Ring Energy, Inc. (NYSE American: REI) (“Ring”) (“Company”)

announced today financial results for the three months and nine

months ended September 30, 2019. For the three-month period ended

September 30, 2019, the Company reported oil and gas revenues of

$50,339,105 compared to revenues of $32,687,179 for the quarter

ended September 30, 2018. For the nine months ended September 30,

2019, the Company reported oil and gas revenues of $143,471,645,

compared to $92,503,453 for the nine months ended September 30,

2018.

For the three months ended September 30, 2019, Ring reported net

income of $9,888,356, or $0.15 per diluted share, compared to net

income of $5,693,628, or $0.09 per fully diluted share for the

three months ended September 30, 2018. For the nine months ended

September 30, 2019, the Company reported net income of $33,353,053,

or $0.50 per diluted share, compared to net income of $16,079,068,

or $0.27 per fully diluted share for the nine-month period ended

September 30, 2018.

For the three months ended September 30, 2019, the net income

included a pre-tax unrealized gain on derivatives of $1,877,368 and

a non-cash charge for stock-based compensation of $792,836.

Excluding these items, the net income per diluted share would have

been $0.12. For the nine months ended September 30, 2019, the net

income included a pre-tax unrealized gain on derivatives of

$3,066,913 and a non-cash charge for stock-based compensation of

$2,436,035. Excluding these items, the net income per diluted share

would have been $0.42. The Company believes results excluding these

items are more comparable to estimates provided by security

analysts and, therefore, are useful in evaluating operational

trends of the Company and its performance, compared to other

similarly situated oil and gas producing companies.

For the three months ended September 30, 2019, oil sales volume

increased to 906,874 barrels, compared to 555,020 barrels (Ring

Only) for the same period in 2018, a 63.4% increase, and gas sales

volume increased to 731,627 MCF (thousand cubic feet), compared to

280,200 MCF (Ring Only) for the same period in 2018, a 161.1%

increase. On a barrel of oil equivalent (“BOE”) basis for the three

months ended September 30, 2019, production sales were 1,028,812

BOEs, compared to 601,720 BOEs (Ring Only) for the same period in

2018, an 70.9% increase, and 988,218 BOEs for the second quarter of

2019, a 4.1% increase. For the nine months ended September 30,

2019, oil sales volume increased to 2,612,742 barrels, compared to

1,504,330 (Ring Only) barrels for the same period in 2018, a 73.7%

increase, and gas sales volume increased to 1,697,373 MCF, compared

to 809,287 MCF (Ring Only) for the same period in 2018, a 109.7%

increase. On a BOE basis for the nine months ended September 30,

2019, production sales increased to 2,895,637 BOEs, compared to

1,639,211 BOEs (Ring Only) for the same period in 2018, a 76.6%

increase.

The average commodity prices received by the Company were $54.59

per barrel of oil and $1.14 per MCF of natural gas for the quarter

ended September 30, 2019, compared to $57.00 per barrel of oil and

$3.76 per MCF of natural gas for the quarter ended September 30,

2018. On a BOE basis for the three-month period ended September 30,

2019, the average price received was $48.93, compared to $54.32 per

BOE for the three months ended September 30, 2018. The average

prices received for the nine months ended September 30, 2019 were

$54.03 per barrel of oil and $1.35 per MCF of natural gas, compared

to $59.65 per barrel of oil and $3.42 per MCF of natural gas for

the nine-month period ended September 30, 2018. On a BOE basis for

the nine-month period ended September 30, 2019, the average price

received was $49.55, compared to $56.43 per BOE for the nine months

ended September 30, 2018.

The average price differential the Company experienced from WTI

pricing in the third quarter 2019 was less than $3.00.

As of September 30, 2019, the Company had entered into

derivative contracts in the form of costless collars of NYMEX WTI

Crude Oil prices in order to protect the Company’s cash flow from

price fluctuation and maintain its capital programs. “Costless

collars” are the combination of two options, a put option (floor)

and call option (ceiling) with the options structured so that the

premium paid for the put option will be offset by the premium

received from selling the call option. The trades were for a total

of 5,500 barrels of oil per day for the period of April 2019

through December 2019 and 2,000 barrels of oil per day for the

period of January 2020 through December 2020. The average prices

for the 5,500 BOPD under contract for 2019 are: Floor = $50.00 /

Ceiling = $68.19. The average prices for the 2,000 BOPD under

contract for 2020 are: Floor = $50.00 / Ceiling = $65.61. The

“Costless Collar” pricing does not take into account any pricing

differentials between NYMEX WTI pricing and the price received by

the Company.

Lease operating expenses (“LOE”), including production taxes,

for the three months ended September 30, 2019 were $17.28 per BOE,

an 18.6% increase from the prior year. Depreciation, depletion and

amortization costs, including accretion, decreased 24.4% to $13.95

per BOE. General and administrative costs, which included a

$792,836 charge for stock-based compensation and $114,112 for an

operating lease expense, were $3.75 per BOE, a 29.6% decrease. For

the nine months ended September 30, 2019, lease operating expenses,

including production taxes, were $14.94 per BOE, a 1.8% increase.

Depreciation, depletion and amortization costs, including

accretion, were $14.63 per BOE, a 17.4% decrease, and general and

administrative costs, which included a $2,436,035 charge for

stock-based compensation and $370,462 for operating lease expenses,

were $5.41 per BOE, an 6.1% decrease.

Mr. Randy Broaddrick, Vice President and Chief Financial

Officer, commented, “The primary reason for the increase in the LOE

per BOE for the third quarter 2019 is an accounting adjustment

related to the processing fees for most of the gas sold on the

Northwest Shelf (“NWS”) assets. These fees were previously

accounted for as a reduction of revenue but are now correctly

included as a lease operating expense. This accounting treatment is

appropriate because of the marketing arrangements in place for this

gas. Additionally, we received older invoices related to the NWS

assets during the third quarter that had to be accounted for. We

believe our ongoing LOE per BOE is under $12.00, including gas

processing fees. Considering cash flows from operations, excluding

changes in assets and liabilities against development capital

expenditures during the period, we were approximately $2 million

shy of reaching cash flow neutrality in the third quarter. Further,

we continue to firmly believe that at a $50.00 per BOE received

price we will attain our goal of cash flow neutrality by year

end.”

Cash provided by operating activities, before changes in working

capital, for the three and nine months ended September 30, 2019 was

$24,930,123, or $0.37 per fully diluted share, and $77,415,296, or

$1.17 per fully diluted share, compared to $18,963,008 and

$55,520,527, or $0.31 and $0.92 per fully diluted share for the

same periods in 2018. Earnings before interest, taxes, depletion

and other non-cash items (“Adjusted EBITDA”) for the three and nine

months ended September 30, 2019 were $29,486,623, or $0.43 per

fully diluted share, and $86,991,225, or $1.31 per fully diluted

share, compared to $18,998,041 and $55,508,099, or $0.31 and $0.92

in 2018. (See accompanying table for a reconciliation of net income

to adjusted EBITDA).

Total capital expenditures for the three and nine months ended

September 30, 2019 were approximately $21.3 and $418.2 million. The

three-month amount included $161,000 of asset retirement

obligations and was reduced $5.5 million by divestiture of

non-operated properties. The nine-month amount includes $296.9

million for property acquisitions, $3.6 million of asset retirement

obligations and was reduced $7.6 million by property

divestitures.

As of September 30, 2019, the outstanding balance on the

Company’s $1 billion senior secured credit facility was $366.5

million. The weighted average interest rate on borrowings under the

senior credit facility was 4.83%. The immediate borrowing base

($425 million) will be re-determined semi-annually on each May 1

and November 1.

The Company’s Chief Executive Officer, Mr. Kelly Hoffman,

stated, “2019 has been a year of consistent operational

performance. In each of the first three quarters we have executed

as we have said we would, and in some instances, surpassed our own

expectations. The third quarter was our first full quarter of

development on our Northwest Shelf (“NWS”) assets. Based on the

results we are experiencing, we have revised our internal estimates

which reflect the higher Initial Potentials (“IPs”), flatter

declines and improved economics the NWS wells are demonstrating. We

continue to focus on our goals of cash flow neutrality by year end

in combination with meaningful production growth. In the third

quarter, we came within $2 million of reaching cash flow neutrality

a full quarter ahead of our goal while showing a 4% increase in

production sales over the second quarter. Management continues to

explore opportunities to reduce our debt through the monetization

of existing assets. With the current and foreseeable focus

remaining on the development of our NWS assets and Central Basin

Platform (“CBP”) properties, the Company has officially started the

process of marketing its Delaware Basin asset. We will be diligent

in our efforts to maintain a strong balance sheet while posturing

your Company for the many years of growth and productivity

ahead.”

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration, development and

production company with current operations in Texas and New

Mexico.

www.ringenergy.com

Safe Harbor Statement

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements involve a wide variety of risks and uncertainties, and

include, without limitations, statements with respect to the

Company’s strategy and prospects. Such statements are subject to

certain risks and uncertainties which are disclosed in the

Company’s reports filed with the SEC, including its Form 10-K for

the fiscal year ended December 31, 2018, its Form 10Q for the

quarter ended September 30, 2019 and its other filings with the

SEC. Readers and investors are cautioned that the Company’s actual

results may differ materially from those described in the

forward-looking statements due to a number of factors, including,

but not limited to, the Company’s ability to acquire productive oil

and/or gas properties or to successfully drill and complete oil

and/or gas wells on such properties, general economic conditions

both domestically and abroad, and the conduct of business by the

Company, and other factors that may be more fully described in

additional documents set forth by the Company.

RING ENERGY, INC. STATEMENTS OF OPERATIONS

Three Months Ended Nine Months Ended

September 30, September

30,

2019

2018

2019

2018

Oil and Gas Revenues

$

50,339,105

$

32,687,179

$

143,471,645

$

92,503,453

Costs and Operating Expenses Oil and gas production

costs

15,478,052

7,217,940

36,455,925

19,638,163

Oil and gas production taxes

2,307,226

1,551,097

6,802,996

4,405,974

Depreciation, depletion and amortization

14,115,170

10,930,563

41,659,494

28,576,057

Asset retirement obligation accretion

236,207

167,433

681,386

493,223

Operating lease expense

114,112

-

370,462

-

General and administrative expense

3,745,928

3,205,116

15,287,072

9,442,327

Total Costs and Operating Expenses

35,996,695

23,072,149

101,257,335

62,555,744

Income from Operations

14,342,410

9,615,030

42,214,310

29,947,709

Other Income (Expense) Interest income

9

5,911

13,505

97,855

Interest expense

(4,556,509

)

(40,944

)

(9,589,434

)

(85,427

)

Realized loss on derivatives

-

(2,722,774

)

-

(6,600,226

)

Unrealized gain (loss) on change in fair value of derivatives

1,877,368

(566,649

)

3,066,913

(2,456,623

)

Net Other Income (Expense)

(2,679,132

)

(3,324,456

)

(6,509,016

)

(9,044,421

)

Income before Tax Provision

11,663,278

6,290,574

35,705,294

20,903,288

Provision for Income Taxes

(1,774,922

)

(596,946

)

(2,352,241

)

(4,824,220

)

Net Income

$

9,888,356

$

5,693,628

$

33,353,053

$

16,079,068

Basic Earnings Per Common Share

$

0.15

$

0.09

$

0.50

$

0.27

Diluted Earnings Per Common Share

$

0.15

$

0.09

$

0.50

$

0.27

Basic Weighted-Average Common Shares

Outstanding

67,811,127

60,405,355

66,149,469

59,084,300

Diluted Weighted-Average Common Shares Outstanding

67,836,968

61,830,381

66,401,422

60,567,232

COMPARATIVE OPERATING STATISTICS Three Months Ended

September 30,

2019

2018

Change

11,183

6,540

70.9%

Per BOE: Average Sales Price

$48.93

$54.32

-9.9%

Lease Operating Expenses

15.04

11.99

25.4%

Production Taxes

2.24

2.58

-13.2%

DD&A

13.72

18.17

-24.5%

Accretion

0.23

0.28

-17.8%

General & Administrative Expenses

3.75

5.33

-29.6%

Nine Months Ended September 30,

2019

2018

Change

Net Sales - BOE per day

10,607

6,004

76.6%

Per BOE: Average Sales price

$49.55

$56.43

-12.2%

Lease Operating Expenses

12.59

11.98

5.1%

Production Taxes

2.35

2.69

-12.6%

DD&A

14.39

17.43

-17.4%

Accretion

0.24

0.30

-20.0%

General & Administrative Expenses

5.41

5.76

-6.1%

RING ENERGY, INC. BALANCE SHEET September 30,

December 31,

2019

2018

ASSETS Current Assets Cash

$

7,599,089

$

3,363,726

Accounts receivable

18,291,698

12,643,478

Joint interest billing receivable

2,025,180

578,144

Operating lease asset

169,115

-

Derivative asset

2,386,066

-

Prepaid expenses and retainers

3,340,178

258,909

Total Current Assets

33,811,326

16,844,257

Property and Equipment Oil and natural gas properties

subject to depletion and amortization

1,059,284,347

641,121,398

Financing lease asset subject to depreciation

947,435

-

Fixed assets subject to depreciation

1,465,551

1,465,551

Total Property and Equipment

1,061,697,333

642,586,949

Accumulated depreciation, depletion and amortization

(142,235,581

)

(100,576,087

)

Net Property and Equipment

919,461,752

542,010,862

Derivative asset

680,847

Deferred Income Taxes

5,434,238

7,786,479

Deferred Financing Costs

3,403,491

424,061

Total Assets

$

962,791,654

$

567,065,659

LIABILITIES AND STOCKHOLDERS' EQUITY Current

Liabilities Accounts payable

$

51,813,690

$

51,910,432

Financing lease liability

$

272,498

-

Operating lease liability

$

169,115

-

Total Current Liabilities

52,255,303

51,910,432

Revolving line of credit

366,500,000

39,500,000

Financing lease liability

588,251

-

Asset retirement obligations

16,703,186

13,055,797

Total Liabilities

436,046,740

104,466,229

Stockholders' Equity Preferred stock - $0.001 par

value; 50,000,000 shares authorized; no shares issued or

outstanding

-

-

Common stock - $0.001 par value; 150,000,000 shares authorized;

67,811,611 shares and 63,229,710 shares issued and outstanding,

respectively

67,812

63,230

Additional paid-in capital

525,679,942

494,892,093

Accumulated earnings (deficit)

997,160

(32,355,893

)

Total Stockholders' Equity

526,744,914

462,599,430

Total Liabilities and Stockholders' Equity

$

962,791,654

$

567,065,659

STATEMENTS OF CASH FLOW Nine Months

Ended September 30, September 30,

2019

2018

Cash Flows From Operating Activities

Net income

$

33,353,053

$

16,079,068

Adjustments to reconcile net income (loss) to net cash

Provided by operating activities: Depreciation, depletion

and amortization

41,659,494

28,576,057

Accretion expense

681,386

493,223

Share-based compensation

2,436,035

3,091,336

Deferred income tax provision

7,498,112

4,389,690

Excess tax deficiency related to share-based compensation

(5,145,871

)

434,530

Change in fair value of derivative instruments

(3,066,913

)

2,456,623

Changes in assets and liabilities: Accounts receivable

(7,095,256

)

435,048

Prepaid expenses and retainers

(6,060,699

)

(509,116

)

Accounts payable

(1,055,397

)

(2,989,645

)

Settlement of asset retirement obligation

(615,732

)

(452,468

)

Net Cash Provided by Operating Activities

62,588,212

52,004,346

Cash Flows from Investing Activities Payments to

purchase oil and natural gas properties

(263,262,046

)

(4,090,642

)

Payments to develop oil and natural gas properties

(122,004,117

)

(158,069,999

)

Proceeds from disposal of fixed assets subject to depreciation

-

105,536

Net Cash Used in Investing Activities

(385,266,163

)

(162,055,105

)

Cash Flows From Financing Activities Proceeds from

revolving line of credit

327,000,000

17,000,000

Proceeds from issuance of common stock, net of offering costs

-

81,815,022

Reduction of financing lease liability

(86,686

)

-

Net Cash Provided by Financing Activities

326,913,314

98,815,022

Net Change in Cash

4,235,363

(11,235,737

)

Cash at Beginning of Period

3,363,726

15,006,581

Cash at End of Period

$

7,599,089

$

3,770,844

Supplemental Cash flow Information Cash paid for

interest

$

5,821,545

$

54,652

Noncash Investing and Financing Activities

Asset retirement obligation incurred during development

602,090

1,058,763

Operating lease assets obtained in exchange for new operating

lease liability

539,577

-

Financing lease assets obtained in exchange for new financing

lease liability

947,435

-

Capitalized expenditures attributable to drilling projects

financed through current liabilities

26,958,655

24,000,000

Acquisition of oil and gas properties Assumption of joint

interest billing receivable

1,464,394

-

Assumption of prepaid assets

2,864,554

-

Assumption of accounts and revenue payables

(1,234,862

)

-

Asset retirement obligation incurred through acquisition

(2,979,645

)

-

Common stock issued as partial consideration in asset acquisition

(28,356,396

)

-

Oil and gas properties subject to amortization

296,910,774

-

RECONCILIATION OF CASH FLOW FROM OPERATIONS

Net cash provided by operating activities

$

62,588,212

$

52,004,346

Change in operating assets and liabilities

14,827,084

3,516,181

Cash flow from operations

$

77,415,296

$

55,520,527

Management believes that the non-GAAP

measure of cash flow from operations is useful information for

investors because it is used internally and is accepted by the

investment community as a means of measuring the Company's ability

to fund its capital program. It is also used by professional

research analysts in providing investment recommendations

pertaining to companies in the oil and gas exploration and

production industry.

RING ENERGY, INC. NON-GAAP DISCLOSURE RECONCILIATION

ADJUSTED EBITDA Nine Months Ended September 30,

September 30,

2019

2018

NET INCOME

$

33,353,053

$

16,079,068

Net other (income) expense

6,509,016

9,044,421

Realized loss on derivatives

-

(6,600,226

)

Income tax expense

2,352,241

4,824,220

Depreciation, depletion and amortization

41,659,494

28,576,057

Accretion of discounted liabilities

681,386

493,223

Stock based compensation

2,436,035

3,091,336

ADJUSTED EBITDA

$

86,991,225

$

55,508,099

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191106006051/en/

Bill Parsons K M Financial, Inc. (702) 489-4447

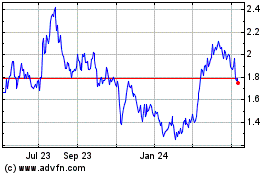

Ring Energy (AMEX:REI)

Historical Stock Chart

From Feb 2025 to Mar 2025

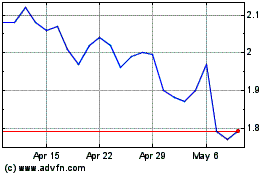

Ring Energy (AMEX:REI)

Historical Stock Chart

From Mar 2024 to Mar 2025