TIDMOCI

RNS Number : 3661B

Oakley Capital Investments Limited

30 September 2022

30 September 2022

Oakley Capital Investments Limited

Result of Annual General Meeting

The Board of Directors (the 'Board') of Oakley Capital

Investments Limited(1) ('OCI' or 'the Company') announces that at

the 2022 Annual General Meeting of the Company held today, 30

September 2022, all the resolutions set out in the Notice of the

Meeting were passed by the requisite majorities.

The results of the AGM resolutions are set out below:

For Against Withheld

% Votes % Votes

R esolution Votes Cast Votes Cast Votes

------------ -------- ----------- -------- ---------

1. R e-appoint KPMG

as Auditor 112,017,563 100.00 0 0.00 4,000

------------ -------- ----------- -------- ---------

2. Re-elect Caroline

Foulger 111,311,013 99.37 710,550 0.63 0

------------ -------- ----------- -------- ---------

3. Re-elect Richard

Lightowler 111,326,287 99.38 695,276 0.62 0

------------ -------- ----------- -------- ---------

4. Re-elect Fiona Beck 112,017,563 100.00 4,000 0.00 0

------------ -------- ----------- -------- ---------

5. Re-elect Peter Dubens 85,643,824 76.45 26,377,739 23.55 0

------------ -------- ----------- -------- ---------

6. Re-elect Stewart

Porter 85,643,824 76.45 26,377,739 23.55 0

------------ -------- ----------- -------- ---------

7. Directors can fill

any vacancy 112,017,563 100.00 4,000 0.00 0

------------ -------- ----------- -------- ---------

8. Authority to issue

shares without pre-emption

rights up to 5% of

issued Share Capital* 110,592,658 98.72 1,428,905 1.28 0

------------ -------- ----------- -------- ---------

*Special Resolution

The Board notes that although resolutions 5 and 6 were each

passed with a substantial majority, there were a material number of

votes cast against. While the composition of our Board complies

with the independence requirements of the AIC Code, we understand

that some shareholders have a policy of voting against the

re-election of any directors who are not independent or who they do

not believe to be independent.

The Board will engage with the shareholders who opposed the

resolutions to address their concerns.

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds.

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V and Oakley Capital Origin

Fund are unlisted lower-mid to mid-market private equity funds that

aim to provide investors with significant long-term capital

appreciation. The investment strategy of the Funds is to focus on

buy-out opportunities in industries with the potential for growth,

consolidation and performance improvement.

Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This announcement may include "forward-looking statements".

These forward-looking statements are statements regarding the

Company's objectives, intentions, beliefs or current expectations

with respect to, amongst other things, the Company's financial

position, business strategy, results of operations, liquidity,

prospects and growth. Forward-looking statements are subject to

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Accordingly

the Company's actual future financial results, operational

performance and achievements may differ materially from those

expressed in, or implied by, the statements. Given these

uncertainties, prospective investors are cautioned not to place any

undue reliance on such forward-looking statements, which speak only

as at the date of this announcement. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained herein to reflect actual

results or any change in the Company's expectations with regard to

them or any change in events, conditions or circumstances on which

any such statements are based unless required to do so by the

Financial Services and Markets Act 2000, the Listing Rules or

Prospectus Regulation Rules of the Financial Conduct Authority or

other applicable laws, regulations or rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGBKKBKNBKDCCN

(END) Dow Jones Newswires

September 30, 2022 10:00 ET (14:00 GMT)

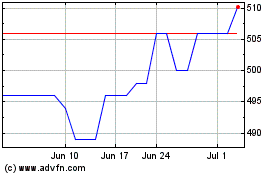

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

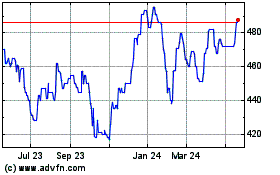

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025