It seems that the two-month long heated Thai-protests will cripple

the country’s near term outlook. In any case, emerging markets like

Thailand will likely remain out of favor in 2014 thanks to the

possible end of the cheap dollar following the Fed’s QE

Taper. Only a country with inherent strength can endure the

broader emerging market volatility this year.

Though Thailand was relatively better placed in the emerging market

pack mainly because of considerable infrastructure spending,

mounting political tension makes the attainment of 3% economic

growth this year uncertain.

Thailand's Fiscal Policy Office (FPO) cut its GDP forecast twice in

2013 – once in November to 3.0% from 3.7% reflecting sagging

exports and once before in July from 4.2% to 3.7% (read: 3 Emerging

Market ETFs to Watch for Political Issues in 2014).

As per the University of Thai Chamber of Commerce, the current

political uproar would cost Thailand "economic loss of

approximately 20 billion Thai baht ($604.6 million)". Given this

loss, and the prospect for volatility ahead, many investors are

turning bearish on Thailand lately.

What Happened in Thailand?

The protest is basically intended to expel Prime Minister Ms

Yingluck Shinawatra’s administration – built on the political

structure of former Prime Minister Thaksin Shinawatra. The rallies

are in protest of an amnesty for transgressions dating back to the

2006 rebellion that expelled former premier, Thaksin Shinawatra,

the brother of the current Prime Minister. The protest took the

shape of a drive to end the sufferings under Thaksin Rule.

The protests were small at first mainly resorting to rallies, but

quickly flared up. Sometimes protesters went on to seize sensitive

areas like police headquarters and TV stations resulting in

injuries and even death.

In December, Prime Minister Yingluck Shinawatra tried to cool off

the agitation by dissolving the country's parliament, and then

calling for snap elections scheduled for February 2.

But the unrest intensified in January thanks to a futile attempt by

the current government to pass a bill that would pardon several

figures from the recent past including the former Prime Minister

Thaksin Shinawatra so that he can return to the country from

exile.

Thaksin – a controversial ruler of the country from 2001 until

2006, was overthrown by the military in a bloodless coup after

being convicted as a corrupt politician.

If this was not enough, there are also reports that Thailand’s

Democrat Party will boycott the upcoming elections in association

with the protest which seeks an electoral reform, pouring cold

water on Thailand’s plans for a resolution. Protesters now aim to

‘shut down’ the capital city, Bangkok, adding even more turbulence

in the nation’s economic center.

To put an end to this revolt, some believe that Yingluck might go

to the extent of declaring a state of emergency, hinting at little

room for any compromise. This long-stretched protest is hurting

government spending and the all-important Thai tourism industry

(contributed 7% of the country’s GDP). In fact, twenty-three

countries issued warnings against visiting Thailand amid the

turmoil.

Market Impact

Quite expectedly, the market has punished Thailand for these

political issues. Thailand's benchmark stock index tumbled more

than 12% in the last one month. The Thai baht has nosedived to

multi-year lows, losing almost 6% against the U.S. dollar since the

start of the political strife.

Despite a modest revival in most developed nations, exports

remained weak thanks mainly to the persistent slowdown in its

biggest trading partner China (read: China ETFs Tumble to Start

2014).

While broad emerging market funds like

iShares MSCI

Emerging Markets ETF

(

EEM ) and

Vanguard FTSE Emerging Markets

ETF (

VWO ) lost 6.05% and 5.78%,

respectively, in the last two months,

iShares MSCI Thailand

Capped ETF (

THD) shed 17.5%.

Thailand ETF in Focus

THD is the only Thailand specific ETF, and it tracks the MSCI

Thailand IMI 25/50 Index. The ETF has seen sizeable asset outflow

in the last one month and presently has about $551.0 million under

management.

Holding 123 securities in its basket, the fund is concentrated in

the top 10 holdings which account for as much as about half of the

total. The ETF charges a reasonable 61 bps in annual fees.

The fund is heavily exposed to financials that make up for 35% of

the share in the basket followed by the energy (18%) and material

(10%) sectors (see more in the Zacks ETF Center). Though the fund

provides exposure to all caps, it puts more focus on large caps.

THD lost 15% in 2013.

Bottom Line

It is hard to predict the near term outlook for Thailand ETF at

this time. There is a high chance of further losses should the

protest escalate.

Still, over the long term, Thailand looks promising given a very

low unemployment rate, contained inflation and still-stable

financial condition. Export profile which was weak all through

2013, might turn around in 2014 as per the World Bank (read: 7 ETFs

to Buy in 2014).

Needless to mention, the countries latent potential will reach

fruition only when the political upheaval cools off. THD presents

an interesting value at this time making it an intriguing option

for long-term investors who have a strong stomach for risks.

However, the near term might be bleak for the country, especially

if protests continue to escalate. Keep in mind though that Thailand

has a history of coups, and the nation has persevered through these

issues before, so this latest round of political fighting might not

be as devastating as what many are predicting, though the near term

could be quite uncertain.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHRS-MSCI THAI (THD): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

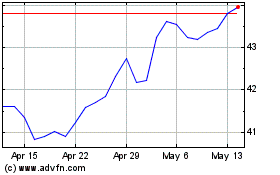

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

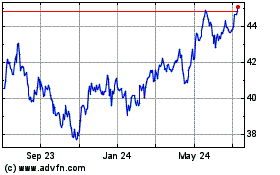

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2023 to Nov 2024