is a quiz to test

your knowledge.

1. According to the World Federation of Exchanges, there are

48,000 listed companies globally. How many equity indexes have been

built to track these stocks?

A. 100,430

B. 3.07 million

C. 48.03 million

D. 25,127

ANSWER: B. According to a June 2018 survey of the world's

largest index administrators conducted by the Index Industry

Association, there are 3.73 million indexes globally, of which 3.07

million track stocks.

2. This might seem like asking who is buried in Grant's tomb,

but here goes: How many securities are tracked by the S&P 500

index?

A. 500

B. 502

C. 505

D. 495

ANSWER: C. Ahh, not so obvious after all. The S&P 500 -- an

index of the largest U.S. publicly traded companies by

float-adjusted market capitalization (meaning closely held shares

are excluded) -- does include 500 companies, as its name implies.

But those companies are represented by 505 securities due to

multiple share classes of Google parent Alphabet, Discovery, News

Corp. (the publisher of The Wall Street Journal), 21st Century Fox

and Under Armour.

3. With nearly $3.7 trillion in assets under management in the

U.S., exchange-traded products have become a primary way for

investors to gain exposure to index-tracking. How many index firms

have exchange-traded products based on their work?

A. 15

B. 75

C. 159

D. 224

ANSWER: C. According to research firm XTF, there are 159

separate index providers whose indexes are licensed by asset

managers offering exchange-traded products.

4. Which index firm was funded initially by an investment bank

and an asset manager to build global benchmarks?

A. S&P Dow Jones Indices

B. FTSE Russell

C. MSCI

D. The Center for Research in Security Prices

ANSWER: C. Originally backed by Morgan Stanley and Capital Group

International, MSCI Inc. builds and maintains stock indexes that

cover the world. The company went public in 2009, and is no longer

controlled by its founding entities.

5. In addition to mutual funds and ETFs, there are futures and

options contracts that allow investors to place wagers on index

moves. When was the first S&P 500 index future introduced in

the U.S.?

A. October 1987

B. October 1929

C. March 2000

D. April 1982

ANSWER: D. The Chicago Mercantile Exchange introduced the first

S&P 500 index future for trading on April 21, 1982. S&P 500

index options were first traded on the Cboe Options Exchange on

July 1, 1983. The first retail S&P 500 index fund launched in

1976, and the first ETF in 1993.

6. This is used by index firms to validate the efficacy of a new

index and how well a new index represents the market, factor or

trend that it is designed to represent.

A. Regression analysis

B. Backtest

C. Heteroskedasticity

D. Stochastic

ANSWER: B. Before releasing or updating an index, an index firm

will conduct a backtest of the methodology using historical data to

see how the index would have worked in the past.

7. Which of the following isn't something that index firms or

index committees regularly consider when evaluating index

methodologies?

A. Rebalancing

B. Reconstitution

C. Tracking error

D. Weighting schema

ANSWER: C. Tracking error -- the difference between the

performance of an investment and its index -- is a concern for

asset managers and investors, not index publishers.

8. The S&P GSCI Total Return Index tracks how many

commodities?

A. 10

B. 15

C. 24

D. 30

ANSWER: C. Introduced in 1991, the S&P GSCI tracks listed

futures contracts on 24 commodities, including wheat, coffee,

cattle, heating oil, lead and, of course, gold.

9. U.S. Treasury securities account for what portion of the

Bloomberg Barclays U.S. Aggregate index, which was built by Lehman

Brothers in 1986 to gauge U.S. bond-market performance?

A. 38.9%

B. 6.1%

C. 24.5%

D. 30.5%

ANSWER: A. The AGG, as the index is known, included 261 U.S.

Treasury securities as of January. Government agency securities

accounted for 6.1% of the index, corporate issues 24.5% and

asset-backed securitizations 30.5%.

10. First published in 1896, the Dow Jones Industrial Average is

a price-weighted index of 30 significant U.S.-based companies

across many industries. How many companies have been included in

the Dow across its tenure?

A. 138

B. 75

C. 202

D. 118

ANSWER: D. Of the current 30 companies, Exxon Mobil has had the

longest run in the index, since 1928, while Walgreens Boots

Alliance was added in June 2018 to replace General Electric, an

original index component in 1896 and then a member continuously

from 1907. (Two Wall Street Journal representatives sit on the

five-person Dow Jones Averages index committee.)

11. Which of the following U.S. groups or entities isn't

directly involved in creating or monitoring securities indexes?

A. Securities and Exchange Commission

B. Calculation agent

C. Index publisher

D. Index licensee

ANSWER: A. In the U.S., securities indexes aren't regulated

directly. The SEC does, however, have an open inquiry regarding the

duties and expectations of an index publisher. The calculation

agent, on the other hand, plays a critical role, tabulating daily

index values based on the methodology.

Mr. Weinberg is a writer in Connecticut. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

March 04, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

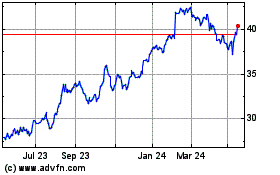

News (ASX:NWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

News (ASX:NWS)

Historical Stock Chart

From Nov 2023 to Nov 2024