Are Investors Taking Another Look At Junk Bond ETFs? - ETF News And Commentary

February 15 2012 - 3:17AM

Zacks

While the economy has slowly begun to improve, many segments

still remain weak, suggesting that we might not be out of the woods

yet. Thanks to this, Ben Bernanke and the rest of the Fed have

decided to keep rates at their ultra-low levels for the foreseeable

future, promising not to raise rates until 2014 at the earliest.

This proclamation has had huge effects on the economy and

investors’ decisions going forward as well. It has pushed many out

of some types of fixed income while it has also limited the appeal

of ultra-safe investment vehicles such as CDs or savings

accounts.

Yet, beyond pushing investors into broad equities, this has also

seemingly reignited the passion that some have for high yielding

securities as a way to supplement income. The focus in this space

has undoubtedly been on high yielding equities as investors have

piled into REITs, MLPs, and other sectors that have traditionally

been known for their impressive payouts. Some also assumed that

this trend might extend to the bond world with investors focusing

in on high yield bond ETFs in order to boost payouts from the fixed

income space but has this really been the case? (read Three Bond

ETFs For A Fixed Income Bear Market)

After all there has been a great deal of talk about investors

moving beyond Treasury bonds and into higher risk securities.

Default rates still remain low when compared to historical levels

for junk-rated securities while yields in this sector still offer a

significant premium over more highly rated Treasury bonds.

Furthermore, junk bonds tend to be more short-duration focused

suggesting that when rates eventually do rise, these securities are

likely to be less impacted then their peers (read Do You Need A

Floating Rate Bond ETF?).

Partially thanks to these factors, it appears that yes,

investors who are looking to increase yield in the bond world are

taking a closer look at junk bond ETFs for their exposure. This is

best evidenced by the significant inflows that two products in the

space—HYG and JNK—have seen in recent time periods. According to

data from XTF.com, the segment, as represented by these two funds,

have been in the top five for inflows for both the past one week

and year-to-date periods, outpacing all other bond products. In

fact, the inflows into these two funds have accounted for nearly

15% of all the aggregate inflows in the ETF world so far this year,

further demonstrating how much investors are clamoring for these

bond ETFs in their portfolios (see Three Outperforming Active

ETFs).

Clearly, while dividend paying equities are growing increasingly

popular, junk bond ETFs are too. The segment is attracting

considerable inflows and could continue to do so if the Fed keeps

rates steady at their current, ultra-low level. As a result, it

could be time to take a closer look at the increasingly popular

space as more inflows will only allow the securities to go up

further in price, especially if current policies continue. For

investors intrigued by this trend, we have briefly highlighted some

of the key points from these increasingly popular and liquid ETFs

below:

iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

This junk bond ETF has added close to $2.7 billion in assets so

far this year, including $350 million in the past week alone,

giving the fund just under $13.7 billion in AUM. The product holds

483 securities in total and charges investors 50 basis points a

year in fees for its services. Consumer staples, industrials and

telecom bonds make up the top three sectors while the focus from a

duration perspective is decidedly on the short end; the effective

duration is just 4.22 years. Overall, the product could serve as a

nice yield booster too, as the fund has a 30-Day SEC Yield of 6.7%,

well above similar duration products in the Treasury space (read

Top Three High Yield Junk Bond ETFs).

SPDR Barclays High Yield Bond ETF (JNK)

This SPDR fund has also seen significant inflows this year,

racking up $2.3 billion since the start of 2012 including more than

half a billion in the past week alone. This gives the product just

over $11.5 billion in assets, ensuring that much like HYG, this

fund has very tight bid ask spreads. Overall, the fund includes 224

securities while charging investors 40 basis points a year in fees

for its services. Top holdings include HCA Inc bonds maturing in

2020, notes from Sprint due in 2018, and bonds from First Data that

mature in 2021. Despite these longer term bonds in the top

holdings, this fund has a slightly higher duration although it too

comes in below 4.5 years. Nevertheless, the fund also had a solid

yield at 6.7% in 30-Day SEC Yield terms, making it another great

option for those looking for higher payouts in the bond space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

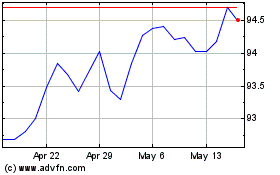

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From Apr 2024 to May 2024

SPDR Bloomberg High Yiel... (AMEX:JNK)

Historical Stock Chart

From May 2023 to May 2024