FALSE000138419500013841952023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________________________________________________________________________________________________

FORM 8-K

_____________________________________________________________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: August 3, 2023

(Date of earliest event reported)

______________________________________________________________________________________

RING ENERGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________

| | | | | | | | | | | | | | |

Nevada | | 001-36057 | | 90-0406406 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1725 Hughes Landing Blvd., Suite 900

The Woodlands, TX 77380

(Address of principal executive offices) (Zip Code)

(281) 397-3699

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

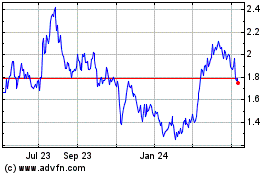

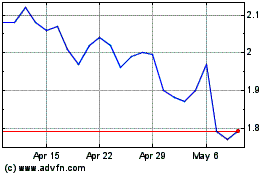

Common Stock, $0.001 par value | REI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2023, Ring Energy, Inc. (the “Company”) issued a press release announcing its financial and operating results for the second quarter ended June 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Current Report on Form 8-K furnished pursuant to Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On August 4, 2023, the Company posted to its website a company presentation (the “Presentation Materials”) that management intends to use from time to time. The Company may use the Presentation Materials, possibly with modifications, in presentations to current and potential investors, lenders, creditors, vendors, customers and others with an interest in the Company and its business.

The information contained in the Presentation Materials is summary information that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While the Company may elect to update the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, the Company specifically disclaims any obligation to do so. The Presentation Materials are furnished herewith as Exhibit 99.2 to this Current Report on Form 8-K and are incorporated herein by reference.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, the Company makes no admission as to the materiality of any information in this Current Report on Form 8-K, including Exhibit 99.2, that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RING ENERGY, INC.

|

| | | |

Date: | August 4, 2023 | By: | /s/ Travis T. Thomas |

| | | Travis T. Thomas |

| | | Chief Financial Officer |

[NOT] FOR IMMEDIATE RELEASE NYSE American – REI

RING ENERGY ANNOUNCES SECOND QUARTER 2023 RESULTS AND REITERATES QUARTERLY GUIDANCE FOR SECOND HALF 2023

~ Second Half 2023 to Benefit from Targeted 2023 Capital Spending Program and Recently Announced Acquisition ~

The Woodlands, TX – August 3, 2023 – Ring Energy, Inc. (NYSE American: REI) (“Ring” or the “Company”) today reported operational and financial results for the second quarter of 2023. In addition, the Company reaffirmed its pro forma guidance for the third and fourth quarters of 2023 assuming completion of its recently announced transaction to acquire additional assets in the Central Basin Platform (“CBP”) of the Permian Basin from Founders Oil & Gas IV, LLC (“Founders”) for $75 million in cash, subject to customary closing adjustments (the “Founders Acquisition”).

Second Quarter 2023 Highlights and Recent Key Items

•Sold 17,271 barrels of oil equivalent per day (“Boe/d”) (69% oil) compared to 18,292 Boe/d (69% oil) for the first quarter of 2023;

◦Primarily impacting sequential quarterly sales volumes were the previously-announced sale of the Company’s non-core asset position in the Delaware Basin, and the deferral of certain well drilling and workover projects due to lower commodity prices and the anticipated funding and incremental benefits of the Founders Acquisition;

•Reported net income of $28.8 million, or $0.15 per diluted share, in the second quarter of 2023, versus net income of $32.7 million, or $0.17 per diluted share in the first quarter of 2023;

◦Second quarter 2023 included a gain on derivative contracts of $3.3 million, while first quarter 2023 included a gain on derivative contracts of $9.5 million;

◦Second quarter 2023 also included a benefit from income taxes of $6.4 million primarily due to the partial release of the valuation allowance. First quarter 2023 included a provision for income taxes of $2.0 million;

•Achieved Adjusted Net Income1 of $28.0 million, or $0.14 per diluted share, for the second quarter of 2023 versus $25.0 million, or $0.13 per diluted share, in the first quarter of 2023;

•Generated Adjusted EBITDA1 of $53.5 million for the second quarter of 2023 compared to $58.6 million in the first quarter of 2023;

•Incurred Lease Operating Expense (“LOE”) of $10.14 per Boe in the second quarter of 2023, which was 9% lower than the mid-point of guidance of $11.00 to $11.40 per Boe and a 4% reduction from $10.61 per Boe the first quarter of 2023;

•Delivered Net Cash Provided by Operating Activities of $43.4 million in the second quarter of 2023;

◦Increased Adjusted Free Cash Flow1 by 20% to $12.6 million from $10.5 million in the first quarter of 2023;

◦Remained cash flow positive for the 15th consecutive quarter;

•Paid down $25.0 million in debt during the second quarter of 2023;

•Ended second quarter 2023 with liquidity of $204.0 million and a Leverage Ratio2 of 1.64x;

◦Reaffirmed borrowing base of $600 million under Ring’s $1.0 billion senior revolving credit facility (the “Credit Facility”) during the second quarter of 2023;

•Continued the 2023 development program, including drilling and completing four horizontal (“Hz”) wells in the Northwest Shelf (“NWS”) and two vertical wells in the CBP, as well as performed three recompletions in the CBP. Capital expenditures were $31.6 million on an accrual basis during the second quarter of 2023, which was 12% lower than the mid-point of guidance of $34 million to $38 million;

1A non-GAAP financial measure; see “Non-GAAP Information” section in this release for more information including reconciliations to the most comparable GAAP measures.

2 Refer to the “Non-GAAP Information” section in this release for calculation of the Leverage Ratio based on our Credit Agreement.

•Completed the sale of its non-core asset position in the West Texas Delaware Basin for net cash proceeds of $8.0 million (the “Delaware Transaction”) during the second quarter of 2023;

•Entered into agreements in April 2023 with certain holders of the Company’s outstanding warrants for the early exercise of an aggregate of 14.5 million warrants (14.5 million shares of Common Stock) that resulted in net cash proceeds of $8.7 million (the “Early Warrant Exercise”). As of June 30, 2023, 78,200 warrants to purchase shares of Ring’s Common Stock remained outstanding;

•Announced on July 11, 2023 the Company’s agreement to acquire the CBP assets of Founders for $75 million in cash with closing expected later this month and an effective date of April 1, 2023; and

•Reiterated guidance for the third and fourth quarters of 2023 based on its outlook for sales volumes, operating expenses and capital spending, which assumes the anticipated completion of the Founders Acquisition.

Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer, commented, “During the second quarter, we benefited from the Stronghold acquisition executed in the second half of 2022, continued strong performance from our legacy assets, implemented our targeted 2023 capital spending program, and continued ongoing efforts to drive further cost efficiencies in the business. While second quarter sales volumes fell short of earlier developed expectations due to a combination of factors, we were pleased with our overall financial results despite the backdrop of decreased realized oil and natural gas prices. This includes posting a 20% sequential quarterly increase in Adjusted Free Cash Flow. In addition to the increase in Adjusted Free Cash Flow, we benefited from the sale of our non-core assets in the Delaware Basin and the Early Warrant Exercise, which allowed us to pay down $25 million of debt.”

Mr. McKinney continued, “We remain focused on the disciplined execution of our 2023 capital spending program and maximizing our Adjusted Free Cash Flow by prioritizing high rate-of-return drilling and recompletion projects. In short, we will continue to execute our value focused proven strategy designed to further improve our balance sheet and position the Company to return capital to stockholders in the future. To make our stock more appealing to a wider cross-section of the investment community, we believe achieving greater size and scale is a key priority. As a result, pursuing immediately accretive and balance sheet enhancing acquisition opportunities continues to be a core focus.”

Mr. McKinney concluded, “We are excited by our pending Founders transaction to acquire additional assets located near our existing operations, where we are deeply familiar with the operating and development characteristics. We look forward to quickly integrating these assets into our operations after closing. As we have previously stated, the Founders Acquisition is immediately accretive, expands our proved reserves, lowers our leverage ratio, accelerates our ability to pay down debt, increases our inventory of low-risk and high rate-of-return drilling locations, improves capital allocation flexibility, and strategically expands our core operating area that allows us to capture further operating and G&A cost synergies. We will continue to pursue additional opportunities to strategically expand our operational footprint.”

Financial Overview: For the second quarter of 2023, the Company reported net income of $28.8 million, or $0.15 per diluted share, which included a $3.1 million before-tax non-cash unrealized commodity derivative gain, $2.3 million in before-tax share-based compensation, and $0.2 million in before-tax transaction related costs for the Delaware Transaction. The Company’s Adjusted Net Income (which excludes the after-tax impact of the adjustments) was $28.0 million, or $0.14 per diluted share. In the first quarter of 2023, the Company reported net income of $32.7 million, or $0.17 per diluted share, which included a $10.1 million before-tax non-cash unrealized commodity derivative gain and $1.9 million for before-tax share-based compensation. The Company’s Adjusted Net Income for the first quarter of 2023 was $25.0 million, or $0.13 per diluted share. For the second quarter of 2022, Ring reported net income of $41.9 million, or $0.32 per diluted share, which included a $12.2 million before-tax non-cash unrealized commodity derivative gain and $1.9 million in before-tax share-based compensation. Adjusted Net Income in the second quarter of 2022 was $31.3 million, or $0.24 per diluted share.

Adjusted EBITDA was $53.5 million for the second quarter of 2023 versus $58.6 million for the first quarter of 2023, and 13% higher than $47.4 million for the second quarter of 2022.

Adjusted Free Cash Flow for the second quarter of 2023 was $12.6 million, which was 20% higher than $10.5 million for the first quarter of 2023. Positively impacting the current period was a $7.3 million decrease in capital spending. Second quarter 2023 Adjusted Free Cash Flow increased 405% over the same period in 2022. Primarily contributing to the increase was $10.2 million in lower capital spending in the second quarter of 2023.

Adjusted Cash Flow from Operations was $44.0 million for the second quarter of 2023 compared to $49.4 million for the first quarter of 2023 and $44.3 million for the second quarter of 2022.

Adjusted Net Income, Adjusted EBITDA, Adjusted Free Cash Flow, and Adjusted Cash Flow from Operations are non-GAAP financial measures, which are described in more detail and reconciled to the most comparable GAAP measures, in the tables shown later in this release under “Non-GAAP Information.”

Sales Volumes, Prices and Revenues: As previously disclosed, beginning July 1, 2022, the Company began reporting revenues on a three-stream basis, separately reporting oil, natural gas, and natural gas liquids (“NGLs”) sales. For periods prior to July 1, 2022, sales and reserve volumes, prices, and revenues for NGLs were included in natural gas.

Sales volumes for the second quarter of 2023 were 17,271 Boe/d (69% oil, 16% natural gas and 15% NGLs), or 1,571,668 Boe, compared to 18,292 Boe/d (69% oil, 16% natural gas and 15% NGLs), or 1,646,306 Boe, for the first quarter of 2023. As noted above, second quarter 2023 sales volumes were below Ring’s original guidance due to the previously announced sale of the Company’s non-core Delaware Basin assets and the deferral of certain drilling and workover projects due to lower commodity prices and the anticipated funding and incremental benefits of the Founders Acquisition. In the second quarter of 2022, sales volumes were 9,341 Boe/d (86% oil and 14% natural gas), or 850,017 Boe. Second quarter 2023 sales volumes were comprised of 1,079,379 barrels (“Bbls”) of oil, 1,557,545 thousand cubic feet (“Mcf”) of natural gas and 232,698 Bbls of NGLs.

For the second quarter of 2023, the Company realized an average sales price of $72.30 per barrel of crude oil, $(0.71) per Mcf of natural gas and $10.35 per barrel of NGLs. The combined average realized sales price for the period was $50.49 per Boe, down 6% versus $53.50 per Boe for the first quarter of 2023, and down 49% from $99.95 per Boe in the second quarter of 2022. The average oil price differential the Company experienced from NYMEX WTI futures pricing in the second quarter of 2023 was a negative $1.77 per barrel of crude oil, while the average natural gas price differential from NYMEX futures pricing was a negative $3.07 per Mcf. The negative realized price of natural gas in the second quarter of 2023 was driven by processing costs that exceeded Henry Hub pricing less basis differentials.

Revenues were $79.3 million for the second quarter of 2023 compared to $88.1 million for the first quarter of 2023 and $85.0 million for the second quarter of 2022. The 10% decrease in

second quarter 2023 revenues from the first quarter of 2023 was driven by lower realized pricing and sales volumes.

Lease Operating Expense (“LOE”): LOE, which includes expensed workovers and facilities maintenance, was $15.9 million, or $10.14 per Boe, in the second quarter of 2023 versus $17.5 million, or $10.61 per Boe, in the first quarter of 2023. LOE for the second quarter of 2022 was $8.3 million, or $9.77 per Boe. Contributing to the decrease in absolute LOE from the first quarter was the sale of the Delaware Basin assets and lower variable costs associated with reduced production volumes. LOE for the second quarter of 2023 was below the low end of guidance of $11.00 to $11.40 per BOE.

Gathering, Transportation and Processing (“GTP”) Costs: As previously disclosed, due to a contractual change effective May 1, 2022, the Company no longer maintains ownership and control of natural gas through processing. As a result, GTP costs are now reflected as a reduction to the natural gas sales price and not as an expense item.

Ad Valorem Taxes: Ad valorem taxes were $1.06 per Boe for the second quarter of 2023 compared to $1.01 per Boe in the first quarter of 2023 and $1.12 per Boe for the second quarter of 2022.

Production Taxes: Production taxes were $2.55 per Boe in the second quarter of 2023 compared to $2.68 per Boe in the first quarter of 2023 and $4.89 per Boe in second quarter of 2022. Production taxes ranged between 4.9% to 5.1% of revenue for all three periods.

Depreciation, Depletion and Amortization (“DD&A”) and Asset Retirement Obligation Accretion: DD&A was $13.23 per Boe in the second quarter of 2023 versus $12.92 per Boe for the first quarter of 2023 and $12.65 per Boe in the second quarter of 2022. Asset retirement obligation accretion was $0.23 per Boe in the second quarter of 2023 compared to $0.22 per Boe for the first quarter of 2023 and $0.22 per Boe in the second quarter of 2022.

Operating Lease Expense: Operating lease expense was $115,353 for the second quarter of 2023, $113,138 for the first quarter of 2023, and $83,590 in the second quarter of 2022. These expenses are primarily associated with the Company’s office leases.

General and Administrative Expenses (“G&A”): G&A was $6.8 million ($4.33 per Boe) for the second quarter of 2023 versus $7.1 million ($4.33 per Boe) for the first quarter of 2023 and $5.8 million ($6.86 per Boe) for the second quarter of 2022. G&A, excluding non-cash share-based compensation, was $4.5 million ($2.89 per Boe) for the second quarter of 2023 versus

$5.2 million ($3.15 per Boe) for the first quarter of 2023 and $3.9 million ($4.63 per Boe) for the second quarter of 2022. G&A, excluding non-cash share-based compensation and Delaware Transaction costs was $4.3 million ($2.75 per Boe), which represents a 13% and 41% respective decrease from first quarter 2023 and second quarter 2022 on a per Boe basis.

Interest Expense: Interest expense was $10.6 million in the second quarter of 2023 versus $10.4 million for the first quarter of 2023 and $3.3 million for the second quarter of 2022 due to increased borrowings and higher interest rates.

Derivative (Loss) Gain: In the second quarter of 2023, Ring recorded a net gain of $3.3 million on its commodity derivative contracts, including a realized $0.2 million cash commodity derivative gain and an unrealized $3.1 million non-cash commodity derivative gain. This compares to a net gain of $9.5 million in the first quarter of 2023, including a realized $0.6 million cash commodity derivative loss and an unrealized $10.1 million non-cash commodity derivative gain, and a net loss on commodity derivative contracts of $7.4 million in the second quarter of 2022, including a realized $19.6 million cash commodity derivative loss and an unrealized $12.2 million non-cash commodity derivative gain.

A summary listing of the Company’s outstanding derivative positions at June 30, 2023 is included in the tables shown later in this release.

For the remainder (July through December) of 2023, the Company has approximately 1.2 million barrels of oil (approximately 52% of oil sales guidance midpoint) hedged and approximately 1.3 billion cubic feet of natural gas (approximately 39% of natural gas sales guidance midpoint) hedged.

Income Tax: The Company recorded a non-cash income tax benefit of $6.4 million in the second quarter of 2023 versus a non-cash income tax provision of $2.0 million in the first quarter of 2023 and a non-cash income tax provision of $1.5 million for the second quarter of 2022. The non-cash tax benefit in the second quarter of 2023 was primarily due to the partial release of the valuation allowance.

Balance Sheet and Liquidity: Total liquidity (defined as cash and cash equivalents plus borrowing base availability) at the end of the second quarter of 2023 was $204.0 million, a 14% increase from March 31, 2023 and a 150% increase from June 30, 2022. Liquidity at June 30, 2023 consisted of cash and cash equivalents of $1.7 million and $202.2 million of availability under Ring’s revolving credit facility, which included a reduction of $0.8 million for letters of

credit. On June 30, 2023, the Company had $397.0 million in borrowings outstanding on its Credit Facility that has a current borrowing base of $600.0 million. Upon completion of the Founders Acquisition, the Company is targeting further future debt reduction dependent on market conditions, the timing and level of capital spending, and other considerations.

Capital Expenditures: During the second quarter of 2023, accrued capital expenditures were $31.6 million, which was below the low end of guidance of $34 million to $38 million. In the NWS, the Company drilled and completed two 1.5-mile Hz wells (one with a working interest (“WI”) of 100% and the other with a WI of 75.4%) and two 1-mile wells (both with a WI of 91.1%). In the CBP, Ring drilled and completed two vertical wells (both with a WI of 100%) and performed three vertical well recompletions (each with a WI of 100%). Also included in capital spending were costs for capital workovers, infrastructure upgrades, and leasing costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter | | Area | | Wells Drilled | | Wells Completed | | Re-completions |

| | | | | | | | |

| 1Q 2023 | | Northwest Shelf | | 4 | | 4 | | — |

| | Central Basin Platform (Vertical) | | 3 | | 3 | | 6 |

| | | | | | | | |

| | Total | | 7 | | 7 | | 6 |

| | | | | | | | |

| 2Q 2023 | | Northwest Shelf | | 4 | | 4 | | — |

| | Central Basin Platform (Vertical) | | 2 | | 2 | | 3 |

| | | | | | | | |

| | Total | | 6 | | 6 | | 3 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

2023 Capital Investment, Sales Volumes, and Operating Expense Guidance

For the second half of 2023, Ring reiterates the pro forma third and fourth quarter of 2023 guidance provided on July 11, 2023 that reflects the Delaware Transaction completed in the second quarter and the positive impact from its pending Founders Acquisition.

The Company is targeting total pro forma capital expenditures in the second half of 2023 of $67 million to $77 million that includes a balanced and capital efficient combination of drilling Hz and vertical wells, as well as performing recompletions. Additionally, the capital spending program includes funds for targeted capital workovers, infrastructure upgrades, leasing costs, and non-operated drilling, completion, and capital workovers.

All projects and estimates are based on assumed WTI oil prices of $65 to $85 per barrel. As in the past, Ring has designed its spending program with flexibility to respond to changes in commodity prices and other market conditions as appropriate.

Based on the $72 million mid-point of spending guidance, the Company expects the following estimated allocation of capital investments, including:

•73% for drilling, completion, and related infrastructure;

•19% for recompletions and capital workovers; and

•8% for land, environmental and safety, and non-operated capital.

The Company remains squarely focused on continuing to generate Adjusted Free Cash Flow in 2023. All 2023 planned capital expenditures will be fully funded by cash on hand and cash from operations, and excess Adjusted Free Cash Flow is currently targeted for further debt reduction upon completion of the Founders Acquisition.

The pro forma guidance in the table below represents the Company's current good faith estimate of the range of likely future results assuming a closing date for the Founders Acquisition of August 15, 2023, and also reflect the Delaware Transaction. Guidance could be affected by the factors discussed below in the "Safe Harbor Statement" section.

| | | | | | | | | | | | | | |

| | PRO FORMA |

| | Q3 | | Q4 |

| | 2023 | | 2023 |

| | | | |

| Sales Volumes: | | | | |

| Total (Boe/d) | | 18,100 - 18,600 | | 18,900 - 19,500 |

| Mid Point (Boe/d) | | 18,350 | | 19,200 |

| Oil (%) | | 68% | | 69% |

| NGLs (%) | | 15% | | 15% |

| Gas (%) | | 17% | | 16% |

| | | | |

| Capital Program: | | | | |

Capital spending(1) (millions) | | $37 - $42 | | $30 - $35 |

| | | | |

| Hz wells drilled | | 5 - 7 | | 3 - 4 |

| Vertical wells drilled | | 1 - 2 | | 3 - 4 |

| Wells completed and online | | 5 - 6 | | 7 - 8 |

| | | | |

| Operating Expenses: | | | | |

| LOE (per Boe) | | $10.50 - $11.00 | | $10.50 - $11.00 |

(1) In addition to Company-directed drilling and completion activities, the capital spending outlook includes funds for targeted well recompletions, capital workovers, and infrastructure upgrades. Also included is anticipated spending for leasing costs, and non-operated drilling, completion, and capital workovers.

Conference Call Information

Ring will hold a conference call on Friday, August 4, 2023 at 11:00 a.m. ET to discuss its second quarter 2023 operational and financial results. An updated investor presentation will be posted to the Company’s website prior to the conference call.

To participate in the conference call, interested parties should dial 833-953-2433 at least five minutes before the call is to begin. Please reference the “Ring Energy Second Quarter 2023 Earnings Conference Call”. International callers may participate by dialing 412-317-5762. The call will also be webcast and available on Ring’s website at www.ringenergy.com under “Investors” on the “News & Events” page. An audio replay will also be available on the Company’s website following the call.

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration, development, and production company with current operations focused on the development of its Permian Basin assets. For additional information, please visit www.ringenergy.com.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without limitation, statements with respect to the Company’s strategy and prospects. The forward-looking statements include statements about the expected benefits of the Founders Acquisition to Ring and its stockholders, the anticipated completion of the Founders Acquisition or the timing thereof, the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Ring and its management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: the ability to complete the Founders Acquisition on anticipated terms and timetable; Ring’s ability to integrate its combined operations successfully after the Founders Acquisition and achieve anticipated benefits from it; the possibility that various closing conditions for the Transaction may not be satisfied or waived; risks relating to any unforeseen liabilities of Ring or Founders;

declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base and interest rates under the Credit Facility; Ring’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; the impacts of hedging on results of operations; and Ring’s ability to replace oil and natural gas reserves. Such statements are subject to certain risks and uncertainties which are disclosed in the Company’s reports filed with the SEC, including its Form 10-K for the fiscal year ended December 31, 2022, and its other filings. Ring undertakes no obligation to revise or update publicly any forward-looking statements except as required by law.

Contact Information

Al Petrie Advisors

Al Petrie, Senior Partner

Phone: 281-975-2146

Email: apetrie@ringenergy.com

RING ENERGY, INC.

Condensed Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | (Unaudited) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Oil, Natural Gas, and Natural Gas Liquids Revenues | $ | 79,348,573 | | | $ | 88,082,912 | | | $ | 84,961,875 | | | $ | 167,431,485 | | | $ | 153,142,907 | |

| | | | | | | | | |

| Costs and Operating Expenses | | | | | | | | | |

| Lease operating expenses | 15,938,106 | | | 17,472,691 | | | 8,301,443 | | | 33,410,797 | | | 17,254,608 | |

| Gathering, transportation and processing costs | (1,632) | | | (823) | | | 549,389 | | | (2,455) | | | 1,846,247 | |

| Ad valorem taxes | 1,670,343 | | | 1,670,613 | | | 949,239 | | | 3,340,956 | | | 1,901,193 | |

| Oil and natural gas production taxes | 4,012,139 | | | 4,408,140 | | | 4,157,457 | | | 8,420,279 | | | 7,375,819 | |

| Depreciation, depletion and amortization | 20,792,932 | | | 21,271,671 | | | 10,749,204 | | | 42,064,603 | | | 20,530,491 | |

| Asset retirement obligation accretion | 353,878 | | | 365,847 | | | 186,303 | | | 719,725 | | | 374,545 | |

| Operating lease expense | 115,353 | | | 113,138 | | | 83,590 | | | 228,491 | | | 167,180 | |

| General and administrative expense | 6,810,243 | | | 7,130,139 | | | 5,832,302 | | | 13,940,382 | | | 11,354,579 | |

| | | | | | | | | |

| Total Costs and Operating Expenses | 49,691,362 | | | 52,431,416 | | | 30,808,927 | | | 102,122,778 | | | 60,804,662 | |

| | | | | | | | | |

| Income from Operations | 29,657,211 | | | 35,651,496 | | | 54,152,948 | | | 65,308,707 | | | 92,338,245 | |

| | | | | | | | | |

| Other Income (Expense) | | | | | | | | | |

| Interest income | 79,745 | | | — | | | — | | | 79,745 | | | — | |

| Interest (expense) | (10,550,807) | | | (10,390,279) | | | (3,279,299) | | | (20,941,086) | | | (6,677,660) | |

| Gain (loss) on derivative contracts | 3,264,660 | | | 9,474,905 | | | (7,457,018) | | | 12,739,565 | | | (35,053,159) | |

| Gain (loss) on disposal of assets | (132,109) | | | — | | | — | | | (132,109) | | | — | |

| Other income | 116,610 | | | 9,600 | | | — | | | 126,210 | | | — | |

| Net Other Income (Expense) | (7,221,901) | | | (905,774) | | | (10,736,317) | | | (8,127,675) | | | (41,730,819) | |

| | | | | | | | | |

| Income Before Benefit from (Provision for) Income Taxes | 22,435,310 | | | 34,745,722 | | | 43,416,631 | | | 57,181,032 | | | 50,607,426 | |

| | | | | | | | | |

| Benefit from (Provision for) Income Taxes | 6,356,295 | | | (2,029,943) | | | (1,472,209) | | | 4,326,352 | | | (1,550,961) | |

| | | | | | | | | |

| Net Income | $ | 28,791,605 | | | $ | 32,715,779 | | | $ | 41,944,422 | | | $ | 61,507,384 | | | $ | 49,056,465 | |

| | | | | | | | | |

| Basic Earnings per share | $ | 0.15 | | | $ | 0.18 | | | $ | 0.39 | | | $ | 0.33 | | | $ | 0.47 | |

| Diluted Earnings per share | $ | 0.15 | | | $ | 0.17 | | | $ | 0.32 | | | $ | 0.32 | | | $ | 0.39 | |

| | | | | | | | | |

| Basic Weighted-Average Shares Outstanding | 193,077,859 | | 177,984,323 | | 106,390,776 | | 185,545,775 | | 103,291,669 |

| Diluted Weighted-Average Shares Outstanding | 195,866,533 | | 190,138,969 | | 130,597,589 | | 193,023,966 | | 126,251,705 |

RING ENERGY, INC.

Condensed Operating Data

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Net sales volumes: | | | | | | | | | |

| Oil (Bbls) | 1,079,379 | | 1,139,413 | | 729,484 | | 2,218,792 | | 1,405,699 |

| Natural gas (Mcf) | 1,557,545 | | 1,601,407 | | 723,196 | | 3,158,952 | | 1,455,479 |

Natural gas liquids (Bbls)(1) | 232,698 | | 239,992 | | — | | 472,690 | | — |

Total oil, natural gas and natural gas liquids (Boe)(1)(2) | 1,571,668 | | 1,646,306 | | 850,017 | | 3,217,974 | | 1,648,279 |

| % Oil | 69 | % | | 69 | % | | 86 | % | | 69 | % | | 85 | % |

| | | | | | | | | |

| Average daily equivalent sales (Boe/d) | 17,271 | | 18,292 | | 9,341 | | 17,779 | | 9,107 |

| | | | | | | | | |

| Average realized sales prices: | | | | | | | | | |

| Oil ($/Bbl) | $ | 72.30 | | | $ | 73.36 | | | $ | 109.24 | | | $ | 72.85 | | | $ | 101.81 | |

| Natural gas ($/Mcf) | (0.71) | | | 0.66 | | | 7.29 | | | (0.01) | | | 6.89 | |

Natural gas liquids ($/Bbls)(1) | 10.35 | | | 14.30 | | | — | | | 12.35 | | | — | |

| Barrel of oil equivalent ($/Boe) | $ | 50.49 | | | $ | 53.50 | | | $ | 99.95 | | | $ | 52.03 | | | $ | 92.91 | |

| | | | | | | | | |

| Average costs and expenses per Boe ($/Boe): | | | | | | | | | |

| Lease operating expenses | $ | 10.14 | | | $ | 10.61 | | | $ | 9.77 | | | $ | 10.38 | | | $ | 10.47 | |

| Gathering, transportation and processing costs | — | | | — | | | 0.65 | | | — | | | 1.12 | |

| Ad valorem taxes | 1.06 | | | 1.01 | | | 1.12 | | | 1.04 | | | 1.15 | |

| Oil and natural gas production taxes | 2.55 | | | 2.68 | | | 4.89 | | | 2.62 | | | 4.47 | |

| Depreciation, depletion and amortization | 13.23 | | | 12.92 | | | 12.65 | | | 13.07 | | | 12.46 | |

| Asset retirement obligation accretion | 0.23 | | | 0.22 | | | 0.22 | | | 0.22 | | | 0.23 | |

| Operating lease expense | 0.07 | | | 0.07 | | | 0.10 | | | 0.07 | | | 0.10 | |

| General and administrative expense (including share-based compensation) | 4.33 | | | 4.33 | | | 6.86 | | | 4.33 | | | 6.89 | |

| G&A (excluding share-based compensation) | 2.89 | | | 3.15 | | | 4.63 | | | 3.03 | | | 4.81 | |

| G&A (excluding share-based compensation and transaction costs) | 2.75 | | | 3.15 | | | 4.63 | | | 2.96 | | | 4.81 | |

(1) Beginning July 1, 2022, revenues were reported on a three-stream basis, separately reporting crude oil, natural gas, and natural gas liquids volumes and sales. For periods prior to July 1, 2022, volumes and sales for natural gas liquids were presented with natural gas.

(2) Boe is determined using the ratio of six Mcf of natural gas to one Bbl of oil (totals may not compute due to rounding.) The conversion ratio does not assume price equivalency and the price on an equivalent basis for oil, natural gas, and natural gas liquids may differ significantly.

RING ENERGY, INC.

Condensed Balance Sheets

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

| | June 30, 2023 | | December 31, 2022 |

| ASSETS | | | | |

| Current Assets | | | | |

| Cash and cash equivalents | | $ | 1,749,975 | | | $ | 3,712,526 | |

| Accounts receivable | | 32,044,159 | | | 42,448,719 | |

| Joint interest billing receivables, net | | 2,617,815 | | | 983,802 | |

| Derivative assets | | 8,307,537 | | | 4,669,162 | |

| Inventory | | 7,327,295 | | | 9,250,717 | |

| Prepaid expenses and other assets | | 3,061,216 | | | 2,101,538 | |

| Total Current Assets | | 55,107,997 | | | 63,166,464 | |

| Properties and Equipment | | | | |

| Oil and natural gas properties, full cost method | | 1,524,510,887 | | | 1,463,838,595 | |

| Financing lease asset subject to depreciation | | 3,144,038 | | | 3,019,476 | |

| Fixed assets subject to depreciation | | 2,762,370 | | | 3,147,125 | |

| Total Properties and Equipment | | 1,530,417,295 | | | 1,470,005,196 | |

| Accumulated depreciation, depletion and amortization | | (331,153,213) | | | (289,935,259) | |

| Net Properties and Equipment | | 1,199,264,082 | | | 1,180,069,937 | |

| Operating lease asset | | 1,628,832 | | | 1,735,013 | |

| Derivative assets | | 10,555,937 | | | 6,129,410 | |

| Deferred financing costs | | 15,458,204 | | | 17,898,973 | |

| Total Assets | | $ | 1,282,015,052 | | | $ | 1,268,999,797 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current Liabilities | | | | |

| Accounts payable | | $ | 90,021,106 | | | $ | 111,398,268 | |

| Income tax liability | | 98,481 | | | — | |

| Financing lease liability | | 761,110 | | | 709,653 | |

| Operating lease liability | | 394,404 | | | 398,362 | |

| Derivative liabilities | | 7,848,580 | | | 13,345,619 | |

| Notes payable | | 1,412,674 | | | 499,880 | |

| Deferred cash payment | | — | | | 14,807,276 | |

| Asset retirement obligations | | 408,958 | | | 635,843 | |

| Total Current Liabilities | | 100,945,313 | | | 141,794,901 | |

| | | | |

| Non-current Liabilities | | | | |

| Deferred income taxes | | 4,074,183 | | | 8,499,016 | |

| Revolving line of credit | | 397,000,000 | | | 415,000,000 | |

| Financing lease liability, less current portion | | 765,753 | | | 1,052,479 | |

| Operating lease liability, less current portion | | 1,263,936 | | | 1,473,897 | |

| Derivative liabilities | | 10,829,096 | | | 10,485,650 | |

| Asset retirement obligations | | 28,296,455 | | | 29,590,463 | |

| Total Liabilities | | 543,174,736 | | | 607,896,406 | |

| Commitments and contingencies | | | | |

| Stockholders' Equity | | | | |

| Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding | | — | | | — | |

| Common stock - $0.001 par value; 450,000,000 shares authorized; 195,350,672 shares and 175,530,212 shares issued and outstanding, respectively | | 195,350 | | | 175,530 | |

| Additional paid-in capital | | 791,450,835 | | | 775,241,114 | |

| Accumulated deficit | | (52,805,869) | | | (114,313,253) | |

RING ENERGY, INC.

Condensed Balance Sheets

| | | | | | | | | | | | | | |

| Total Stockholders’ Equity | | 738,840,316 | | | 661,103,391 | |

| Total Liabilities and Stockholders' Equity | | $ | 1,282,015,052 | | | $ | 1,268,999,797 | |

RING ENERGY, INC.

Condensed Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Cash Flows From Operating Activities | | | | | | | | | |

| Net income | $ | 28,791,605 | | | $ | 32,715,779 | | | $ | 41,944,422 | | | $ | 61,507,384 | | | $ | 49,056,465 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation, depletion and amortization | 20,792,932 | | | 21,271,671 | | | 10,749,203 | | | 42,064,603 | | | 20,530,490 | |

| Asset retirement obligation accretion | 353,878 | | | 365,847 | | | 186,303 | | | 719,725 | | | 374,545 | |

| Amortization of deferred financing costs | 1,220,385 | | | 1,220,384 | | | 189,274 | | | 2,440,769 | | | 388,548 | |

| Share-based compensation | 2,260,312 | | | 1,943,696 | | | 1,899,245 | | | 4,204,008 | | | 3,421,155 | |

| Bad debt expense | 19,315 | | | 2,894 | | | — | | | 22,209 | | | — | |

| Deferred income tax expense (benefit) | (6,548,363) | | | 1,972,653 | | | 1,485,022 | | | (4,575,710) | | | 1,550,961 | |

| Excess tax expense (benefit) related to share-based compensation | 150,877 | | | — | | | — | | | 150,877 | | | — | |

| (Gain) loss on derivative contracts | (3,264,660) | | | (9,474,905) | | | 7,457,018 | | | (12,739,565) | | | 35,053,159 | |

| Cash received (paid) for derivative settlements, net | 179,595 | | | (658,525) | | | (19,617,265) | | | (478,930) | | | (33,732,766) | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Accounts receivable | 5,320,051 | | | 3,428,287 | | | (4,315,730) | | | 8,748,338 | | | (14,393,828) | |

| Inventory | 1,480,824 | | | 442,598 | | | — | | | 1,923,422 | | | — | |

| Prepaid expenses and other assets | (1,489,612) | | | 529,934 | | | (2,470,602) | | | (959,678) | | | (2,267,717) | |

| Accounts payable | (5,471,391) | | | (9,589,898) | | | 4,328,968 | | | (15,061,289) | | | 6,847,979 | |

| Settlement of asset retirement obligation | (429,567) | | | (490,319) | | | (1,113,208) | | | (919,886) | | | (1,666,576) | |

| Net Cash Provided by Operating Activities | 43,366,181 | | | 43,680,096 | | | 40,722,650 | | | 87,046,277 | | | 65,162,415 | |

| | | | | | | | | |

| Cash Flows From Investing Activities | | | | | | | | | |

| Payments for the Stronghold Acquisition | — | | | (18,511,170) | | | — | | | (18,511,170) | | | — | |

| Payments to purchase oil and natural gas properties | (819,644) | | | (59,099) | | | (383,003) | | | (878,743) | | | (743,851) | |

| Payments to develop oil and natural gas properties | (35,611,915) | | | (36,939,307) | | | (35,793,923) | | | (72,551,222) | | | (49,654,172) | |

| Payments to acquire or improve fixed assets subject to depreciation | (11,324) | | | (14,570) | | | (81,646) | | | (25,894) | | | (91,760) | |

| Sale of fixed assets subject to depreciation | 332,230 | | | — | | | 126,100 | | | 332,230 | | | 134,600 | |

| Proceeds from divestiture of equipment for oil and natural gas properties | — | | | 54,558 | | | 25,066 | | | 54,558 | | | 25,066 | |

| Receipt from sale of Delaware properties | 7,992,917 | | | — | | | — | | | 7,992,917 | | | — | |

| Net Cash (Used in) Investing Activities | (28,117,736) | | | (55,469,588) | | | (36,107,406) | | | (83,587,324) | | | (50,330,117) | |

| | | | | | | | | |

| Cash Flows From Financing Activities | | | | | | | | | |

| Proceeds from revolving line of credit | 28,500,000 | | | 56,000,000 | | | 40,500,000 | | | 84,500,000 | | | 50,500,000 | |

| Payments on revolving line of credit | (53,500,000) | | | (49,000,000) | | | (50,500,000) | | | (102,500,000) | | | (70,500,000) | |

| Proceeds from issuance of common stock from warrant exercises | 8,687,655 | | | 3,613,941 | | | 5,163,126 | | | 12,301,596 | | | 5,163,126 | |

| | | | | | | | | |

| Payments for taxes withheld on vested restricted shares, net | (141,682) | | | (134,381) | | | (257,694) | | | (276,063) | | | (257,694) | |

| Proceeds from notes payable | 1,565,071 | | | — | | | 928,626 | | | 1,565,071 | | | 928,626 | |

| Payments on notes payable | (152,397) | | | (499,880) | | | (253,360) | | | (652,277) | | | (620,741) | |

| Payment of deferred financing costs | — | | | — | | | — | | | — | | | — | |

| Reduction of financing lease liabilities | (182,817) | | | (177,014) | | | (111,864) | | | (359,831) | | | (230,642) | |

| Net Cash Provided by (Used in) Financing Activities | (15,224,170) | | | 9,802,666 | | | (4,531,166) | | | (5,421,504) | | | (15,017,325) | |

| | | | | | | | | |

| Net Increase (Decrease) in Cash | 24,275 | | | (1,986,826) | | | 84,078 | | | (1,962,551) | | | (185,027) | |

| Cash at Beginning of Period | 1,725,700 | | | 3,712,526 | | | 2,139,211 | | | 3,712,526 | | | 2,408,316 | |

| Cash at End of Period | $ | 1,749,975 | | | $ | 1,725,700 | | | $ | 2,223,289 | | | $ | 1,749,975 | | | $ | 2,223,289 | |

RING ENERGY, INC.

Financial Commodity Derivative Positions

As of June 30, 2023

The following tables reflect the details of current derivative contracts as of June 30, 2023 (Quantities are in barrels (Bbl) for the oil derivative contracts and in million British thermal units (MMBtu) for the natural gas derivative contracts.):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oil Hedges (WTI) |

| Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Q4 2024 | | Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 |

| | | | | | | | | | | | | | | | | | | |

| Swaps: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (Bbl) | 181,700 | | | 138,000 | | | 170,625 | | | 156,975 | | | 282,900 | | | 368,000 | | | — | | | — | | | — | | | — | |

| Weighted average swap price | $ | 74.19 | | | $ | 74.52 | | | $ | 67.40 | | | $ | 66.40 | | | $ | 65.49 | | | $ | 68.43 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| Deferred premium puts: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (Bbl) | 230,000 | | | 165,600 | | | 45,500 | | | 45,500 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Weighted average strike price | $ | 80.47 | | | $ | 83.78 | | | $ | 84.70 | | | $ | 82.80 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Weighted average deferred premium price | $ | 10.60 | | | $ | 14.61 | | | $ | 17.15 | | | $ | 17.49 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| Two-way collars: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (Bbl) | 211,163 | | | 274,285 | | | 339,603 | | | 325,847 | | | 230,000 | | | 128,800 | | | 474,750 | | | 464,100 | | | — | | | — | |

| Weighted average put price | $ | 55.56 | | | $ | 56.73 | | | $ | 64.20 | | | $ | 64.30 | | | $ | 64.00 | | | $ | 60.00 | | | $ | 57.06 | | | $ | 60.00 | | | $ | — | | | $ | — | |

| Weighted average call price | $ | 69.25 | | | $ | 70.77 | | | $ | 79.73 | | | $ | 79.09 | | | $ | 76.50 | | | $ | 73.24 | | | $ | 75.82 | | | $ | 69.85 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| Three-way collars: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (Bbl) | 16,242 | | | 15,598 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Weighted average first put price | $ | 45.00 | | | $ | 45.00 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Weighted average second put price | $ | 55.00 | | | $ | 55.00 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Weighted average call price | $ | 80.05 | | | $ | 80.05 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas Hedges (Henry Hub) |

| Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Q4 2024 | | Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 |

| | | | | | | | | | | | | | | | | | | |

| NYMEX Swaps: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (MMBtu) | 144,781 | | | 203,706 | | | 152,113 | | | 138,053 | | | 121,587 | | | 644,946 | | | 616,199 | | | 591,725 | | | — | | | — | |

| Weighted average swap price | $ | 3.36 | | | $ | 3.35 | | | $ | 3.62 | | | $ | 3.61 | | | $ | 3.59 | | | $ | 4.45 | | | $ | 3.78 | | | $ | 3.43 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| Two-way collars: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (MMBtu) | 404,421 | | | 579,998 | | | 591,500 | | | 568,750 | | | 552,000 | | | — | | | — | | | — | | | — | | | — | |

| Weighted average put price | $ | 3.17 | | | $ | 3.15 | | | $ | 4.00 | | | $ | 4.00 | | | $ | 4.00 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Call hedged volume (MMBtu) | 404,421 | | | 579,998 | | | 591,500 | | | 568,750 | | | 552,000 | | | — | | | — | | | — | | | — | | | — | |

| Weighted average call price | $ | 4.55 | | | $ | 4.50 | | | $ | 6.29 | | | $ | 6.29 | | | $ | 6.29 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oil Hedges (basis differential) |

| Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Q4 2024 | | Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 |

| | | | | | | | | | | | | | | | | | | |

| Argus basis swaps: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (MMBtu) | 305,000 | | | 460,000 | | | 364,000 | | | 364,000 | | | 368,000 | | | 368,000 | | | 270,000 | | | 273,000 | | | 276,000 | | | 276,000 | |

Weighted average spread price (1) | $ | 1.10 | | | $ | 1.10 | | | $ | 1.15 | | | $ | 1.15 | | | $ | 1.15 | | | $ | 1.15 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

RING ENERGY, INC.

Financial Commodity Derivative Positions

As of June 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas Hedges (basis differential) |

| Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Q4 2024 | | Q1 2025 | | Q2 2025 | | Q3 2025 | | Q4 2025 |

| | | | | | | | | | | | | | | | | | | |

| Waha basis swaps: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (MMBtu) | 332,855 | | | 324,021 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Weighted average spread price (1) | $ | 0.55 | | | $ | 0.55 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| El Paso Permian Basin basis swaps: | | | | | | | | | | | | | | | | | | | |

| Hedged volume (MMBtu) | 329,529 | | | 459,683 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Weighted average spread price (1) | $ | 0.63 | | | $ | 0.63 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

(1) The oil basis swap hedges are calculated as the fixed price (weighted average spread price above) less the difference between WTI Midland and WTI Cushing, in the issue of Argus Americas Crude. The gas basis swap hedges are calculated as the Henry Hub natural gas price less the fixed amount specified as the weighted average spread price above.

RING ENERGY, INC.

Non-GAAP Information

Certain financial information included in this release are not measures of financial performance recognized by accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures are “Adjusted Net Income”, “Adjusted EBITDA”, “Adjusted Free Cash Flow” or “AFCF,” “Adjusted Cash Flow from Operations” or “ACFFO,” “G&A Excluding Share-Based Compensation” “G&A Excluding Share-Based Compensation and Transaction Costs,” and “Leverage Ratio.” Management uses these non-GAAP financial measures in its analysis of performance. In addition, Adjusted EBITDA is a key metric used to determine the Company’s incentive compensation awards. These disclosures may not be viewed as a substitute for results determined in accordance with GAAP and are not necessarily comparable to non-GAAP performance measures which may be reported by other companies.

Reconciliation of Net Income to Adjusted Net Income

“Adjusted Net Income” is calculated as Net Income minus the estimated after-tax impact of share-based compensation, ceiling test impairment, unrealized gains and losses on changes in the fair value of derivatives, and related transaction costs. Adjusted Net Income is presented because the timing and amount of these items cannot be reasonably estimated and affect the comparability of operating results from period to period, and current period to prior periods. The Company believes that the presentation of Adjusted Net Income provides useful information to investors as it is one of the metrics management uses to assess the Company’s ongoing operating and financial performance, and also is a useful metric for investors to compare our results with our peers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Total | | Per share - diluted | | Total | | Per share - diluted | | Total | | Per share - diluted | | Total | | Per share - diluted | | Total | | Per share - diluted |

| Net Income | $ | 28,791,605 | | | $ | 0.15 | | | $ | 32,715,779 | | | $ | 0.17 | | | $ | 41,944,422 | | | $ | 0.32 | | | $ | 61,507,384 | | | $ | 0.32 | | | $ | 49,056,465 | | | $ | 0.39 | |

| | | | | | | | | | | | | | | | | | | |

| Share-based compensation | 2,260,312 | | | 0.01 | | | 1,943,696 | | | 0.01 | | | 1,899,245 | | | 0.01 | | | 4,204,008 | | | 0.02 | | | 3,421,155 | | | 0.03 | |

| Unrealized loss (gain) on change in fair value of derivatives | (3,085,065) | | | (0.02) | | | (10,133,430) | | | (0.05) | | | (12,160,246) | | | (0.09) | | | (13,218,495) | | | (0.07) | | | 1,320,393 | | | 0.01 | |

| Transaction costs - executed A&D | 220,191 | | | — | | | — | | | — | | | — | | | — | | | 220,191 | | | — | | | — | | | — | |

| Tax impact on adjusted items | (171,282) | | | — | | | 478,467 | | | — | | | (347,939) | | | — | | | 307,185 | | | — | | | 145,314 | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted Net Income | $ | 28,015,761 | | | $ | 0.14 | | | $ | 25,004,512 | | | $ | 0.13 | | | $ | 31,335,482 | | | $ | 0.24 | | | $ | 53,020,273 | | | $ | 0.27 | | | $ | 53,943,327 | | | $ | 0.43 | |

| | | | | | | | | | | | | | | | | | | |

| Diluted Weighted-Average Shares Outstanding | 195,866,533 | | | | | 190,138,969 | | | | | 130,597,589 | | | | | 193,023,966 | | | | | 126,251,705 | | | |

| | | | | | | | | | | | | | | | | | | |

| Adjusted Net Income per Diluted Share | $ | 0.14 | | | | | $ | 0.13 | | | | | $ | 0.24 | | | | | $ | 0.27 | | | | | $ | 0.43 | | | |

Reconciliation of Net Income to Adjusted EBITDA

The Company defines “Adjusted EBITDA” as net income (loss) plus net interest expense, unrealized loss (gain) on change in fair value of derivatives, ceiling test impairment, income tax (benefit) expense, depreciation, depletion and amortization, asset retirement obligation accretion, transaction costs for executed acquisitions and divestitures (A&D), share-based compensation, loss (gain) on disposal of assets, and backing out the effect of other income. Company management believes Adjusted EBITDA is relevant and useful because it helps investors understand Ring’s operating performance and makes it easier to compare its results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in isolation from or as a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. Adjusted EBITDA, as Ring calculates it, may not be comparable to Adjusted EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds available for discretionary use.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net Income | $ | 28,791,605 | | | $ | 32,715,779 | | | $ | 41,944,422 | | | $ | 61,507,384 | | | $ | 49,056,465 | |

| | | | | | | | | |

| Interest expense, net | 10,471,062 | | | 10,390,279 | | | 3,279,299 | | | 20,861,341 | | | 6,677,660 | |

| Unrealized loss (gain) on change in fair value of derivatives | (3,085,065) | | | (10,133,430) | | | (12,160,246) | | | (13,218,495) | | | 1,320,393 | |

| Income tax (benefit) expense | (6,356,295) | | | 2,029,943 | | | 1,472,209 | | | (4,326,352) | | | 1,550,961 | |

| Depreciation, depletion and amortization | 20,792,932 | | | 21,271,671 | | | 10,749,204 | | | 42,064,603 | | | 20,530,491 | |

| Asset retirement obligation accretion | 353,878 | | | 365,847 | | | 186,303 | | | 719,725 | | | 374,545 | |

| Transaction costs - executed A&D | 220,191 | | | — | | | — | | | 220,191 | | | — | |

| Share-based compensation | 2,260,312 | | | 1,943,696 | | | 1,899,245 | | | 4,204,008 | | | 3,421,155 | |

| Loss (gain) on disposal of assets | 132,109 | | | — | | | — | | | 132,109 | | | — | |

| Other income | (116,610) | | | (9,600) | | | — | | | (126,210) | | | — | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 53,464,119 | | | $ | 58,574,185 | | | $ | 47,370,436 | | | $ | 112,038,304 | | | $ | 82,931,670 | |

| | | | | | | | | |

| Adjusted EBITDA Margin | 67 | % | | 66 | % | | 56 | % | | 67 | % | | 54 | % |

Reconciliations of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow and Adjusted EBITDA to Adjusted Free Cash Flow

The Company defines “Adjusted Free Cash Flow” or “AFCF” as Net Cash Provided by Operating Activities less changes in operating assets and liabilities (as reflected on our statements of cash flows); plus transaction costs for executed acquisitions and divestitures; current tax expense (benefit); proceeds from divestitures of equipment for oil and natural gas properties; loss (gain) on disposal of assets; and less capital expenditures; bad debt expense; and other income. For this purpose, our definition of capital expenditures includes costs incurred related to oil and natural gas properties (such as drilling and infrastructure costs and the lease maintenance costs) but excludes acquisition costs of oil and gas properties from third parties that are not included in our capital expenditures guidance provided to investors. Our management believes that Adjusted Free Cash Flow is an important financial performance measure for use in evaluating the performance and efficiency of our current operating activities after the impact of accrued capital expenditures and net interest expense and without being impacted by items such as changes associated with working capital, which can vary substantially from one period to another. Other companies may use different definitions of Adjusted Free Cash Flow.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Net Cash Provided by Operating Activities | $ | 43,366,181 | | | $ | 43,680,096 | | | $ | 40,722,650 | | | $ | 87,046,277 | | | $ | 65,162,415 | |

| Adjustments - Condensed Statements of Cash Flows | | | | | | | | | |

| Changes in operating assets and liabilities | 589,695 | | | 5,679,398 | | | 3,570,574 | | | 6,269,093 | | | 11,480,143 | |

| Transaction Costs - executed A&D | 220,191 | | | — | | | — | | | 220,191 | | | — | |

| Income tax expense (benefit) - current | 41,191 | | | 57,290 | | | (12,813) | | | 98,481 | | | — | |

| Capital expenditures | (31,608,483) | | | (38,925,497) | | | (41,810,442) | | | (70,533,980) | | | (61,554,135) | |

Proceeds from divestiture of equipment for oil and natural gas

properties | — | | | 54,558 | | | 25,066 | | | 54,558 | | | 25,066 | |

| Bad debt expense | (19,315) | | | (2,894) | | | — | | | (22,209) | | | — | |

| Loss (gain) on disposal of assets | 132,109 | | | — | | | — | | | 132,109 | | | — | |

| Other income | (116,610) | | | (9,600) | | | — | | | (126,210) | | | — | |

| | | | | | | | | |

| Adjusted Free Cash Flow | $ | 12,604,959 | | | $ | 10,533,351 | | | $ | 2,495,035 | | | $ | 23,138,310 | | | $ | 15,113,489 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Adjusted EBITDA | $ | 53,464,119 | | | $ | 58,574,185 | | | $ | 47,370,436 | | | $ | 112,038,304 | | | $ | 82,931,670 | |

| | | | | | | | | |

| Net interest expense (excluding amortization of deferred financing costs) | (9,250,677) | | | (9,169,895) | | | (3,090,025) | | | (18,420,572) | | | (6,289,112) | |

| Capital expenditures | (31,608,483) | | | (38,925,497) | | | (41,810,442) | | | (70,533,980) | | | (61,554,135) | |

| Proceeds from divestiture of equipment for oil and natural gas properties | — | | | 54,558 | | | 25,066 | | | 54,558 | | | 25,066 | |

| | | | | | | | | |

| Adjusted Free Cash Flow | $ | 12,604,959 | | | $ | 10,533,351 | | | $ | 2,495,035 | | | $ | 23,138,310 | | | $ | 15,113,489 | |

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Cash Flow from Operations

The Company defines “Adjusted Cash Flow from Operations” or “ACFFO” as Net Cash Provided by Operating Activities, per the Condensed Statements of Cash Flows, less the changes in operating assets and liabilities, including accounts receivable, inventory, prepaid expenses and other assets, accounts payable, and settlement of asset retirement obligation, which are subject to variation due to the nature of the Company’s operations. Accordingly, the Company believes this non-GAAP measure is useful to investors because it is used often in its industry and allows investors to compare this metric to other companies in its peer group as well as the E&P sector.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| Net Cash Provided by Operating Activities | $ | 43,366,181 | | | $ | 43,680,096 | | | $ | 40,722,650 | | | $ | 87,046,277 | | | $ | 65,162,415 | |

| | | | | | | | | |

| Changes in operating assets and liabilities | 589,695 | | | 5,679,398 | | | 3,570,572 | | | 6,269,093 | | | 11,480,143 | |

| | | | | | | | | |

| Adjusted Cash Flow from Operations | $ | 43,955,876 | | | $ | 49,359,494 | | | $ | 44,293,222 | | | $ | 93,315,370 | | | $ | 76,642,558 | |

Reconciliation of General and Administrative Expense (G&A) to G&A Excluding Share-Based Compensation and Transaction Costs

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited for All Periods) |

| Three Months Ended | | Six Months Ended |

| June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | |

| General and administrative expense (G&A) | $ | 6,810,243 | | | $ | 7,130,139 | | | $ | 5,832,302 | | | $ | 13,940,382 | | | $ | 11,354,579 | |

| Shared-based compensation | 2,260,312 | | | 1,943,696 | | | 1,899,245 | | | 4,204,008 | | | 3,421,155 | |

| G&A excluding share-based compensation | 4,549,931 | | | 5,186,443 | | | 3,933,057 | | | 9,736,374 | | | 7,933,424 | |

| Transaction costs - executed A&D | 220,191 | | | — | | | — | | | 220,191 | | | — | |

| G&A excluding share-based compensation and transaction costs | $ | 4,329,740 | | | $ | 5,186,443 | | | $ | 3,933,057 | | | $ | 9,516,183 | | | $ | 7,933,424 | |

Calculation of Leverage Ratio

“Leverage” or the “Leverage Ratio” is calculated under our existing senior revolving credit facility and means as of any date, the ratio of (i) our consolidated total debt as of such date to (ii) our Consolidated EBITDAX for the four consecutive fiscal quarters ending on or immediately prior to such date for which financial statements are required to have been delivered under our existing senior revolving credit facility; provided that for the purposes of the definition of ‘Leverage Ratio’, (a) for the fiscal quarter ended September 30, 2022, Consolidated EBITDAX is calculated by multiplying Consolidated EBITDAX for such fiscal quarter by four, (b) for the fiscal quarter ended December 31, 2022, Consolidated EBITDAX is calculated by multiplying Consolidated EBITDAX for the two fiscal quarter period ended on December 31, 2022 by two, (c) for the fiscal quarter ended March 31, 2023, Consolidated EBITDAX is calculated by multiplying Consolidated EBITDAX for the three fiscal quarter period ended on March 31, 2023 by four-thirds, and (d) for each fiscal quarter thereafter, Consolidated EBITDAX will be calculated by adding Consolidated EBITDAX for the four consecutive fiscal quarters ending on such date.

The Company defines “Consolidated EBITDAX” in accordance with our existing senior revolving credit facility and it means for any period an amount equal to the sum of (i) consolidated net income for such period plus (ii) to the extent deducted in determining consolidated net income for such period, and without duplication, (A) consolidated interest expense, (B) income tax expense determined on a consolidated basis in accordance with GAAP, (C) depreciation, depletion and amortization determined on a consolidated basis in accordance with GAAP, (D) exploration expenses determined on a consolidated

basis in accordance with GAAP, and (E) all other non-cash charges acceptable to our senior revolving credit facility administrative agent determined on a consolidated basis in accordance with GAAP, in each case for such period minus (iii) all noncash income added to consolidated net income for such period; provided that, for purposes of calculating compliance with the financial covenants set forth in our senior revolving credit facility, to the extent that during such period we shall have consummated an acquisition permitted by the senior revolving credit facility or any sale, transfer or other disposition of any person, business, property or assets permitted by the senior revolving credit facility, Consolidated EBITDAX will be calculated on a pro forma basis with respect to such person, business, property or assets so acquired or disposed of.

Also set forth in our existing senior revolving credit facility is the maximum permitted Leverage Ratio of 3.00. The following table shows the leverage ratio calculation for the Company’s most recent fiscal quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) |

| Three Months Ended | | |

| September 30, | | December 31, | | March 31, | | June 30, | | Last Four Quarters |

| 2022 | | 2022 | | 2023 | | 2023 | |

| Consolidated EBITDAX Calculation: | | | | | | | | | |

| Net Income (Loss) | $ | 75,085,891 | | | $ | 14,492,669 | | | $ | 32,715,779 | | | $ | 28,791,605 | | | $ | 151,085,944 | |

| Plus: Interest expense | 7,021,381 | | | 9,468,688 | | | 10,390,279 | | | 10,550,807 | | | 37,431,155 | |

| Plus: Income tax provision (benefit) | 4,315,783 | | | 2,541,980 | | | 2,029,943 | | | (6,356,295) | | | 2,531,411 | |

| Plus: Depreciation, depletion and amortization | 14,324,502 | | | 20,885,774 | | | 21,271,671 | | | 20,792,932 | | | 77,274,879 | |

| Plus: non-cash charges acceptable to Administrative Agent | (45,926,132) | | | 7,962,406 | | | (7,823,887) | | | (470,875) | | | (46,258,488) | |

| Consolidated EBITDAX | $ | 54,821,425 | | | $ | 55,351,517 | | | $ | 58,583,785 | | | $ | 53,308,174 | | | $ | 222,064,901 | |

| Plus: Pro Forma Acquired Consolidated EBITDAX | $ | 22,486,182 | | | $ | — | | | $ | — | | | $ | — | | | $ | 22,486,182 | |

| Less: Pro Forma Divested Consolidated EBITDAX | (355,824) | | | (507,709) | | | (683,723) | | | (201,859) | | | $ | (1,749,115) | |

| Pro Forma Consolidated EBITDAX | $ | 76,951,783 | | | $ | 54,843,808 | | | $ | 57,900,062 | | | $ | 53,106,315 | | | $ | 242,801,968 | |

| | | | | | | | | |

| Non-cash charges acceptable to Administrative Agent | | | | | | | | | |

| Asset retirement obligation accretion | $ | 243,140 | | | $ | 365,747 | | | $ | 365,847 | | | $ | 353,878 | | | |

| Unrealized loss (gain) on derivative assets | (47,712,305) | | | 5,398,615 | | | (10,133,430) | | | (3,085,065) | | | |

| Share-based compensation | 1,543,033 | | | 2,198,044 | | | 1,943,696 | | | 2,260,312 | | | |

| Total non-cash charges acceptable to Administrative Agent | $ | (45,926,132) | | | $ | 7,962,406 | | | $ | (7,823,887) | | | $ | (470,875) | | | |

| | | | | | | | | |

| As of | | | | | | | | |

| June 30, | | | | | | | | |

| 2023 | | | | | | | | |

| Leverage Ratio Covenant: | | | | | | | | | |

| Total Debt | $ | 397,000,000 | | | | | | | | | |

| Pro Forma Consolidated EBITDAX | $ | 242,801,968 | | | | | | | | | |

| Leverage Ratio | 1.64 | | | | | | | | | |

| Maximum Allowed | ≤ 3.00x | | | | | | | | |

NYSE American: REIwww.ringenergy.com VALUE FOCUSED PROVEN STRATEGY Q2 2023 EARNINGS

Ring Energy, Inc. Forward-Looking Statements and Supplemental Non-GAAP Financial Measures 2 Value focused Proven Strategy | August 3, 2023 | NYSE American: REI Forward –Looking Statements This Presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of strictly historical facts included in this Presentation constitute forward-looking statements and may often, but not always, be identified by the use of such words as “may,” “will,” “should,” “could,” “intends,” “estimates,” “expects,” “anticipates,” “plans,” “project,” “guidance,” “target,” “potential,” “possible,” “probably,” and “believes” or the negative variations thereof or comparable terminology. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without limitation, statements with respect to the Company’s strategy and prospects. The forward-looking statements include statements about the expected benefits of the proposed acquisition of oil and gas properties (the “Founders Acquisition”) from Founders Oil & Gas IV, LLC (“Founders”) to Ring and its stockholders, the anticipated completion of the Founders Acquisition or the timing thereof, the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Ring and its management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: the ability to complete the Founders Acquisition on anticipated terms and timetable; Ring’s ability to integrate its combined operations successfully after the Founders Acquisition and achieve anticipated benefits from it; the possibility that various closing conditions for the Founders Acquisition may not be satisfied or waived; risks relating to any unforeseen liabilities of Ring or Founders; declines in oil, natural gas liquids or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base and interest rates under the Company’s credit facility; Ring’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; the impacts of hedging on results of operations; and Ring’s ability to replace oil and natural gas reserves. Such statements are subject to certain risks and uncertainties which are disclosed in the Company’s reports filed with the SEC, including its Form 10-K for the fiscal year ended December 31, 2022, and its other filings. All forward-looking statements in this Presentation are expressly qualified by the cautionary statements and by reference to the underlying assumptions that may prove to be incorrect. The Company undertakes no obligation to revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. The financial and operating estimates contained in this Presentation represent our reasonable estimates as of the date of this Presentation. Neither our independent auditors nor any other third party has examined, reviewed or compiled the estimates and, accordingly, none of the foregoing expresses an opinion or other form of assurance with respect thereto. The assumptions upon which the estimates are based are described in more detail herein. Some of these assumptions inevitably will not materialize, and unanticipated events may occur that could affect our results. Therefore, our actual results achieved during the periods covered by the estimates will vary from the estimated results. Investors are not to place undue reliance on the estimates included herein. Supplemental Non-GAAP Financial Measures This Presentation includes financial measures that are not in accordance with accounting principles generally accepted in the United States (“GAAP”), such as “Adjusted Net Income,” “Adjusted EBITDA,” “PV-10,” “Adjusted Free Cash Flow,” or “AFCF,” “Adjusted Cash Flow from Operations,” or “ACFFO,” “Cash Return on Capital Employed” or “CROCE,” “Liquidity” and “Leverage Ratio.” While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For definitions of such non-GAAP financial measures and their reconciliations to GAAP measures, please see the Appendix.