TIDMINC

RNS Number : 1097T

Incanthera PLC

23 March 2021

23 March 2021

Incanthera plc

("Incanthera" or the "Company")

Placing to Raise GBP1,144,650

Incanthera plc (AQSE: INC), the specialist oncology company

focused on transforming cancer treatment, is pleased to announce

that it has raised gross proceeds of GBP1,144,650 through an

oversubscribed placing of 9,538,750 new ordinary shares ("Placing

Shares") with existing and new investors at a price of 12 pence per

share ("Issue Price").

Incanthera successfully floated on AQSE on 28 February 2020,

raising funds to concentrate on the commercialisation of lead

asset, Sol, a proprietary topical formulation designed to deliver

into the skin an active known to treat solar keratosis and prevent

the formation of skin cancers.

The results of two successful studies, announced in September

2020, demonstrated Sol's permeation across the skin barrier and

safety profile on human skin, both of which surpassed expectations,

strengthening the technology's commercial potential and valuation,

which was further enhanced through the filing of a new patent which

gives extended patent protection to Sol to 2040.

Incanthera began introducing Sol's technology to a number of

potential commercial partners last year. In February 2021, the

Company issued a corporate update in which it advised that the

Company has prioritised those potential partners and is currently

focussed on discussions with two Global cosmetic companies.

The net proceeds from the Placing now extends the Company's

existing cash runway into the second half of 2022 and provides

funds for the Company to progress discussions in respect of a

potential commercial deal for Sol from a strong financial

position.

Stanford Capital Partners Ltd acted as lead broker and joint

placing agent, with SI Capital Ltd acting as joint placing agent to

the Placing. They have entered into a placing agreement with the

Company which contains customary terms and conditions.

Placing and Admission

The Company has raised GBP1,144,650 before expenses through a

placing of the Placing Shares at the Placing Price, conditional

only on admission to trading on AQSE ("Admission"). The Placing

Shares will represent 12.88 per cent. of the enlarged issued share

capital of the Company upon Admission and the Placing Price

represents a discount of 6.6% to the closing mid-market price of

12.85 pence on 22 March 2021, the last practicable day prior to

this announcement. The Placing Shares will rank pari passu with the

existing ordinary shares and an application will be made for

Admission of the Placing Shares which is anticipated to occur at

8.00 a.m. on or around 30 March 2021.

For each Placing Share, Placees were offered one warrant to

subscribe for an ordinary share in the Company at a price of 20

pence, for a period of two years from the issue date. The Company

has received acceptances of warrants from Placees over a total of

8,500,000 new ordinary shares ("Placing Warrants") which have been

conditionally granted subject to, inter alia, the approval by the

Company's shareholders of resolutions granting authority to its

Directors to be able to allot and issue sufficient new ordinary

shares for exercise of the Placing Warrants on a non-pre-emptive

basis. A circular will be posted to shareholders to convene a

general meeting in due course.

In addition to the Placing Warrants, the Company entered into a

warrant instrument on 23 March 2021 in which the Company agreed to

grant Stanford Capital Partners Ltd 667,963 warrants to subscribe

for ordinary shares in the Company at the Issue Price of 12 pence

per ordinary share. Stanford may exercise the warrants at any time

from Admission until the date 10 years from the date of

Admission.

Total Voting Rights

For the purposes of the Disclosure Guidance and Transparency

Rules of the Financial Conduct Authority ("DTR"), the Board of

Incanthera hereby notifies the market that following Admission, the

Company's total issued share capital will consist of 74,082,871

ordinary shares with a nominal value of 2 pence each per share.

The figure of 74,082,871 ordinary shares may be used by

shareholders as the denominator for the calculations by which they

may determine if they are required to notify their interests in, or

a change to their interests in the share capital Company under the

DTR.

Commenting on the Placing, Chairman, Tim McCarthy commented:

"The Company is delighted at the results of this Placing and the

support from existing and new shareholders, at an important time

for Incanthera.

Our recent commercial update highlighted the progress we have

made towards a commercial deal on Sol. The security of the

additional funding allows the management team to concentrate on

concluding the current negotiations."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018).

For further enquiries:

Incanthera plc

www.incanthera.com

Tim McCarthy, Chairman

tim.mccarthy@incanthera.com

Simon Ward, Chief Executive Officer

simon.ward@incanthera.com +44 (0) 7831 675747

Suzanne Brocks, Head of Communications +44 (0) 7747 625506

suzanne.brocks@incanthera.com +44 (0) 7776 234600

Aquis Exchange Corporate Adviser:

Cairn Financial Advisers LLP

Jo Turner/James Lewis +44 (0) 20 7213 0880

Broker:

Stanford Capital Partners Ltd

Patrick Claridge/John Howes/Bob Pountney +44 (0) 20 3815 8880

Notes to Editors:

Incanthera is a specialist oncology company focused on

transforming cancer treatment by creating environments in which

cancer cannot survive. It seeks to identify and develop innovative

solutions to current clinical, commercially relevant unmet needs,

utilising new technology from leading academic institutions.

The Company's current lead product and focus is Sol, a

potentially innovative topical product for the treatment of solar

keratosis and the prevention of skin cancers.

The Company originated from the Institute of Cancer Therapeutics

("ICT") at the University of Bradford and has acquired and

developed a portfolio of specific cancer-targeting therapeutics

through a Pipeline Agreement with the ICT and other corporate

acquisitions.

Incanthera's strategy is to develop each candidate in the

portfolio from initial acquisition or discovery to securing its

future through commercially valuable partnerships at the earliest

opportunity in its development pathway.

For more information on the Company please visit:

www.incanthera.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXUURURAKUOUUR

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

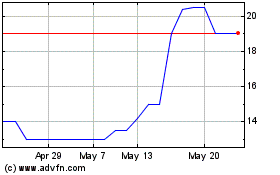

Incanthera (AQSE:INC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Incanthera (AQSE:INC)

Historical Stock Chart

From Mar 2024 to Mar 2025