Time to Exit Junk Bonds ETFs? - ETF News And Commentary

March 13 2013 - 8:30AM

Zacks

Over the past several years, junk bonds ETFs were popular

destinations for yield starved investors who didn’t really want a

huge upgrade in duration risk. ETFs tracking this segment have

enjoyed four years of robust returns and solid payouts, leaving

many quite satisfied with their exposure.

But now, it seems that investors are pulling back their money

from this fixed income asset class and are cycling their exposure

into equities that enjoy strong market confidence. The investors

have put more than $77 billion in stock funds during the first

month of this year, the largest inflow since February 2000. Broad

equity indexes are reaching new highs on the back of improving

global economic conditions (read: 3 ETFs at the Heart of the Recent

Rally).

As such, junk bond ETFs are seeing huge outflows of late as

investors are hunting for income in the stock or MLP/REIT worlds

instead. This chase and strong outflows have pushed down the yield

on junk bonds to record lows. Junk bond yields recently fell below

6% for the first time (giving them a 500 basis points spread over

U.S. Treasury bills).

As the yields are currently very low, it could be rough if

interest rates go up. So, investors have started taking short

positions in the high yield bond market, betting on the decline in

the price of junk bonds and a spike in yields (read: Comprehensive

Guide to U.S. Junk Bond ETF Investing).

Further, investors are worried about the outcomes in Italy, and

a corruption scandal in Spain. An increase in European corporate

default rates and low interest rates set by the Federal Reserve are

also denting the bond market.

In this backdrop, the two most popular junk bond ETFs –

iBoxx $ High Yield Corporate Bond Fund

(HYG) and SPDR

Barclays Capital High Yield Bond ETF

(JNK) – have seen big

outflows to start the year. In fact, their combined outflow for

both so far in 2013 is over $1.1 billion, putting both into the

bottom ten for flows this year in the fixed income world.

Both funds offer extreme liquidity and are the largest bond ETFs

in the high yield bond space. Though both focus on intermediate

term corporates, these are different from each other in many

aspects (see more ETFs in the Zacks ETF Center).

HYG seeks to match the performance of the iBoxx $ Liquid High

Yield Index, before fees and expenses, holding 736 securities in

the basket. About 69% of the product’s holdings mature in less than

10 years, giving HYG an effective duration of only 4.03 years and

average maturity of 4.45 years.

In terms of credit quality, the fund focuses on higher quality

non-investment grade bonds, allocating just 12% of the portfolio to

bonds rated ‘B’ or lower. Instead, ‘BB’ bonds make up nearly 38% of

the portfolio while ‘B’ rated securities comprise the rest.

The ETF is also well spread across a variety of sectors.

Consumer service makes up about 16% of the total, while oil &

gas and financials comprise another 13% each (read: 5 Sector ETFs

Surging to Start 2013).

The product has so far attracted assets worth $15.2 billion,

charging investors a fee of 50 bps a year. It yields 6.08% in

annual dividends, 5.06% in 30-day SEC yield and 5.54% in yield to

maturity.

With AUM of about $12 billion, JNK tracks the overall

performance of the Barclays Capital High Yield Very Liquid Index,

charging 40 bps in annual fees from investors. The index includes

fixed-rate, taxable, low-rated corporate bonds usually ‘BBB’ and

below. The individual bond has more than $600 million in face value

and remaining maturity of at least one year.

The fund is heavily exposed to the industrial sector with 86% of

JNK and holds around 450 bonds in its basket. The product has a

modified adjusted duration of 4.28 years and average maturity of

6.70 years. In terms of yield, the ETF pays out 6.25% in dividends,

5.21% in 30-day SEC yield and 6.25% in yield to maturity.

Bottom Line

HYG managed to stay flat, losing 0.2% in the year while JNK lost

about 0.3% year-to-date (as of March 13). Thus, we see that the

returns of junk bonds are diminishing and might go down further as

we move further into 2013 (read: HYEM: The Best Choice in Junk Bond

ETFs?). Both ETFs currently have Zacks Rank #3 or ‘Hold’ Rating,

suggesting that the funds might not perform well over the next one

year either.

This suggests that it may finally be time for junk bond ETF

investors to start looking elsewhere for better options. At current

valuations, stocks look much more attractive than bonds and could

deliver better returns in the medium to longer term.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-IBX HYCB (HYG): ETF Research Reports

SPDR-BC HY BD (JNK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

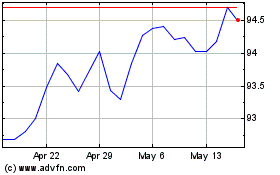

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Apr 2024 to May 2024

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From May 2023 to May 2024