Will The S&P 500 Index Enter a Bull Market In July?

July 03 2023 - 6:41AM

Finscreener.org

A recent CNBC “Delivering Alpha”

survey reveals that most Wall Street investors believe the stock

market has entered a new bull market in 2023. Investors also expect

the U.S. economy to remain strong and dodge recession fears this

year.

The survey reportedly collected

opinions from approximately 400 individuals, including chief

investment officers, equity strategists, portfolio managers, and

CNBC contributors who handle money, asking them about market

predictions for Q3 and beyond.

About 61% of those surveyed are

optimistic that the market is entering a new period of growth,

known as a bull market. The remaining 39% anticipate a temporary

market uptick within a general downtrend or a bear market

rally.

Going by the book, some people

have already proclaimed the onset of a new bull market since

the

S&P 500 has risen

20% from its low point in October, a basic criterion for a bull

market. However, some investors donU+02019t consider it the end of

a bear market until the S&P 500 hits a fresh high. The

record closing high for the wider index is 4,796.56, while it

closed on Thursday at 4,396.44.

Despite concerns about rate

increases, a debt ceiling debate, and a series of bank failures,

the market has held its ground this year. The S&P 500 is on

track to finish the yearU+02019s first half with a significant

increase of nearly 15% following four consecutive months of gains.

The tech-heavy Nasdaq Composite has performed even better, soaring by 30% this

year, largely thanks to Wall

StreetU+02019s keen interest in artificial intelligence.

Carol Schleif, the Chief

Investment Officer at the BMO Family Office, suggests that there

are plenty of reasons to be positive about U.S. stocks in the

latter half of 2023, especially since the market is showing more

variety.

Most investors predict the

economy will steer clear of a serious downturn this year, despite

the Federal ReserveU+02019s rapid rate increases. The Fed raised

rates at every meeting from March 2022 onwards, making four

consecutive three-quarter point hikes before taking a breather in

June.

The exceptional conditions of an

unprecedented pandemic, which led to historic fiscal and monetary

responses, may bring about a unique economic downturn.

Jason Draho, the Head of Asset

Allocation Americas at UBS Global Wealth Management, suggests that

we may see rolling recessions affecting different sectors rather

than a typical, all-encompassing recession.

For the rest of 2023, investors

anticipate the best returns from short-term Treasuries and the

S&P 500 and overseas stock markets like Japan, China, and

Europe.

Jobs market and payrolls report

Updates on the job market are due

this week. The Bureau of Labor Statistics (BLS) is set to publish

the Job Openings and Labor Turnover Survey (JOLTS) report on

Thursday. This report will reveal the number of May job openings,

hires, resignations, and layoffs.

Predictions suggest a drop in job

openings to 9.9 million from 10.1 million in April.

ADP (NASDAQ:

ADP), a payroll provider, will also release its

report for June on the same day, showing private sector job growth

expected to be around 180,000.

On Friday, the June nonfarm

payroll report will be out. Experts believe U.S. businesses added

200,000 jobs in June, a slowdown from the unexpected increase of

339,000 in May. The unemployment rate is likely to hold steady at

3.7%. If job creation beats these forecasts, it could support the

Federal ReserveU+02019s argument for additional rate increases to

manage the economy and curb inflation.

The Federal Reserve will make the

minutes from the latest FOMC meeting public on Wednesday. During

this meeting earlier this month, the central bank kept interest

rates unchanged. This came after ten consecutive rate increases

from March of the previous year, aiming to control the highest

inflation in 40 years.

Market traders predict that the

Fed will start raising interest rates again at its policy meeting

in July. According to data from CME Group, there is a 90% chance of

a 25 basis points (0.25%) increase. This could put the key federal

funds rate at 5.25% to 5.5%, the highest in 22 years.

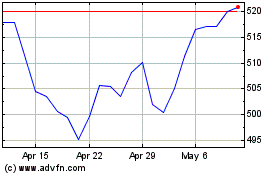

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

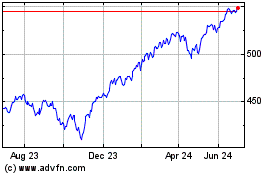

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024