What Is Wrong with Gold Mining Stocks? - Real Time Insight

May 22 2012 - 9:00AM

Zacks

Although gold has been a solid performer in years past, the

yellow metal has started to fall back in recent months, dipping

below the $1,600/oz. mark as of late. This represents a nearly

$220/oz. drop from the metal’s 52 week highs, a disappointing trend

given the broad risk-off trade in the markets during the second

quarter of 2012.

Yet, while gold has been a weak place to put assets, the gold

mining space has been a downright miserable spot for investors over

the last six month period. All four of the major gold mining

ETFs—GDX, GDXJ,

GGGG, and PSAU—are each down

about 20% over the last half year, compared to a roughly 5.7% slump

in the price of gold bullion over the same time period.

Unfortunately, this recent slump continues a relatively long

history of underperformance for gold miners over the past few

years. In fact, when looking at the past five years, GDX (the most

popular and oldest gold mining ETF) has added about 16.7% while

GLD has more than doubled, gaining 134% over the

same time frame (see more on ETFs in the Zacks ETF

Center).

Given this, one has to wonder why anyone still bothers with gold

miners since not only do they often underperform precious metals,

but they do so with significantly higher levels of volatility as

well.

Still, some impressive values are beginning to appear in the

gold mining space as evidenced by some of the valuation metrics in

the big mining firms. For example, the PEG ratio for

Barrick Gold (ABX) is below 0.2, Goldcorp

(GG) looks to have EPS growth of about 18% this quarter,

while Newmont Mining (NEM) has a yield approaching

3%.

Despite these favorable metrics, it should be noted that the

segment does rank quite poorly from a Zacks Industry Rank

perspective-- the gold mining segment is in the bottom 20% from

this look— suggesting that more trouble could be ahead for the

sector. Nevertheless, there are some potential values beginning to

surface in what could be an oversold industry segment where stocks

are approaching 52 week lows across the board…

Why do you think gold miners have underperformed by so much as

of late?

Can they turn it around or will they continue to lag gold in the

second half of the year?

Let us know what you think in the comments below!

(Eric is long IAU and gold bullion)

BARRICK GOLD CP (ABX): Free Stock Analysis Report

GOLDCORP INC (GG): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

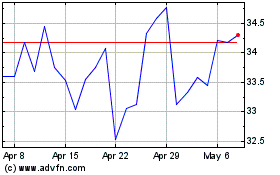

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

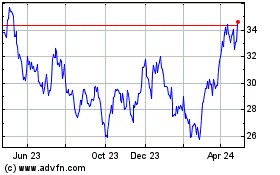

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jul 2023 to Jul 2024