Genworth Australia Cautions Key Metrics to Weaken

February 07 2017 - 6:07PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Signs of rising mortgage stress in parts

of Australia and a likely cooling of house-price growth this year

look set to weigh on Genworth Mortgage Insurance Australia Ltd.

(GMA.AU), a provider of insurance to lenders against the risk of

borrowers defaulting.

Genworth Australia, spun out of U.S.-based Genworth Financial

Inc. (GNW) in 2014, said it expects several important metrics to

weaken in 2017, including gross written premium which it forecast

would be between 10% and 15% lower, subject to the timing and

extent of changes in its customer portfolio.

The warning came as the company turned in an 11% fall in net

profit to 203.1 million Australian dollars (US$155.6 million) in

2016 from A$228 million the year before, and a 25% fall in gross

written premium to A$381.9 million from A$507.6 million.

The result was in line with the company's earlier guidance.

Chief Executive and Managing Director Georgette Nicholas said

profitability was strong and the business model resilient despite a

challenging market that includes a rise in mortgage delinquencies

in resources-exposed regional economies in Australia and a drop in

high loan-to-value home loans.

The risk appetite of Australia's mortgage lenders has waned over

the past two years even as home prices continued to rise, with

banks responding to regulatory concerns about stresses in the

market by tightening standards for loans to property investors and

toughening mortgage lending criteria for foreigners. The broader

economy has also moderated as the country shifts away from a

reliance on mining investment to wider sources of growth.

Genworth Australia provides lenders with insurance against a

loss if borrowers default on their home loans, allowing a borrower

who doesn't have a large downpayment to buy a home sooner or to

borrow a higher portion of the purchase price.

In January, the company renewed for a further three years a

contract to supply Commonwealth Bank of Australia Ltd. (CBA.AU),

the country's largest mortgage lender.

Genworth Australia said national unemployment edged up slightly

to 5.8% in December, and other indicators remain mixed, with the

under-employment rate remaining elevated. It forecast home-price

growth would moderate in 2017, with Sydney and Melbourne continuing

to outperform other major cities.

Its net earned premium was likely to decline by about 10%-15%

and its annual loss ratio would be between 40% and 50% this year.

The loss ratio widened to just above 35% in 2016 from 24% the year

before, while net earned premium slipped 3.6% to A$452.9

million.

The company, which remains majority owned by Genworth Financial,

said it would pay a final dividend of 14 Australian cents a share,

in line with the interim payout.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 07, 2017 17:52 ET (22:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

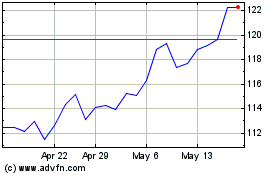

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

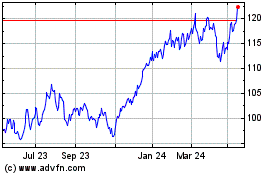

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Feb 2024 to Feb 2025