0000876343false00008763432024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2024 |

Lineage Cell Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

California |

001-12830 |

94-3127919 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2173 Salk Avenue, Suite 200 |

|

Carlsbad, California |

|

92008 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 287-8990 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common shares |

|

LCTX |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Lineage Cell Therapeutics, Inc. issued a press release announcing financial results for the quarter ended June 30, 2024, a copy of which is furnished as Exhibit 99.1.

The information under this Item 2.02 and in Exhibit 99.1 is being furnished and is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any filing of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Lineage Cell Therapeutics, Inc. |

|

|

|

|

Date: |

August 8, 2024 |

By: |

/s/ George A. Samuel III |

|

|

Name: Title: |

George A. Samuel III

General Counsel and Corporate Secretary |

LINEAGE CELL THERAPEUTICS REPORTS SECOND QUARTER 2024 FINANCIAL RESULTS AND PROVIDES BUSINESS UPDATE

•24 Month Visual Acuity Benefits from a Single Administration with OpRegen® Reported at 2024 Retinal Cell & Gene Therapy Innovation Summit

•Supported OpRegen for Geographic Atrophy in Phase 2a Study in Collaboration with Roche and Genentech

•Initiated Activities Under Recently Established Services Agreement with Genentech to Support Ongoing Development of OpRegen Program

•OPC1 Clinical Study Start Up Preparations Ongoing

•Hosted 2nd Annual Spinal Cord Injury Investor Symposium

CARLSBAD, CA – August 8, 2024 - Lineage Cell Therapeutics, Inc. (NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for unmet medical needs, today reported its second quarter 2024 financial and operating results. The Company will host a conference call today at 4:30 p.m. Eastern Time to discuss these results and to provide a business update.

“The second quarter was highlighted by clinical and preclinical execution alongside expanded awareness and data updates on our lead program,” stated Brian M. Culley, Lineage CEO. “As the cell transplant field expands and continues to deliver exciting clinical outcomes, we are excited about our validating partnership and the collective expertise of the team at Roche and Genentech, as well as their ongoing leadership of the OpRegen program through presentations at scientific conferences and internal thought leader events, including Roche’s Virtual Ophthalmology Day, hosted just last month. We continue to support the ongoing Phase 2a clinical study and also have initiated activities under the recently established services agreement with Genentech, enabling our partners to take advantage of our cell transplant expertise to more fully investigate the potential of the OpRegen program. In parallel, we are focused on activities in support of returning our second cell transplant program, OPC1, into the clinic this year for the treatment of spinal cord injury, a condition with growing awareness of its unmet need and commercial opportunity.”

“Importantly, our continued inclusion within the Russell 3000® Index, can help our efforts to broaden investor awareness of, and support for, Lineage as a uniquely positioned cell transplant company, one with a pharma-validated lead program and a platform technology of internally-owned clinical and preclinical assets, which is focused on growing our internally-owned cGMP capabilities in support of process and intellectual property development,” added Mr. Culley.

Recent Operational Highlights

oContinued execution under our collaboration with Roche and Genentech, a member of the Roche Group, across multiple functional areas, including support for the ongoing Phase 2a clinical study in patients with geographic atrophy (GA) secondary to age-related macular degeneration (AMD).

oInitiated activities under recently established services agreement with Genentech to support ongoing development of OpRegen. Lineage is providing additional clinical, technical, training and manufacturing services, fully funded by Genentech, that further support the ongoing advancement and optimization of the OpRegen program and include: (i) activities to support the ongoing Phase 1/2a study and currently-enrolling Phase 2a study; and (ii) additional technical training and

materials related to Lineage’s cell therapy technology platform to support commercial manufacturing strategies.

oPositive clinical data from long-term follow-up of patients from the Phase 1/2a clinical study of OpRegen presented by David Telander, MD, PhD, Retinal Consultants Medical Group, at the 2024 Retinal Cell & Gene Therapy Innovation Summit.

▪Mean best corrected visual acuity (BCVA) gain of 5.5 letters at 24 months (n=10) in Cohort 4 patients (less advanced GA)

▪Mean BCVA gains greater among patients with improvement in outer retinal structure (n=5, +7.4 letters)

▪Maintenance or increases in external limiting membrane (ELM) and retinal pigment epithelium (RPE) layer area at 24 months observed in patients with extensive coverage of OpRegen across the areas of GA (n=5)

▪Data suggest OpRegen may counteract RPE cell dysfunction and cell loss in patients with GA by providing support to remaining retinal cells, with multi-year effects observed following a single administration

oPreclinical results from a surgical development study of OpRegen presented by Rachel N. Andrews, DVM, PhD, DACVP, Genentech, a member of the Roche Group, at 2024 Association for Research in Vision and Ophthalmology Annual Meeting (2024 ARVO).

oDOSED (Delivery of Oligodendrocyte Progenitor Cells for Spinal Cord Injury: Evaluation of a Novel Device) clinical study for the treatment of subacute and chronic spinal cord patient start-up activities continue.

oHosted the 2nd Annual Spinal Cord Injury Investor Symposium, in partnership with the Christopher & Dana Reeve Foundation.

Balance Sheet Highlights

Cash, cash equivalents, and marketable securities of $38.5 million as of June 30, 2024 is expected to support planned operations into Q4 2025.

Second Quarter Operating Results

Revenues: Lineage’s revenue is generated primarily from collaboration revenues and royalties. Total revenues for the three months ended June 30, 2024 were $1.4 million, a net decrease of $1.8 million as compared to approximately $3.2 million for the same period in 2023. The decrease was primarily driven by less collaboration and licensing revenue recognized from deferred revenues under the collaboration and license agreement with Roche.

Operating Expenses: Operating expenses are comprised of research and development (R&D) expenses and general and administrative (G&A) expenses. Total operating expenses for the three months ended June 30, 2024 were $7.3 million, a decrease of $0.9 million as compared to $8.2 million for the same period in 2023.

R&D Expenses: R&D expenses for the three months ended June 30, 2024 were $2.9 million, a net decrease of $1.0 million as compared to $3.9 million for the same period in 2023. The net decrease was primarily driven by $0.6 million for our OPC1 program and $0.3 million for our preclinical programs.

G&A Expenses: G&A expenses for the three months ended June 30, 2024 were approximately $4.3 million, a net increase of approximately $0.1 million as compared to $4.2 million for the same period in 2023. The increase was primarily driven by stock-based compensation expense and personnel costs.

Loss from Operations: Loss from operations for the three months ended June 30, 2024 were $5.9 million, an increase of $0.9 million as compared to $5.0 million for the same period in 2023.

Other Income/(Expenses): Other income (expenses) for the three months ended June 30, 2024 reflected other income of $0.1 million, compared to other expenses of ($0.2) million for the same period in 2023. The change was

primarily driven by exchange rate fluctuations related to Lineage’s international subsidiaries, fair market value changes in marketable equity securities, and interest income earned within our money market accounts.

Net Loss Attributable to Lineage: The net loss attributable to Lineage for the three months ended June 30, 2024 was $5.8 million, or $0.03 per share (basic and diluted), compared to a net loss attributable to Lineage of $5.2 million, or $0.03 per share (basic and diluted), for the same period in 2023.

Conference Call and Webcast

Interested parties may access the conference call on August 8th, 2024, by dialing (800) 715-9871 from the U.S. and Canada and should request the “Lineage Cell Therapeutics Call”. A live webcast of the conference call will be available online in the Investors section of Lineage’s website. A replay of the webcast will be available on Lineage’s website for 30 days and a telephone replay will be available through August 15th, 2024, by dialing (800) 770-2030 from the U.S. and Canada and entering conference ID number 6024260.

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel or "off-the-shelf," cell therapies to address unmet medical needs. Lineage’s programs are based on its proprietary cell-based technology platform and associated development and manufacturing capabilities. From this platform, Lineage designs, develops, manufactures, and tests specialized human cells with anatomical and physiological functions similar or identical to cells found naturally in the human body. These cells are created by applying directed differentiation protocols to established, well-characterized, and self-renewing pluripotent cell lines. These protocols generate cells with characteristics associated with specific and desired developmental lineages. Cells derived from such lineages are transplanted into patients in an effort to replace or support cells that are absent or dysfunctional due to degenerative disease, aging, or traumatic injury, and to restore or augment the patient's functional activity. Lineage’s neuroscience focused pipeline currently includes: (i) OpRegen, a retinal pigment epithelial cell therapy in Phase 2a development under a worldwide collaboration with Roche and Genentech, a member of the Roche Group, for the treatment of geographic atrophy secondary to age-related macular degeneration; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of spinal cord injuries; (iii) ANP1, an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; (iv) PNC1, a photoreceptor neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage; and (v) RND1, a novel hypoimmune induced pluripotent stem cell line being developed in collaboration with Eterna Therapeutics Inc. For more information, please visit www.lineagecell.com or follow the company on X/Twitter @LineageCell.

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “aim,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “tend to,” or the negative version of these words and similar expressions. Lineage’s forward-looking statements are based upon its current expectations and beliefs and involve assumptions that may never materialize or may prove to be incorrect. Such statements include, but are not limited to, statements relating to: the benefits of our new services agreement with Genentech and its impact on advancing the OpRegen program; the commencement of the DOSED clinical study for OPC1; that our cash, cash equivalents and marketable securities is sufficient to support our planned operations into the fourth quarter of 2025; the impacts to Lineage of our continued inclusion within the Russell 3000 Index; and the potential of our platform technology and/or manufacturing capabilities to create value. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including, but not limited to, the following risks: that we may need to allocate our cash to unexpected events and expenses causing us to use our cash, cash equivalents and marketable securities more quickly than expected; that clinical trials of our product candidates may not commence, progress or be completed as expected due to many factors within and outside of our control; that positive findings in early clinical and/or nonclinical studies of a product candidate may not be predictive of success in subsequent clinical and/or nonclinical studies of that candidate; that OpRegen may never

be proven to provide durable anatomical functional improvements in dry-AMD patients, that competing alternative therapies may adversely impact the commercial potential of OpRegen; that Roche and Genentech may not successfully advance OpRegen or be successful in completing further clinical trials for OpRegen and/or obtaining regulatory approval for OpRegen in any particular jurisdiction; that the ongoing Israel-Hamas war may materially and adversely impact our manufacturing processes, including cell banking and product manufacturing for our cell therapy product candidates, all of which are conducted by our subsidiary in Jerusalem, Israel; that Lineage may not be able to manufacture sufficient clinical quantities of its product candidates in accordance with current good manufacturing practice; and those risks and uncertainties inherent in Lineage’s business and other risks discussed in Lineage’s filings with the Securities and Exchange Commission (SEC). Further information regarding these and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the SEC, including Lineage’s most recent Annual Report on Form 10-K filed with the SEC and its other reports, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law. All forward-looking statements are expressly qualified in their entirety by these cautionary statements.

Lineage Cell Therapeutics, Inc. IR

Ioana C. Hone

(ir@lineagecell.com)

(442) 287-8963

LifeSci Advisors

Daniel Ferry

(daniel@lifesciadvisors.com)

(617) 430-7576

Russo Partners – Media Relations

Nic Johnson or David Schull

(Nic.johnson@russopartnersllc.com)

(David.schull@russopartnersllc.com)

(212) 845-4242

Tables to follow

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29,622 |

|

|

$ |

35,442 |

|

Marketable securities |

|

|

8,874 |

|

|

|

50 |

|

Accounts receivable, net |

|

|

235 |

|

|

|

745 |

|

Prepaid expenses and other current assets |

|

|

1,659 |

|

|

|

2,204 |

|

Total current assets |

|

|

40,390 |

|

|

|

38,441 |

|

|

|

|

|

|

|

|

NONCURRENT ASSETS |

|

|

|

|

|

|

Property and equipment, net |

|

|

2,018 |

|

|

|

2,245 |

|

Operating lease right-of-use assets |

|

|

2,584 |

|

|

|

2,522 |

|

Deposits and other long-term assets |

|

|

598 |

|

|

|

577 |

|

Goodwill |

|

|

10,672 |

|

|

|

10,672 |

|

Intangible assets, net |

|

|

46,540 |

|

|

|

46,562 |

|

TOTAL ASSETS |

|

$ |

102,802 |

|

|

$ |

101,019 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

5,018 |

|

|

$ |

6,270 |

|

Operating lease liabilities, current portion |

|

|

1,069 |

|

|

|

830 |

|

Finance lease liabilities, current portion |

|

|

46 |

|

|

|

52 |

|

Deferred revenues, current portion |

|

|

9,142 |

|

|

|

10,808 |

|

Total current liabilities |

|

|

15,275 |

|

|

|

17,960 |

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES |

|

|

|

|

|

|

Deferred tax liability |

|

|

273 |

|

|

|

273 |

|

Deferred revenues, net of current portion |

|

|

18,543 |

|

|

|

18,693 |

|

Operating lease liabilities, net of current portion |

|

|

1,768 |

|

|

|

1,979 |

|

Finance lease liabilities, net of current portion |

|

|

68 |

|

|

|

91 |

|

TOTAL LIABILITIES |

|

|

35,927 |

|

|

|

38,996 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Preferred shares, no par value, 2,000 shares authorized; none issued and

outstanding as of June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common shares, no par value, 450,000 shares authorized as of June 30, 2024

and December 31, 2023; 188,824 and 174,987 shares issued and outstanding

as of June 30, 2024 and December 31, 2023, respectively |

|

|

467,928 |

|

|

|

451,343 |

|

Accumulated other comprehensive loss |

|

|

(2,470 |

) |

|

|

(3,068 |

) |

Accumulated deficit |

|

|

(397,158 |

) |

|

|

(384,856 |

) |

Lineage's shareholders’ equity |

|

|

68,300 |

|

|

|

63,419 |

|

Noncontrolling deficit |

|

|

(1,425 |

) |

|

|

(1,396 |

) |

Total shareholders’ equity |

|

|

66,875 |

|

|

|

62,023 |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

102,802 |

|

|

$ |

101,019 |

|

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenues |

|

$ |

1,098 |

|

|

$ |

2,871 |

|

|

$ |

2,285 |

|

|

$ |

4,992 |

|

Royalties, license and other revenues |

|

|

310 |

|

|

|

354 |

|

|

|

567 |

|

|

|

619 |

|

Total revenues |

|

|

1,408 |

|

|

|

3,225 |

|

|

|

2,852 |

|

|

|

5,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

44 |

|

|

|

127 |

|

|

|

142 |

|

|

|

246 |

|

Research and development |

|

|

2,868 |

|

|

|

3,873 |

|

|

|

5,878 |

|

|

|

8,058 |

|

General and administrative |

|

|

4,363 |

|

|

|

4,249 |

|

|

|

9,360 |

|

|

|

8,973 |

|

Total operating expenses |

|

|

7,275 |

|

|

|

8,249 |

|

|

|

15,380 |

|

|

|

17,277 |

|

Loss from operations |

|

|

(5,867 |

) |

|

|

(5,024 |

) |

|

|

(12,528 |

) |

|

|

(11,666 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

463 |

|

|

|

382 |

|

|

|

925 |

|

|

|

792 |

|

Loss on marketable equity securities, net |

|

|

(10 |

) |

|

|

(150 |

) |

|

|

(15 |

) |

|

|

(110 |

) |

Foreign currency transaction loss, net |

|

|

(378 |

) |

|

|

(497 |

) |

|

|

(732 |

) |

|

|

(969 |

) |

Other income |

|

|

19 |

|

|

|

86 |

|

|

|

19 |

|

|

|

543 |

|

Total other income (expenses) |

|

|

94 |

|

|

|

(179 |

) |

|

|

197 |

|

|

|

256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES |

|

|

(5,773 |

) |

|

|

(5,203 |

) |

|

|

(12,331 |

) |

|

|

(11,410 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,803 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

|

|

(5,773 |

) |

|

|

(5,203 |

) |

|

|

(12,331 |

) |

|

|

(9,607 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (income) loss attributable to noncontrolling interest |

|

|

13 |

|

|

|

(26 |

) |

|

|

29 |

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS ATTRIBUTABLE TO LINEAGE |

|

$ |

(5,760 |

) |

|

$ |

(5,229 |

) |

|

$ |

(12,302 |

) |

|

$ |

(9,601 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share attributable to Lineage

basic and diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares used to compute basic and

diluted net loss per common share |

|

|

188,813 |

|

|

|

170,592 |

|

|

|

185,861 |

|

|

|

170,361 |

|

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss attributable to Lineage |

|

$ |

(12,302 |

) |

|

$ |

(9,601 |

) |

Net loss attributable to noncontrolling interest |

|

|

(29 |

) |

|

|

(6 |

) |

Adjustments to reconcile net loss attributable to Lineage Cell Therapeutics, Inc.

to net cash used in operating activities: |

|

|

|

|

|

|

Loss on marketable equity securities, net |

|

|

15 |

|

|

|

110 |

|

Accretion of income on marketable debt securities |

|

|

(102 |

) |

|

|

(516 |

) |

Depreciation and amortization expense |

|

|

295 |

|

|

|

276 |

|

Change in right-of-use assets and liabilities |

|

|

(20 |

) |

|

|

81 |

|

Amortization of intangible assets |

|

|

22 |

|

|

|

65 |

|

Stock-based compensation |

|

|

2,432 |

|

|

|

2,311 |

|

Deferred income tax benefit |

|

|

— |

|

|

|

(1,803 |

) |

Foreign currency remeasurement and other loss |

|

|

767 |

|

|

|

1,011 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

508 |

|

|

|

(147 |

) |

Prepaid expenses and other current assets |

|

|

516 |

|

|

|

(270 |

) |

Accounts payable and accrued liabilities |

|

|

(1,245 |

) |

|

|

(3,941 |

) |

Deferred revenue |

|

|

(1,816 |

) |

|

|

(5,080 |

) |

Net cash used in operating activities |

|

|

(10,959 |

) |

|

|

(17,510 |

) |

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from the sale of marketable equity securities |

|

|

18 |

|

|

|

— |

|

Purchases of marketable debt securities |

|

|

(8,761 |

) |

|

|

(12,635 |

) |

Maturities of marketable debt securities |

|

|

— |

|

|

|

47,664 |

|

Purchase of equipment |

|

|

(88 |

) |

|

|

(444 |

) |

Net cash (used in) provided by investing activities |

|

|

(8,831 |

) |

|

|

34,585 |

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from employee options exercised |

|

|

219 |

|

|

|

80 |

|

Common shares received and retired for employee taxes paid |

|

|

(23 |

) |

|

|

(37 |

) |

Proceeds from sale of common shares |

|

|

14,070 |

|

|

|

5,789 |

|

Payments for offering costs |

|

|

(113 |

) |

|

|

(174 |

) |

Repayment of finance lease liabilities |

|

|

(27 |

) |

|

|

(29 |

) |

Net cash provided by financing activities |

|

|

14,126 |

|

|

|

5,629 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(158 |

) |

|

|

(192 |

) |

NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS AND

RESTRICTED CASH |

|

|

(5,822 |

) |

|

|

22,512 |

|

|

|

|

|

|

|

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH: |

|

|

|

|

|

|

At beginning of the period |

|

|

35,992 |

|

|

|

11,936 |

|

At end of the period |

|

$ |

30,170 |

|

|

$ |

34,448 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

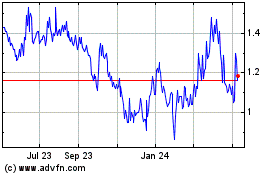

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

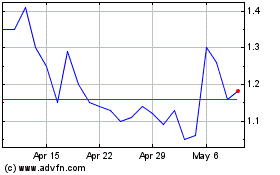

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Dec 2023 to Dec 2024