TIDMBZT

RNS Number : 5234D

Bezant Resources PLC

29 June 2021

29 June 2021

Bezant Resources Plc

("Bezant", the "Company" or, together with its subsidiaries, the

"Group")

Final Results for the Year Ended 31 December 2020,

Publication of Annual Report and Update on Timing of AGM

Bezant (AIM: BZT), the copper-gold exploration and development

company, announces its audited final results for the year ended 31

December 2020.

Highlights :

Financial :

-- GBP1.0m loss after tax (2019: GBP1.1m loss).

-- No Impairment charge (2019: GBP211,000) relating to the

Company's Mankayan Copper-Gold Project, Philippines.

-- Approximately GBP1.1m cash at bank at the period end (2019: GBP0.3m).

Operational:

As explained in the Chairman's statement below during the year

the Company remained focused on seeking to develop its existing

projects through strategic alliances / joint ventures / sales and

the identification and acquisition of copper-gold resources moving

towards development of projects which pass the relevant criteria

for investment.

Kalengwa Project : Our 30% interest in the Kalengwa copper

silver project in Zambia, where Bezant acts as operator, was

acquired in April 2020 and comprises a large exploration licence

surrounding one of the richest open pits ever worked in Zambia.

During its working life, the Kalengwa mine, produced 1.9 million

tonnes of ore at an average grade of 9.4% copper with over 25% of

the ore mined exceeding 20% copper. The exploration licence has

numerous indications of similar geology, along with poorly tested

geochemical and geophysical anomalies, which could lead to

discovery of further typical Copper Belt mineralisation. The key

areas of interest include sparsely drilled copper mineralisation

just 4km northeast of the main pit and a 13km strike zone of

coincident geochemical and structural anomalism, which has not been

drill tested. Post the year end in April 2021 we announced the

provisional results of our initial two drill holes which were very

pleasing and our plans for 2021 are referred to in the Chairman's

statement below.

Hope Copper Gold Project : We completed the acquisition of 100%

of Virgo Resources +70% interest in the Hope and Gorob licences in

Namibia, in August 2020 which already have a combined Mineral

Resource of 10.2Mt @1.9% Cu and 0.3g/t Au at a 0.7% Cu cut-off,

reported in accordance with the JORC Code (2012). The concession

has a further untested potential mineralised area of over 150km as

well as additional targets for drill testing adjacent to the Hope

and Gorob deposits. Post-acquisition, archive search, showed that

the values of gold at Hope were on many occasions higher than the

average in the mineral resource statement, including some values

over 1g per tonne. Samples from the Gorob deposit were not assayed

for gold by previous owners, thus giving the impression that no

gold existed. During the period the Company commenced a

reconnaissance drilling programme to test the Gorob prospect for

gold and to increase the resource base in the area surrounding the

Hope property and in January 2021 announced that the result of this

initial programme achieved the objective of confirming our

assertion that gold should be present at the Gorob-Vendome deposit

since it is present at the Hope project and our plans for 2021 are

referred to in the Chairman's statement below.

Mankayan Project Philippines : In 2019 the Company sold 80% of

its interest in the Mankayan copper-gold porphyry project in the

Philippines to MMIH of Singapore who intend a reverse takeover or

listing on the Singapore or other suitable exchange. Post the

period end on 28 April 2021 the Company announced it had served

notice of termination of its transaction agreement (the

"Transaction Agreement") dated 4 October 2019 with Mining and

Minerals Industries Holding Pte. Ltd. ("MMIH"), a private company

incorporated in Singapore, with respect to the sale of 80 per cent.

of the Company's interest in the Mankayan copper -- gold project in

the Philippines (the "Mankayan Project") to MMJV Pte. Ltd.

("MMJV"), a 100 percent subsidiary of MMIH, (the "Transaction") as

MMIH has not met its Total Funding Commitment as defined in the

Transaction Agreement. Bezant, will explore and pursue options

including the possibility of re -- positioning the Mankayan project

within the Company's portfolio of copper and gold assets. The

Company will provide a further update(s) as and when appropriate

and the termination is referred to in notes 5 & 11.1 to the

accounts.

Eureka Project Argentina : The Eureka Project in Argentina has

been kept in good standing. We have previously undertaken the

initial desktop work, to define drilling programmes, which will

test various geophysical and geochemical anomalies and, when

complete, should define, the nature of the gold distribution and

overall potential of the project. Argentina has, like many

countries, been adversely affected by COVID-19 but we have received

expressions of interest to either joint venture or sell the project

and are still considering the best route to take for the

project.

Fundraising:

On 19 June 2020, the Company announced a GBP350,000 (before

expenses) fundraising. The fundraising comprised a placing of

406,250,000 new Ordinary Shares (the "Placing Shares") for

GBP325,000 at a price of 0.08 pence per Ordinary Share (the

"Placing Price") (the "Placing") and a subscription by Colin Bird,

Bezant's Executive Chairman, who invested GBP25,000 to subscribe

for 31,250,000 new Ordinary Shares at the Placing Price (the

"Subscription Shares") (the "Subscription"), representing 7.14 per

cent. of the total Fundraising amount. Each of the participants in

the Fundraising also received a warrant exercisable at a 100%

premium to the Placing Price for each Fundraising Share which they

have subscribed valid for 2 years from Admission. The Company also

issued a warrant to Novum to subscribe for 21,875,000 new Ordinary

Shares exercisable at the Placing Price for a period of 2 years

from Admission.

As announced on 28 August 2020, the Company raised GBP625,000

before expenses from a fundraising comprising 750,000,000 new

Ordinary Shares ("Placing Shares") for GBP600,000 at a price of

0.08 pence per Ordinary Share (the "Placing Price") (the "Placing")

and a subscription by Colin Bird, Bezant's Executive Chairman, who

invested GBP25,000 to subscribe for 31,250,000 new Ordinary Shares

at the Placing Price (the "Subscription Shares") (the

"Subscription"), representing 4.17 per cent. of the total

Fundraising amount. Each of the participants in the Fundraising

also received half a warrant exercisable at 0.16 pence for each

Fundraising Share which they have subscribed valid for two years

from Admission. The Company also issued a warrant to Novum to

subscribe for 37,500,000 new Ordinary Shares exercisable at the

Placing Price for a period of two years from Admission.

During the period 476,875,000 of the warrants issued in relation

to the two fundraisings announced on 19 June 2020 and 28 August

2020 were exercised and the Company was paid in aggregate

GBP739,250 in relation to the exercise of these warrants. As at the

year end.

2021 Annual General Meeting

In light of current restrictions on public gatherings and the

uncertainty as to when and to what extent these will be lifted and

to ensure shareholders comply with the Government measures, the

Company will as in 2020 be calling an Annual General Meeting at

which shareholders will not permitted to attend in person but

arrangement will be made for shareholders to dial into the AGM and

submit questions in advance of the AGM.

The Company will hold an Annual General Meeting on or around

Friday, 30 July 2021 and the wording of each resolution to be

tabled will be set out in a formal Notice of Annual General Meeting

to be sent to shareholders.

Shareholders who are unable to attend the Annual General Meeting

and who wish to appoint a proxy in their place must ensure that

their proxy is appointed in accordance with the provisions set out

in the Notice of Annual General Meeting.

Corporate

On 26 October the Company announced the appointment to the Board

of Raju Samtani as a Finance Director and Edward (Ed) Slowey as a

Technical Director of the Company.

Raju Samtani, Associate Chartered Management Accountant, serves

currently as Finance Director of the AIM-listed Tiger Royalties and

Investments Plc. His previous experience includes his position as a

Finance Director of Kiwara Plc which was acquired by First Quantum

Minerals Ltd in January 2010 and prior to that he spent three years

as Group Financial Controller at marketing services agency - WTS

Group Limited, where he was appointed by the Virgin Group to

oversee their investment in the WTS Group Ltd.

Ed Slowey holds a BSc degree in Geology from the National

University of Ireland and is a founder member of The Institute of

Geology of Ireland. Ed has more than 40 years' experience in

mineral exploration, mining and project management including

working as a mine geologist at Europe's largest zinc mine in Navan,

Ireland and was exploration manager for Rio Tinto in Ireland for

more than a decade, which led to the discovery of the Cavanacaw

gold deposit. Ed is an experienced exploration geologist, having

worked in Africa, Europe, America and the FSU and his experience

includes joint venture negotiation, exploration programme planning

and management through to feasibility study implementation for a

variety of commodities. As a professional consultant, Ed's work has

included completion of CPR's and 43-101 technical reports for

international stock exchange listings and fundraising, while also

undertaking assignments for the World Bank and European Union

bodies. Ed has also served as director of several private and

public companies, including the role of CEO and Technical Director

at AIM-listed Orogen Gold Plc which discovered the Mutsk gold

deposit in Armenia.

Post Period End :

1. Termination of Agreement with MMIH: In 2019 the Company

sold 80% of its interest in the Mankayan copper-gold porphyry

project in the Philippines to MMIH of Singapore who intend a

reverse takeover or listing on the Singapore or other suitable

exchange. Post the period end on 28 April 2021 the Company announced

it had served notice of termination of its transaction agreement

(the "Transaction Agreement") dated 4 October 2019 with Mining

and Minerals Industries Holding Pte. Ltd. ("MMIH"), a private

company incorporated in Singapore, with respect to the sale

of 80 per cent. of the Company's interest in the Mankayan copper

-- gold project in the Philippines (the "Mankayan Project")

to MMJV Pte. Ltd. ("MMJV"), a 100 percent subsidiary of MMIH,

(the "Transaction") as MMIH has not met its Total Funding Commitment

as defined in the Transaction Agreement. Bezant, is exploring

and pursuing options including the possibility of re -- positioning

the Mankayan project within the Company's portfolio of copper

and gold assets. As mentioned in note 5 the previous provisions

writing the Group investment in the Mankayan Project to Nil

have not been written back. Due to the termination of the Transaction

Agreement the contingent consideration due to the Company under

the Transaction Agreement of S$10m shares in a ListCo has not

been recognised.

2. Completion of acquisition of 100% of Metrock Resources:

On 12 February 2021 the Company announced the completion of

its share purchase agreement with the shareholders of Metrock

(the "Vendors") dated 21 December 2020 to acquire 100% of Metrock

Resources Ltd, incorporated in Australia (ACN 634 959 274) ("Metrock")

(the "Acquisition"). Metrock through its 100% owned Australian

subsidiary Coastal Resources Pty Ltd (ACN 624 968 752) owns

i) 100% of Cypress Sources Pty Ltd incorporated in Botswana

which owns PLs 377/2018, 378/2018, 379/2018, 420/2018, 421/2018,

423/2018, 424/2018, 425/2018, and ii) 100% of Coastal Minerals

Pty Ltd Incorporated in Botswana which owns PL129/2019.

The initial consideration payable by Bezant at completion of

the Acquisition ("Completion") was i) GBP405,000 by the issue

of 150,000,000 new ordinary shares of 0.002 pence each in the

capital of the Company ("Bezant Shares") at a deemed issue price

of 0.27 pence per Bezant Share ("Ordinary Shares Consideration")

which was a premium of 17.4% to the closing price of 0.23 pence

on 11 February 2021, ii) the issue of 31,800,000 Unlisted Options

in the share capital of Bezant. The options will have a strike

price of 0.40 pence per share and will have an expiry date of

30 September 2024 ("Option Consideration"). The Company also

issued a total of 84,597,407 Bezant Shares to acquire Loans

of GBP198,213 and settle creditors of GBP30,200 owed by Metrock

which will be issued i) to two of the Vendors namely 50,422,222

Bezant Shares to Breamline Pty Ltd and 5,860,370 Bezant Shares

to M&A Wealth Pty Ltd and ii) 28,314,815 Bezant Shares to Tiger

Royalties and Investments Plc (AIM:TIR) ("Loan Accounts Consideration

Shares") (the "Consideration"). The Company at Completion settled

creditors of Metrock of approximately A$26,508 (approximately

GBP14,900) in cash.

3. Issue of Namibian Licence: On 12 February 2021 the Company,

further to its announcement of 19 June 2020 announced that EPL

7170 has been granted and is registered in the name of the group's

80% owned subsidiary Hope Namibia Mineral Exploration Pty Ltd

. The consideration for the acquisition of EPL 7170 was the

issue of 15,763,889 new ordinary shares at a deemed issue price

of 0.27 pence per share, which was at a premium of 17.4% to

the closing price of 0.23 pence on 11 February 2021 issued to

Bezant's local partner in relation to the issue of EPL 7170

and its transfer to Hope Namibia (the "Initial Shares") and

a further 15,763,889 Bezant Shares are to be issued on 13 July

2021 (the "Balance Shares") (together the "New Shares").

4. Issue of equity regarding acquisition of Virgo Resources

Ltd: On 1 March 2021 the Company announced the issue of 34,000,000

ordinary shares representing the Balance of Assets Sellers Shares

referred to the Company's 17 August 2020 announcement.

5. Exercise of warrants . On the following dates the Company

announced the exercise of warrants at a price on 0.16p per share;

i) 28 April 2021- 16,250,000 warrants for GBP26,000;

ii) 7 May 2021 - 26,250,000 warrants for GBP42,000;

iii) 11 May 2021 - 6,250,000 warrants for GBP10,000; and

17 May 2021 - 43,437,500 warrants GBP69,500

Other that these matters, no significant events have occurred

subsequent to the reporting date that would have a material

impact on the consolidated financial statements.

Colin Bird, Executive Chairman of Bezant, today commented :

"During 2020 we have increased the Company's copper projects in

Southern Africa by acquire a 30% interest in the Kalengwa copper

silver project in Zambia and a >70% interest in the Hope Copper

Gold project in Namibia which means the Company is well positioned

in the gold-copper space when the demand for copper is expected to

double by 2030. Post the year end we increased our position in

Southern Africa by the acquisition of the Kanye Manganese Project

in Botswana."

The Company's Annual Report and Financial Statements for the

year ended 31 December 2020 has been published today and will

shortly be available on the Company's website at:

https://www.bezantresources.com/financial-reports

The audited financial information contained in this announcement

does not constitute the Company's full financial statements for the

year ended 31 December 2020, but is derived from those financial

statements, approved by the board of directors. The auditors'

report on the 2020 financial statements was unqualified and did not

contain any statement under section 498(2) or (3) of the Companies

Act 2006 but did contain an 'material uncertainty' paragraph

relating to going concern. The full audited financial statements

for the year ended 31 December 2020 will be delivered to the

Registrar of Companies and filed at Companies House.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

For further information, please contact :

Bezant Resources plc

Colin Bird

Executive Chairman

Beaumont Cornish (Nominated Adviser) +27 726 118 724

Roland Cornish

Novum Securities Limited (Broker) +44 (0) 20 7628 3396

Jon Belliss

or visit http://www.bezantresources.com +44 (0) 20 7399 9400

EXTRACTS FROM THE 2020 ANNUAL REPORT

Chairman's Statement

Dear Shareholder,

In last year's Chairman's letter, I mentioned the Board's move

to focus on Southern Africa and during the year under review,

Bezant acquired a 30% interest in the Kalengwa Copper Silver

Project in Zambia, and +70% interest in the Hope Copper Gold

Project in Namibia and also entered into an agreement to acquire

the Kanye Manganese Project in Botswana which closed after the year

end. We remained focused on seeking to develop existing projects

through strategic alliances / joint ventures / sales and the

identification and acquisition of copper-gold resources moving

towards development of projects which pass the relevant criteria

for investment.

Kalengwa Project : Our 30% interest in the Kalengwa copper

silver project in Zambia, where Bezant acts as operator, was

acquired in April 2020 and comprises a large exploration licence

surrounding one of the richest open pits ever worked in Zambia.

During its working life, the Kalengwa mine, produced 1.9 million

tonnes of ore at an average grade of 9.4% copper with over 25% of

the ore mined exceeding 20% copper. The exploration licence has

numerous indications of similar geology, along with poorly tested

geochemical and geophysical anomalies, which could lead to

discovery of further typical Copper Belt mineralisation. The key

areas of interest include sparsely drilled copper mineralisation

just 4km northeast of the main pit and a 13km strike zone of

coincident geochemical and structural anomalism, which has not been

drill tested. Post the year end on 12(th) and 22(nd) April 2021 we

announced the provisional results of our initial two drill holes

which were very pleasing. We have identified 350m of mineralised

strike to date and, in order to build up a significant copper

tonnage, we intend to carry out a ground IP geophysics survey as

well as drilling at least two further holes in the vicinity of the

two already completed holes. We are pleased with the results to

date as we have not yet tested several other targets on the large

Kalengwa property, including a 13km zone of enhanced soil

geochemistry along an interpreted structure. We plan to carry out

initial geophysical surveying on this target while the geophysics

crew is on site.

Hope Copper Gold Project : We completed the acquisition of 100%

of Virgo Resources +70% interest in the Hope and Gorob licences in

Namibia, which already have a combined Mineral Resource of 10.2Mt

@1.9% Cu and 0.3g/t Au at a 0.7% Cu cut-off, reported in accordance

with the JORC Code (2012). The concession has a further untested

potential mineralised area of over 150km as well as additional

targets for drill testing adjacent to the Hope and Gorob deposits.

Post-acquisition, archive search, showed that the values of gold at

Hope were on many occasions higher than the average in the mineral

resource statement, including some values over 1g per tonne.

Samples from the Gorob deposit were not assayed for gold by

previous owners, thus giving the impression that no gold existed.

During the period the Company commenced a reconnaissance drilling

programme to test the Gorob prospect for gold and to increase the

resource base in the area surrounding the Hope property and in

January 2021 announced that the result of this initial programme

achieved the objective of confirming our assertion that gold should

be present at the Gorob-Vendome deposit since itis present at the

Hope project. Both copper and gold values were pleasing, and we

will obviously internally rework the valuation of Gorob based on

the new results. In the first half of 2021 we tested the130km of

strike under license by a heli-airborne electromagnetic survey and

the preliminary evaluation of this announced on 2 June 2021 showed

good results as the survey covered areas suspected to be

prospective and has also identified further prospective EM and

magnetic targets with significant strike lengths. We are currently

interrogating the raw data to refine target selection. Our focus

will be on near surface anomalies and/or targets with significant

strike lengths.

Kanye Manganese Project Botswana: We announced on 22 December

2020 the conditional acquisition of a 100% interest in the Kanye

Manganese Project and announced the completion of the acquisition

on 12 February 2021. The project comprises a collection of nine

prospecting licenses, located in south-central Botswana south of

the town of Jwaneng and west of the town of Kanye and 150 km by

road from the capital Gaborone. The licenses cover a total area of

4,043 km2 and provide the holder with the right to prospect for

Metals. The target for manganese mineralisation is manganiferous

shale horizons located on the contact between the Taupone Group and

the underlying Black Reef Formation. This geological setting is

similar to that of the Giyani Metals Corp manganese occurrences on

their Kwgakgwe Hill (K-Hill), Otse and Lobatse projects which are

located just a few kilometres off the Kanye property. The most

significant of these (K-Hill) comprises a manganese-rich black

shale formation within the lower Taupone Group containing an

Inferred Mineral Resource of 1.24Mt @ 27.3% MnO at a cut-off grade

of 8.9% MnO prepared in accordance with Canadian National

Instrument 43-101. (As reported by Giyani Metals Corp. in April

2020). Post-acquisition the Company has in 2021 commenced an

initial exploration programme involving filed work and

trenching.

Mankayan Project Philippines : In 2019 the Company sold 80% of

its interest in the Mankayan copper-gold porphyry project in the

Philippines to MMIH of Singapore who intend a reverse takeover or

listing on the Singapore or other suitable exchange. Post the

period end on 28 April 2021 the Company announced it had served

notice of termination of its transaction agreement (the

"Transaction Agreement") dated 4 October 2019 with Mining and

Minerals Industries Holding Pte. Ltd. ("MMIH"), a private company

incorporated in Singapore, with respect to the sale of 80 per cent.

of the Company's interest in the Mankayan copper -- gold project in

the Philippines (the "Mankayan Project") to MMJV Pte. Ltd.

("MMJV"), a 100 percent subsidiary of MMIH, (the "Transaction") as

MMIH has not met its Total Funding Commitment as defined in the

Transaction Agreement. Bezant, will explore and pursue options

including the possibility of re -- positioning the Mankayan project

within the Company's portfolio of copper and gold assets. The

Company will provide a further update(s) as and when appropriate

and the termination is referred to in notes 5 & 11.1 to the

accounts

Eureka Project Argentina : The Eureka Project in Argentina has

been kept in good standing. We have previously undertaken the

initial desktop work, to define drilling programmes, which will

test various geophysical and geochemical anomalies and, when

complete, should define, the nature of the gold distribution and

overall potential of the project. Argentina has, like many

countries, been adversely affected by COVID-19 but we have received

expressions of interest to either joint venture or sell the project

and are still considering the best route to take for the

project.

Market Outlook : The gold price is always difficult to predict,

but in our projects where gold occurs it is secondary and has the

potential for significant revenue addition particularly in Namibia.

We are particularly confident for the prospects of copper, and as I

have indicated before there are forecast that the demand for copper

is expected to double by 2030. The supply fundamentals have

deteriorated over the last 3 to 4 years, mainly due to do the weak

financing conditions for explorers and social challenges in places

such as Chile and the DRC and this has been borne out by a strong

increase in the copper price over the last year. It remains our

view, that the copper industry will return to its structure of the

1990s, where small high-grade mines existed, medium sized open pit

and underground mines existed and of course, the large open pits

which were the key contributors.

COVID-19 and Brexit : Following on from last year's Chairman's

letter it is now 15 months or so when we all first learnt about the

COVID-19 pandemic and notwithstanding success in the development of

vaccinations it is still very much with us as second and third

waves have emerged. Geo-political tensions have not in the meantime

got any better which has led to a very uncertain world. The paradox

against this uncertainty is sharply rising base metal prices and

bullish forecast for commodities for the coming years. We continue

to believe that for the coming year uncertainties will be

increased, but that the underlying strong trend in commodities will

be maintained. As COVID-19 remains very much a live issue to be

carefully monitored, at the corporate level we have continued to

work from home. Notwithstanding COVID-19 in the period we completed

two acquisitions and two fundraisings both of which I participated

in. Notwithstanding local COVID-19 requirements during the period

we commenced our planned reconnaissance drilling in Namibia and

post year end were able to do the same in Zambia. With no projects

in Europe Brexit has had a minimal effect on the Company.

I would like to thank my fellow directors of Bezant and

management, who have seen many changes during the year and have

been resilient during the transition phase.

I look forward to reporting positive developments in our

projects, with the Company well positioned in the copper-gold

space.

Mr Colin Bird

Executive Chairman

28 June 2021

Consolidated Statement of Profit and Loss

For the year ended 31 December 2020

Notes Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

CONTINUING OPERATIONS

Group revenue - -

Cost of sales - -

------------- -------------

Gross profit/(loss) - -

Operating expenses (658) (911)

Share based payments (380) (6)

Operating loss (1,038) (917)

Interest received - 1

Other income 12 -

Impairment of assets 2 - (211)

Loss before taxation (1,026) (1,127)

Taxation - -

------------- -------------

Loss for the financial year from

continuing operations (1,026) (1,127)

Loss for the financial year (1,026) (1,127)

============= =============

Attributable to:

Owners of the Company (977) (1,127)

------------- -------------

- Continuing operations (977) (1,127)

- Discontinued operations - -

------------- -------------

Non-controlling interest (49) -

------------- -------------

(1,026) (1,127)

============= =============

Loss per share (pence)

Basic loss per share from continuing

operations 3 (0.05) (0.11)

============= =============

Diluted loss per share from continuing

operations 3 (0.05) (0.11)

============= =============

Consolidated Statement of Other Comprehensive Income

For the year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Other comprehensive income:

Loss for the financial year (1,026) (1,127)

Items that may be reclassified

to profit or loss:

Foreign currency reserve movement (1) (17)

------------- -------------

Total comprehensive loss for the

financial year (1,027) (1,144)

============= =============

Attributable to:

Owners of the Company (978) (1,144)

------------- -------------

Non-controlling interest (49) -

------------- -------------

(1,027) (1,144)

============= =============

Consolidated Statement of Changes in Equity

For the year ended 31 December 2020

Non

Share Share Other Retained Controlling Total

Capital Premium Reserves1 Losses interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 31 December

2020

Balance at 1 January

2020 2,003 36,429 840 (34,489) - 4,783

Current year loss - - - (977) (49) (1,026)

Foreign currency reserve - - (1) - - (1)

Total comprehensive

loss for the year - - (1) (977) (49) (1,027)

--------- --------- ----------- --------- ------------- ---------

Proceeds from shares

issued 24 951 - - - 975

Share issue costs - (105) - - - (105)

Shares issued - Acquisitions 12 1,120 - - - 1,132

Warrants issued to

shareholders - - 486 (451) - 35

Warrants exercised 10 730 (243) 243 - 740

Share options granted - - 441 - - 441

Non-controlling interests

on acquisition of

subsidiary - - - - 37 37

Balance at 31 December

2020 2,049 39,125 1,523 (35,674) (12) 7,011

========= ========= =========== ========= ============= =========

Non

Share Share Other Retained Controlling Total

Capital Premium Reserves(1) Losses interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 31 December

2019

Balance at 1 January

2019 1,998 36,074 840 (33,362) - 5,550

Current year loss - - - (1,127) - (1,127)

Foreign currency reserve - - (17) - - (17)

Total comprehensive

loss for the year - - (17) (1,127) - (1,144)

--------- --------- ------------- --------- ------------- ---------

Proceeds from shares

issued 5 366 - - - 371

Warrants issued - (38) 38 - - -

Lapsed warrants - 27 (27) - - -

Share options granted - - 6 - - 6

Balance at 31 December

2019 2,003 36,429 840 (34,489) - 4,783

========= ========= ============= ========= ============= =========

(1) Other reserves is made up of the share-based payment and

foreign exchange reserve.

Consolidated and company Balance Sheet

As at 31 December 2020

Consolidated Company

2020 2019 2020 2019

Notes GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Plant and equipment 4 3 4 - 1

Investments 5 - - 4,516 2,870

Exploration and evaluation

assets 6 6,405 4,778 3,129 3,129

--------- --------- --------- -----------

Total non-current

assets 6,408 4,782 7,645 6,000

--------- --------- --------- -----------

Current assets

Trade and other receivables 28 65 16 58

Cash and cash equivalents 1,128 330 1,094 329

--------- --------- --------- -----------

1,156 395 1,110 387

Total current assets 1,156 395 1,110 387

--------- --------- --------- -----------

TOTAL ASSETS 7,564 5,177 8,755 6,387

LIABILITIES

Current liabilities

Trade and other payables 553 394 399 371

Total current liabilities 553 394 399 371

--------- --------- --------- -----------

NET ASSETS 7,011 4,783 8,356 6,016

========= ========= ========= ===========

EQUITY

Share capital 7 2,049 2,003 2,049 2,003

Share premium 7 39,125 36,429 39,125 36,429

Share-based payment

reserve 858 174 858 174

Foreign exchange reserve 665 666 142 142

Retained losses (35,674) (34,489) (33,818) (32,732)

--------- --------- --------- -----------

7,023 4,783 8,356 6,016

Non-controlling interests (12) - - -

--------- --------- --------- -----------

TOTAL EQUITY 7,011 4,783 8,356 6,016

========= ========= ========= ===========

In accordance with the provisions of Section 408 of the

Companies Act 2006, the Parent Company has not presented a separate

income statement. A loss for the year ended 31 December 2020 of

GBP878,000 (2019: GBP1,216,000) has been included in the

consolidated income statement.

Consolidated and Company Statement of Cash Flows

For the year ended 31 December 2020

Consolidated Company

Year ended Year ended Year ended Year ended

31 December 31 December 31 December 31 December

2020 2019 2020 2019

Notes GBP'000 GBP'000 GBP'000 GBP'000

Net cash outflow from operating

activities 8 (629) (437) (460) (352)

------------- ------------- ------------- -------------

Cash flows from investing

activities

Interest received - 1 - -

Other income 53 43 53 43

Option payments - (27) - -

Proceeds from sale of PP&E 12 - - -

Deferred exploration expenditure (271) - - -

Investment in subsidiary - - (245) -

Loans to associates - (58) - (58)

Loans to subsidiaries - - (227) (108)

------------- ------------- ------------- -------------

(206) (41) (419) (123)

------------- ------------- ------------- -------------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 1,644 329 1,644 329

------------- ------------- ------------- -------------

Increase/(decrease) in cash 809 (149) 765 (146)

Cash and cash equivalents

at beginning of year 330 492 329 481

Foreign exchange movement (11) (13) - (6)

------------- ------------- ------------- -------------

Cash and cash equivalents

at end of year 1,128 330 1,094 329

============= ============= ============= =============

Notes to the financial information

For the year ended 31 December 2019

1. Basis of preparation

The financial information, which incorporates the financial

information of the Company and its subsidiary undertakings

(the "Group"), has been prepared using the historical cost

convention and in accordance with International Financial

Reporting Standards ("IFRS") including IFRS 6 'Exploration

for and Evaluation of Mineral Resources', as adopted by the

European Union ("EU").

The audited financial information contained in this announcement

does not constitute the Company's full financial statements

for the year ended 31 December 2020, but is derived from those

financial statements, approved by the board of directors.

The auditors' report on the 2020 financial statements was

unqualified and did not contain any statement under section

498(2) or (3) of the Companies Act 2006 but did contain an

'material uncertainty' paragraph relating to going concern.

The full audited financial statements for the year ended 31

December 2020 will be delivered to the Registrar of Companies

and filed at Companies House.

Going concern basis of accounting

The Group made a loss from all operations for the year ended

31 December 2020 after tax of GBP1,026,000 (2019: GBP1.1 million),

had negative cash flows from operations and is currently not

generating revenues. Cash and cash equivalents were GBP1.1

million as at 31 December 2020. An operating loss is expected

in the year subsequent to the date of these accounts and as

a result the Company will need to raise funding to provide

additional working capital to finance its ongoing activities.

Management has successfully raised money in the past, but

there is no guarantee that adequate funds will be available

when needed in the future.

The COVID-19 pandemic announced by the World Health Organisation

in the period initially had a markedly negative impact on

global stock markets although many sectors and stock market

losses have been recovered there is increased volatility as

stock markets react to ongoing news in relation to the short-term

and long-term impact of COVID-19 and the financially implications

of the economic stimulus packages adopted by most governments

to protect and / or support their economies this has also,

affected currencies and general business activity. Notwithstanding

this the Company was able to complete and announce fundraisings

of GBP350,000 on 19 June 2020 and GBP625,000 on 28 August

2020. The timing and extent of the impact and recovery from

COVID-19 is still not certain as although certain countries

have implemented successful vaccination programs others lag

behind , many international travel restrictions remain in

place and different countries are experiencing new waves of

infection so COVID-19 remains an issue that requires ongoing

monitoring in 2021 and likely at least into 2022 but possibly

longer.

Based on the Board's assessment that the Company will be able

to raise additional funds, as and when required, to meet its

working capital and capital expenditure requirements, the

Board have concluded that they have a reasonable expectation

that the Group can continue in operational existence for the

foreseeable future. For these reasons the Group continues

to adopt the going concern basis in preparing the annual report

and financial statements.

There is a material uncertainty related to the conditions

above that may cast significant doubt on the Group's ability

to continue as a going concern and therefore the Group may

be unable to realise its assets and discharge its liabilities

in the normal course of business.

The financial report does not include any adjustments relating

to the recoverability and classification of recorded asset

amounts or liabilities that might be necessary should the

entity not continue as a going concern.

2. Impairment

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Impairment loss on loan to associate - 211

- 211

================================================================== ==============

The Mankayan project owned by Crescent Mining and Development

Corporation is part of the continuing operations and was fully

impaired in 2016 (see note 11) due to then significant lingering

uncertainty concerning the political and tax environment in

the Philippines. Although the political and tax environment

has subsequently improved it was not considered prudent in

the 2019 accounts to write back any of the provision made

in prior years.

In 2019, as per note 11.1, of the accounts Group sold 80%

of its interest in the Mankayan copper-gold project and derecognised

its investment in its subsidiary, Asean Copper Investments

Limited and the loan balances outstanding have been fully

impaired.

On 28 April 2021 post the period end ( see note 25 of the

accounts) the Company announced that it had served notice

of termination of its transaction agreement (the "Transaction

Agreement") dated 4 October 2019 with Mining and Minerals

Industries Holding Pte. Ltd. ("MMIH"), a private company incorporated

in Singapore, with respect to the sale of 80 per cent. of

the Company's interest in the Mankayan copper -- gold project

in the Philippines (the "Mankayan Project") to MMJV Pte. Ltd.

("MMJV"), a 100 percent subsidiary of MMIH, (the "Transaction")

as MMIH has not met its Total Funding Commitment as defined

in the Transaction Agreement. Bezant, will explore and pursue

options including the possibility of re -- positioning the

Mankayan project within the Company's portfolio of copper

and gold assets but in the meantime the previous provisions

against the Company's investment in the Mankayan Project writing

it down to Nil have not been written back.

3. Loss per share

The basic and diluted loss per share have been calculated

using the loss attributable to equity holders of the Company

for the year ended 31 December 2020 of GBP977,000 (2019: GBP1,127,000)

of which GBP977,000 (2019: GBP1,127,000) was from Continuing

Operations and GBPnil (2019: nil) was from Discontinued Operations.

The basic loss per share was calculated using a weighted average

number of shares in issue of 2,046,170,268 (2019: 1,018,075,876).

The diluted loss per share has been calculated using a weighted

average number of shares in issue and to be issued of 2,397,420,278

(2019: 1,018,075,876).

The diluted loss per share and the basic loss per share are

recorded as the same amount, as conversion of share options

decreases the basic loss per share, thus being anti-dilutive.

4. Plant and equipment

2020 2019

GBP'000 GBP'000

Plant and equipment

Cost

At beginning of year 68 73

Exchange differences (1) (5)

-------- --------

At end of year 67 68

-------- --------

Depreciation

At beginning of year 64 67

Charge for the year 1 1

Exchange differences (1) (4)

-------- --------

At end of year 64 64

-------- --------

Net book value at end of year 3 4

======== ========

5. Investments

2020 2019

GBP'000 GBP'000

Loan to associate 211 211

Impairment provision (note 2) (211) (211)

-------- --------

- 279

======== ========

6. Exploration and evaluation assets 2020 2019

GBP'000 GBP'000

Balance at beginning of year 4,778 4,781

Acquisitions during year -

Namibia (note 9) 1,283 -

Zambia (note 9) 131 -

Exploration expenditure 218 -

Exchange differences (5) (3)

----------- --------

Carried forward at end of year 6,405 4,778

=========== ========

7. Share capital

2020 2019

Number GBP'000 GBP'000

Authorised

5,000,000,000 ordinary shares of 0.002p 100 -

each

5,000,000,000 deferred shares of 0.198p 9,900 -

each

--------------- --------------

10,000 10,000

=============== ==============

Allotted ordinary shares, called up

and fully paid

As at beginning of the year 25 1,998

Share subscription 24 5

Shares issued to directors and management 12 -

Shares issued to settle third party

fees 10 -

Sub-divided to deferred shares (1) - (1,978)

--------------- --------------

Total ordinary shares at end of year

r 71 25

--------------- --------------

Allotted deferred shares, called up

and fully paid

As at beginning of the period 1,978 -

Sub-divided from ordinary shares (1) - 1,978

--------------- --------------

Total deferred shares at end of period 1,978 1,978

--------------- --------------

Ordinary and deferred as at end of

year 2,049 2,003

=============== ==============

Number of Number of

shares 2020 shares 2019

Ordinary share capital is summarised

below:

As at beginning of the year 1,269,755,181 998,773,038

Share subscription 1,218,750,000 250,000,000

Shares issued for exploration project

acquisitions 578,318,935(3)

Shares issued on exercise of warrants 476,875,000 -

Shares issued to settle third party

fees (-) 20,982,143(2)

--------------- --------------

As at end of year 3,543,699,116 1,269,755,181

=============== ==============

Deferred share capital is summarised

below:

As at beginning of the year - -

Issued due to sub-division (1) 998,773,038 998,773,038

--------------- --------------

As at the end of the year 998,773,038 998,773,038

=============== ==============

(1) On 24 May 2019, a resolution was passed at the Company's

Annual General Meeting to approve the reorganisation of

the Company's share capital in order to reduce the nominal

value of the Company's ordinary shares such that the Company

is able to issue new ordinary shares at a price below GBP0.02

per ordinary share in the event that the Directors seek

to raise additional equity finance at such a price to provide,

inter alia, additional working capital for the group. Pursuant

to this resolution, every existing ordinary share in the

capital of the Company in issue of GBP0.002 each ("Existing

Ordinary Shares") on 24 May 2019 was re-designated and

sub-divided into 1 (one) new ordinary share of GBP0.00002

each ("New Ordinary Shares") and 1 (one) deferred share

of GBP0.00198 each ("Deferred Shares"). The New Ordinary

Shares have been admitted for trading on AIM in place of

the Existing Ordinary Shares. The New Ordinary Shares continue

to carry the same rights as attached to the Existing Ordinary

Shares (save for the reduction in their nominal value).

The Deferred Shares have very limited rights and are effectively

valueless as they have no voting rights and have no rights

as to dividends and only very limited rights on a return

of capital. The Deferred Shares are not admitted to trading

or listed on any stock exchange and are not freely transferable.

(2) On 5 December 2019, certain professional fees amounting

to GBP29,375 owed to Novum Securities Ltd was settled by

the issue of 20,982,143 new Ordinary Shares (the "Fee Shares").

The Fee Shares were issued at a price of 0.14 pence per

share, being the price at which the Company completed its

fundraise announced on 5 December 2019 which represented

a discount of approximately 30 per cent. to the Company's

closing mid-market share price of 0.2 pence on 4 December

2019.

(3) On 14 August 2020 the Company completed the acquisition

of 100% of Virgo Resources Ltd and its interests in the

Hope Copper-Gold Project in Namibia. Acquisition consideration

included the issue of 501,395,858 ordinary shares to the

vendors of the project (note 12). On 27 April 2020 the

Company entered into a binding agreement with KPZ International

Limited ("KPZ Int") in relation to the acquisition of a

30 per cent. interest in the approximate 974 km(2) large

scale exploration licence numbered 24401-HQ-LEL in the

Kalengwa greater exploration area in The Republic of Zambia

(the "Licence") by acquiring a 30 per cent. shareholding

in KPZ Int. The Licence is held by Kalengwa Processing

Zone Ltd ("KPZ"), a 100 per cent. (less one share) Zambian

subsidiary of KPZ Int, and is for the exploration of copper,

cobalt, silver, gold and certain other specified minerals.

The Licence was granted on 2 April 2019 and is valid for

an initial period up to 1 April 2023. Consideration for

the acquisition was US$250,000 (LIR202,493) settled on

6 November by the issue of 76,923,077 shares and costs

of GBP23,77

2020 2019

GBP'000 GBP'000

The share premium was as follows:

As at beginning of year 36,429 36,074

Share subscription 951 345

Shares issued to directors and management - -

Shares issued to settle third party

fees - 42

Shares issued - Acqusitions 1,120 -

Share issue costs (105) (21)

Warrants lapsed - 27

Warrants exercised 730 -

Warrants issued - (38)

As at end of year 39,125 36,429

======== ========

Each fully paid ordinary share carries the right to one vote

at a meeting of the Company. Holders of shares also have the

right to receive dividends and to participate in the proceeds

from sale of all surplus assets in proportion to the total

shares issued in the event of the Company winding up.

8. Reconciliation of operating loss to net

cash outflow from operating activities

Year ended Year ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Operating loss from all operations (1,038) (917)

Depreciation and amortisation - 1

VAT refunds received (53) (43)

Share options 380 6

Shares converted at a discount - 13

Foreign exchange gain 5 154

Decrease in receivables 37 29

Increase in payables 40 320

------------- -------------

Net cash outflow from operating activities (629) (437)

============= =============

9. Acquisition of subsidiaries

Acquisition of Virgo Resources Limited

Namibia

On 14 August 2020 the Company completed the acquisition of

100% of Virgo Resources Ltd and its interests in the Hope

Copper-Gold Project in Namibia.

The fair value of the assets and liabilities acquired were

as follows:

2020

GBP'000

Consideration

Equity consideration

* Ordinary shares (issued) 939

* Ordinary shares (deferred) 126

* Options 61

Cash consideration 86

----------

1,212

Fair value of assets and

liabilities acquired

* Assets 33

* Liabilities (104)

----------

(71)

Deemed fair value of

exploration assets acquired 1,283

==========

On 27 April 2020 the Company entered into a binding joint

venture agreement with KPZ International Limited ("KPZ Int")

in relation to the acquisition of a 30 per cent. interest

in the approximate 974 km(2) large scale exploration licence

numbered 24401-HQ-LEL in the Kalengwa greater exploration

area in The Republic of Zambia (the "Licence") by acquiring

a 30 per cent. shareholding in KPZ Int. The Licence is held

by Kalengwa Processing Zone Ltd ("KPZ"), a 100 per cent. (less

one share) Zambian subsidiary of KPZ Int, and is for the exploration

of copper, cobalt, silver, gold and certain other specified

minerals. The Licence was granted on 2 April 2019 and is valid

for an initial period up to 1 April 2023.

The fair value of the assets and liabilities acquired were

as follows:

2020

GBP'000

Consideration

Consideration

* Was due to be paid in cash but subsequently agreed to

be settled by Ordinary shares (issued) 193

193

Fair value of assets and

liabilities acquired

* Assets 53

-

* Liabilities

--------

53

Deemed fair value of

exploration assets acquired 140

========

10. Availability of Annual Report and Financial Statements

Copies of the Company's full Annual Report and Financial Statements

are being posted to those shareholders who have elected to

receive hardcopy shareholder communications from the Company

and are also available to download from the Company's website

at www.bezantresources.com .

The Annual Report and Financial Statements will also be made

available for inspection at the Company's registered office

during normal business hours on any weekday. Bezant Resources

Plc is registered in England and Wales with registered number

02918391. The registered office is at Floor 6, Quadrant House,

4 Thomas More Square, London E1W 1YW.

11 Subsequent events

. 1. Termination of Agreement with MMIH: In 2019 the Company

sold 80% of its interest in the Mankayan copper-gold porphyry

project in the Philippines to MMIH of Singapore who intend

a reverse takeover or listing on the Singapore or other

suitable exchange. Post the period end on 28 April 2021

the Company announced it had served notice of termination

of its transaction agreement (the "Transaction Agreement")

dated 4 October 2019 with Mining and Minerals Industries

Holding Pte. Ltd. ("MMIH"), a private company incorporated

in Singapore, with respect to the sale of 80 per cent.

of the Company's interest in the Mankayan copper -- gold

project in the Philippines (the "Mankayan Project") to

MMJV Pte. Ltd. ("MMJV"), a 100 percent subsidiary of MMIH,

(the "Transaction") as MMIH has not met its Total Funding

Commitment as defined in the Transaction Agreement. Bezant,

is exploring and pursuing options including the possibility

of re -- positioning the Mankayan project within the Company's

portfolio of copper and gold assets. As mentioned in note

5 the previous provisions writing the Group investment

in the Mankayan Project to Nil have not been written back.

Due to the termination of the Transaction Agreement the

contingent consideration due to the Company under the Transaction

Agreement of S$10m shares in a ListCo has not been recognised.

2. Completion of acquisition of 100% of Metrock Resources:

On 12 February 2021 the Company announced the completion

of its share purchase agreement with the shareholders of

Metrock (the "Vendors") dated 21 December 2020 to acquire

100% of Metrock Resources Ltd, incorporated in Australia

(ACN 634 959 274) ("Metrock") (the "Acquisition"). Metrock

through its 100% owned Australian subsidiary Coastal Resources

Pty Ltd (ACN 624 968 752) owns i) 100% of Cypress Sources

Pty Ltd incorporated in Botswana which owns PLs 377/2018,

378/2018, 379/2018, 420/2018, 421/2018, 423/2018, 424/2018,

425/2018, and ii) 100% of Coastal Minerals Pty Ltd Incorporated

in Botswana which owns PL129/2019.

The initial consideration payable by Bezant at completion

of the Acquisition ("Completion") was i) GBP405,000 by

the issue of 150,000,000 new ordinary shares of 0.002 pence

each in the capital of the Company ("Bezant Shares") at

a deemed issue price of 0.27 pence per Bezant Share ("Ordinary

Shares Consideration") which was a premium of 17.4% to

the closing price of 0.23 pence on 11 February 2021, ii)

the issue of 31,800,000 Unlisted Options in the share capital

of Bezant. The options will have a strike price of 0.40

pence per share and will have an expiry date of 30 September

2024 ("Option Consideration"). The Company will also issued

a total of 84,597,407 Bezant Shares to acquire Loans of

GBP198,213 and settle creditors of GBP30,200 owed by Metrock

which will be issued i) to two of the Vendors namely 50,422,222

Bezant Shares to Breamline Pty Ltd and 5,860,370 Bezant

Shares to M&A Wealth Pty Ltd and ii) 28,314,815 Bezant

Shares to Tiger Royalties and Investments Plc (AIM:TIR)

("Loan Accounts Consideration Shares") (the "Consideration").

The Company at Completion settled creditors of Metrock

of approximately A$26,508 (approximately GBP14,900) in

cash.

3. Issue of Namibian Licence: On 12 February 2021 the

Company, further to its announcement of 19 June 2020 announced

that EPL 7170 has been granted and is registered in the

name of the group's 80% owned subsidiary Hope Namibia Mineral

Exploration Pty Ltd . The consideration for the acquisition

of EPL 7170 was the issue of 15,763,889 new ordinary shares

at a deemed issue price of 0.27 pence per share, which

was at a premium of 17.4% to the closing price of 0.23

pence on 11 February 2021 issued to Bezant's local partner

in relation to the issue of EPL 7170 and its transfer to

Hope Namibia (the "Initial Shares") and a further 15,763,889

Bezant Shares are to be issued on 13 July 2021 (the "Balance

Shares") (together the "New Shares").

4. Issue of equity regarding acquisition of Virgo Resources

Ltd: On 1 March 2021 the Company announced the issue of

34,000,000 ordinary shares representing the Balance of

Assets Sellers Shares referred to the Company's 17 August

2020 announcement

5. Exercise of warrants . On the following dates the Company

announced the exercise of warrants at a price on 0.16p

per share;

iv) 28 April 2021- 16,250,000 warrants for GBP26,000;

v) 7 May 2021 - 26,250,000 warrants for GBP42,000;

vi) 11 May 2021 - 6,250,000 warrants for GBP10,000; and

17 May 2021 - 43,437,500 warrants GBP69,500

Other that these matters, no significant events have occurred

subsequent to the reporting date that would have a material

impact on the consolidated financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BXGDLXGDDGBC

(END) Dow Jones Newswires

June 29, 2021 09:08 ET (13:08 GMT)

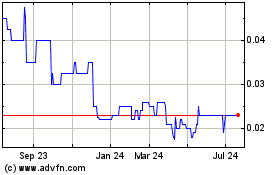

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

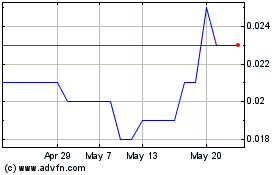

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025