TIDMWIL

RNS Number : 2071C

Wilmington PLC

21 February 2022

21 February 2022

Wilmington plc

Strong organic revenue and profit growth

Wilmington plc, (LSE: WIL, 'Wilmington' or 'the Group') the

provider of data, information, education and training services in

the global Governance, Risk and Compliance (GRC) markets, today

announces its half year results for the six months ended 31

December 2021 (H1 FY22).

Financial performance

H1 FY22 H1 FY21 Change

Revenue GBP58.9m GBP55.1m 7%

--------- --------- -------

Adjusted PBT(1) GBP9.5m GBP7.0m 35%

--------- --------- -------

Adjusted basic EPS(2) 8.60p 6.44p 34%

--------- --------- -------

Interim dividend 2.4p 2.1p 14%

--------- --------- -------

Statutory PBT incl. GBP24.6m GBP5.5m

AMT sale

Statutory basic

EPS 26.14p 5.05p

--------- ---------

Highlights

- Organic(3) revenue growth 12% driven by the acceleration of

digitalisation programme and return of face-to-face events to

pre-pandemic levels

o Information & Data delivered 10% organic growth; Training

& Education delivered 15% organic growth

o Excluding face-to-face events, organic revenue growth of

6%

- H1 FY22 revenue exceeded pre-Covid H1 FY20 and H1 FY19 for

retained businesses with profits materially ahead

- H1 FY22 Group adjusted profit margins improved to 16% (H1 FY21: 13%)

- Strategic sale of AMT in December 21 for GBP23.4m

- Robust balance sheet position with Group net cash(4) at 31 Dec

21 of GBP11.0m (31 Dec 20: net debt: GBP23.2m; 30 Jun 21: net debt:

GBP17.2m)

- Significant progress made in establishing single technology platforms for each division

- Increasingly strong outlook

Mark Milner, Chief Executive Officer, commented:

"We continue to deliver on our strategy and are now seeing the

results of the Group's repositioning and redirection, the

acceleration of our digitalisation programme and investment in new

products over the last two years.

"This has led to double-digit organic revenue growth,

significant profitability improvement and strong cash conversion.

Both divisions and our teams are performing strongly. Revenues and

profits are now ahead of the pre-Covid periods.

"As we stated on 27 January 2022, trading in the current

financial year is ahead of our earlier expectations. If the major

face-to-face events happen in March as expected, we anticipate our

profitability to improve still further."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement this inside information is now considered to be in the

public domain.

For further information, please contact:

Wilmington plc

Mark Milner, Chief Executive Officer 020 7490 0049

Guy Millward, Chief Financial Officer

Meare Consulting

Adrian Duffield 07990 858548

1 Adjusted profit before tax - see note 4

2 Adjusted basic earnings per share - see note 6

3 Organic - eliminating the effects of exchange rate

fluctuations and the impact of acquisitions and disposals

(4) Net cash includes cash and cash equivalents, bank loans

(excluding capitalised loan arrangement fees) and bank overdrafts

but excludes lease liabilities

Notes to Editors

Wilmington plc is the recognised knowledge leader and partner of

choice for data, information, education and training in the global

Governance, Risk and Compliance (GRC) markets. Wilmington employs

close to 1,000 people and sells to around 120 countries. Wilmington

is listed on the main market of the London Stock Exchange.

Results and dividend

Our strong performance in H1 FY22 demonstrates the value of our

diversified portfolio and focus on the GRC and Regulatory

Compliance markets, with growth driven by our agile teams and the

resilience that this diversity and business model has brought over

the past two years. Demand for our products remains strong with our

customers continuing to rely on us to help them operate

successfully.

Revenue of GBP58.9m was up 7%. Organic revenue growth was 12%,

adjusted for the closure and disposal of discontinued businesses

and the minor impact of currency movements. Excluding face-to-face

events, we saw organic revenue growth of 6%.

This growth was driven by the acceleration of our digitalisation

programme, the investment in new products over the last two years

and the return to face-to-face events.

The Information & Data division achieved 10% organic revenue

growth (5% total revenue growth) with the Training & Education

division achieving organic revenue growth of 15% (10% total revenue

growth). All our businesses grew organically in the first half.

14% of our ongoing revenues are in US dollars, 12% in Euros and

3% in Singapore Dollars, no other currency other than Sterling is

material.

H1 FY22 revenue exceeded both pre-Covid periods H1 FY20 and H1

FY19 on a like-for-like basis with profits being materially

ahead.

Adjusted profit before tax of GBP9.5m (H1 FY21: GBP7.0m) was up

35% and up 42% organically. Costs have increased due to the

anticipated increase in staff costs and the return of some

face-to-face delivery costs, mainly venue hire and some increased

travel. Despite the expected cost increases, adjusted pre-tax

profit margins improved to 16% (H1 FY21: 13%).

Operating cash conversion remained strong at 113%, with net cash

of GBP11.0m (30 June 2021: net debt GBP17.2m) following proceeds

from the sale of the AMT financial training business in December

for GBP23.4m. Net cash including lease liabilities was GBP1.0m.

Remaining debt was repaid in early January 2022.

The interim dividend is being increased by 14% to 2.4p (H1 FY21:

2.1p) and will be paid on 6 April 2022 to shareholders on the share

register as at 4 March 2022, with an associated ex-dividend date of

3 March 2022.

Strategic and operational progress

Our strategy is to grow revenues and profits organically in the

large, growing and rapidly evolving GRC and Regulatory Compliance

markets by investing in our business and actively managing our

portfolio of businesses.

Our investment focus is on establishing single technology

platforms for each division. This supports our digital-first

approach and will enable the Group to grow organically and by

acquisition more efficiently which will ensure we continue to

maintain high margin levels.

In the Training & Education division we have established the

Digital Hub in ICA, rolled out the solution to Bond Solon and are

now moving the Accountancy training business onto the platform over

the next 12 months. In the Information & Data division, we have

begun to establish a single data platform for all our lines of

business based around Snowflake(R) technology and expect this

project to roll out over the next two years.

Our first virtual classroom went live in March 2021 and is

helping us continue to achieve high levels of innovative digital

delivery in training and education products.

Further investments in sales and product management academy roll

outs have started to deliver returns in revenue growth as has an

increased focus on pricing and packaging. We have successfully

increased the number of multi-year subscription contracts in the

first half as a result of this.

We remain focussed on actively managing our portfolio by

assessing the potential of each business to exhibit the six common

Wilmington characteristics that we recognise as key drivers of

organic revenue growth and profitability improvement.

In December 2021, we sold AMT Training to Train The Street, LLC

for an enterprise value of GBP23.4m, subject to customary working

capital adjustments. The cash received leaves us with a net cash

position. As previously announced, we continue to seek a buyer for

our Spanish insurance business, Inese.

We intend to use our cash resources and our GBP65m bank facility

to acquire suitable GRC businesses to add further growth and

profitability to the Group. We will continue to apply high levels

of scrutiny in respect of target identification and multiples paid.

We are clear in our ambition but also clear in the characteristics

we will seek in any business we look to acquire. The ability to

drive value and growth for Wilmington shareholders will always be a

key priority.

Current trading and outlook

We continue to derive considerable benefits from our diversified

portfolio as well as the investment we have made in product

development and digitalisation over the past two years. In addition

to driving organic growth, we have continued to improve

margins.

Provided we can continue to run events face-to-face, we expect

an additional boost to profitability in H2 FY22. If not, we still

expect profits and revenues to be higher than last year despite the

sale of AMT.

ESG

The delivery of our strategy is supported by our ongoing

commitment to responsible business practice, which echoes our

commitment to help customers to do the right business in the right

way.

A core component of our ESG strategy is to promote an open and

inclusive culture in which employee feedback guides our decisions.

During the period we responded to key issues raised by our

colleagues and had a 91% participation rate in the recently

completed annual engagement survey.

We continued to enhance our well-established employee wellbeing

programmes and formalised our Diversity & Inclusion strategy

with a clear roadmap for action. We also used our latest engagement

survey to capture richer data that will help us to demonstrate

progress against our diversity, wellbeing and employee development

ambitions.

In September 2021, we committed to becoming carbon neutral in

FY22. We have achieved this goal already. We have supported high

quality certified carbon reduction and storage programmes to offset

almost double the scope 1, 2 and 3 emissions reported in respect of

FY21.

In H1 FY22, we have completed a more detailed scope 3 emissions

inventory, which will facilitate our work in the second half to set

net zero targets in line with a 1.5-degree trajectory. We are

currently implementing the strategic element of the TCFD

recommendations as an integral component of our annual business

planning process.

Divisional and Financial Review

Information & Data

H1 FY22 H1 FY21 Absolute Organic

Variance Variance

Revenue GBP'm GBP'm

Healthcare 15.9 13.9 14% 16%

Financial Services

& other 10.5 10.3 1% 4%

Identity &

Charities 2.4 2.4 3% 3%

Discontinued 0.3 1.2 (78%)

Total 29.1 27.8 5% 10%

Operating

profit 5.6 4.4 28% 32%

Margin 19% 16%

Revenues in the Information & Data division were up 10% on

an organic basis.

This strong performance was driven by Healthcare which

benefitted from the return to face-to-face events and good growth

in HSJ subscriptions. Financial Services achieved solid organic

growth, again from subscriptions. Identity & Charities achieved

growth despite restructuring initiatives impacting the first

half.

Profitability in the division materially improved, particularly

in Healthcare where revenue growth and cost reductions will combine

in H2 to drive towards a margin target in excess of 20%.

Training & Education

H1 FY22 H1 FY21 Absolute Organic

Variance Variance

Revenue GBP'm GBP'm

Global 11.4 11.2 2% 3%

UK & Ireland 11.7 9.9 17% 18%

North America 2.6 1.5 74% 81%

Discontinued 4.1 4.7 (11%)

Total 29.8 27.3 10% 15%

Operating profit 7.1 5.9 20% 27%

Margin 24% 22%

Revenues grew 15% organically, led by a strong performance in

North America where the return to face-to-face events has boosted

revenues by 81%.

UK and Ireland also had a strong six months with both

Accountancy and Legal seeing double-digit growth due to increased

customer demand. Accountancy revenues are still recovering to

pre-pandemic levels and so the comparative was weak but Legal is

now a much bigger business than it was pre-pandemic.

Global is now mostly ICA following the sale of AMT. UK growth

offsets a decline in Singapore following a very strong FY21.

The increase in the division's revenue was accompanied by an

increase in costs as face-to-face events brought a return of venue

hire and travel costs. However, we have maintained a much higher

proportion of digital training delivery volumes compared to the

pre-pandemic period, resulting in higher margins.

Amortisation excluding computer software, impairment charge and

other income

Amortisation of intangible assets (excluding computer software)

was GBP1.2m (H1 FY21: GBP1.7m), the fall driven by some historic

assets becoming fully amortised. The impairment charge of GBP0.6m

relates to a long leasehold building in Sutton Coldfield we have

been unable to sell since vacating it two years ago. Other income

represents the net gain of GBP16.1m from the sale of AMT Training

and GBP0.8m from the sale of buildings in Basildon linked to our

office consolidation programme.

Finance costs

Net finance costs fell to GBP0.6m (H1 FY21: GBP0.8m) driven

primarily by lower net debt levels. Non-utilisation fees on the

banking facility will mean smaller finance costs will persist in

the second half of the financial year.

Profit before taxation and Earnings per Share

The increase in revenue, improved profit margins and the large

gain on the sale of AMT have resulted in a profit before tax of

GBP24.6m (H1 FY21: GBP5.5m). Earnings per share measures improved

for the same reasons.

Taxation

The tax charge is GBP1.7m (H1 FY21: GBP1.1m) with an overall

effective tax rate(5) of 7% compared to 20% in the prior period.

The fall in effective tax rate was due to the gain on sale of AMT

not being subject to corporation tax. The underlying tax rate(6)

which ignores the tax effects of adjusting items remained flat at

20% (H1 FY21: 20%).

Balance sheet and cashflow

Balance sheet movements are explained by the sale of AMT and

trading in the period, as well as the sale of buildings in Basildon

and the impairment of a long leasehold property in Sutton

Coldfield. Cash generation improved on the prior period due to the

improved trading performance despite the return of dividend

payments.

5 The effective tax rate is calculated as the total tax charge

divided by profit before tax

6 The underlying tax rate is calculated as one minus the

adjusted profit after tax divided by the adjusted profit before tax

- the tax rate excluding the tax impact of adjusting items

Consolidated Income Statement

Year

Six months Six months

ended ended ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 5 58,945 55,071 113,027

Operating expenses before amortisation of

intangibles excluding computer software,

impairment and adjusting items (48,921) (47,282) (96,378)

Impairment of goodwill, intangible assets

and property, plant and equipment 4 (597) - (14,834)

Adjusting items 4 22 (580) (2,970)

Amortisation of intangible assets excluding

computer software 4 (1,183) (1,700) (3,400)

------------------------------------------------ ----- ------------ ----------------- ----------

Operating expenses (50,679) (49,562) (117,582)

Other income - net gain on office consolidation 4 758 - -

Other income - gain on disposal of business

operations 4 - - 3,394

Other income - gain on disposal of subsidiary 7 16,115 770 770

Operating profit/(loss) 25,139 6,279 (391)

Net finance costs (551) (783) (1,634)

Profit/(loss) before tax 4 24,588 5,496 (2,025)

Taxation (1,687) (1,073) (2,522)

------------ ----------------- ----------

Profit/(loss) for the period attributable

to owners of the parent 22,901 4,423 (4,547)

------------ ----------------- ----------

Earnings/(loss) per share:

Basic (p) 6 26.14 5.05 (5.18)

Diluted (p) 6 25.92 5.03 (5.18)

------------ ----------------- ----------

Consolidated Statement of Comprehensive Income

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period 22,901 4,423 (4,547)

Other comprehensive income/(expense):

Items that may be reclassified subsequently

to the Income Statement

---------------------------------------------- ------------- ------------- ----------

Fair value movements on interest rate swap,

net of tax 389 (113) 93

Currency translation differences 341 (1,460) (1,732)

Net investment hedges, net of tax (164) 683 762

---------------------------------------------- ------------- ------------- ----------

Other comprehensive income/(expense) for

the period, net of tax 566 (890) (877)

------------- ------------- ----------

Total comprehensive income/(expense) for

the period attributable to owners of the

parent 23,467 3,533 (5,424)

------------- ------------- ----------

Items in the statement above are disclosed net of tax.

Consolidated Balance Sheet

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 59,912 76,705 65,833

Intangible assets 12,986 17,711 14,000

Property, plant and equipment 7,909 15,826 9,277

Deferred consideration receivable 1,516 1,750 1,585

Derivative financial instruments 537 - 57

Deferred tax assets 1,233 1,244 1,364

84,093 113,236 92,116

------------ ------------ ----------

Current assets

Trade and other receivables 25,904 23,640 28,698

Deferred consideration receivable 250 483 250

Current tax asset 238 1,072 312

Derivative financial instruments - 367 -

Cash and cash equivalents 24,160 7,905 7,374

Assets held for sale - - 1,588

------------ ------------ ----------

50,552 33,467 38,222

------------ ------------ ----------

Total assets 134,645 146,703 130,338

------------ ------------ ----------

Current liabilities

Trade and other payables (51,561) (54,476) (54,959)

Lease liabilities (2,243) (2,571) (2,356)

Derivative financial instruments (125) (198) -

Borrowings - - (3,644)

Provisions (307) - (461)

(54,236) (57,245) (61,420)

Non-current liabilities

Borrowings (12,734) (30,400) (20,430)

Lease liabilities (7,750) (9,288) (8,386)

Deferred tax liabilities (1,762) (2,346) (2,054)

Provisions (1,381) - (1,381)

(23,627) (42,034) (32,251)

------------ ------------ ----------

Total liabilities (77,863) (99,279) (93,671)

------------ ------------ ----------

Net assets 56,782 47,424 36,667

------------ ------------ ----------

Equity

Share capital 4,380 4,380 4,380

Share premium 45,225 45,225 45,225

Treasury and ESOT reserves (960) (453) (701)

Share based payments reserve 1,736 1,419 1,390

Translation reserve 2,410 2,341 2,069

Retained earnings/(accumulated losses) 3,991 (5,488) (15,696)

------------ ------------ ----------

Total equity 56,782 47,424 36,667

------------ ------------ ----------

Consolidated Statement of Changes in Equity

Share capital,

share premium, Share Retained

treasury based earnings/

shares and payments Translation (accumulated Total

ESOT shares reserve reserve losses) equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June 2020 (audited) 49,015 1,195 3,801 (10,605) 43,406

Profit for the period - - - 4,423 4,423

Other comprehensive (expense)/income

for the period - - (1,460) 570 (890)

---------------- ---------- -------------- --------------- ---------

49,015 1,195 2,341 (5,612) 46,939

Performance share plan awards

vesting settled via ESOT 137 (241) - 104 -

Share based payments - 465 - - 465

Tax on share based payments - - - 20 20

At 31 December 2020 (unaudited) 49,152 1,419 2,341 (5,488) 47,424

Loss for the period - - - (8,970) (8,970)

Other comprehensive income/(expense)

for the period - - (272) 285 13

49,152 1,419 2,069 (14,173) 38,467

Dividends paid - - - (1,829) (1,829)

ESOT share purchases (263) - - - (263)

Sale of treasury shares 15 - - - 15

Share based payments - (29) - - (29)

Tax on share based payments - - - 306 306

At 30 June 2021 (audited) 48,904 1,390 2,069 (15,696) 36,667

Profit for the period - - - 22,901 22,901

Other comprehensive income

for the period - - 341 225 566

48,904 1,390 2,410 7,430 60,134

Dividends paid - - - (3,399) (3,399)

Performance share plan awards

vesting settled via ESOT 84 (105) - 21 -

ESOT share purchases (371) - - - (371)

Sale of treasury shares 28 - - - 28

Share based payments - 451 - - 451

Tax on share based payments - - - (61) (61)

At 31 December 2021 (unaudited) 48,645 1,736 2,410 3,991 56,782

---------------- ---------- -------------- --------------- ---------

Consolidated Cash Flow Statement

Six months ended Year ended

Six months ended 31 December 2021 31 December 2020 30 June 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from operations

before adjusting items 9 11,374 9,203 17,290

Cash flows for adjusting items -

operating activities (31) (302) (339)

Cash flows from tax on share based

payments (4) (5) 9

---------------------------------- ------------------ --------------

Cash generated from operations 11,339 8,896 16,960

Interest paid (302) (763) (1,196)

Tax paid (1,805) (1,169) (2,697)

---------------------------------- ------------------ --------------

Net cash generated from operating

activities 9,232 6,964 13,067

---------------------------------- ------------------ --------------

Cash flows from investing

activities

Disposal of a subsidiary 21,875 400 400

Disposal of business operations - - 4,144

Deferred consideration received 125 - 250

Cash flows for adjusting items -

investing activities (92) (43) (151)

Purchase of property, plant and

equipment (275) (455) (1,047)

Proceeds from disposal of property,

plant and equipment 3,439 7 103

Purchase of intangible assets (988) (1,422) (1,969)

---------------------------------- ------------------ --------------

Net cash generated from/(used in)

investing activities 24,084 (1,513) 1,730

---------------------------------- ------------------ --------------

Cash flows from financing

activities

Dividends paid to owners of the

parent (3,399) - (1,829)

Payment of lease liabilities (1,095) (1,285) (2,530)

Purchase of shares by ESOT (371) - (263)

Fees paid relating to new and

extended loan facility (5) (215) (191)

Increase in bank loans - 1,000 2,000

Decrease in bank loans (8,000) (18,181) (29,181)

Net cash used in financing

activities (12,870) (18,681) (31,994)

---------------------------------- ------------------ --------------

Net increase/(decrease) in cash and

cash equivalents, net of bank

overdrafts 20,446 (13,230) (17,197)

Cash and cash equivalents, net of

bank overdrafts, at beginning of

the period 3,730 21,426 21,426

Exchange losses on cash and cash

equivalents (16) (291) (499)

---------------------------------- ------------------ --------------

Cash and cash equivalents, net of

bank overdrafts at end of the

period 24,160 7,905 3,730

---------------------------------- ------------------ --------------

Reconciliation of net cash/(debt)

---------------------------------- ------------------ --------------

Cash and cash equivalents at

beginning of the period 7,374 21,426 21,426

Bank overdrafts at beginning of the - -

period (3,644)

Bank loans at beginning of the

period (20,960) (49,082) (49,082)

Lease liabilities at beginning of

the period (10,742) (13,121) (13,121)

---------------------------------- ------------------ --------------

Net debt at beginning of the period (27,972) (40,777) (40,777)

Net increase/(decrease) in cash and

cash equivalents (net of bank

overdrafts) 20,430 (13,521) (17,696)

Net repayment in bank loans 8,000 17,181 27,181

Exchange (loss)/gain on bank loans (202) 842 941

Movement in lease liabilities 749 1,262 2,379

---------------------------------- ------------------ --------------

Cash and cash equivalents at end of

the period 24,160 7,905 7,374

Bank overdrafts at end of the

period - - (3,644)

Bank loans at end of the period (13,162) (31,059) (20,960)

Lease liabilities at end of the

period (9,993) (11,859) (10,742)

---------------------------------- ------------------ --------------

Net cash/(debt) at end of the

period 1,005 (35,013) (27,972)

---------------------------------- ------------------ --------------

Notes to the Financial Results

General information

The Company is a public limited company incorporated and

domiciled in the UK. The address of the Company's registered office

is 10 Whitechapel High Street, London, E1 8QS.

The Company is listed on the Main Market on the London Stock

Exchange. The Company is a provider of data information, training

and education to the professional markets.

This condensed consolidated interim financial information

('Interim Information') was approved for issue by the Board of

Directors on 18 February 2022.

The Interim Information is neither reviewed nor audited and does

not comprise statutory accounts within the meaning of Section 434

of the Companies Act 2006. Statutory accounts for the year ended 30

June 2021 were approved by the Board of Directors on 17 September

2021 and subsequently filed with the Registrar. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

1. Basis of preparation

This Interim Information for the six months ended 31 December

2021 has been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Conduct Authority and in

accordance with IAS 34 'Interim Financial Reporting'. The Interim

Information should be read in conjunction with the Annual Financial

Statements for the year ended 30 June 2021 which have been prepared

in accordance with IFRSs applicable to companies reporting under

IFRS, adopted pursuant to Regulation (EC) No 1606/2002 as it

applies in the European Union and international accounting

standards in conformity with the requirements of the Companies Act

2006, and are available on the Group's website:

wilmingtonplc.com.

The Group's forecast and projections, taking account of

reasonably possible changes in trading performance, show that the

Group will be able to operate well within the level of its current

banking facilities, further supported by the net cash position. The

Directors have therefore adopted a going concern basis in preparing

the Interim Information.

2. Accounting policies

The accounting policies, significant judgements and key sources

of estimation adopted in the preparation of this Interim Report are

consistent with those applied by the Group in its consolidated

financial statements for the year ended 30 June 2021.

There has been no material impact on the financial statements of

adopting new standards or amendments.

Amended standards and interpretations not yet effective are not

expected to have a significant impact on the Group's consolidated

financial statements.

3. Principal risks and uncertainties

The principal risks and uncertainties that affect the Group

remain unchanged from those stated on pages 31 to 37 of the

strategic report in the Annual Report and Financial Statements for

the year ended 30 June 2021.

4. Measures of profit

Reconciliation to profit on continuing activities before

tax.

To provide shareholders with additional understanding of the

trading performance of the Group, adjusted EBITA has been

calculated as profit before tax after adding back:

-- impairment of goodwill, intangible assets and property, plant and equipment;

-- amortisation of intangible assets excluding computer software;

-- adjusting items;

-- other income - net gain on office consolidation;

-- other income - gain on disposal of business operations;

-- other income - gain on disposal of subsidiary; and

-- net finance costs.

Adjusted profit before tax, adjusted EBITA and adjusted EBITDA

reconcile to profit on continuing activities before tax as

follows:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- -------------- -----------

Profit/(loss) before tax 24,588 5,496 (2,025)

Impairment of goodwill, intangible assets and

property, plant and equipment 597 - 14,834

Amortisation of intangible assets excluding

computer software 1,183 1,700 3,400

Adjusting items (22) 580 2,970

Other income - net gain on office consolidation (758) - -

Other income - gain on disposal of business

operations - - (3,394)

Other income - gain on disposal of a subsidiary (16,115) (770) (770)

Adjusted profit before tax 9,473 7,006 15,015

Net finance costs 551 783 1,634

------------- -------------- -----------

Adjusted operating profit ('adjusted EBITA') 10,024 7,789 16,649

Depreciation of property, plant and equipment

included in operating expenses 1,217 1,700 3,399

Amortisation of intangible assets - computer

software 784 1,064 2,416

------------- -------------- -----------

Adjusted EBITA before depreciation ('adjusted

EBITDA') 12,025 10,553 22,464

------------- -------------- -----------

The net gain on office consolidation included in adjusting items

is in respect of the exercise performed to consolidate the Group's

office space. Included in this amount is the gain on disposal of

two buildings and their associated assets on 31 August 2021.

The following adjusting items have been charged to the Income

Statement during the period but are considered to be adjusting so

are shown separately:

Six months ended Six months ended Year ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------- ---------------- ----------

Costs relating to the consolidation of office space - - 1,842

(Gain)/expense relating to strategic activities (22) 580 1,128

Adjusting items (22) 580 2,970

Impairment of goodwill, intangible assets and property, plant and

equipment 597 - 14,834

Amortisation of intangible assets excluding computer software 1,183 1,700 3,400

Total adjusting items (classified in profit before tax) 1,758 2,280 21,204

---------------- ---------------- ----------

The impairment of goodwill, intangible assets and property,

plant and equipment relates to:

Six months ended Six months ended Year ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------- ------------------------ ----------

Goodwill - - 9,873

Intangible assets - - 1,516

Property, plant and equipment 597 - 3,445

597 - 14,834

---------------- ------------------------ ----------

The impairment in the period relates to the impairment of assets

associated with an office property, recognised as a result of an

exercise performed to consolidate the Group's office space.

5. Segmental information

In accordance with IFRS 8 the Group's operating segments are

based on the operating results reviewed by the Board, which

represents the chief operating decision maker.

The Group's dynamic portfolio provides customers with a range of

information, data, training and education solutions. The two

divisions (Training & Education and Information & Data) are

the Group's segments and generate all of the Group's revenue. The

Board considers the business from both a geographic and product

perspective. Geographically, management considers the performance

of the Group between the UK, Europe (excluding the UK), North

America and the Rest of the World.

(a) Business segments

Six months ended Year ended

Six months ended 31 December 2020 30 June 2021

31 December 2021 (unaudited) (unaudited) (audited)

------------------------------- ---------------------- ----------------------

Revenue Contribution Revenue Contribution Revenue Contribution

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ----------------- -------- ------------ -------- ------------

Training & Education 29,867 7,096 27,271 5,927 56,211 12,197

Information & Data 29,078 5,616 27,800 4,372 56,816 9,320

Group contribution 58,945 12,712 55,071 10,299 113,027 21,517

Unallocated central overheads - (2,152) - (1,981) - (4,302)

Share based payments - (536) - (529) - (566)

58,945 10,024 55,071 7,789 113,027 16,649

Impairment of goodwill, intangible

assets and

property, plant and equipment (597) - (14,834)

Amortisation of intangible assets

excluding computer software (1,183) (1,700) (3,400)

Adjusting items 22 (580) (2,970)

Other income - net gain on office

consolidation 758 - -

Other income - gain on disposal of

business operations - - 3,394

Other income - gain on disposal of a

subsidiary 16,115 770 770

Net finance costs (551) (783) (1,634)

Profit/(loss) before tax 24,588 5,496 (2,025)

Taxation (1,687) (1,073) (2,522)

----------------- ------------ ------------

Profit/(loss) for the financial

period 22,901 4,423 (4,547)

----------------- ------------ ------------

There are no intra-segmental revenues which are material for

disclosure. Unallocated central overheads represent head office

costs that are not specifically allocated to segments. Total assets

and liabilities for each reportable segment are not presented, as

such information is not provided to the Board.

(b) Segmental information by geography

The UK is the Group's country of domicile and the Group

generates the majority of its revenue from external customers in

the UK. The geographical analysis of revenue is on the basis of the

country of origin in which the customer is invoiced:

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- ------------- ----------

UK 30,874 30,815 61,999

North America 10,431 6,208 15,042

Europe (excluding the UK) 11,922 11,444 23,304

Rest of the world 5,718 6,604 12,682

------------- ------------- ----------

Total revenue 58,945 55,071 113,027

------------- ------------- ----------

6. Earnings/(loss) per share

Adjusted earnings/(loss) per share has been calculated using

adjusted earnings calculated as profit/(loss) after taxation but

before:

-- impairment of goodwill, intangible assets and property, plant and equipment;

-- amortisation of intangible assets excluding computer software;

-- adjusting items;

-- other income - net gain on office consolidation;

-- other income - gain on disposal of business operations; and

-- other income - gain on disposal of subsidiary.

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- ------------- -----------

Earnings/(loss) from continuing operations

for the purpose of basic earnings per share 22,901 4,423 (4,547)

Add/(remove):

Impairment of goodwill, intangible assets and

property, plant and equipment 597 - 14,834

Amortisation of intangible assets excluding

computer software 1,183 1,700 3,400

Adjusting items (22) 580 2,970

Other income - net gain on office consolidation (758) - -

Other income - gain on disposal of business

operations - - (3,394)

Other income - gain on disposal of subsidiary (16,115) (770) (770)

Tax effect of adjustments above (253) (293) (558)

Adjusted earnings for the purposes of adjusted

earnings per share 7,533 5,640 11,935

------------- ------------- -----------

Number Number Number

------------- ------------- -----------

Weighted average number of ordinary shares

for the purpose of basic and adjusted earnings

per share 87,603,917 87,603,917 87,603,917

Effect of dilutive potential ordinary shares:

Future exercise of share awards and options 745,931 293,090 410,301

Weighted average number of ordinary shares

for the purposes of diluted earnings per share 88,349,848 87,897,007 88,014,218

------------- ------------- -----------

Basic earnings/(loss) per share 26.14p 5.05p (5.18p)

Diluted earnings/(loss) per share 25.92p 5.03p (5.18p)

Adjusted basic earnings per share ('adjusted

earnings per share') 8.60p 6.44p 13.62p

Adjusted diluted earnings per share 8.53p 6.42p 13.56p

------------- ------------- -----------

7. Disposal of subsidiary

On 24 December 2021 the Group disposed of its financial training

business, AMT with subsidiary companies in the UK, US and Hong Kong

for a consideration of GBP23.4m. A gain of GBP16.1m arose on

disposal after taking into account GBP0.4m costs of disposal. As at

the disposal date, the net assets of the AMT companies were

GBP6.9m.

8. Related party transactions

The Company and its wholly owned subsidiary undertakings offer

certain group-wide purchasing facilities to the Company's other

subsidiary undertakings whereby the actual costs are recharged.

There were no (H1 FY21: GBP55,625) transactions with related

parties of key management personnel in the period.

9. Cash generated from operations

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- ------------- -----------

Profit/(loss) from continuing operations

before tax 24,588 5,496 (2,025)

Net gain on office consolidation (758) - -

Gain on disposal of business operations - - (3,394)

Gain on disposal of a subsidiary (16,115) (770) (770)

Adjusting items (22) 580 2,970

Depreciation of property, plant and equipment 1,217 1,700 3,399

Amortisation of intangible assets 1,967 2,764 5,816

Impairment of goodwill, intangible assets

and property, plant and equipment 597 - 14,834

(Profit)/loss on non-adjusting disposal of

property, plant and equipment (40) 1 2

Share based payments (including social security

costs) 536 529 566

Net finance costs 551 783 1,634

------------- ------------- -----------

Operating cash flows before movements in

working capital 12,521 11,083 23,032

Decrease/(increase) in trade and other receivables 2,905 2,319 (3,619)

Decrease in trade and other payables (3,898) (4,199) (2,123)

Decrease in provisions (154) - -

------------- ------------- -----------

Cash generated from operations before adjusting

items 11,374 9,203 17,290

------------- ------------- -----------

Cash conversion is calculated as a percentage of cash generated

by operations to adjusted EBITA as follows:

Year ended

Six months Six months

ended ended 30 June

31 December 31 December

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- -------------- -----------

Funds from operations before adjusting items:

Adjusted EBITA (note 4) 10,024 7,789 16,649

Share based payments (including social security

costs) 536 529 566

Amortisation of intangible assets - computer

software 784 1,064 2,416

Depreciation of property, plant and equipment

included in operating expenses 1,217 1,700 3,399

(Profit)/loss on disposal of property, plant

and equipment (40) 1 2

------------- -------------- -----------

Operating cash flows before movements in

working capital 12,521 11,083 23,032

Net working capital movement (1,147) (1,880) (5,742)

------------- -------------- -----------

Funds from operations before adjusting items 11,374 9,203 17,290

------------- -------------- -----------

Cash conversion 113% 118% 104%

------------- -------------- -----------

Free cash flows:

Operating cash flows before movement in

working capital 12,521 11,083 23,032

Proceeds on disposal of property, plant

and equipment 3,439 7 103

Net working capital movement (1,147) (1,880) (5,742)

Interest paid (302) (763) (1,196)

Payment of lease liabilities (1,095) (1,285) (2,530)

Tax paid (1,805) (1,169) (2,697)

Purchase of property, plant and equipment (275) (455) (1,047)

Purchase of intangible assets (988) (1,422) (1,969)

------------- -------------- -----------

Free cash flows 10,348 4,116 7,954

------------- -------------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR TMMMTMTATTBT

(END) Dow Jones Newswires

February 21, 2022 02:00 ET (07:00 GMT)

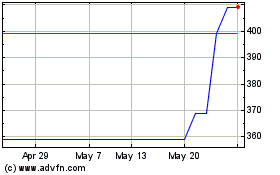

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025