While surging natural gas prices have taken most of the headlines

in the energy market, oil prices have also seen strength in 2014.

Though the gains have been pretty modest in this corner of the

market, there is plenty of hope that more solid trading will take

place in this segment of the broader energy sector.

After all, cold weather across the U.S. has kept heating oil demand

quite high, and with more frigid temperatures, this is expected to

remain elevated in the near term after an already brutal

winter.

And more importantly, G20 finance ministers recently agreed to set

a growth target of about 2% above current levels over the next five

years, suggesting more policy initiatives are coming down the pike,

a situation that is nearly always good for oil prices.

Thanks to both short term and longer term hope for higher oil

prices, along with elevated natural gas as well, it is looking very

bright for those in the exploration side of the oil and gas market.

These companies generally benefit from higher prices, and with a

broad market push towards natural resource names too, these stocks

could be worth a closer look (see A Comprehensive Guide to Oil

& Gas ETFs).

Companies in this space have edged out the broad market for the

most part in 2014, but with strong underlying gas and oil prices,

demand could be picking up for more exploration. And with a very

favorable last few trading days, we could be witnessing the

beginning of this trend in the market.

How to Play

Fortunately, there are several ETFs that track this space and offer

up diversified exposure to this burgeoning trend. Below, we

highlight some of the key factors for each of these funds, any of

which could be great picks for investors seeking broad access to

the natural gas and oil exploration and production market:

iShares U.S. Oil & Gas Exploration & Production ETF

(IEO)

This ETF tracks the Dow Jones US Select Oil Exploration &

Production Index, following roughly 75 companies in total. The fund

charges investors 46 basis points a year in fees, while volume is

modest at about 130,000 shares a day.

ConocoPhilips (COP) takes the number one spot at

about 12.3% of assets, while EOG Resources and Philips 66 round out

the rest of the top three. The fund does have a significant large

cap focus, though mid caps do account for about 15% of the total.

The ETF currently has a Zacks ETF Rank #1 (Strong Buy) and it has

added about 6.3% since the start of February (see all the Top

Ranked ETFs here).

SPDR S&P Oil & Gas Exploration & Production ETF

(XOP)

This fund uses an equal weight approach, following the S&P Oil

and Gas Exploration and Production index for exposure. The fund

holds about 80 stocks in its basket, charging a pretty low 35 basis

points a year in fees.

Thanks to its equal weight technique, no single security makes up

more than 2% of assets, so concentration risk is pretty much a

non-issue from a single stock perspective. Additionally, the equal

weighting makes it so that large caps only account for 30% of

assets, leaving nearly half the portfolio for small and micro cap

securities.

The ETF has a Rank of 3 or 'hold' and it can see volatile moves due

to its focus on small cap securities. This has benefited the fund

has of late though, as it has added over 8% since the start of the

month (see 7 ETFs to Buy in 2014).

PowerShares Dynamic Energy Exploration & Production ETF

(PXE)

PXE is the most expensive on this list, charging investors 65 basis

points a year in fees, while seeing average volume below

40,000 shares a day. This is because the fund follows the Dynamic

Energy Exploration and Production Intellidex index, a benchmark

that selects stocks based on a variety of criteria for inclusion in

the product.

This is also done with an equal weighted approach, though with the

initial screens, only about 30 stocks find their way into the

portfolio. The resulting stock basket is currently heavy on large

caps, and there is a modest oil refining & marketing segment in

the fund.

Nevertheless, the fund has performed well in the past few sessions,

adding 4.9% since the start of February. And, though the fund has

underperformed over the past year, it has easily outperformed in

longer time frames, paying for its added cost.

Bottom Line

Many natural resources have seen a great start to 2014, leading to

strength in various mining and production companies. And with

predictions of more solid performances in the oil and gas sectors,

it could be a good idea to look to exploration names in the near

term (also read 3 Top Ranked ETFs that Will Crush the Market in

2014).

This space hasn’t surged yet, but recent trading suggests that it

is on the verge of breaking out. So if investors want to tap into

this trend with a lower risk method, a look to any of the

aforementioned ETFs could be a very solid choice.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

CONOCOPHILLIPS (COP): Free Stock Analysis Report

ISHARS-US O&G (IEO): ETF Research Reports

PWRSH-DYN ENRG (PXE): ETF Research Reports

SPDR-SP O&G EXP (XOP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

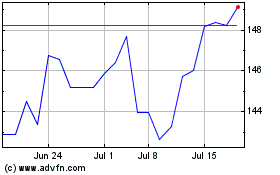

SPDR S&P Oil and Gas Exp... (AMEX:XOP)

Historical Stock Chart

From Dec 2024 to Dec 2024

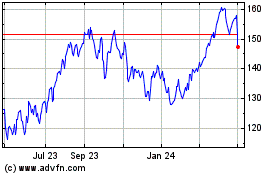

SPDR S&P Oil and Gas Exp... (AMEX:XOP)

Historical Stock Chart

From Dec 2023 to Dec 2024