NovaBay Pharmaceuticals Accepts Revised Offer from PRN Physician Recommended Nutriceuticals, LLC and Enters into an Amendment to the Asset Purchase Agreement to Increase Purchase Price

November 06 2024 - 4:05PM

Business Wire

NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) (“NovaBay”

or the “Company”) today announces that the Company has accepted a

revised transaction proposal from PRN Physician Recommended

Nutriceuticals, LLC (“PRN”) to increase the base purchase price for

the Company’s eyecare business from $9.5 million to $11.5 million.

The Company has entered into an amendment (the “Amendment”) to its

previously announced Asset Purchase Agreement, dated September 19,

2024, with PRN (the “Original PRN APA” and, as amended, the “PRN

APA”). The Company's transaction with PRN remains subject to

certain closing conditions, including receiving stockholder

approval.

“We are pleased to accept PRN’s revised offer for the Avenova®

brand and continue our efforts to obtain stockholder approval. With

the newly added value, we truly believe this deal is in the best

interests of our stockholders," said Justin Hall, NovaBay CEO.

In addition to the increased base purchase price of $11.5

million, the Amendment provides for (i) the removal of debt

financing contingencies and related PRN representations, while

adding a new PRN representation that it has sufficient funding for

the base purchase price; (ii) PRN providing the Company with a

secured promissory note for up to $1.0 million to be funded by two

future installments of $0.5 million each, which loan is expected to

be repaid in full upon the closing of the PRN transaction as a

deduction from the purchase price (the “Bridge Loan”); and (iii)

PRN providing the Company with an equity funding commitment letter

(collectively, the “Revised PRN Transaction Terms”).

When evaluating the Revised PRN Transaction Terms and the

Amendment, the Company’s Board of Directors (the “Board”) gave due

consideration to the unsolicited and non-binding acquisition

proposal received from Refresh Acquisitions BidCo LLC (“Refresh”),

which the Board previously determined was a “Superior Proposal”

under the PRN APA as announced on October 29, 2024. The Board

carefully assessed the relative benefits and risks of the proposals

from both PRN and Refresh. Following this assessment, the Board

determined that the Refresh unsolicited and non-binding acquisition

proposal was no longer a “Superior Proposal” and that entering into

the Amendment and the Bridge Loan were advisable and in the best

interests of the Company and its stockholders. As a result of the

Board’s determination to enter into the Amendment and continue its

transaction with PRN, the Company ended its engagement with Refresh

in accordance with the terms of the PRN APA.

The Special Meeting of the Company’s stockholders (the “Special

Meeting”) to approve the transaction with PRN remains scheduled for

November 22, 2024 at 11:00 a.m. Pacific Time. The Board continues

to unanimously recommend that stockholders approve the pending

transaction with PRN, as well as the potential voluntary

liquidation and dissolution of the Company at the Special Meeting.

If stockholders have questions or need help voting their shares,

please call the Company’s proxy solicitation firm, Sodali &

Co., at 1-800-607-0088.

This summaries of the Amendment and the Bridge Loan do not

purport to be complete, and the Company encourages stockholders to

read the full text of the Amendment and the Bridge Loan that will

be included with the Company’s Current Report on Form 8-K, which

will be filed with the Securities and Exchange Commission (the

“SEC”) in due course. Further, the Company intends to provide its

stockholders with additional supplemental disclosure to the

definitive proxy statement filed with the SEC on October 16, 2024

(the “Special Meeting Proxy Statement”) and will file relevant

materials with the SEC. Stockholders are urged to read the Special

Meeting Proxy Statement as supplemented and such other relevant

materials for more information, including with respect to the terms

of the Amendment and the Bridge Loan.

About NovaBay Pharmaceuticals, Inc.

NovaBay’s leading product Avenova® Lid & Lash Cleansing

Spray is often recommended by eyecare professionals for blepharitis

and dry eye disease. Manufactured in the U.S., Avenova spray is

formulated with NovaBay’s patented, proprietary, stable and pure

form of hypochlorous acid. All Avenova products are available

directly to consumers through online distribution channels such as

Amazon.com and Avenova.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. These

forward-looking statements are based upon the Company and its

management’s current expectations, assumptions, estimates,

projections and beliefs. Such statements include, but are not

limited to, statements regarding the contemplated transaction with

PRN (including the Amendment and the Bridge Loan), the unsolicited

offer by Refresh and related matters. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or achievements to be materially different and

adverse from those expressed in, or implied by, these

forward-looking statements. Other risks relating to NovaBay’s

business, including risks that could cause results to differ

materially from those projected in the forward-looking statements

in this press release, are detailed in the Company’s latest Form

10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC

and the Special Meeting Proxy Statement, especially under the

heading “Risk Factors.” The forward-looking statements in this

release speak only as of this date, and the Company disclaims any

intent or obligation to revise or update publicly any

forward-looking statement except as required by law.

Additional Information and Where to Find It

In connection with the solicitation of proxies, on October 16,

2024, NovaBay filed the Special Meeting Proxy Statement with the

SEC with respect to the Special Meeting to be held in connection

with the proposed asset sale to PRN and a potential voluntary

liquidation and dissolution of the Company. Promptly after filing

the Special Meeting Proxy Statement with the SEC, NovaBay mailed

the Special Meeting Proxy Statement and a proxy card to each

stockholder entitled to vote at the Special Meeting to consider the

contemplated asset sale to PRN and potential dissolution.

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS

THAT NOVABAY HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of

charge, the Special Meeting Proxy Statement, any amendments or

supplements thereto, and any other relevant documents filed by

NovaBay with the SEC in connection with the contemplated asset sale

to PRN and potential dissolution at the SEC's website

(http://www.sec.gov) or at the Company’s investor relations website

https://novabay.com/investors/) or by writing to NovaBay

Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street,

Suite 1150, Emeryville, CA 94608. The information provided on, or

accessible through, our website is not part of this communication,

and therefore is not incorporated herein by reference.

Participants in the Solicitation

NovaBay and its directors and executive officers may be deemed

to be participants in the solicitation of proxies from NovaBay’s

stockholders in connection with the contemplated asset sale to PRN

and the potential dissolution. A list of the names of the directors

and executive officers of the Company and information regarding

their interests in the contemplated asset sale to PRN and the

potential dissolution, including their respective ownership of the

Company’s common stock and other securities is contained in the

Special Meeting Proxy Statement. In addition, information about the

Company’s directors and executive officers and their ownership in

the Company is set forth in the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and filed with the

SEC on March 26, 2024, as amended on March 29, 2024 and as modified

or supplemented by any Form 3 or Form 4 filed with the SEC since

the date of such filing.

Socialize and Stay Informed on

NovaBay’s Progress Like us on Facebook Follow us on X

Connect with NovaBay on LinkedIn Visit NovaBay’s Website

Avenova Purchasing

Information For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com Avenova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106147268/en/

NovaBay Contact Justin Hall

Chief Executive Officer and General Counsel 510-899-8800

jhall@novabay.com

Investor Contact Alliance

Advisors IR Jody Cain 310-691-7100 jcain@allianceadvisors.com

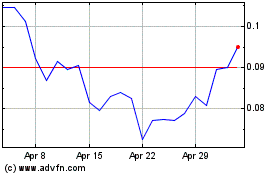

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Nov 2023 to Nov 2024