| UNITED STATES |

| SECURITIES AND

EXCHANGE COMMISSION |

| Washington, D.C.

20549 |

| |

| SCHEDULE 14A |

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ) |

| |

| Filed by the Registrant ý |

| |

|

| Filed by a Party

other than the Registrant ¨ |

| |

|

| Check the appropriate

box: |

| |

|

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ý |

Definitive Proxy Statement |

| |

|

| ¨ |

Definitive Additional Materials

|

| |

|

| ¨ |

Soliciting Material under § 240.14a-12 |

| |

| Tellurian

Inc. |

| (Name

of Registrant as Specified in its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing

Fee (Check all boxes that apply): |

| |

|

| ý |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary

materials. |

| |

|

| ¨ |

Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

(832) 962-4000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on Wednesday, June 8, 2022

To the Stockholders of Tellurian Inc.:

We will hold an annual meeting

of the stockholders of Tellurian Inc. (“Tellurian” or the “Company”), a Delaware corporation, on Wednesday, June 8,

2022, at 8:30 a.m. local time at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor, Houston, Texas

77002, for the following purposes:

| 1. | To elect the three nominees identified

in the enclosed proxy statement as members of the board of directors of Tellurian (the “Board”),

each to hold office for a three-year term expiring at the 2025 annual meeting of stockholders; |

| 2. | To ratify the appointment of Deloitte

& Touche LLP as the independent registered public accounting firm of the Company for

the fiscal year ending December 31, 2022; and |

| 3. | To transact such other business as may

properly come before the annual meeting or any adjournment or postponement thereof. |

Only holders of record of

Tellurian common stock, par value $0.01 per share, or Tellurian Series C convertible preferred stock, par value $0.01 per share,

at the close of business on April 25, 2022, the record date for the annual meeting, are entitled to notice of and to vote at the

meeting or any adjournment or postponement of the meeting.

The Board recommends that

you vote (1) “FOR” the election of each individual named as a director nominee in the enclosed proxy statement to the

Company’s board of directors for a three-year term and (2) “FOR” the proposal to ratify the appointment of Deloitte

& Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022.

To ensure your representation

at the annual meeting, please complete and promptly mail your proxy card in the return envelope enclosed, or authorize the individuals

named on your proxy card to vote your shares by calling the toll-free telephone number or by using the Internet as described in the instructions

included with your proxy card or voting instruction card. This will not prevent you from voting in person but will help to secure a quorum

for the annual meeting and avoid added solicitation costs. If your shares are held in “street name” by your broker, bank

or other nominee, only that holder can vote your shares, and the vote cannot be cast on Proposal 1 unless you provide instructions

to your broker, bank or other nominee. You should follow the directions provided by your broker, bank or other nominee regarding how

to instruct your nominee to vote your shares. Your proxy may be revoked at any time before it is voted. Please review the proxy statement

accompanying this notice for more complete information regarding the annual meeting.

We intend to hold our annual

meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that

public health officials may issue in light of the evolving coronavirus (COVID-19) situation. As a result, we may impose procedures or

limitations to assure the safety of meeting attendees. In addition, (i) stockholders and others who might otherwise attend in person

may instead listen to the meeting in real-time by calling toll free 1-877-465-4508 or international direct 1-857-244-8215 (passcode:

194 921 39#) and (ii) those stockholders who have questions that they would like to have answered at the meeting may send those

questions to our Corporate Secretary in advance of the meeting at the address set forth in “Information About the Meeting—Assistance.”

Stockholders dialing in to listen to the meeting will not be able to vote their Tellurian shares during the call. We will continue to

monitor the COVID-19 situation and if changes to our current plan become advisable, we will disclose the updated plan on our proxy website

(http://www.proxyvote.com). We encourage you to check this website prior to the meeting if you plan to attend.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

|

| |

Meredith S. Mouer, Deputy General Counsel and

Corporate Secretary |

| |

April 28, 2022 |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, JUNE 8, 2022

Our notice of annual

meeting of stockholders, proxy statement and Annual Report on Form 10-K for the

fiscal year ended December 31, 2021 are available at http://www.proxyvote.com.

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO

ATTEND THE ANNUAL MEETING, PLEASE SUBMIT ALL PROXIES YOU RECEIVE. STOCKHOLDERS OF RECORD CAN SUBMIT THEIR PROXIES IN ANY ONE OF THREE

WAYS:

| · | BY

TELEPHONE: CALL THE TOLL-FREE NUMBER ON YOUR PROXY CARD TO SUBMIT YOUR PROXY BY PHONE; |

| · | VIA

INTERNET: VISIT THE WEBSITE ON YOUR PROXY CARD TO SUBMIT YOUR PROXY VIA THE INTERNET; OR |

| · | BY

MAIL: MARK, SIGN, DATE, AND MAIL YOUR PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE. |

THE METHOD BY WHICH YOU DECIDE

TO SUBMIT YOUR PROXY WILL NOT LIMIT YOUR RIGHT TO VOTE AT THE ANNUAL MEETING. IF YOU LATER DECIDE TO ATTEND THE ANNUAL MEETING IN PERSON,

YOU MAY VOTE YOUR SHARES EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY.

IF YOU HOLD YOUR SHARES THROUGH

A BANK, BROKER OR OTHER NOMINEE, YOU MUST FOLLOW THE VOTING INSTRUCTIONS PROVIDED BY THE NOMINEE. IN ADDITION, YOU MUST OBTAIN A PROXY,

EXECUTED IN YOUR FAVOR, FROM THE NOMINEE TO BE ABLE TO VOTE IN PERSON AT THE MEETING. YOU MAY BE ABLE TO SUBMIT YOUR

VOTING INSTRUCTIONS VIA THE INTERNET OR BY TELEPHONE

IN ACCORDANCE WITH THE INSTRUCTIONS THE NOMINEE PROVIDES.

TABLE OF CONTENTS

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

(832) 962-4000

PROXY STATEMENT

The Tellurian Inc. (“Tellurian”

or the “Company”) board of directors (the “Board”) is soliciting the accompanying proxy for use in connection

with the annual meeting of stockholders (including any adjournment or postponement thereof, the “Meeting”) to be held on

Wednesday, June 8, 2022, at 8:30 a.m. local time at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor,

Houston, Texas 77002.

This proxy statement and

the accompanying notice of annual meeting of stockholders, proxy card and Annual Report on Form 10-K for the fiscal year ended December 31,

2021 are being mailed to stockholders on or about April 28, 2022.

INFORMATION

ABOUT THE MEETING

Date,

Time, and Place

The Meeting will take place

at 8:30 a.m. local time, on Wednesday, June 8, 2022, at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor,

Houston, Texas 77002.

Purpose;

Other Matters

At the Meeting, holders of

Tellurian shares will be asked to consider and vote upon two proposals. The first proposal will be to elect three directors nominated

by the Board, each for a term of three years. The second proposal will be to ratify the appointment of Deloitte & Touche LLP as the

independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022.

Holders of Tellurian shares

may also be asked to consider and vote upon such other matters as may properly come before the Meeting, or any adjournment or postponement

of the Meeting. As of the mailing date of this proxy statement, the Board knows of no other matter to be presented at the Meeting. If,

however, other matters are properly brought before the Meeting, or any adjournment or postponement of the Meeting, the persons named

in the proxy will vote the proxies in accordance with their best judgment with respect to those matters.

Recommendation

of the Tellurian Board

The Board has carefully considered

each of the matters to be considered at the Meeting. Based on its review, the Board recommends that you vote (i) “FOR”

the election of the three directors nominated by the Board for three-year terms and (ii) “FOR” the proposal to ratify

the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year

ending December 31, 2022.

Record

Date, Outstanding Shares, and Voting Rights

Each holder of record of

Tellurian common stock, par value $0.01 per share, or Tellurian Series C convertible preferred stock, par value $0.01 per share

(the “Preferred Stock”), at the close of business on April 25, 2022, the record date, is entitled to notice of and to

vote at the Meeting. Each such stockholder is entitled to cast one vote for each share of Tellurian common stock or Preferred Stock owned

on each matter properly submitted to a vote of stockholders at the Meeting. As set forth in the Company’s Certificate of Designations

of Series C Convertible Preferred Stock, the Preferred Stock votes with the Tellurian common stock on all matters presented to the

stockholders for their action or consideration. As of the record date, there were 568,227,494 shares of Tellurian common stock and

6,123,782 shares of Preferred Stock issued and outstanding and entitled to vote at the Meeting. The holders of the Preferred Stock

and the holders of Tellurian common stock are voting together as a single class on each of the proposals to be considered at the Meeting.

Quorum

and Vote Required; “Broker Non-Votes” and Abstentions

Quorum Required

A quorum of Tellurian stockholders

is necessary to hold the Meeting. In accordance with the Company’s bylaws, the holders of 33⅓% in voting power of the total

number of shares issued and outstanding and entitled to be voted at the Meeting, present in person or by proxy, will constitute a quorum

for the transaction of business. Stockholders are counted as present at the Meeting if they are present in person or have authorized

a valid proxy. The presence of holders of at least 191,450,426 shares of Tellurian common stock and Preferred Stock in the aggregate

will constitute a quorum. Under the General Corporation Law of the State of Delaware (the “DGCL”), abstentions and “broker

non-votes” (described below) are counted as present and are, therefore, included for purposes of determining whether a quorum of

shares is present at the Meeting. Shares of Tellurian common stock or Preferred Stock held by stockholders who are not present in person

or by proxy will not be counted towards a quorum.

Vote Required

The election of each director

nominee set forth in Proposal 1, and the approval of Proposal 2, will require the affirmative vote of the holders of a majority

of the votes cast with respect to the relevant matter.

Differences Between

Holding Shares as a Stockholder of Record and as a Beneficial Owner; Broker Non-Votes

If your shares are registered

directly in your name with Tellurian’s transfer agent, Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”),

you are considered the “stockholder of record” of those shares, and the notice of annual meeting of stockholders, proxy statement,

proxy card and Annual Report on Form 10-K for the fiscal year ended December 31, 2021 have been sent directly to you by Tellurian.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner”

of such shares held in “street name,” and the proxy materials have been forwarded to you by your broker, bank or other nominee.

As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by using the voting

instruction card included in the mailing or by following the instructions for submitting your voting instructions by telephone or on

the Internet.

Broker non-votes occur when

a nominee holding Tellurian shares for a beneficial owner returns a properly executed or otherwise submitted proxy but has not received

voting instructions from the beneficial owner, and such nominee does not possess discretionary authority on one or more proposals with

respect

to such shares. Brokers are not allowed to exercise

their voting discretion with respect to the approval of matters which are considered “non-routine” under applicable rules

without specific instructions from the beneficial owner. Proposal 1 is considered non-routine and Proposal 2 is considered

routine. Accordingly, your broker will not be entitled to vote your shares on Proposal 1 unless you provide instructions on how

to vote by fulfilling out the voter instruction form sent to you by your broker with this proxy statement, but your broker will be entitled

to vote your shares on Proposal 2 without such instructions.

Abstentions

An “abstention”

represents a stockholder’s affirmative choice to decline to vote on a proposal. Stockholders may abstain with respect to any of

the proposals described in this proxy statement by returning a properly executed or otherwise submitted proxy.

Effects of Broker

Non-Votes and Abstentions

Pursuant to Delaware law

and our bylaws, abstentions are not considered votes cast and, therefore, will not have an effect on the outcome of the vote on Proposal 1

or 2.

Broker non-votes are not

considered votes cast and, therefore, will have no effect on the outcome of the vote on Proposal 1. Because Proposal 2 is considered

a routine matter and brokers will be entitled to vote your shares in their discretion if no voting instructions are timely received,

there will be no broker non-votes with respect to this proposal.

Voting

by Tellurian Directors and Executive Officers

As of the record date, the

directors and executive officers of Tellurian beneficially owned and were entitled to vote 58,589,750 shares of Tellurian common

stock, which represent approximately 10.2% of the voting power of the Tellurian capital stock, including the Preferred Stock. The directors

and executive officers of Tellurian are expected to vote “FOR” all of the proposals being considered at the Meeting.

Adjournment

and Postponement

Adjournments and postponements

of the Meeting may be made for the purpose of, among other things, soliciting additional proxies. The Meeting may be adjourned by the

chairman of the Meeting or the vote of a majority of Tellurian shares present in person or represented by proxy at the Meeting, even

if less than a quorum.

Voting

of Proxies

Voting by Proxy

Card

All Tellurian shares entitled

to vote and represented by properly executed proxies received prior to the Meeting, and not revoked, will be voted at the Meeting in

accordance with the instructions indicated on the proxy card accompanying this proxy statement. If no direction is given and the proxy

is validly executed, the stock represented by the proxy will be voted in favor of the election of each director nominee named in Proposal 1

and “FOR” Proposal 2. The persons authorized under the proxies will vote upon any other business that may properly come

before the Meeting according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote.

Tellurian does not anticipate that any other matters will be raised at the Meeting.

If you are a holder of record,

there are two additional ways to submit your proxy:

Submit your proxy by telephone—call

toll free 1-800-690-6903.

| · | Submit

your proxy 24 hours a day, 7 days a week, until 11:59 p.m. Eastern Time on

June 7, 2022. |

| · | Please

have your proxy card and the last four digits of your Social Security Number or Tax Identification

Number available. Follow the instructions the voice provides you. |

Submit your proxy by the

Internet—http://www.proxyvote.com.

| · | Use

the Internet to submit your proxy 24 hours a day, 7 days a week, until 11:59 p.m.

Eastern Time on June 7, 2022. |

| · | Please

have your proxy card and the last four digits of your Social Security Number or Tax Identification

Number available. Follow the instructions to obtain your records and create an electronic

ballot. |

Submitting your proxy by

telephone or Internet authorizes the named proxies to vote your shares at the Meeting or any adjournment or postponement thereof in the

same manner as if you had marked, signed and returned your proxy card. The law of Delaware, where Tellurian is incorporated, allows a

proxy to be sent electronically, so long as it includes or is accompanied by information that lets the inspector of elections know that

it has been authorized by the stockholder.

If your shares are held in

street name, your broker, bank or other nominee may provide the option of submitting your voting instructions through the Internet or

by telephone instead of by mail. Please check the voting instruction card provided by your broker, bank or other nominee to see which

options are available and the procedures to be followed.

Voting by Attending

the Meeting

Holders of record of Tellurian

shares and their authorized proxies may also vote their shares in person at the Meeting. If you attend the Meeting, you may submit your

vote in person, and any previous proxies submitted by you will be superseded by the vote that you cast at the Meeting.

Revocability of

Proxies

You may revoke your proxy

at any time before the vote is taken at the Meeting. If you are a holder of record, you may revoke your proxy by:

| 1. | giving written notice of revocation no

later than the commencement of the Meeting to Tellurian’s Corporate Secretary: |

| · | if

before commencement of the Meeting on the date of the Meeting, by personal delivery to Tellurian’s

Corporate Secretary at the Petroleum Club of Houston, located at 1201 Louisiana Street, 35th Floor,

Houston, Texas 77002; and |

| · | if

delivered before the date of the Meeting, to Tellurian’s Corporate Secretary at Tellurian’s

offices, 1201 Louisiana Street, Suite 3100, Houston, Texas 77002; |

| 2. | delivering no later than the commencement

of the Meeting a properly executed, later-dated proxy; or |

| 3. | voting in person at the Meeting; however,

simply attending the Meeting without voting will not revoke an earlier proxy. |

Voting by proxy will in no way limit your right

to vote at the Meeting if you later decide to attend in person. If your stock is held in the name of a broker, bank or other nominee,

you must obtain a proxy, executed in your favor, to be able to vote at the Meeting, and must follow instructions provided to you by your

broker, bank or other nominee to revoke or change your vote.

Solicitation of

Proxies; Expenses

The entire expense of preparing

and mailing this proxy statement and any other soliciting material (including, without limitation, costs, if any, related to advertising,

printing, fees of attorneys, financial advisors, and solicitors, public relations, transportation, and litigation) will be borne by Tellurian.

In addition to the use of the mail, Tellurian or certain of its officers or other employees may solicit proxies by telephone and personal

solicitation; however, no additional compensation will be paid to those officers or employees in connection with such solicitation. The

Company has retained Morrow Sodali LLC, 470 West Avenue, Stamford, Connecticut 06902, for a fee of $7,500, plus out-of-pocket expenses,

to assist in soliciting proxies in connection with the Meeting. In addition, the Company has retained Broadridge to provide or coordinate

specified telephone and Internet voting, mailing, handling, tabulation, and document hosting services. The estimated fees and expenses

payable to Broadridge by the Company for these services are approximately $58,000, plus per item charges for each registered or beneficial

stockholder vote, per document charges for the hosting services, and reimbursement of Broadridge’s mailing costs and expenses.

Banks, brokerage houses,

and other custodians, nominees, and fiduciaries will be requested to forward solicitation material to the beneficial owners of Tellurian

stock that such institutions hold of record, and the Company will reimburse such institutions for their reasonable out-of-pocket disbursements

and expenses.

No

Appraisal Rights

There are no appraisal rights

pursuant to Section 262 of the DGCL with respect to any of the proposed corporate actions on which the stockholders are being asked

to vote.

Assistance

If you need assistance in

completing your proxy card, have questions regarding the Meeting, the proposals to be made at the Meeting or how to submit your proxy,

or want additional copies of this proxy statement or the enclosed proxy card, please contact either of the following:

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

Attention: Corporate Secretary

Telephone: (832) 962-4000

Facsimile: (832) 962-4055

E-mail: CorpSec@tellurianinc.com |

Morrow Sodali LLC

470 West Avenue

Stamford, Connecticut 06902

Telephone: (203) 658-9400

Toll Free: (800) 662-5200

Facsimile: (203) 658-9444

E-mail: tell.info@morrowsodali.com |

PROPOSAL 1—ELECTION

OF DIRECTORS TO THE COMPANY’S BOARD

In accordance with the Company’s

certificate of incorporation, three directors are to be elected at the Meeting to hold office for a term of three years, expiring at

the 2025 annual meeting of stockholders. The Company’s certificate of incorporation provides for three classes of directors who

are to be elected for terms of three years each and until their successors shall have been elected and shall have been duly qualified.

All of the nominees for election at the Meeting, Charif Souki, Brooke Peterson and Don Turkleson, are currently serving as directors

of the Company. Each of Messrs. Souki, Peterson and Turkleson has consented to being named in this proxy statement as a nominee

for election as a director and will serve as a director if elected.

Under the Company’s

bylaws, a director will be elected if he or she receives the affirmative vote of the holders of a majority of the votes cast with respect

to an election that is not a contested election. Abstentions and broker non-votes will not be considered votes cast for this purpose

and, therefore, will not have an effect on the outcome of the election.

Background

Information About the Nominees

The following sets forth

certain information about (i) each of the Company’s nominees for election as a director at the Meeting to hold office for

a term expiring at the 2025 annual meeting of stockholders and (ii) each director whose term of office continues beyond the Meeting.

The information presented includes, with respect to each such person: (a) the year during which he or she first became a director

of the Company; (b) his or her other positions with the Company, if any; (c) his or her business experience for at least the

past five years; (d) any other director positions held currently or at any time during the past five years with any company with

a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or subject to the requirements of Section 15(d) of the Exchange Act, or any company registered as an investment company

under the Investment Company Act of 1940, as amended; (e) information regarding involvement in certain legal or administrative proceedings,

if applicable; (f) his or her age as of the date of this proxy statement; and (g) the experience, qualifications, attributes,

or skills that led to the conclusion that the person should serve as a director for the Company. There are no family relationships among

any of Tellurian’s directors or executive officers.

Vote

Required for Approval

The election of each director

nominee pursuant to this Proposal 1 will require the affirmative vote of the holders of a majority of the votes cast with respect

to the election, assuming that a quorum exists.

If you fail to vote or submit

a proxy, fail to instruct your broker to vote, or vote to “abstain,” it will have no effect on the election of director nominees

pursuant to this Proposal 1, assuming that a quorum exists.

Board

Recommendation

The Board unanimously recommends

that Tellurian stockholders vote to elect each of Charif Souki, Brooke Peterson and Don Turkleson to the Board for a three-year term.

Director

Nominees to Hold Office for a Three-Year Term Expiring at the 2025 Annual Meeting of Stockholders

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

|

|

|

Charif

Souki

|

Executive

Chairman |

Mr. Souki

(age 69) has served as the Executive Chairman of Tellurian since June 2020 and as a

director of Tellurian since February 2017. He co-founded Tellurian in 2016 and served as

a director and Chairman of the board of directors of Tellurian Investments Inc. (now known

as Tellurian Investments LLC (“Tellurian Investments”)) from February 2016 to

February 2017. Mr. Souki co-founded Cheniere Energy, Inc. (“Cheniere”) in

1996 and served as Chairman of the board of directors (2000–2015), Chief Executive

Officer (2003–2015), and President (2003–2004 and 2008–2015) until December

2015. Prior to Cheniere, Mr. Souki was an investment banker. Mr. Souki serves on

the board of trustees of the American University of Beirut, as a member of the Advisory Board

of the Center on Global Energy Policy at Columbia University, and on the International Advisory

Board for the Neurological Research Institute (NRI) at Texas Children’s Hospital. Mr. Souki

received a B.A. from Colgate University and an M.B.A. from Columbia University.

Mr. Souki is qualified to serve as a

director of Tellurian due to his knowledge of and experience in the liquefied natural gas (“LNG”) industry, including

his leading the conception, development and construction of the first large-scale LNG export facility in the United States. In addition

to his industry experience, his qualifications include his leadership skills, long-standing senior management experience and public

company board experience in the LNG industry.

|

Brooke

A. Peterson

|

None |

Mr. Peterson

(age 72) has served as a director of Tellurian since February 2017, and he served as

a director of Tellurian Investments from July 2016 to February 2017. He has been involved

in construction, resort development and real estate for more than 40 years and has been extensively

involved in non-profit work since moving to Aspen, Colorado, in 1975. Mr. Peterson is

a member of the Colorado Bar and has been licensed to practice law for over 40 years, has

served as an arbitrator and mediator since 1985, and has served as a Municipal Court Judge

in Aspen since 1981. Mr. Peterson has served as Manager of Ajax Holdings LLC and its

affiliated companies since December 2012 and as the Chief Executive Officer of Coldwell Banker

Mason Morse since January 2013. Mr. Peterson earned his B.A. from Brown University in

1972 and his J.D. from the University of Denver College of Law in 1975.

Mr. Peterson’s qualifications

to serve as a director of Tellurian include his knowledge of and experience in project development and the construction industry.

|

| |

|

|

|

|

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

Don

A. Turkleson

|

Chair

of the Audit Committee and Member of the Compensation Committee |

Mr. Turkleson

(age 67) has served as a director of Tellurian since March 2017, and he served as Vice

President and Chief Financial Officer of Gulf Coast Energy Resources, LLC, a privately held

energy exploration and production company, from April 2012 until his retirement in April

2015. He served as Senior Vice President and Chief Financial Officer of Cheniere Energy Partners

GP, LLC, the general partner of Cheniere Energy Partners, L.P. (NYSE American: CQP), an indirect

subsidiary of Cheniere, from November 2006 to March 2009 and was a member of the board of

directors of Cheniere Energy Partners GP, LLC from November 2006 until September 2012. From

December 2013 until February 2017, Mr. Turkleson served on the board of directors and

audit committee of Cheniere Energy Partners LP Holdings, LLC. From February 2018 until May

2020, Mr. Turkleson served on the board of directors and as chairman of the finance

and audit committees of ACCEL Energy Canada Limited, a privately held company constructing

and operating facilities for the delivery of energy, ultra-clean fuels and specialty products.

From November 2013 until July 2015, he served on the board of directors of the general partner

of QEP Midstream Partners, L.P., a midstream publicly traded master limited partnership.

In addition, he served on the board of directors and as the chairman of the audit committee

of Miller Energy Resources, Inc., a publicly traded energy exploration, production and drilling

company, from January 2011 to April 2014. Mr. Turkleson is a Certified Public Accountant

and received a B.S. in Accounting from Louisiana State University. He is also a Board Governance

Fellow with the National Association of Corporate Directors.

Mr. Turkleson’s qualifications

to serve as a director of Tellurian include his background and experience in the energy industry and his background as a Certified

Public Accountant.

|

Directors

Continuing in Office for a Term Expiring at the 2023 Annual Meeting of Stockholders

|

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

| |

|

|

|

Jean P. Abiteboul

|

Member of the Compensation Committee |

Mr. Abiteboul (age 70) has served as

a director of Tellurian since November 2020, and he is the founder and since August 2017 has been the Chief Executive Officer of JA Energy

Consulting. From November 2016 to November 2017, Mr. Abiteboul served as a consultant to Tellurian Services LLC, a subsidiary of

Tellurian Investments. Previously, at Cheniere, he served as Senior Vice President – International (February 2006–November

2016), President of Cheniere Marketing Ltd., a wholly owned subsidiary of Cheniere (April 2010–November 2016), and Executive Director

of Cheniere LNG Services S.A.R.L., a wholly owned subsidiary of Cheniere (February 2006–April 2010). From 1975 until February 2006,

Mr. Abiteboul held different positions at Gaz de France, a publicly traded natural gas distribution company, including Secretary

of the board of directors (2004–2006), International Executive Vice President (2003–2004), Executive Vice President –

Gas Supply, Trading and Marketing (2002–2003), and Executive Vice President – Gas Supply (1998–2003). He also served

on the board of directors of Tejas Power Corporation (United States) (1991–1997), Gas Metropolitan (Canada) (1994–2006), Sceptre

Resources (Canada) (1991–1996), and other affiliated companies of Gaz de France in Europe. Since November 24, 2020, he has

served as the President of GIIGNL, the International Group of Liquefied Natural Gas Importers. Mr. Abiteboul graduated as an engineer

from École Centrale de Lyon and obtained a diploma in Economics from Université de Lyon.

Mr. Abiteboul’s qualifications to serve

as a director of Tellurian include his knowledge of and experience in the LNG industry and his leadership and management experience.

|

|

Diana Derycz-Kessler

|

Chair of the Compensation Committee and Member of the Environmental, Social, Governance (ESG) and Nominating Committee |

Ms. Derycz-Kessler (age 57) has served

as a director of Tellurian since February 2017, and she served as a director of Tellurian Investments from December 2016 to February 2017.

Ms. Derycz-Kessler is an investor with a background in law, business and finance. She has been an active principal of her investment

advisory firm Bristol Capital Advisors, LLC since 2000. Her investments have included companies in the energy, biotechnology, technology,

education, real estate and consumer products sectors. As part of these investments, she has assumed active operational roles, including

a 17-year tenure as Chief Executive Officer of the media arts college of The Los Angeles Film School and manager of commercial property

partnerships. In February 2019, Ms. Derycz-Kessler became a founding member and director of LK Advisors, Inc. (formerly PiMac Advisors

Inc.) a mortgage lending advisory company. Since October 2019, Ms. Derycz-Kessler has been a member of the board of managers of Bristol

Luxury Group LLC and Sugarfina Corporation (formerly Sugarfina Holdings LLC), the parent companies to Sugarfina USA LLC, a luxury candy

retailer. Ms. Derycz-Kessler’s early career

|

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

| |

|

|

| |

| began

as a lawyer in the international oil and gas sector, working at the law firm of Curtis, Mallet-Prevost,

Colt & Mosle LLP in New York. Subsequently, she joined Occidental Petroleum Corporation,

overseeing legal for its Latin American exploration and production operations. From 2016

to 2018, Ms. Derycz-Kessler was a partner in UNESCO’s TeachHer program, a private–public

sector partnership bridging the global gender gap in education. Ms. Derycz-Kessler holds

a law degree from Harvard Law School and a master’s degree from Stanford University

in Latin American Studies. She obtained her undergraduate “double” degree in

History and Latin American Studies from University of California, Los Angeles (UCLA).

Ms. Derycz-Kessler’s qualifications

to serve as a director of Tellurian include her knowledge of and experience in the energy industry and her leadership and management

experience.

|

Dillon

J. Ferguson

|

Chair

of the Environmental, Social, Governance (ESG) and Nominating Committee |

Mr. Ferguson

(age 74) has served as a director of Tellurian since February 2017, and he served as

a director of Tellurian Investments from December 2016 to February 2017. Mr. Ferguson

is a partner at Pillsbury Winthrop Shaw Pittman LLP in its energy and litigation practices.

Mr. Ferguson focuses his practice on oil and gas law, with an emphasis on both transaction

and litigation matters. His clients are composed of companies and individuals who are engaged

in oil and gas activities, including exploration, production, processing, transportation,

marketing and consumption. Mr. Ferguson has been a partner at Pillsbury Winthrop Shaw

Pittman LLP since May 2016. He was a partner at Andrews Kurth LLP from 2001 to May 2016.

Mr. Ferguson earned his B.B.A. from The University of Texas at Austin in 1970 and his

J.D. from South Texas College of Law in 1973.

Mr. Ferguson’s qualifications

to serve as a director of Tellurian include his experience practicing law and counseling energy companies involved in a wide array

of transaction and litigation matters.

|

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

Claire

R. Harvey

|

Member

of each of the Audit Committee and Environmental, Social, Governance (ESG) and Nominating Committee |

Ms. Harvey

(age 42) has served as a director of Tellurian since December 15, 2021. Since 2020,

Ms. Harvey has been the President of ARM Resource Partners, LLC, the upstream oil and

gas division of ARM Energy Holdings, LLC, a producer services firm providing innovative solutions

across the energy value chain. From May 2019 to August 2020, she was the Chief Executive

Officer of Gryphon Oil and Gas, LLC, a private equity-sponsored company focused on acquiring

non-operated interests in the Permian Basin. Previously, Ms. Harvey made upstream oil

and gas investments on behalf of two private equity funds, Pine Brook Partners (March 2014–May

2019) and TPH Partners (May 2010–February 2014). Earlier in her career, she worked

as an investment banker at Lehman Brothers and Barclays Capital, primarily focused on corporate

finance and mergers and acquisitions for oil and gas companies. Ms. Harvey has served

as chairman of the board of directors of Falcon Minerals Corporation, a publicly traded company

which owns and manages mineral interests in the United States, since May 2020. Ms. Harvey

earned a BBA in Finance at Texas A&M University. In addition, Ms. Harvey earned

an MBA from the Jones Graduate School of Business at Rice University where she was the Jones

Scholar and M.A. Wright Award winner.

Ms. Harvey’s qualifications to

serve as a director of Tellurian include her knowledge of and experience in oil and gas mergers and acquisitions and energy investments

and her leadership and management experience.

|

Directors

Continuing in Office for a Term Expiring at the 2024 Annual Meeting of Stockholders

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

|

|

|

Martin

J. Houston

|

Vice

Chairman of the Board |

Mr. Houston

(age 64) has served as a director of Tellurian since February 2017. He co-founded Tellurian

in 2016 and served as a director of Tellurian Investments from February 2016 to February

2017. He was also President of Tellurian Investments from February 2016 until August 2016.

Immediately prior to Tellurian Investments, Mr. Houston served as Chairman of Parallax

Enterprises LLC starting in December 2014. Having spent more than three decades at BG Group

plc, a Financial Times Stock Exchange (FTSE) 10 international integrated oil and gas company,

Mr. Houston retired in February 2014 as the BG Group plc’s Chief Operating Officer

and an executive director, which positions he held beginning in November 2011 and 2009, respectively.

He is a former director of the Society of International Gas Tanker and Terminal Operators

(SIGTTO), and from 2008 to 2014 he was the vice president for the Americas of GIIGNL, the

International Group of Liquefied Natural Gas Importers. From November 2014 to February 2018,

Mr. Houston was the international chairman of the Houston-based investment bank Tudor

Pickering Holt. From August 2017 to February 2018, he was a senior advisor to Gresham Advisory

Partners Limited, an M&A advisory firm based in Sydney, Australia. From 2014 to 2019,

he was a non-executive director of Bupa, an unlisted international healthcare insurer and

provider, based in the United Kingdom. Since January 2019, he has been a non-executive director

of Bupa Arabia, a Saudi-listed healthcare insurer and provider. Since October 2019, Mr. Houston

has served as chairman of the board of directors of EnQuest PLC, an independent petroleum

production and development company with operations in the U.K. North Sea and Malaysia. Mr. Houston

is also a senior advisory partner and chairman of the global energy group of Moelis &

Company (a global independent investment bank), sits on the National Petroleum Council of

the United States, and is a nonexecutive director of CC Energy Development (a private oil

and gas exploration and production company). Mr. Houston was the first recipient of

the CWC LNG Executive of the Year award in 2011 and is a Fellow of the Geological Society

of London. In addition, he is on the advisory board of the Center on Global Energy Policy

at Columbia University’s School of International Public Affairs (SIPA) in New York

and of Radia Inc. Mr. Houston received a bachelor’s degree in Geology from Newcastle

University in England in 1979 and a master’s degree in Petroleum Geology from Imperial

College in London in 1983.

Mr. Houston’s qualifications to

serve as a director of Tellurian include his knowledge of and experience in the LNG industry. In addition to his industry experience,

his qualifications include his leadership skills and long-standing senior management experience in the energy industry.

|

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

|

|

|

James

D. Bennett

|

Member

of the Audit Committee |

Mr. Bennett

(age 52) has served as a director of Tellurian since September 22, 2021, and he

is a former senior executive in the energy industry with 30 years of industry, investing

and banking experience. Mr. Bennett served as the President and Chief Executive Officer

(2013–2018) and as the Chief Financial Officer (2011–2013) of SandRidge Energy,

Inc., which filed for Chapter 11 bankruptcy protection in May 2016. From 2010 to 2011,

he was a Managing Director and Partner for White Deer Energy, an energy private equity fund

focused on the exploration and production, oilfield service and equipment, and midstream

sectors. From 2006 to 2009, Mr. Bennett was employed by GSO Capital Partners L.P., where

he served in various capacities, including as a Managing Director. His prior experience also

includes serving as the Chief Financial Officer of Aquilex Services Corp, an energy investment

banker at Donaldson, Lufkin and Jenrette, and an analyst at NationsBank. Mr. Bennett

has served as a board member of SN EF UnSub L.P. since 2019, as a director of Kimray Inc.

since 2021, and as chairman of the board of directors of IOG Resources, LLC since January

2022. Previously, he also served as executive chairman of Tapstone Energy, Inc. and a board

member of Energy Alloys Inc., SandRidge Energy, Inc., Cheniere Energy Partners L.P. and PostRock

Energy Corporation. Mr. Bennett graduated with a Bachelor of Business Administration,

with a major in Finance from Texas Tech University.

Mr. Bennett’s qualifications to

serve as a director of Tellurian include his knowledge of and experience in upstream exploration and energy investments and his prior

board, leadership and management experience.

|

Jonathan

S. Gross

|

Member

of the Audit Committee |

Mr. Gross

(age 63) has served as a director of Tellurian since November 2020, and he is an oil

and gas consultant. Since June 2009, his company, Jexco LLC, has provided upstream exploration

geological and geophysical technical services as well as information technology services

to clients with projects in domestic and international basins. From June 2010 to January

2011, Mr. Gross served as Senior Vice President of Energy Partners, Ltd., a public exploration

and production company. From July 2008 to April 2009, he served as Chief Operating Officer

of Houston Exploration Services, Inc., a subsidiary of Kuwait Energy Company, a private exploration

and production company based in Kuwait. Mr. Gross served as Vice President –

Exploration of Cheniere from October 2000 to May 2004, when he became Senior Vice President –

Exploration with responsibilities for its domestic exploration program and international

LNG sourcing through April 2008. Prior to joining Cheniere in 1999, Mr. Gross worked

for Zydeco Energy, Inc. (1998–1999) and Amoco Production Company as a geoscientist

and team leader (1981–1998). Mr. Gross received his Bachelor of Arts in Geophysical

Science from the University of Chicago in 1981. From April 2010 to July 2012, Mr. Gross

served on the board of |

Name |

Other

Positions

Held with the

Company |

Age

and Business Experience |

|

|

|

|

|

directors

of Miller Energy Resources, Inc., a publicly traded oil and gas exploration and production

company, where he was Chairman of the Nominating and Corporate Governance Committee. From

March 2014 to September 2018, Mr. Gross served on the board of directors of Cheniere

Energy Partners LP Holdings, LLC, a publicly traded subsidiary of Cheniere, where he was

a member of the Audit and Conflicts Committees. He is a member of the Society of Exploration

Geophysicists, the Houston Geological Society, and the American Association of Petroleum

Geologists, where he is a Certified Geologist.

Mr. Gross’s qualifications to

serve as a director of Tellurian include his knowledge of and experience in the energy industry and his prior board, leadership and

management experience.

|

Executive

Officers

As of April 25, 2022,

our executive officers were as follows:

Name |

Title |

Age |

| |

|

|

| Charif

Souki |

Executive

Chairman |

69 |

| Octávio

M.C. Simões |

President

and Chief Executive Officer |

62 |

| R.

Keith Teague |

Chief

Operating Officer |

57 |

| L.

Kian Granmayeh |

Chief

Financial Officer |

43 |

| Daniel

A. Belhumeur |

General

Counsel |

43 |

| Khaled

A. Sharafeldin |

Chief

Accounting Officer |

59 |

See “Proposal 1—Election

of Directors to the Company’s Board— Director Nominees to Hold Office for a Three-Year Term Expiring at the 2025 Annual Meeting

of Stockholders” for biographical information concerning Mr. Souki.

Octávio M.C.

Simões has served as the President and Chief Executive Officer of Tellurian since November 2020. Mr. Simões

began acting as a Senior Advisor to the Chief Executive Officer of Tellurian in April 2019, and he was appointed as the Company’s

Executive Vice President, LNG Marketing and Business Development in September 2020. Prior to joining the Company, Mr. Simões

was President and Chief Executive Officer of Sempra LNG & Midstream from January 2012 to March 2019, where he was responsible for

all LNG and natural gas midstream activities, including Cameron LNG, a 12 million tonnes per annum (“mtpa”) liquefaction

facility that came onstream with first LNG exports in August 2019. He has engineering degrees from the Georgia Institute of Technology

and from the University of Massachusetts – Dartmouth, and he is a registered professional engineer.

R. Keith Teague

has served as the Chief Operating Officer of Tellurian since the completion of the merger (the “Merger”) in February 2017

between Tellurian Investments and a subsidiary of Magellan Petroleum Corporation (now known as Tellurian Inc.), and he served as Chief

Operating Officer of Tellurian Investments from October 2016 until the completion of the Merger. Previously, at Cheniere, Mr. Teague

served as Executive Vice President, Asset Group (February 2014–September 2016), Senior Vice President – Asset Group

(April 2008–February 2014), Vice President – Pipeline Operations (May 2006–April 2008), and Director of Facility

Planning (February 2004–May 2006). Mr. Teague also served as President of CQH Holdings Company, LLC (formerly known as Cheniere

Pipeline Company), a wholly owned subsidiary of Cheniere, from January 2005 until September 2016. From December 2001 until September

2003, Mr. Teague served as the Director of Strategic Planning for the CMS Panhandle Companies. He began his career with Texas Eastern

Transmission Corporation, where he managed pipeline operations and facility expansion projects. Mr. Teague received a B.S. in Civil

Engineering from Louisiana Tech University and an M.B.A. from Louisiana State University.

L. Kian Granmayeh

has served as the Chief Financial Officer of Tellurian since March 2020. Mr. Granmayeh began at Tellurian as a consultant to the

Chief Financial Officer in January 2019 and was appointed as its Director of Special Projects in July 2019 and as the Company’s

Director of Investor Relations in August 2019. Prior to joining Tellurian, he worked at Apache Corporation (now known as APA Corporation)

from May 2014 until February 2018, including as Manager of Investor Relations (July 2016–February 2018), Manager of Strategic Planning

(January 2015–June 2016) and Manager of Project Execution (May 2014–December 2014). Prior to that, he was an Associate, and

then a Vice President, at Lazard Frères & Co. from 2009 to 2014. He holds a B.A. from Columbia University and an M.B.A. from

Rice University.

Daniel A. Belhumeur

has served as the General Counsel of Tellurian since the completion of the Merger in February 2017 and as Chief Compliance Officer

of Tellurian since March 2017, and he served as General Counsel of Tellurian Investments from October 2016 until the completion of the

Merger. Previously, at Cheniere, Mr. Belhumeur served as Vice President, Tax and General Tax Counsel (January 2011–October

2016), Tax Director (January 2010–December 2010), and Domestic Tax Counsel (2007–2010). Mr. Belhumeur began his career

in public accounting after he received his bachelor’s degree and master’s degree in Accounting from Texas A&M University.

He then went on to obtain his law degree from the University of Kansas School of Law and his LL.M. from the Georgetown University Law

Center.

Khaled A. Sharafeldin

has served as the Chief Accounting Officer of Tellurian since the completion of the Merger in February 2017, and he served as

Chief Accounting Officer of Tellurian Investments from January 2017 until the completion of the Merger. From April 2012 to January 2017,

Mr. Sharafeldin served as Vice President – Internal Audit at Cheniere. Previously, at Pride International, he served

as Director – Quality Management (2010–2011) and Director of Internal Audit (2005–2010). In addition, he served

as Director of Internal Audit at BJ Services Company (2003–2005), served in several financial management roles at Schlumberger

Limited (1996–2003), and was employed by the public accounting firm Price Waterhouse LLP in Houston, Texas (1991–1996). Mr. Sharafeldin

received his Bachelor of Commerce from Cairo University in Egypt. He is also a Certified Public Accountant in the State of California.

Corporate

Governance

Director Independence

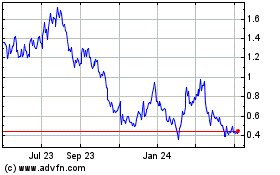

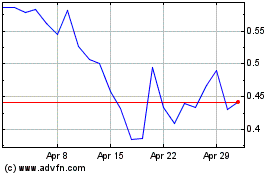

Tellurian common stock is

listed on NYSE American LLC (the “NYSE American”) under the trading symbol “TELL.” The NYSE American LLC Company

Guide requires that a majority of the Company’s directors be “independent directors,” as defined by NYSE American corporate

governance listing standards. Generally, a director does not qualify as an independent director if the director has, or in the past three

years has had, certain material relationships or affiliations with the Company, its external or internal auditors, or is an employee

of the Company.

The Board is currently composed

of 10 directors: Charif Souki, Martin Houston, Jean Abiteboul, James Bennett, Diana Derycz-Kessler, Dillon Ferguson, Jonathan Gross,

Claire Harvey, Brooke Peterson, and Don Turkleson. The Board has determined that each of Mses. Derycz-Kessler and Harvey and Messrs. Abiteboul,

Bennett, Ferguson, Gross, and Turkleson are “independent” for purposes of the NYSE American corporate governance listing

standards. In assessing the independence of Mr. Ferguson, the Board considered his role as a partner at Pillsbury Winthrop Shaw

Pittman LLP, a law firm that previously represented the Company on various matters from time to time but has not done so since 2020 and

is not expected to do so going forward.

Board Leadership

Structure

Mr. Souki is the Executive

Chairman and Mr. Simões is the President and Chief Executive Officer. The Board believes that having different individuals

serving in the separate roles of Executive Chairman and Chief Executive Officer is in the best interest of stockholders in the Company’s

current circumstances because it reflects the Executive Chairman’s oversight of Board functions, strategic and commercial development

and financing activities and the Chief Executive Officer’s responsibility over management of the Company’s operations.

Board Role in Risk

Oversight

The Board has an active role,

as a whole and at the committee level, in overseeing management of the Company’s risks. The Board or an appropriate committee regularly

receives reports from members of senior management and its outside advisors on areas of material risk to the Company, including operational,

financial, legal, regulatory, environmental, and strategic and reputational risks. The full Board or an appropriate committee receives

these reports from the appropriate executive or advisor, as the case may be, so that it may understand and oversee the strategies used

to identify, manage, and mitigate risks. The Compensation Committee oversees the management of risks relating to the Company’s

incentive compensation plans, policies, practices and arrangements by considering information and reports with respect to whether such

plans, policies, practices and arrangements encourage unnecessary or excessive risk taking, and presenting concerns to the full Board.

The Audit Committee oversees management of financial, legal, and regulatory risks, including with respect to related party transactions.

The Environmental, Social, Governance (ESG) and Nominating Committee manages risks associated with the independence of the Board as well

as risks associated with sustainability.

Board Evaluations

Each year, the members of

the Board and each Board committee conduct a confidential oral assessment of their performance with members of our legal department.

As part of the evaluation process, the Board reviews its overall composition, leadership structure, diversity, individual skill sets,

format for meetings, and relationship with management to ensure that it serves the best interests of stockholders and positions the Company

for future success. The results of the oral assessments are then summarized and communicated back to the Board. After the evaluations,

the Board and management work to improve upon any issues or focus points disclosed during the evaluation process. We believe that conducting

these evaluations through a discussion with our Board members leads to more meaningful results that are more likely to result in changes

when compared to conducting evaluations through a written process or completion of a questionnaire. As part of the evaluation process,

each committee reviews its charter annually.

Age Limit for Directors

The Board believes that experience

as a director is a valuable asset and, therefore, no term limits will be imposed on directors. However, beginning in March 2022, as reflected

in the Company’s revised corporate governance guidelines, non-employee directors of the Company are not permitted to stand for

re-election after reaching age 75 unless the Board waives this requirement in a particular case.

Standing

Board Committees

Audit Committee

The Audit Committee is composed

of Mr. Bennett, Mr. Gross, Ms. Harvey, and Mr. Turkleson (Chair). The functions of the Audit Committee are set forth

in its written charter, as amended on December 15, 2021 (the “Audit Committee Charter”). The Audit Committee Charter

is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance

documents.” The Board has determined that each member of the committee is independent under applicable NYSE American listing standards

and Securities and Exchange Commission (“SEC”) rules and that each of Ms. Harvey and Messrs. Bennett, Gross, and

Turkleson qualifies as an “audit committee financial expert” as defined in SEC rules.

Under the Audit Committee

Charter, the Audit Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to (i) the

Company’s accounting and financial reporting processes and the integrity of the Company’s financial statements; (ii) the

effectiveness of the Company’s internal accounting and financial controls, disclosure controls and procedures, and internal control

over financial reporting, as well as the performance of the Company’s internal audit function; (iii) the audits of the Company’s

financial statements and the appointment, engagement, compensation, termination (if necessary), qualifications, independence, and performance

of the Company’s independent registered public accounting firm; and (iv) the Company’s compliance with legal and regulatory

requirements and ethics programs. The Audit Committee has the sole authority to select, engage (including approval of the fees and terms

of engagement), oversee, and terminate, as appropriate, the Company’s independent registered public accounting firm.

In connection with the Audit

Committee’s oversight of legal and regulatory compliance, the Audit Committee receives regular, quarterly updates on cybersecurity

matters from the Company’s head of information technology. The Company uses industry-leading software and hardware to identify

and manage cyber risks and conducts internal and external penetration testing at least annually. In addition, Tellurian conducts monthly

phishing exercises with, and cybersecurity email campaigns for, all personnel, and provides such personnel with annual compliance and

cybersecurity training. The Company has not had a known material information security breach since the Merger.

Compensation Committee

The Compensation Committee

is composed of Mr. Abiteboul, Ms. Derycz-Kessler (Chair), and Mr. Turkleson. The functions of the Compensation Committee

are set forth in its written charter, as amended on December 15, 2021 (the “Compensation Committee Charter”). The Compensation

Committee Charter is posted on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company

and governance—Governance documents.”

The Board has determined

that each member of the Compensation Committee qualifies as (i) an independent director under applicable NYSE American listing standards,

(ii) a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and (iii) to the extent required

for awards intended to constitute “qualified performance-based compensation” within the meaning of Section 162(m) of

the Internal Revenue Code of 1986, as amended (the “Code”), an “outside director” for purposes of Section 162(m)

of the Code.

Under the Compensation Committee

Charter, the primary duties and responsibilities of the Compensation Committee are to assist the Board in fulfilling its responsibilities

with respect to the Company’s compensation plans, policies, programs, and practices, including (i) determining, and/or recommending

to the Board for its determination, the compensation of the Company’s chief executive officer and all other executive officers

of the Company; and (ii) reviewing and approving, and/or recommending to the Board for its approval, equity and other incentive

compensation plans, policies, and programs for the Company’s directors, officers, employees, or consultants, and overseeing and

administering such plans, policies, and programs in accordance with their terms. From time to time, the Compensation Committee consults

with the Executive Chairman regarding executive and director compensation matters and with the Chief Executive Officer and/or Chief Human

Resources Officer of the Company regarding executive compensation matters. Prior to December 14, 2021, the Vice Chairman of the

Board served as a non-voting advisory participant in meetings of the Compensation Committee. On December 14, 2021, the Compensation

Committee rescinded the prior invitation to the Vice Chairman of the Board to attend meetings of the committee as a non-voting advisory

participant to limit director participation in Compensation Committee meetings to independent directors. Independent directors of the

Board are generally invited to attend meetings of the committee.

Environmental,

Social, Governance (ESG) and Nominating Committee

The Environmental, Social,

Governance (ESG) and Nominating Committee (the “ESG and Nominating Committee”) is composed of Ms. Derycz-Kessler, Ms.

Harvey, and Mr. Ferguson (Chair). The functions of the ESG and Nominating Committee are set forth in its written charter, as amended

on December 15, 2021 (the “ESG and Nominating Committee Charter”). The ESG and Nominating Committee Charter is posted

on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance

documents.” The Board has determined that each member of the committee is independent under applicable NYSE American listing standards.

Under the ESG and Nominating

Committee Charter, the ESG and Nominating Committee is responsible for assisting the Board in fulfilling its oversight responsibilities

with respect to (i) identifying individuals qualified to serve as directors; (ii) recommending to the Board candidates for

nomination for election to the Board at the annual meeting of stockholders or to fill Board vacancies; (iii) developing and recommending

to the Board a set of corporate governance guidelines and reviewing on a regular basis the overall corporate governance of the Company;

and (iv) monitoring and reviewing, and as necessary recommending Board action with respect to, sustainability matters, including

environmental, social and governance (“ESG”) issues.

Corporate

Responsibility and ESG Practices

Oversight for the Company’s

ESG efforts resides with the Board and its committees. In particular, the ESG and Nominating Committee is responsible for monitoring

and reviewing, and as necessary recommending Board action with respect to, sustainability matters, including ESG issues. The committee’s

responsibilities were expanded in 2021 to expressly address environmental and social issues. The ESG and Nominating Committee regularly

receives ESG-related reports from management.

We also coordinate environmental

and social activities through a non-Board committee with representatives from throughout the organization, including our Chief Executive

Officer and Chief Operating Officer and representatives from our operations and regulatory, communications, health and safety, strategy,

legal, human resources and investor relations functions. We consider ESG-related risks and opportunities on an ongoing basis, disclose

meaningful and appropriate ESG-related information with regard to our current and planned operations, and encourage dialogue on ESG topics

with our stakeholders. We continue to make improvements to our risk evaluation and mitigation programs with respect to ESG and climate-related

risks. With respect to environmental issues in particular, we monitor developments in greenhouse gas emissions, air quality, water management,

biodiversity, incident management, climate-related matters and emerging regulations, and incorporate them into our risk management process

when appropriate.

Health, Safety

and Environment

Our health, safety and environment

policy reflects our commitments to our employees and the communities in which we operate. We strive to protect the health and safety

of our employees and to prevent injury, ill health or damage to the environment. During 2021, we had no lost-time incidents, as determined

in accordance with the recordkeeping and reporting requirements of the Occupational Safety and Health Administration (“OSHA”).

Our current operations focus

on natural gas development and production. The environmental protection practices we follow when conducting these operations include:

| · |

routing gas

to production facilities to minimize flaring and/or emissions following well completions; |

| · | performing

periodic leak detection and repair surveys utilizing optical gas imaging to allow early detection

and repairs to minimize emissions; |

| · | deploying

LUMEN Terrain technology, developed by Avitas, a Baker Hughes company, on all of our new

producing facilities, allowing for continuous, autonomous methane emissions monitoring to

facilitate timely methane emissions management; and |

| · | replacing

gas-operated valves and controllers with electric drivers. |

Social

Human Capital Management

We position ourselves as

an employer of choice by offering industry competitive compensation, including an industry-leading benefits package to provide for the

health and welfare and retirement needs of our employees. Our benefits include health insurance at no cost, a company match on 401(k)

retirement savings, and paid maternity and paternity leave. In addition, we have the following policies to foster an ethical, respectful

and inclusive workplace environment:

| · | our

Code of Business Conduct and Ethics provides a comprehensive resource governing ethical concerns,

employee privacy and workplace matters, legal compliance, and other matters; |

| · | our

Equal Employment Opportunity Policy commits us to fairly treating all employees and candidates,

without regard to characteristics having no bearing on job performance; and |

| · | our

Harassment Policy addresses many forms of unwanted attention, including sexual harassment. |

In 2021, diversity, equity

and inclusion (“DEI”) was a focus for Tellurian. We believe that a diverse and inclusive culture supports our ability to

meet our commitment of creating a consistent global employee experience and to attract and retain talent, drive innovation and enable

the long-term success of our business. We have developed a comprehensive DEI strategy. As of December 31, 2021, (i) approximately

40% of Tellurian’s workforce was a member of a minority group and (ii) the ratio of male to female employees was approximately

60:40.

COVID-19 Response

Tellurian’s response

to COVID-19 has prioritized the health and safety of our workforce while maintaining safe operations and business continuity. Our Crisis

Management Team (CMT), a cross-functional team that leads our crisis and risk management efforts, established COVID-19 protocols related

to workplace arrangements, travel policy, information technology support, employee communication and training.

In October 2021, Tellurian

commenced its full-time return to the office, with management continuing to address employee matters related to the pandemic with the

utmost attention to ensure the continued health and safety our work force. Additionally, management announced the implementation of a

mandatory vaccination policy that requires all current employees and independent contractors to be

vaccinated, subject to exemptions for health

and religious reasons. Future hires will be required to show proof of the vaccination as a condition of employment, subject to the same

exemptions.

Community Investment

As part of its stakeholder

engagement program, Tellurian is committed to being a good neighbor and to strengthening its relationships with communities by working

together on projects that improve the quality of life for all residents. In 2019, we invested $1.5 million to build the Belle Cove

Road near the site of the proposed Driftwood Project, improving access from local neighborhoods to a highway, fulfilling a longtime need

of the community and surrounding area. Following the devastating destruction in Southwest Louisiana caused by Hurricanes Laura and Delta

in 2020, Tellurian committed over $100,000 to help rebuild hurricane-damaged houses. In 2021, we donated $277,000 to charities and foundations

in Texas and Louisiana.

In December 2021, we announced

that we partnered with the National Forest Foundation on a five-year, $25 million plan for reforestation and other projects across

the United States. One of the first projects will be to re-plant 300,000 trees in the Kisatchie National Forest, located near Alexandria,

Louisiana, where nearly 40,000 acres of native trees were lost due to recent weather events. We have also made significant donations

to various research initiatives and programs, including at Columbia University for electrification research with a particular focus on

decarbonization of the country’s electricity supply and at the University of Texas at Austin for a multi-phase, life-cycle analysis

focusing on supply chain and environmental trade-offs related to specific energy sources used to generate and store electricity, including

natural gas, wind, solar and batteries.

Governance

We believe that our efforts

for effective corporate governance are illustrated by the following practices:

| · | All

of our Board committees are composed of independent directors. |

| · | The

functioning of our Board and Board committees is assessed annually. |

| · | Non-employee

directors of the Company are not permitted to stand for re-election after reaching age 75

unless the Board waives this requirement in a particular case. |

| · | Our

stock ownership guidelines align the interests of our directors and officers with the interests

of our stockholders. |

| · | Our

key corporate governance and compliance policies are reviewed annually. |

Code

of Conduct and Business Ethics

The Company has adopted a

Code of Business Conduct and Ethics (the “Code of Conduct”) that summarizes Tellurian’s compliance and ethical standards

and the expectations it has for its officers, directors, and employees. Under the Code of Conduct, all directors, officers, and employees

must follow ethical business practices in all business relationships, both within and outside of the Company.

The Code of Conduct is available

on the Company’s website, http://www.tellurianinc.com, under the heading “Investors—Company and governance—Governance

documents.” Tellurian intends to

provide disclosure regarding waivers of or amendments

to the Code of Conduct by posting such waivers or amendments to the website in the manner provided by applicable law.

Compensation

Committee Interlocks and Insider Participation

No member of the Compensation

Committee was, during the fiscal year ended December 31, 2021, an officer or employee of the Company, and no such member has ever

served as an officer of the Company. During the fiscal year ended December 31, 2021, none of our executive officers served as a

director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive

officers served on our Compensation Committee or the Board.

Communications

with Directors

Any stockholder wishing to

communicate with the Board or any individual director may do so by contacting the Corporate Secretary at the address, telephone number,

facsimile number, or e-mail address listed below:

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

Attention: Corporate Secretary

Telephone: (832) 962-4000

Facsimile: (832) 962-4055

Website: http://www.tellurianinc.com

E-mail: CorpSec@tellurianinc.com

All communications will be

forwarded to the Board or the relevant Board member. The Corporate Secretary has been authorized by the Board to screen frivolous or

unlawful communications or commercial advertisements.

Stockholders also may communicate

with management by contacting the Corporate Secretary using the above contact information.

Director

Attendance at Annual Meetings

The Company does not have

a policy regarding attendance of directors at annual meetings of stockholders. All of the Company’s current directors attended

by phone the Company’s last annual meeting of stockholders held on June 9, 2021.

Board

Nomination Process

The ESG and Nominating Committee

identifies director nominees based on recommendations from management, directors, stockholders, and other sources. In identifying and

evaluating director nominees, the ESG and Nominating Committee takes into account, among other things, individual director performance

(including for incumbent directors, their Board and committee meeting attendance and performance and length of Board service), qualifications,

expertise, integrity, independence under NYSE American or other applicable listing standards, depth and diversity of experience (including

service as a director or executive with other entities engaged in the Company’s business), willingness to serve actively and collaboratively,

leadership and other skills, and the ability to exercise sound judgment. The Board does not currently employ an executive search firm,

or pay a fee to any other third party, to identify qualified candidates for director positions.

The Board and ESG and Nominating

Committee will consider any director candidates recommended to the Board by stockholders on the same basis as candidates submitted by

others. Stockholders who wish to recommend a prospective director nominee for consideration by the Board should notify the Corporate

Secretary in writing at the Company’s offices at 1201 Louisiana Street, Suite 3100, Houston, Texas 77002. The Corporate Secretary

will forward all such stockholder recommendations on to the Board for its consideration. Any such recommendation should provide whatever

supporting material the stockholder considers appropriate but should include at a minimum such background and biographical material as

will enable the ESG and Nominating Committee to make an initial determination as to whether the nominee satisfies the Board membership

criteria set forth above. No stockholder recommendation of a prospective Tellurian director was received by the Board in 2021.

Audit

Committee Report

In connection with the preparation

and filing of the audited financial statements of Tellurian, for the fiscal year ended December 31, 2021 (the “audited financial

statements”), the Audit Committee performed the following functions:

| · | The

Audit Committee reviewed and discussed the audited financial statements with senior management

and Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered

public accounting firm. The review included a discussion of the quality, not just the acceptability,

of the Company’s accounting principles, the reasonableness of significant judgments,