TIDMDSG

RNS Number : 7864Z

Dillistone Group PLC

23 September 2020

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Interim Results

Dillistone Group Plc, the AIM quoted supplier of software for

the international recruitment industry, announces its results for

the six months ended 30 June 2020.

Key points of the unaudited interim report:

-- The management of our cost base and better operational

performance, has led to improved performance in H1 2020, versus the

same period in 2019, despite Covid-19 having a significant negative

impact on our clients and therefore our revenue

-- Operating profit of GBP0.048m before acquisition related items (2019: loss GBP0.044m)

-- Group is cash generative at an operational level

-- Cash balances of GBP1.732m at 30 June 2020 (2019: GBP0.769m)

-- CBIL loan of GBP1.5m received in June 2020

-- Recurring revenue of GBP3.0m (2019: GBP3.5m)

-- Recurring revenue covers 101% of operational overheads (2019: 91%)

-- Recurring revenues represent 90% of total revenue (2019: 83%)

-- NED Mike Love to retire from the Board, in line with long

term plan, on the announcement of the interim results.

Commenting on the results and prospects, Giles Fearnley,

Non-Executive Chairman, said:

"Any business serving the recruitment sector is going to find a

global pandemic to be a difficult environment to operate through.

However, despite this, the Group is delighted to report

significantly improved operational performance in the period under

review.

"Whilst Covid-19 will continue to impact our revenues, the steps

we've taken to manage our costs while also continuing to invest in

product development will benefit the business through the medium

and long term.

"I would like to take this opportunity to sincerely thank Dr

Mike Love for his services to the Company. Mike was our Chairman

for many years, prior to stepping into the role of NED in January,

with a view to retiring at the time of our Interim results

announcement. Mike remains fully supportive of the Board strategy

and a committed shareholder."

Enquiries:

Dillistone Group Plc Via Walbrook PR

Jason Starr Chief Executive

Julie Pomeroy Finance Director

WH Ireland Limited (Nominated adviser)

Managing Director,

Chris Fielding Corporate Finance 020 7220 1650

Walbrook PR

Tom Cooper / Nick Rome 020 7933 8780

dillistone@walbrookpr.com

Notes to Editors:

Dillistone Group Plc is a leader in the supply and support of

software and services to the recruitment industry. Dillistone

operates through the Ikiru People brand.

The Group develops, markets and supports the FileFinder,

Infinity, Midoffice, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London

Stock Exchange plc, in June 2006. The Group employs around 100

people globally with offices in Basingstoke, Southampton, New

Jersey and Sydney.

Recruitment Software:

https://www.voyagersoftware.com/recruitment-software-blog/best-recruitment-software-agencies/

Temporary Recruitment Software:

https://www.voyagersoftware.com/temporary-recruitment-agency-software/

ISV Skills Testing: https://www.isv.online

GatedTalent: https://www.talentis.global

FileFinder: https://www.dillistone.com

Chairman's Statement

2020 started well for the Group with our early months delivering

results ahead of internal expectations. The Covid-19 pandemic has

obviously had a significant impact on our clients (predominantly

recruitment companies) and therefore our business.

Nevertheless, I am able to report a significantly improved set

of results following the steps taken in 2019 to reorganise the

business and the decisive action by management in the early days of

the pandemic.

The business has returned to profit (before acquisition related

items) and has put in place a cost base that reflects current

revenues. The streamlined operating structure has allowed us to do

this without negatively impacting on our service levels. Indeed,

our Trustpilot scores since January 1(st) have seen us achieve an

excellent rating with 4.5 stars out of a maximum of 5.

Government support clearly played a part in our H1 results and,

with this expecting to be ending, we have now taken further steps

to minimise our cost base. This will lead to some reorganisation

costs being reported in H2.

Following the 2019 reorganisation, the previous divisional

structure has been amalgamated under one trading name, Ikiru

People, and therefore divisional results will no longer be

reported.

Financial Performance

Revenue in the six months ended 30 June 2020 amounted to

GBP3.359m, down GBP0.824m (20%) (2019: GBP4.183m) due to Covid-19

and loss of clients and / or reductions in users, coupled with the

withdrawal of a product in December 2019. Recurring revenues

decreased by 13% to GBP3.029m over the comparable period last year

(2019: GBP3.469m) and represented 90% of total revenues (2019:

83%). Non-recurring revenues were down at GBP0.290m (2019:

GBP0.549m).

Cost of sales reduced to GBP0.328m (2019: GBP0.419m). Excluding

amortisation and depreciation, administration expenses reduced by

GBP0.774m to GBP2.305m (2019: GBP3.079m) in part reflecting the

2019 reorganisation and in part the impact of Covid-19. Such

administration expenses are covered 131% by recurring revenue

(2019: 113%). Excluding acquisition related items, depreciation and

amortisation decreased by 7% to GBP0.678m (2019: GBP0.729m).

Including such operational amortisation in administrative costs

they are covered 101% by recurring revenue (2019: 91%).

Administrative costs also include GBP0.106m (2019: GBP0.198m)

relating to the amortisation of acquisition intangibles. In 2019,

administration costs also included reorganisation costs of

GBP0.115m (2020: GBPnil). The loss for the period before taxation

reduced to GBP0.110m (2019: loss GBP0.397m). The Group generated a

profit after tax and before acquisition related costs of GBP0.019m.

The loss for the period was GBP(0.088m) (2019: GBP(0.320m)).

There is a tax credit for the period of GBP0.022m (2019: credit

GBP0.077m). The 2019 and 2020 tax credits have benefited from

claims in the UK for research and development tax credits

reflecting the continuing development of our products. Also, the

tax credit was impacted through the increase in the rate for

deferred tax to 19% (2019:17%).

Cash generated from operating activities was GBP0.403m (2019:

GBP0.225m). Total cash flows in the 6 months ended 30 June 2020

showed a net inflow of GBP1.043m (2019: inflow GBP0.063m). The main

elements of non-operating expenditure related to investment in new

product development of GBP0.499m (2019: GBP0.615m) and the receipt

of GBP1.500m from the CBIL loan scheme and a loan under the US

payroll protection program of GBP0.086m. At 30 June 2020, we had

cash reserves of GBP1.732m (2019: GBP0.769m) and GBP2.309m in

borrowings (2019: GBP0.885m).

In view of the Covid-19 pandemic and the uncertainty this has

brought, the Board has decided not to pay an interim dividend this

year (2019: nil).

Strategy

The Group continues to invest in its products which it sees as

fundamental to the future success of the Group. Dillistone is an

innovator and thought leader in the recruitment sector, designing

and launching technology solutions for recruiters whose working

practices are ever evolving.

The Board restructured our product portfolio in 2019,

withdrawing certain products from the market, and refocussing our

development expenditure on projects that, we believe, will deliver

long term benefits to shareholders. We expect to begin to see the

benefit of this strategy in 2021.

Outlook

Development remains high on our agenda and we are continuing to

invest in both current and new products which will enable the

recruiters of the future. We are excited by the opportunities that

this investment will deliver and look forward to updating the

market further.

While Covid-19 will continue to impact upon our revenues, with a

stable core business through our long-term underlying client base,

a strong balance sheet as a result of our GBP1.5m CBIL loan,

administrative overheads (excluding depreciation, amortisation and

other one off costs) that are covered by our recurring revenue,

improved operational performance and ongoing investment in product

development, we believe we are well positioned to deliver growth as

we emerge from the current crisis.

Giles Fearnley

Non-Executive Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note 6 Months ended Year ended

30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 4 3,359 4,183 8,027

Cost of sales (328) (419) (849)

---------- ---------- -----------

Gross profit 3,031 3,764 7,178

Administrative expenses (3,089) (4,121) (8,268)

---------- ---------- -----------

Result from operating activities 4 (58) (357) (1,090)

Analysed as:

Result from operating activities

before acquisition related

items 48 (44) (207)

Acquisition and reorganisation

related items 5 (106) (313) (883)

---------- ---------- -----------

Result after acquisition related

items (58) (357) (1090)

----------------------------------------- ---------- ---------- -----------

Financial cost (52) (40) (91)

---------- ---------- -----------

(Loss) before tax (110) (397) (1,181)

Tax income 6 22 77 339

---------- ---------- -----------

(Loss) for the period (88) (320) (842)

Other comprehensive income net

of tax:

Currency translation differences (15) (26) (16)

---------- ---------- -----------

Total comprehensive (loss)

for period net of tax (103) (346) (858)

---------- ---------- -----------

Earnings per share (pence)

Basic 8 (0.45) (1.63) (4.28)

Diluted (0.45) (1.63) (4.28)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June As at 30 June 2019 As at 31 Dec

2020 2019

Unaudited unaudited Audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 3,415 3,415 3,415

Intangible assets 4,022 4,542 4,234

Right of use assets 735 763 754

Property plant & equipment 38 69 54

-------------- ------------------- -------------

8,210 8,789 8,457

Current assets

Inventories - 2 -

Trade and other receivables 1,159 1,750 1,222

Current tax receivable - 112 293

Cash and cash equivalents 1,732 769 690

-------------- ------------------- -------------

2,891 2,633 2,205

-------------- ------------------- -------------

Total assets 11,101 11,422 10,662

-------------- ------------------- -------------

EQUITY AND LIABILITIES

Equity

Share capital 983 983 983

Share premium 1,631 1,631 1,631

Merger reserve 365 365 365

Convertible loan reserve 14 14 14

Retained earnings 783 1,367 871

Share option reserve 106 112 94

Translation reserve 32 37 47

-------------- ------------------- -------------

Total equity 3,914 4,509 4,005

Liabilities

Non current liabilities

Trade and other payables 341 559 443

Lease liabilities 690 772 741

Borrowings 1,995 645 523

Deferred tax 323 393 340

-------------- ------------------- -------------

Total non-current liabilities 3,349 2,369 2,047

-------------- ------------------- -------------

Current liabilities

Trade and other payables 3,410 4,265 3,977

Lease liabilities 100 39 82

Borrowings 314 240 551

Current tax payable 14 - -

-------------- ------------------- -------------

Total non-current liabilities 3,838 4,544 4,610

-------------- ------------------- -------------

Total liabilities 7,187 6,913 6,657

Total liabilities and

equity 11,101 11,422 10,662

-------------- ------------------- -------------

The interim report was approved by the Board of directors and

authorised for issue on 22 September 2020. They were signed on its

behalf by:

JS Starr J P Pomeroy

CONSOLIDATED STATEMENT OF CASH FLOWS

As at 30 June

2020 2019 2019

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating Activities

(Loss) before tax (110) (397) (1,181)

Adjustment for

Financial cost 51 40 91

Depreciation and amortisation 784 918 1,794

Share option expense 12 6 14

Other including foreign exchange adjustments

arising from operations 16 (20) (33)

Operating cash flows before movements

in working capital 753 547 685

increase / (decrease) in receivables 65 (234) 282

Decrease in inventories - 1 3

(decrease) in payables (730) (229) (603)

Taxation repaid 315 140 167

Net cash generated from operating activities 403 225 534

---------- ---------- ---------

Investing Activities

Purchases of property plant and equipment (2) (7) (29)

Proceeds from sale of assets - 10 2

Investment in development costs (499) (615) (1,070)

Net cash used in investing activities (501) (612) (1,097)

---------- ---------- ---------

Financing Activities

Finance cost (49) (23) (83)

Lease payments made (68) (20) (49)

New loan 1,586 500 500

Bank loan repayments (40) (7) (126)

Utilisation of banking facility (288) - 288

---------- ---------- ---------

Net cash generated from financing activities 1,141 450 530

---------- ---------- ---------

Net change in cash and cash equivalents 1,043 63 (33)

Cash and cash equivalents at beginning

of the period 690 725 725

Effect of foreign exchange rate changes (1) (19) (2)

Cash and cash equivalents at end of

period 1,732 769 690

---------- ---------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Retained Convertible Share Foreign Total

capital premium Reserve earnings loan reserve option exchange

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December

2019 983 1,631 365 871 14 94 47 4,005

Comprehensive income

Loss for the 6

months ended 30

June 2020 - - - (88) - - - (88)

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - (15) (15)

Total comprehensive

(loss) - - - (88) - - (15) (103)

--------- --------- --------- --------- ------------- --------- --------- --------

Transactions with

owners

Share option charge - - - - - 12 - 12

Balance at 30 June

2020 983 1,631 365 783 14 106 32 3,914

--------- --------- --------- --------- ------------- --------- --------- --------

Balance at 31 December

2018 983 1,631 365 1,687 14 106 63 4,849

Comprehensive income

Loss for the 6

months ended 30

June 2019 - - - (320) - - - (320)

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - (26) (26)

Total comprehensive

(loss) - - - (320) - - (26) (346)

--------- --------- --------- --------- ------------- --------- --------- --------

Transactions with

owners

Share option charge - - - - - 6 - 6

Balance at 30 June

2019 983 1,631 365 1,367 14 112 37 4,509

--------- --------- --------- --------- ------------- --------- --------- --------

NOTES TO THE INTERIM

NOTES TO THE UNAUDITED INTERIM REPORT

CONSOLIDATED STATEMENT OF

1. Basis of Preparation

The financial information for the six months ended 30 June 2020

included in this condensed interim report comprises the

consolidated statement of comprehensive income, the consolidated

statement of financial position, the consolidated statement of cash

flows, the consolidated statement of changes in equity and the

related notes.

The financial information in these interim results is that of

the holding company and all of its subsidiaries (the Group). It has

been prepared in accordance with the recognition and measurement

requirements of International Financial Reporting Standards as

adopted for use in the EU (IFRSs) but does not include all of the

disclosures that would be required under IFRSs. The accounting

policies applied by the Group in this financial information are the

same as those applied by the Group in its financial statements for

the year ended 31 December 2019 and are those which will form the

basis of the 2020 financial statements.

The comparative financial information presented herein for the

year ended 31 December 2019 does not constitute full statutory

accounts for that period. The Group's annual report and accounts

for the year ended 31 December 2019 have been delivered to the

Registrar of Companies. The Group's independent auditor's report on

those statutory accounts was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

Going concern and the impact of COVID-19.

The uncertainty as to the future impact on the Group of the

recent COVID-19 outbreak has been considered as part of the Group's

adoption of the going concern basis. The Group has seen many of its

clients shrink and with some clients closing. It has additionally

supported many clients through agreeing discounted periods and

deferred terms. Accordingly, the Group will see a reduction in

revenue in 2020. However, the Group has acted quickly, taking

advantage of various government schemes, including furloughing, and

staff unanimously supporting a temporary pay-cut, including all

executive and non-executive directors. The Group also agreed a 6

month payment holiday on its existing bank loan. The Company has

also secured a loan of GBP1.5m under the UK Government's Business

Interruption Loan (CBIL) scheme.

The Board has considered various downside scenarios on the

Group's results as a result of the COVID-19 outbreak. In preparing

this analysis the following assumptions were made for the base

case: a reduction in recurring revenue and non recurring revenue in

2020 with some recovery in the second half of 2020 but with revenue

not returning to full pre Covid-19 levels in 2020 or 2021. A

further scenario was modelled ("stress test scenario") that reduced

revenue further by GBP0.275m. On this basis, the Group's cash

reserves would be reduced to

GBP0.293m in September 2021. The Group also has an overdraft facility of GBP0.200m.

Based on current trading, the stress test scenario is considered

unlikely. However, it is difficult to predict the overall impact

and outcome of COVID-19 at this stage, particularly with the

concerns of a second wave this autumn. Nevertheless, after making

enquiries, and considering the uncertainties described above and

after receiving a CBIL loan of GBP1.5m, the directors have a

reasonable expectation that the company has adequate resources to

continue in operational existence for the foreseeable future. For

these reasons, they continue to adopt the going concern basis in

preparing the annual report and accounts.

Dillistone Group Plc is the Group's ultimate parent company. It

is a public listed company and is domiciled in the United Kingdom.

The address of its registered office and principal place of

business is 12 Cedarwood, Crockford Lane, Chineham Business Park,

Basingstoke, RG24 8WD. Dillistone Group Plc's shares are listed on

the Alternative Investment Market (AIM).

2. Share Based Payments

The Company operates two share option schemes. The fair value of

the options granted under these schemes is recognised as an

employee expense with a corresponding increase in equity. The fair

value is measured at grant date and spread over the period at the

end of which the option holder may exercise the option. The fair

value of the options granted is measured using the Black-Scholes

model.

3. Reconciliation of adjusted operating profits to consolidated

statement of comprehensive income

30 June 2020 and 30 June 2019

Adjusted Acquisition Adjusted Acquisition

operating related operating and reorganisation

profits items profits related

items

30-Jun-20 2020* 30-Jun-20 30-Jun-19 2019* 30-Jun-19

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 3,359 - 3,359 4,183 - 4,183

Cost of sales (328) - (328) (419) - (419)

Gross profit 3,031 - 3,031 3,764 - 3,764

Administrative expenses (2,983) (106) (3,089) (3,808) (313) (4,121)

Results from operating

activities 48 (106) (58) (44) (313) (357)

Financial cost (52) - (52) (38) (2) (40)

Profit/(loss) before

tax (4) (106) (110) (82) (315) (397)

Tax expense/(income) 23 (1) 22 40 37 77

Profit/(loss) for

the year 19 (107) (88) (42) (278) (320)

Other comprehensive

income net of tax:

Currency translation

differences (15) - (15) (26) - (26)

Total comprehensive

income/ (loss) for

the year net of tax 4 (107) (103) (68) (278) (346)

----------- ------------ ---------- ----------- -------------------- ----------

Earnings per share - from continuing activities

Basic 0.10p (0.45)p (0.21)p (1.63)p

Diluted 0.10p (0.45)p (0.21)p (1.63)p

* see accounts note 5

31 December 2019

Adjusted Acquisition

operating and reorganisation

profits related

items

31 December 2019* 31 December

2019 2019

GBP'000 GBP'000 GBP'000

Revenue 8,027 - 8,027

Cost of sales (849) - (849)

------------ -------------------- ------------

Gross profit 7,178 - 7,178

Administrative expenses (7,385) (883) (8,268)

Results from operating activities (207) (883) (1,090)

Financial cost (91) - (91)

Profit/(loss) before tax (298) (883) (1,181)

Tax income 268 71 339

Profit for the year (30) (812) (842)

Other comprehensive income

net of tax:

Currency translation differences (16) - (16)

Total comprehensive loss for

the year net of tax (46) (812) (858)

============ ==================== ==============

Earnings per share - from continuing activities

Basic (0.15)p (4.28)p

Diluted (0.15)p (4.28)p

* see accounts note 5

4. Segment reporting

Following the group reorganisation in 2019, there is only one

trading segment in 2020, Ikiru People.

Results

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

Results from operating activities

Ikiru People 70 82 (72)

Central (22) (126) (135)

Reorganisation costs (578)

Amortisation of acquisition

intangibles and reorganisation

costs (106) (313) (305)

Result from operating

activities (58) (357) (1,090)

======== =========== ========

Geographical segments

The following table provides an analysis of the Group's revenues

by geographical market.

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

UK 2,286 2,888 5,700

Europe 529 480 928

US 394 624 1,034

Australia 150 191 365

3,359 4,183 8,027

======================= ======== ===========

Business Segment

The following table provides an analysis of the Group's revenues

by products and services.

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

Recurring 3,029 3,469 6,593

Non recurring 290 549 1,160

Third party revenues 40 165 274

3,359 4,183 8,027

======================= ======== ===========

'Recurring income' represents all income recognised over time,

whereas 'Non-recurring income' represents all income recognised

at a point in time. Recurring income includes all support services,

software as a service income (SaaS) and hosting income. Non-recurring

income includes sales of new licenses, and income derived from

installing those licenses including training, installation, and

data translation. Third party revenues arise from the sale of

third party software.

5. Acquisition related items and other one off costs

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

Reorganisation costs - 115 578

Amortisation of acquisition

intangibles 106 198 305

106 313 883

Interest on bank loan to

finance reorganisation - 2 -

Total 106 315 883

============ =========== ===========

6. Tax

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

Current tax (5) 18 (50)

Prior year adjustment - current

tax - - (140)

Deferred tax release (18) (58) (67)

Prior year adjustment - deferred

tax - - (24)

Deferred tax re acquisition

intangibles 1 (37) (58)

Tax (income) for the period (22) (77) (339)

============ =========== ===========

The tax charge is impacted by the higher rates of corporation

tax payable in the US offset by the R&D tax credits available

in the UK. Deferred tax has been provided at the rate of 19% (2019:

rates between 17% and 19%).

7. Dividends

The Board has decided not to pay an interim dividend (2019: nil

per share).

8. Earnings per Share

Year ended

6 months ended 30 June 31 Dec

2020 2019 2019

Basic earnings per share

(Loss) attributable to ordinary

shareholders GBP(88,000) GBP(320,000) GBP(842,000)

Weighted average number of

shares 19,668,021 19,668,021 19,668,021

Basic (loss) per share (pence) (0.45) (1.63) (4.28)

============ ============= =============

Diluted earnings per share

(Loss) attributable to ordinary GBP(88,000) GBP(320,000) GBP(842,000)

shareholders

Diluted weighted average number

of shares 19,668,021 19,668,021 19,668,021

Diluted (loss) per share (pence) (0.45) (1.63) (4.28)

============ ============= =============

9. Related party transactions

The Company has a related party relationship with its

subsidiaries, its directors, and other employees of the Company

with management responsibility. There were no transactions with

these parties during the period outside the usual course of

business.

The Directors participated in the issue of convertible loan

notes in 2017 which carry interest at 8.15% per annum payable

quarterly in arrears.

There were no transactions with any other related parties.

10. Cautionary statement

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Company's

strategies and the potential for these strategies to succeed. The

Interim Report should not be relied on by any other party or for

any other purpose. The Interim Report contains certain

forward-looking statements with respect to the financial condition,

results of operations and businesses of the Company. These

statements are made in good faith based on the information

available to them up to the time of their approval of this report.

However, such statements should be treated with caution as they

involve risk and uncertainty because they relate to events and

depend upon circumstances that will occur in the future. There are

a number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements. The continuing uncertainty in global

economic outlook inevitably increases the economic and business

risks to which the Company is exposed. Nothing in this announcement

should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QLLFLBKLXBBK

(END) Dow Jones Newswires

September 23, 2020 02:00 ET (06:00 GMT)

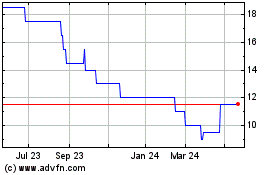

Dillistone (AQSE:DSG.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dillistone (AQSE:DSG.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025