0000876343

false

Q2

--12-31

0000876343

2023-01-01

2023-06-30

0000876343

2023-08-04

0000876343

2023-06-30

0000876343

2022-12-31

0000876343

2023-04-01

2023-06-30

0000876343

2022-04-01

2022-06-30

0000876343

2022-01-01

2022-06-30

0000876343

2021-12-31

0000876343

2022-06-30

0000876343

LCTX:RocheAgreementMember

2023-01-01

2023-06-30

0000876343

LCTX:CollaborationLicenseAgreementMember

2023-01-01

2023-06-30

0000876343

LCTX:CellCureNeurosciencesLtdMember

2023-01-01

2023-06-30

0000876343

LCTX:CellCureNeurosciencesLtdMember

2023-06-30

0000876343

LCTX:EsCellInternationalPteLtdMember

2023-01-01

2023-06-30

0000876343

LCTX:EsCellInternationalPteLtdMember

2023-06-30

0000876343

LCTX:CellCureNeurosciencesLtdMember

2021-12-31

0000876343

LCTX:HadasitBioHoldingsLtdMember

2022-07-31

0000876343

us-gaap:RoyaltyMember

2023-04-01

2023-06-30

0000876343

us-gaap:RoyaltyMember

2022-04-01

2022-06-30

0000876343

us-gaap:RoyaltyMember

2023-01-01

2023-06-30

0000876343

us-gaap:RoyaltyMember

2022-01-01

2022-06-30

0000876343

LCTX:UpfrontLicenseFeesMember

2023-04-01

2023-06-30

0000876343

LCTX:UpfrontLicenseFeesMember

2022-04-01

2022-06-30

0000876343

LCTX:UpfrontLicenseFeesMember

2023-01-01

2023-06-30

0000876343

LCTX:UpfrontLicenseFeesMember

2022-01-01

2022-06-30

0000876343

LCTX:RocheAndImmunomicTherapeuticsCollaborationAgreementMember

2023-04-01

2023-06-30

0000876343

LCTX:RocheAndImmunomicTherapeuticsCollaborationAgreementMember

2023-01-01

2023-06-30

0000876343

LCTX:RocheCollaborationAgreementMember

2022-01-01

2022-12-31

0000876343

LCTX:RocheAndImmunomicTherapeuticsCollaborationAgreementMember

2022-04-01

2022-06-30

0000876343

LCTX:RocheAndImmunomicTherapeuticsCollaborationAgreementMember

2022-01-01

2022-06-30

0000876343

LCTX:RocheCollaborationAgreementMember

2021-01-01

2021-12-31

0000876343

us-gaap:USTreasurySecuritiesMember

2023-06-30

0000876343

us-gaap:USTreasurySecuritiesMember

2022-12-31

0000876343

LCTX:OncoCyteCorporationMember

2023-06-30

0000876343

LCTX:OncoCyteCorporationMember

2022-12-31

0000876343

LCTX:OncoCyteCorporationMember

2023-04-01

2023-06-30

0000876343

LCTX:OncoCyteCorporationMember

2023-01-01

2023-06-30

0000876343

LCTX:OncoCyteCorporationMember

2022-04-01

2022-06-30

0000876343

LCTX:OncoCyteCorporationMember

2022-01-01

2022-06-30

0000876343

LCTX:EquipmentFurnitureAndFixturesMember

2023-06-30

0000876343

LCTX:EquipmentFurnitureAndFixturesMember

2022-12-31

0000876343

us-gaap:LeaseholdImprovementsMember

2023-06-30

0000876343

us-gaap:LeaseholdImprovementsMember

2022-12-31

0000876343

LCTX:RightOfUseAssetsMember

2023-06-30

0000876343

LCTX:RightOfUseAssetsMember

2022-12-31

0000876343

LCTX:InProcessResearchAndDevelopmentOPCOneMember

2023-06-30

0000876343

LCTX:InProcessResearchAndDevelopmentOPCOneMember

2022-12-31

0000876343

LCTX:InProcessResearchAndDevelopmentVACMember

2023-06-30

0000876343

LCTX:InProcessResearchAndDevelopmentVACMember

2022-12-31

0000876343

us-gaap:PatentsMember

2023-06-30

0000876343

us-gaap:PatentsMember

2022-12-31

0000876343

LCTX:RoyaltyContractsMember

2023-06-30

0000876343

LCTX:RoyaltyContractsMember

2022-12-31

0000876343

srt:MinimumMember

2023-06-30

0000876343

srt:MaximumMember

2023-06-30

0000876343

us-gaap:MoneyMarketFundsMember

2023-06-30

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000876343

LCTX:MarketableDebtSecuritiesMember

2023-06-30

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000876343

LCTX:MarketableEquitySecuritiesMember

2023-06-30

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000876343

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000876343

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000876343

LCTX:CellCureWarrantsMember

2023-06-30

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000876343

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000876343

us-gaap:MoneyMarketFundsMember

2022-12-31

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000876343

us-gaap:MoneyMarketFundsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000876343

LCTX:MarketableDebtSecuritiesMember

2022-12-31

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000876343

LCTX:MarketableDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000876343

LCTX:MarketableEquitySecuritiesMember

2022-12-31

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000876343

LCTX:MarketableEquitySecuritiesMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000876343

us-gaap:FairValueInputsLevel1Member

2022-12-31

0000876343

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000876343

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000876343

LCTX:CellCureWarrantsMember

2022-12-31

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0000876343

LCTX:CellCureWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000876343

LCTX:NealBradsherMember

LCTX:BroadwoodPartnersLPMember

2023-01-01

2023-06-30

0000876343

LCTX:SalesAgreementMember

srt:ParentCompanyMember

2021-03-01

2021-03-31

0000876343

LCTX:SalesAgreementMember

srt:ParentCompanyMember

2021-12-01

2021-12-31

0000876343

srt:ParentCompanyMember

LCTX:SalesAgreementMember

2023-01-01

2023-06-30

0000876343

srt:ParentCompanyMember

LCTX:SalesAgreementMember

2023-06-30

0000876343

LCTX:DecemberTwentyTwentyTwoProspectusSupplementMember

2023-04-01

2023-06-30

0000876343

2023-01-01

2023-03-30

0000876343

LCTX:CantorFitzgeraldAndCoMember

LCTX:TwoThousandSeventeenSalesAgreementMember

2023-01-01

2023-03-31

0000876343

us-gaap:PreferredStockMember

2022-12-31

0000876343

us-gaap:CommonStockMember

2022-12-31

0000876343

us-gaap:RetainedEarningsMember

2022-12-31

0000876343

us-gaap:NoncontrollingInterestMember

2022-12-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000876343

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0000876343

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000876343

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000876343

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-03-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000876343

2023-01-01

2023-03-31

0000876343

us-gaap:PreferredStockMember

2023-03-31

0000876343

us-gaap:CommonStockMember

2023-03-31

0000876343

us-gaap:RetainedEarningsMember

2023-03-31

0000876343

us-gaap:NoncontrollingInterestMember

2023-03-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000876343

2023-03-31

0000876343

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0000876343

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000876343

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000876343

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000876343

us-gaap:PreferredStockMember

2023-06-30

0000876343

us-gaap:CommonStockMember

2023-06-30

0000876343

us-gaap:RetainedEarningsMember

2023-06-30

0000876343

us-gaap:NoncontrollingInterestMember

2023-06-30

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000876343

us-gaap:PreferredStockMember

2021-12-31

0000876343

us-gaap:CommonStockMember

2021-12-31

0000876343

us-gaap:RetainedEarningsMember

2021-12-31

0000876343

us-gaap:NoncontrollingInterestMember

2021-12-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0000876343

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0000876343

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0000876343

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0000876343

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-03-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0000876343

2022-01-01

2022-03-31

0000876343

us-gaap:PreferredStockMember

2022-03-31

0000876343

us-gaap:CommonStockMember

2022-03-31

0000876343

us-gaap:RetainedEarningsMember

2022-03-31

0000876343

us-gaap:NoncontrollingInterestMember

2022-03-31

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0000876343

2022-03-31

0000876343

us-gaap:PreferredStockMember

2022-04-01

2022-06-30

0000876343

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0000876343

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0000876343

us-gaap:NoncontrollingInterestMember

2022-04-01

2022-06-30

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0000876343

us-gaap:PreferredStockMember

2022-06-30

0000876343

us-gaap:CommonStockMember

2022-06-30

0000876343

us-gaap:RetainedEarningsMember

2022-06-30

0000876343

us-gaap:NoncontrollingInterestMember

2022-06-30

0000876343

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0000876343

LCTX:TwoThousandTwentyOneEquityIncentivePlanMember

2021-09-13

0000876343

LCTX:TwoThousandTwentyOneEquityIncentivePlanMember

2023-06-30

0000876343

LCTX:TwoThousandAndTwelvePlanAndTwoThousandAndEighteenEquityIncentivePlanMember

2023-06-30

0000876343

LCTX:TwoThousandAndTwelvePlanAndTwoThousandAndEighteenEquityIncentivePlanMember

2023-01-01

2023-06-30

0000876343

LCTX:TwoThousandTwentyOneEquityIncentivePlanMember

2023-01-01

2023-06-30

0000876343

LCTX:StockOptionPlanOf2012and2018Member

2023-01-01

2023-06-30

0000876343

LCTX:StockOptionPlanOf2021Member

2022-12-31

0000876343

LCTX:StockOptionPlanOf2021Member

2023-01-01

2023-06-30

0000876343

LCTX:StockOptionPlanOf2021Member

2023-06-30

0000876343

LCTX:StockOptionPlanOf2012and2018Member

2022-12-31

0000876343

LCTX:StockOptionPlanOf2012and2018Member

2023-06-30

0000876343

LCTX:TwoThousandAndTwelvePlanMember

2023-01-01

2023-06-30

0000876343

LCTX:TwoThousandAndTwelvePlanMember

2022-01-01

2022-06-30

0000876343

us-gaap:ResearchAndDevelopmentExpenseMember

2023-04-01

2023-06-30

0000876343

us-gaap:ResearchAndDevelopmentExpenseMember

2022-04-01

2022-06-30

0000876343

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-06-30

0000876343

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-06-30

0000876343

us-gaap:GeneralAndAdministrativeExpenseMember

2023-04-01

2023-06-30

0000876343

us-gaap:GeneralAndAdministrativeExpenseMember

2022-04-01

2022-06-30

0000876343

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0000876343

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0000876343

LCTX:StockOptionsMember

2023-04-01

2023-06-30

0000876343

LCTX:StockOptionsMember

2022-04-01

2022-06-30

0000876343

LCTX:StockOptionsMember

2023-01-01

2023-06-30

0000876343

LCTX:StockOptionsMember

2022-01-01

2022-06-30

0000876343

us-gaap:RestrictedStockUnitsRSUMember

2023-04-01

2023-06-30

0000876343

us-gaap:RestrictedStockUnitsRSUMember

2022-04-01

2022-06-30

0000876343

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

0000876343

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-06-30

0000876343

LCTX:CarlsbadLeaseMember

2019-05-31

0000876343

LCTX:CarlsbadLeaseMember

2019-05-01

2019-05-31

0000876343

LCTX:CarlsbadLeaseMember

2023-06-30

0000876343

LCTX:CarlsbadSubLeaseMember

2022-09-30

0000876343

LCTX:CarlsbadSubLeaseMember

2022-09-01

2022-09-30

0000876343

LCTX:CarlsbadSubLeaseMember

2023-06-30

0000876343

LCTX:CellCureMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2023-06-30

0000876343

LCTX:CellCureMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2023-01-01

2023-06-30

0000876343

LCTX:NISCurrencyExchangeMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2023-06-30

0000876343

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

LCTX:DecemberTwoThousandEighteenExchangeRateMember

2023-06-30

0000876343

LCTX:CellCureMember

2018-01-31

0000876343

LCTX:CellCureMember

2018-01-01

2018-01-31

0000876343

LCTX:CellCureMember

LCTX:NISCurrencyExchangeMember

2018-01-01

2018-01-31

0000876343

LCTX:JanuaryTwoThousandAndEighteenLeaseMember

2023-06-30

0000876343

LCTX:CellCureMember

2021-11-30

0000876343

LCTX:CellCureMember

2021-11-29

2021-11-30

0000876343

LCTX:CellCureMember

LCTX:NISCurrencyExchangeMember

2021-11-30

0000876343

LCTX:CellCureMember

2022-10-31

2022-11-01

0000876343

LCTX:CellCureMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2022-08-31

0000876343

LCTX:CellCureMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2022-07-29

2022-08-31

0000876343

LCTX:CellCureMember

LCTX:OfficeAndLaboratorySpaceJerusalemIsraelMember

2022-07-29

2022-08-01

0000876343

2021-12-01

2021-12-31

0000876343

2022-01-01

2022-01-31

0000876343

LCTX:IsraelInnovationAuthorityMember

2022-01-01

2022-01-31

0000876343

LCTX:HadasitMedicalResearchServicesAndDevelopmentLtdMember

2022-01-01

2022-01-31

0000876343

LCTX:HadasitMedicalResearchServicesAndDevelopmentLtdMember

srt:MaximumMember

2022-01-01

2022-01-31

0000876343

LCTX:ITICollaborationAgreementMember

2023-01-01

2023-06-30

0000876343

LCTX:ITICollaborationAgreementMember

2023-06-30

0000876343

2021-11-30

0000876343

2021-12-17

0000876343

2021-12-17

2021-12-17

0000876343

2017-06-15

0000876343

LCTX:LicenseAgreementMember

LCTX:GBPPoundSterlingMember

2020-05-01

2020-05-31

0000876343

LCTX:LicenseAgreementMember

2020-05-01

2020-05-31

0000876343

LCTX:LicenseAgreementMember

LCTX:GBPPoundSterlingMember

2020-05-04

2020-05-06

0000876343

LCTX:SettlementAgreementMember

2023-02-01

2023-02-28

0000876343

LCTX:SettlementAgreementMember

LCTX:InsurersMember

2023-02-01

2023-02-28

0000876343

LCTX:SettlementAgreementMember

srt:ParentCompanyMember

2023-02-01

2023-02-28

0000876343

2023-02-01

2023-02-28

0000876343

LCTX:OperatingLeaseMember

2023-06-30

0000876343

LCTX:OperatingLeaseMember

2022-12-31

0000876343

LCTX:FinancingLeasesMember

2023-06-30

0000876343

LCTX:FinancingLeasesMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

utr:sqm

iso4217:ILS

iso4217:GBP

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _________ to ________

Commission

file number 001-12830

Lineage

Cell Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| California |

|

94-3127919 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

No.) |

2173

Salk Avenue, Suite 200

Carlsbad,

California 92008 |

| (Address

of principal executive offices) (Zip code) |

(Registrant’s

telephone number, including area code) (442) 287-8990

Securities

registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

shares no par value |

|

LCTX |

|

NYSE

American |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| Emerging

growth company ☐ |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The

number of common shares outstanding as of August 4, 2023 was 174,986,671.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are subject to substantial risks and uncertainties.

The forward-looking statements are contained principally in Part I, Item 2. “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” of this report, but are also continued elsewhere in this report. We make such forward-looking

statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities

laws. All statements other than statements of historical facts contained in this report are forward-looking statements. In some cases,

you can identify forward-looking statements by the words “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “continue”

and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the

future. Forward-looking statements in this report include, but are not limited to, statements about:

| |

● |

the

potential to receive developmental, regulatory, and commercialization milestone and royalty payments under our Collaboration and

License Agreement with F. Hoffmann-La Roche Ltd and Genentech, Inc.; |

| |

|

|

| |

● |

our

plans to research, develop and commercialize our product candidates; |

| |

|

|

| |

● |

the

initiation, progress, success, cost and timing of our clinical trials and other product development activities; |

| |

|

|

| |

● |

the

therapeutic potential of our product candidates, and the indications for which we intend to develop our product candidates; |

| |

|

|

| |

● |

our

ability to successfully manufacture our product candidates for clinical development and, if approved, for commercialization, and

the timing and costs of such manufacture; |

| |

|

|

| |

● |

the

potential of our cell therapy platform; |

| |

|

|

| |

● |

our

expectations and plans regarding existing and potential future collaborations with third parties such as pharmaceutical and biotechnology

companies, government agencies, academic laboratories, and research institutes for the discovery, development, and/or commercialization

of novel cell therapy products; |

| |

|

|

| |

● |

the

size and growth of the potential markets for our product candidates and our ability to serve those markets; |

| |

|

|

| |

● |

the

potential scope and value of our intellectual property rights; and |

| |

|

|

| |

● |

the

effects on our operations of pandemics, including the recent COVID-19 pandemic, geopolitical conflicts, political and economic

instability, and rising inflation and interest rates. |

Forward-looking

statements reflect our views and expectations as of the date of this report about future events and our future performance and condition,

and involve known and unknown risks, uncertainties and other factors that may cause our actual activities, performance, results or condition

to be materially different from those expressed or implied by the forward-looking statements. You should refer to “Item 1A. Risk

Factors” in Part I of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 10-K”)

as filed with the Securities and Exchange Commission on March 9, 2023, for a discussion of important factors that may cause our actual

activities, performance, results and condition to differ materially from those expressed or implied by our forward-looking statements.

As a result of a variety of factors, including those discussed in Part I, Item 1A of the 2022 10-K, our forward-looking statements may

prove to be inaccurate, and the inaccuracy may be material. Accordingly, you should not place undue reliance on any forward-looking statement.

We anticipate that subsequent events and developments may cause our current views and expectations to change. However, while we may elect

to update the forward-looking statements in this report at some point in the future, we undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should,

therefore, not rely on these forward-looking statements as representing our views as of any date after the date of this report.

You

should read this report completely and with the understanding that our actual future performance, results and condition may be materially

different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

MARKET

DATA AND TRADEMARKS

This

report may also contain market data, industry forecasts and other data made by independent parties and by us relating to market size

and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to

give undue weight to such data. In addition, projections, assumptions and estimates of our future performance and the future performance

of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

All

brand names or trademarks appearing in this report are the property of their respective owners. Solely for convenience, the trademarks

and trade names in this report are referred to without the symbols ® and TM, but such references should not be construed as any indication

that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

******

Unless

otherwise stated or the context requires otherwise, references in this report to “Lineage,” the “Company,” “our

company,” “we,” “us,” and “our” refer collectively to Lineage Cell Therapeutics, Inc. and its

consolidated subsidiaries.

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(IN

THOUSANDS)

| | |

June 30, 2023 | | |

December 31, | |

| | |

(Unaudited) | | |

2022 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 33,886 | | |

$ | 11,355 | |

| Marketable securities | |

| 12,039 | | |

| 46,520 | |

| Accounts receivable, net (Note 3) | |

| 443 | | |

| 297 | |

| Prepaid expenses and other current assets | |

| 2,123 | | |

| 1,828 | |

| Total current assets | |

| 48,491 | | |

| 60,000 | |

| | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Property and equipment, net (Notes 6 and 14) | |

| 5,310 | | |

| 5,673 | |

| Deposits and other long-term assets | |

| 588 | | |

| 627 | |

| Goodwill | |

| 10,672 | | |

| 10,672 | |

| Intangible assets, net | |

| 46,627 | | |

| 46,692 | |

| TOTAL ASSETS | |

$ | 111,688 | | |

$ | 123,664 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 4,685 | | |

$ | 8,608 | |

| Lease liabilities, current portion (Note 14) | |

| 933 | | |

| 916 | |

| Financing lease, current portion (Note 14) | |

| 54 | | |

| 36 | |

| Deferred revenues (Note 3) | |

| 10,379 | | |

| 9,421 | |

| Other current liabilities | |

| 1 | | |

| - | |

| Total current liabilities | |

| 16,052 | | |

| 18,981 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Deferred tax liability | |

| 273 | | |

| 2,076 | |

| Deferred revenues, net of current portion (Note 3) | |

| 21,688 | | |

| 27,725 | |

| Lease liability, net of current portion (Note 14) | |

| 2,304 | | |

| 2,860 | |

| Financing lease, net of current portion (Note 14) | |

| 113 | | |

| 84 | |

| Other long-term liabilities | |

| - | | |

| 2 | |

| TOTAL LIABILITIES | |

| 40,430 | | |

| 51,728 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 14) | |

| - | | |

| - | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

Preferred shares, no par value, authorized 2,000 shares; none issued and

outstanding as of June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

Common shares, no par value, 250,000 shares authorized; 174,439 and

170,093 shares issued and outstanding as of June 30, 2023 and

December 31, 2022, respectively | |

| 448,249 | | |

| 440,280 | |

| Accumulated other comprehensive loss | |

| (2,611 | ) | |

| (3,571 | ) |

| Accumulated deficit | |

| (372,971 | ) | |

| (363,370 | ) |

| Lineage Cell Therapeutics, Inc. shareholders’ equity | |

| 72,667 | | |

| 73,339 | |

| Noncontrolling deficit | |

| (1,409 | ) | |

| (1,403 | ) |

| Total shareholders’ equity | |

| 71,258 | | |

| 71,936 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 111,688 | | |

$ | 123,664 | |

See

accompanying notes to the condensed consolidated interim financial statements.

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN

THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months ended June 30, | | |

Six Months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| REVENUES: | |

| | |

| | |

| | |

| |

| Collaboration revenues | |

$ | 2,871 | | |

$ | 4,148 | | |

$ | 4,992 | | |

$ | 9,013 | |

| Royalties and license fees | |

| 354 | | |

| 405 | | |

| 619 | | |

| 777 | |

| Total revenues | |

| 3,225 | | |

| 4,553 | | |

| 5,611 | | |

| 9,790 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| (127 | ) | |

| (215 | ) | |

| (246 | ) | |

| (391 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 3,098 | | |

| 4,338 | | |

| 5,365 | | |

| 9,399 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,873 | | |

| 3,302 | | |

| 8,058 | | |

| 6,290 | |

| General and administrative | |

| 4,249 | | |

| 5,270 | | |

| 8,973 | | |

| 13,739 | |

| Total operating expenses | |

| 8,122 | | |

| 8,572 | | |

| 17,031 | | |

| 20,029 | |

| Loss from operations | |

| (5,024 | ) | |

| (4,234 | ) | |

| (11,666 | ) | |

| (10,630 | ) |

| OTHER INCOME (EXPENSES): | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 382 | | |

| 51 | | |

| 792 | | |

| 51 | |

| Unrealized loss on marketable equity securities, net | |

| (150 | ) | |

| (709 | ) | |

| (110 | ) | |

| (1,444 | ) |

| Gain on revaluation of warrant liability | |

| - | | |

| 2 | | |

| 1 | | |

| 223 | |

| Other expenses, net | |

| (411 | ) | |

| (1,892 | ) | |

| (427 | ) | |

| (2,075 | ) |

| Total other income (expenses), net | |

| (179 | ) | |

| (2,548 | ) | |

| 256 | | |

| (3,245 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Deferred income tax benefit | |

| - | | |

| - | | |

| 1,803 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (5,203 | ) | |

| (6,782 | ) | |

| (9,607 | ) | |

| (13,875 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (income) loss attributable to noncontrolling interest | |

| (26 | ) | |

| 19 | | |

| 6 | | |

| 25 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO LINEAGE CELL THERAPEUTICS, INC. | |

$ | (5,229 | ) | |

$ | (6,763 | ) | |

$ | (9,601 | ) | |

$ | (13,850 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS PER COMMON SHARE: | |

| | | |

| | | |

| | | |

| | |

| BASIC | |

$ | (0.03 | ) | |

$ | (0.04 | ) | |

$ | (0.06 | ) | |

$ | (0.08 | ) |

| DILUTED | |

$ | (0.03 | ) | |

$ | (0.04 | ) | |

$ | (0.06 | ) | |

$ | (0.08 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| BASIC | |

| 170,592 | | |

| 169,731 | | |

| 170,361 | | |

| 169,689 | |

| DILUTED | |

| 170,592 | | |

| 169,731 | | |

| 170,361 | | |

| 169,689 | |

See

accompanying notes to the condensed consolidated interim financial statements.

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(IN

THOUSANDS)

(UNAUDITED)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months ended June 30, | | |

Six Months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| NET LOSS | |

$ | (5,203 | ) | |

$ | (6,782 | ) | |

$ | (9,607 | ) | |

$ | (13,875 | ) |

| Other comprehensive income, net of tax: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 446 | | |

| 1,730 | | |

| 819 | | |

| 1,854 | |

| Unrealized gain on marketable debt securities | |

| 50 | | |

| - | | |

| 141 | | |

| - | |

| COMPREHENSIVE LOSS | |

| (4,707 | ) | |

| (5,052 | ) | |

| (8,647 | ) | |

| (12,021 | ) |

| Less: Comprehensive (income) loss attributable to noncontrolling interest | |

| (26 | ) | |

| 19 | | |

| 6 | | |

| 25 | |

| COMPREHENSIVE LOSS ATTRIBUTABLE TO LINEAGE COMMON SHAREHOLDERS | |

$ | (4,733 | ) | |

$ | (5,033 | ) | |

$ | (8,641 | ) | |

$ | (11,996 | ) |

See

accompanying notes to the condensed consolidated interim financial statements.

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN

THOUSANDS)

(UNAUDITED)

| | |

2023 | | |

2022 | |

| | |

Six Months ended June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss attributable to Lineage Cell Therapeutics, Inc. | |

$ | (9,601 | ) | |

$ | (13,850 | ) |

| Net loss allocable to noncontrolling interest | |

| (6 | ) | |

| (25 | ) |

| Adjustments to reconcile net loss attributable to Lineage Cell Therapeutics, Inc. to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Accretion of income on marketable debt securities | |

| (516 | ) | |

| - | |

| Unrealized loss on marketable equity securities, net | |

| 110 | | |

| 1,444 | |

| Depreciation expense, including amortization of leasehold improvements | |

| 276 | | |

| 296 | |

| Change in right-of-use assets and liabilities | |

| 81 | | |

| (7 | ) |

| Amortization of intangible assets | |

| 65 | | |

| 65 | |

| Stock-based compensation | |

| 2,311 | | |

| 2,341 | |

| Gain on revaluation of warrant liability | |

| (1 | ) | |

| (223 | ) |

| Deferred income tax benefit | |

| (1,803 | ) | |

| - | |

| Foreign currency remeasurement and other gain | |

| 1,012 | | |

| 2,331 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net (Note 3) | |

| (147 | ) | |

| 50,111 | |

| Prepaid expenses and other current assets | |

| (270 | ) | |

| 594 | |

| Accounts payable and accrued liabilities (Note 7) | |

| (3,941 | ) | |

| (19,230 | ) |

| Deferred revenue and other liabilities (Note 3) | |

| (5,080 | ) | |

| (9,005 | ) |

| Net cash (used in) provided by operating activities | |

| (17,510 | ) | |

| 14,842 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Maturities of marketable debt securities | |

| 47,664 | | |

| - | |

| Purchase of equipment and other assets, net | |

| (444 | ) | |

| (143 | ) |

| Net cash provided by (used in) investing activities | |

| 34,585 | | |

| (143 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from employee options exercised | |

| 80 | | |

| 388 | |

| Common shares received and retired for employee taxes paid | |

| (37 | ) | |

| (17 | ) |

| Proceeds from exercise of subsidiary warrants, net | |

| - | | |

| 99 | |

| Proceeds from sale of common shares | |

| 5,789 | | |

| 148 | |

| Payments for offering costs | |

| (174 | ) | |

| (57 | ) |

| Repayment of financing lease liability | |

| (29 | ) | |

| (15 | ) |

| Net cash provided by financing activities | |

| 5,629 | | |

| 546 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | |

| (192 | ) | |

| (161 | ) |

| NET INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| 22,512 | | |

| 15,084 | |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH: | |

| | | |

| | |

| At beginning of the period | |

| 11,936 | | |

| 56,277 | |

| At end of the period | |

$ | 34,448 | | |

$ | 71,361 | |

| | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash, end of period: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 33,886 | | |

$ | 70,857 | |

| Restricted cash included in deposits and other long-term assets (see Note 14 (Commitments and Contingencies)) | |

| 562 | | |

| 504 | |

| Total cash, cash equivalents, and restricted cash | |

$ | 34,448 | | |

$ | 71,361 | |

See

accompanying notes to the condensed consolidated interim financial statements.

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

NOTES

TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

1.

Organization and Business Overview

We

are a clinical-stage biotechnology company developing novel allogeneic cell therapies to address unmet medical needs. Our programs are

based on our proprietary cell-based technology platform and associated development and manufacturing capabilities. From this platform,

we design, develop, manufacture, and test specialized human cells with anatomical and physiological functions similar or identical to

cells found naturally in the human body. The cells we manufacture are created by applying developmental biological differentiation protocols

to established, well-characterized, and self-renewing pluripotent cell lines. These cells are transplanted into patients and are designed

to (a) replace or support cells that are absent or dysfunctional due to degenerative disease, aging, or traumatic injury, and (b) restore

or augment the patient’s functional activity.

Our

strategy is to efficiently leverage our technology platform and our development, formulation, delivery, and manufacturing capabilities

to advance our programs internally or in conjunction with strategic partners to further enhance their value and probability of success.

As one example, in December 2021 we entered into a Collaboration and License Agreement (the “Roche Agreement”) with F. Hoffmann-La

Roche Ltd and Genentech, Inc., a member of the Roche Group (collectively or individually, “Roche” or “Genentech”),

wherein we granted to Roche exclusive worldwide rights to develop and commercialize retinal pigment epithelium (“RPE”) cell

therapies, including our proprietary cell therapy program known as OpRegen®, for the treatment of ocular disorders, including

geographic atrophy (GA) secondary to age-related macular degeneration (AMD). Under the terms of the Roche Agreement, Lineage received

a $50.0 million upfront payment and is eligible to receive up to $620.0 million in certain developmental, regulatory, and commercialization

milestone payments. Lineage also is eligible to receive tiered double-digit percentage royalties on net sales of OpRegen in the U.S.

and other major markets. See Note 14 (Commitments and Contingencies) for additional information regarding the Roche Agreement.

As

of June 30, 2023, we have five allogeneic, or “off-the-shelf,” cell therapy programs in development, of which three have

reached human clinical testing:

Product

Candidates

| |

● |

OpRegen®,

an allogeneic RPE cell replacement therapy currently in a Phase 2a multicenter clinical trial, being conducted by Roche, for the

treatment of GA secondary to AMD, also known as atrophic or dry AMD. A previous Phase 1/2a trial we conducted enrolled individuals

with dry AMD with GA. In December 2021, this program was partnered with Roche for further clinical development and commercialization. |

| |

|

|

| |

● |

OPC1,

an allogeneic oligodendrocyte progenitor cell therapy currently in long-term follow-up from a Phase 1/2a multicenter clinical trial

for cervical spinal cord injuries (“SCI”). To date, five patients with thoracic spinal cord injuries and 25 patients

with cervical SCI have been enrolled in clinical trials of OPC1. We recently received a response from the U.S. Food and Drug

Administration to our Type B meeting submission which will help guide our next regulatory interactions. The clinical development of

OPC1 has been partially funded by $14.3

million received under a grant from the California Institute for Regenerative Medicine (“CIRM”). Additional clinical

trials are being planned. |

| |

|

|

| |

● |

ANP1,

an allogeneic auditory neuron progenitor cell transplant currently in preclinical development

for the treatment of debilitating hearing loss (“DHL”).

|

| |

● |

PNC1,

an allogeneic photoreceptor cell transplant currently in preclinical development for the treatment of vision loss due to photoreceptor

dysfunction or damage. |

| |

|

|

| |

● |

VAC,

an allogeneic cancer immunotherapy comprised of antigen-presenting dendritic cells. A Phase 1 clinical trial in non-small cell lung

cancer (“NSCLC”) of one of the VAC product candidates, VAC2, was recently completed. This clinical trial was funded and

conducted by Cancer Research UK (“CRUK”), one of the world’s largest independent cancer research charities. Another

VAC-based product candidate is in preclinical development with our partner, Immunomic Therapeutics, Inc. (“ITI”), for

the treatment of glioblastoma multiforme (“GBM”). |

Other

Programs

We

have additional undisclosed product candidates being considered for development covering a range of therapeutic areas and unmet medical

needs. Generally, these product candidates are based on the same platform technology and employ a similar guided cell differentiation

and transplant approach as the product candidates described above, but in some cases may also include genetic modifications designed

to enhance efficacy and/or safety profiles.

In

addition to seeking to create value for shareholders by developing product candidates and advancing those candidates through clinical

development, we also may seek to create value from our intellectual property and additional related technologies and capabilities, through

partnering and/or strategic transactions.

2.

Basis of Presentation, Liquidity and Summary of Significant Accounting Policies

The

accompanying unaudited condensed consolidated interim financial statements were prepared in accordance with generally accepted accounting

principles in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article

8 of Regulation S-X. In accordance with those rules and regulations, certain information and footnote disclosures normally included in

comprehensive consolidated financial statements have been condensed or omitted. The condensed consolidated balance sheet as of December

31, 2022 was derived from the audited consolidated financial statements at that date but does not include all the information and footnotes

required by GAAP. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited

consolidated financial statements and notes thereto included in the 2022 10-K.

The

accompanying unaudited condensed consolidated interim financial statements, in the opinion of management, include all adjustments, consisting

only of normal recurring adjustments, necessary for a fair presentation of our financial condition and results of operations. The condensed

consolidated results of operations are not necessarily indicative of the results to be expected for any other interim period or for the

entire year.

Principles

of consolidation

The

accompanying unaudited condensed consolidated interim financial statements include the accounts of our subsidiaries. All material intercompany

accounts and transactions have been eliminated in consolidation. The following table sets out Lineage’s ownership, directly or

indirectly, of the outstanding shares of its subsidiaries as of June 30, 2023.

Schedule

of Lineage’s Ownership of Outstanding Shares of its Subsidiaries

| Subsidiary | |

Field of Business | |

Lineage Ownership | |

|

Country | |

| Cell Cure Neurosciences Ltd. | |

Manufacturing of Lineage’s product candidates | |

| 94 | %(1)(2) |

|

| Israel | |

| ES Cell International Pte. Ltd. | |

Research and clinical grade cell lines | |

| 100 | % |

|

| Singapore | |

As

of June 30, 2023, Lineage consolidated its direct and indirect wholly-owned or majority-owned subsidiaries because Lineage has the ability

to control their operating and financial decisions and policies through its ownership, and the noncontrolling interest is reflected as

a separate element of shareholders’ equity on Lineage’s condensed consolidated balance sheets.

Liquidity

At

June 30, 2023, we had $45.9 million of cash, cash equivalents and marketable securities. Based on our current operating plan, we believe

that our cash, cash equivalents and marketable securities, together with our projected cash flows, will be sufficient to enable us to

carry out our planned operations through at least twelve months from the issuance date of the accompanying condensed consolidated interim

financial statements.

Capital

Resources

Since

inception we have incurred significant operating losses and have funded our operations primarily through the issuance of equity securities,

the sale of common stock of our former subsidiaries, OncoCyte and AgeX, receipt of proceeds from research grants, revenues from collaborations,

royalties from product sales, and sales of research products and services.

As

of June 30, 2023, $58.0 million remained available for sale under our at the market offering program (“ATM”). See Note 11

(Shareholders’ Equity) for additional information.

We

may use our marketable securities for liquidity as necessary and as market conditions allow. The market value of our marketable securities

may not represent the amount that could be realized in a sale of such securities due to various market and regulatory factors, including

trading volume, prevailing market conditions and prices at the time of any sale and subsequent sales of securities by the entities. In

addition, the value of our marketable securities may be significantly and adversely impacted by deteriorating global economic conditions

and the recent disruptions to and volatility in the credit and financial markets in the United States and worldwide resulting from the

recent pandemics, including the COVID-19 pandemic, geopolitical conflicts, rising inflation and interest rates, and other macroeconomic

factors.

Additional

Capital Requirements

Our

financial obligations primarily consist of obligations to licensors under license agreements, obligations related to grants received

from government entities, including the Israel Innovation Authority (“IIA”), obligations under contracts with vendors who

provide research services and purchase commitments with suppliers.

Our

obligations to licensors under license agreements and our obligations related to grants received from government entities require us

to make future payments, such as sublicense fees, milestone payments, redemption fees, royalties and patent maintenance costs. Sublicense

fees are payable to licensors or government entities when we sublicense the applicable intellectual property to third parties; the fees

are based on a percentage of the license fees we receive from sublicensees. Milestone payments, including those related to the Roche

Agreement, are due to licensors or government entities upon achievement of commercial, development and regulatory milestones. Redemption

fees due to the IIA under the Innovation Law are due upon receipt of milestone payments and royalties received under the Roche Agreement.

See Note 14 (Commitment and Contingencies) for additional information. Royalties, including those related to royalties we may receive

under the Roche Agreement, are payable to licensors or government entities based on a percentage of net sales of licensed products. Patent

maintenance costs are payable to licensors as reimbursement for the cost of maintaining license patents. Due to the contingent nature

of the payments, the amounts and timing of payments to licensors under our in-license agreements are uncertain and may fluctuate significantly

from period to period. As of June 30, 2023, we have not included these commitments on our condensed consolidated balance sheet because

the achievement of events that would trigger our payment obligations and the timing thereof are not fixed and determinable.

In

the normal course of business, we enter into services agreements with contract research organizations, contract manufacturing organizations

and other third parties. Generally, these agreements provide for termination upon notice, with specified amounts due upon termination

based on the timing of termination and the terms of the agreement. The amounts and timing of payments under these agreements are uncertain

and contingent upon the initiation and completion of the services to be provided.

Significant

Accounting Policies

We

describe our significant accounting policies in Note 2 to the consolidated financial statements in Item 8 of the 2022 10-K. There have

been no changes to our significant accounting policies during the six months ended June 30, 2023.

Recently

Issued and Recently Adopted Accounting Pronouncements

From

time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard

setting bodies that are adopted by the Company as of the specified effective date. The Company has evaluated recently issued accounting

pronouncements and does not believe any will have a material impact on the Company’s condensed consolidated financial statements

or related financial statement disclosures.

3.

Revenue

Our

disaggregated revenues were as follows for the periods presented (in thousands):

Schedule

of Disaggregated Revenues

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months ended June 30, | | |

Six Months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Royalties and license fees | |

$ | 354 | | |

$ | 405 | | |

$ | 619 | | |

$ | 777 | |

| | |

| | | |

| | | |

| | | |

| | |

| Revenues under collaborative agreements | |

| | | |

| | | |

| | | |

| | |

| Upfront license fees | |

$ | 2,871 | | |

$ | 4,148 | | |

$ | 4,992 | | |

$ | 9,013 | |

| Total revenues under collaborative agreements | |

$ | 2,871 | | |

$ | 4,148 | | |

$ | 4,992 | | |

$ | 9,013 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

$ | 3,225 | | |

$ | 4,553 | | |

$ | 5,611 | | |

$ | 9,790 | |

During

the three and six months ended June 30, 2023, we recognized $3.2 million and $5.6 million in total revenue, respectively, of which $2.9

million and $5.0 million, respectively, was recognized in collaboration revenues related to the $50.0 million upfront payment from Roche,

which was included in deferred revenues at December 31, 2022.

During

the three and six months ended June 30, 2022, we recognized $4.6 million and $9.8 million in total revenue, respectively, of which $4.1

million and $9.0 million, respectively, was recognized in collaboration revenues related to the $50.0 million upfront payment from Roche, which was

included in deferred revenues at December 31, 2021.

We

are recognizing the $50.0 million upfront payment under the Roche Agreement utilizing an input method of costs incurred over total estimated

costs to be incurred. At each reporting period, we update our total estimated collaboration costs, and any resulting adjustments are

recorded on a cumulative basis which would affect revenue and net income (loss) in the period of adjustment. We believe the input methodology

represents the most appropriate measure of progress towards satisfaction of the identified performance obligations.

Accounts

receivable, net, and deferred revenues (contract liabilities) from contracts with customers, including collaboration partners, consisted

of the following (in thousands):

Schedule of Contract with Customer Contract Liability and Receivable

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Accounts receivable, net (1) | |

$ | 406 | | |

$ | 297 | |

| Deferred revenues | |

| 32,067 | | |

| 37,146 | |

As

of June 30, 2023, the amounts included in the transaction price of our contracts with customers (ASU 2014-09 – Revenue from

Contracts with Customers (Topic 606)), including collaboration partners, and allocated goods and services not yet provided were $33.7

million, of which $32.1 million has been collected and is reported as deferred revenues, and $1.6 million relates to unfulfilled commitments

related to the ITI collaboration (see Note 14 (Commitments and Contingencies) for additional information), the latter is currently estimated

to be delivered by the end of the second quarter of 2024. Of the total deferred revenues of $32.1 million, approximately $10.4 million

is expected to be recognized within the next 12 months.

4.

Marketable Debt Securities

The

following tables are a summary of available-for-sale debt securities in cash and cash equivalents or marketable securities in the Company’s

condensed consolidated balance sheet as of June 30, 2023 and December 31, 2022 (in thousands):

Summary

of Available for Sale Debt Securities

| | |

June 30, 2023 (Unaudited) | |

| Financial Assets: | |

Amortized Cost | | |

Unrealized Gaines | | |

Unrealized Losses | | |

Fair Value | |

| U.S. Treasury securities | |

$ | 11,735 | | |

$ | - | | |

$ | (8 | ) | |

$ | 11,727 | |

| Total | |

$ | 11,735 | | |

$ | - | | |

$ | (8 | ) | |

$ | 11,727 | |

| | |

December 31, 2022 | |

| Financial Assets: | |

Amortized Cost | | |

Unrealized Gaines | | |

Unrealized Losses | | |

Fair Value | |

| U.S. Treasury securities | |

$ | 46,247 | | |

$ | 2 | | |

$ | (152 | ) | |

$ | 46,097 | |

| Total | |

$ | 46,247 | | |

$ | 2 | | |

$ | (152 | ) | |

$ | 46,097 | |

The

Company has not recognized an allowance for credit losses on any securities in an unrealized loss position as of June 30, 2023. We believe

that the individual unrealized losses represent temporary declines resulting from changes in interest rates, and we intend to hold these

marketable securities to their maturity. The Company currently does not intend to sell these securities prior to maturity and does not

consider these investments to be other-than-temporarily impaired at June 30, 2023.

As

of June 30, 2023, the amortized cost and estimated fair value of the Company’s available-for-sale debt securities by contractual

maturity are shown below (in thousands):

Schedule

of Amortized cost And Estimated fair Value

| Available-for-sale debt securities maturing: | |

Amortized Cost | | |

Estimated Fair Value | |

| In one year or less | |

$ | 11,735 | | |

$ | 11,727 | |

| Total available-for-sale debt securities | |

$ | 11,735 | | |

$ | 11,727 | |

We

did not have any marketable debt securities classified as cash equivalents on the condensed consolidated balance sheets as of June 30,

2023 or December 31, 2022.

5.

Marketable Equity Securities

As

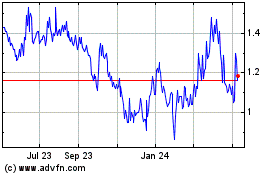

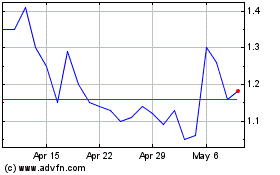

of June 30, 2023, Lineage owned 1.1 million shares of OncoCyte common stock, which had a fair value of $0.3 million as of that date,

based on the closing price of OncoCyte common stock of $0.23 per share on that date.

As

of December 31, 2022, Lineage owned 1.1 million shares of OncoCyte common stock, which had a fair value of $0.4 million as of that date,

based on the closing price of OncoCyte common stock of $0.32 per share on that date.

For

the three and six months ended June 30, 2023, Lineage recorded a net unrealized loss on marketable equity securities of $150,000 and

$110,000, respectively, primarily related to changes in the fair market value of OncoCyte common stock price during the respective periods.

For

the three and six months ended June 30, 2022, Lineage recorded a net unrealized loss on marketable equity securities of $0.7 million

and $1.4 million, respectively, related to changes in the fair market value of OncoCyte’s common stock price during the respective

periods.

All

share prices are determined based on the closing price of OncoCyte common stock on the last day of the applicable quarter, or the last

trading day of the applicable quarter, if the last day of a quarter fell on a day that was not a trading day.

6.

Property and Equipment, Net

At

June 30, 2023 and December 31, 2022 property and equipment, net was comprised of the following (in thousands):

Schedule of Property and Equipment, Net

| | |

June 30, 2023 | | |

December 31, | |

| | |

(Unaudited) | | |

2022 | |

| Equipment, furniture and fixtures | |

$ | 3,421 | | |

$ | 3,264 | |

| Leasehold improvements | |

| 2,266 | | |

| 2,150 | |

| Right-of-use assets | |

| 6,006 | | |

| 6,109 | |

| Accumulated depreciation and amortization | |

| (6,383 | ) | |

| (5,850 | ) |

| Property and equipment, net | |

$ | 5,310 | | |

$ | 5,673 | |

Property

and equipment for financing leases was $196,000 and $121,000 on June 30, 2023 and December 31, 2022, respectively.

Depreciation

and amortization expense was $138,000 and $146,000 for the three months ended June 30, 2023 and 2022, respectively, and $276,000 and

$296,000 for the six months ended June 30, 2023 and 2022, respectively.

7.

Goodwill and Intangible Assets, Net

At

June 30, 2023 and December 31, 2022 goodwill and intangible assets, net consisted of the following (in thousands):

Schedule of Goodwill and Intangible Assets Net

| | |

June 30, 2023 | | |

December 31, | |

| | |

(Unaudited) | | |

2022 | |

| Goodwill (1) | |

$ | 10,672 | | |

$ | 10,672 | |

| | |

| | | |

| | |

| Intangible assets: | |

| | | |

| | |

| Acquired IPR&D – OPC1 (from the Asterias Merger) (2) | |

$ | 31,700 | | |

$ | 31,700 | |

| Acquired IPR&D – VAC (from the Asterias Merger) (2) | |

| 14,840 | | |

| 14,840 | |

| Intangible assets subject to amortization: | |

| | | |

| | |

| Acquired patents | |

| 18,953 | | |

| 18,953 | |

| Acquired royalty contracts (3) | |

| 650 | | |

| 650 | |

| Total intangible assets | |

| 66,143 | | |

| 66,143 | |

| Accumulated amortization (4) | |

| (19,516 | ) | |

| (19,451 | ) |

| Intangible assets, net | |

$ | 46,627 | | |

$ | 46,692 | |

Lineage

amortizes its intangible assets over an estimated period of 5 to 10 years on a straight-line basis. Lineage recognized approximately

$32,000 in amortization expense of intangible assets during each of the three months ended June 30, 2023 and 2022, and $65,000 during

each of the six months ended June 30, 2023 and 2022.

Amortization

of intangible assets for periods subsequent to June 30, 2023 is as follows (in thousands):

Schedule of Intangible Assets Future Amortization Expenses

| Year Ending December 31, | |

Amortization Expense | |

| 2023 | |

$ | 65 | |

| 2024 | |

| 22 | |

| Total | |

$ | 87 | |

8.

Accounts Payable and Accrued Liabilities

At

June 30, 2023 and December 31, 2022 accounts payable and accrued liabilities consisted of the following (in thousands):

Schedule of Accounts Payable and Accrued Liabilities

| | |

June 30, 2023 | | |

December 31, | |

| | |

(Unaudited) | | |

2022 | |

| Accounts payable | |

$ | 2,187 | | |

$ | 2,393 | |

| Accrued compensation | |

| 1,917 | | |

| 2,382 | |

| Accrued liabilities (1) | |

| 581 | | |

| 3,833 | |

| Total | |

$ | 4,685 | | |

$ | 8,608 | |

9.

Fair Value Measurements

Fair

value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. To increase the comparability of fair value measures, the following hierarchy prioritizes

the inputs to valuation methodologies used to measure fair value (ASC 820-10-50), Fair Value Measurements and Disclosures:

| |

● |

Level

1 – Inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets. |

| |

|

|

| |

● |

Level

2 – Inputs other than Level 1 that are observable, either directly or indirectly, such

as quoted prices for similar assets or liabilities; quoted prices in markets that are not

active; or other inputs that are observable or can be corroborated by observable market data

for substantially the full term of the assets or liabilities.

|

| |

● |

Level

3 – Inputs to the valuation methodology are unobservable; that reflect management’s own assumptions about the assumptions

market participants would make and significant to the fair value. |

We

have not transferred any instruments between the three levels of the fair value hierarchy.

We

measure our money market fund, marketable securities and our liability classified warrants at fair value on a recurring basis. The fair

values of such assets and liabilities were as follows for June 30, 2023 and December 31, 2022 (in thousands):

Schedule of Fair Value of Assets and Liabilities Valued on Recurring Basis

| | |

| | |

Fair Value Measurements Using | |

| | |

Balance at June 30, 2023 | | |

Quoted Prices in Active Markets for Identical Assets (Level 1) | | |

Significant Other Observable Inputs (Level 2) | | |

Significant Unobservable Inputs (Level 3) | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Money market fund (1) | |

$ | 25,641 | | |

$ | 25,641 | | |

$ | - | | |

$ | - | |

| Marketable debt securities | |

| 11,727 | | |

| 11,727 | | |

| - | | |

| - | |

| Marketable equity securities | |

| 312 | | |

| 312 | | |

| - | | |

| - | |

| Total assets measured at fair value | |

$ | 37,680 | | |

$ | 37,680 | | |

$ | - | | |

$ | - | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Warrants to purchase Cell Cure ordinary shares (2) | |

$ | 1 | | |

$ | - | | |

$ | - | | |

$ | 1 | |

| Total liabilities measured at fair value | |

$ | 1 | | |

$ | - | | |

$ | - | | |

$ | 1 | |

| | |

| | |

Fair Value Measurements Using | |

| | |

Balance at December 31, 2022 | | |

Quoted Prices in Active Markets for Identical Assets (Level 1) | | |

Significant Other Observable Inputs (Level 2) | | |

Significant Unobservable Inputs (Level 3) | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Money market fund (1) | |

$ | 4,102 | | |

$ | 4,102 | | |

$ | - | | |

$ | - | |

| Marketable debt securities | |

| 46,097 | | |

| 46,097 | | |

| - | | |

| - | |

| Marketable equity securities | |

| 423 | | |

| 423 | | |

| - | | |

| - | |

| Total assets measured at fair value | |

$ | 50,622 | | |

$ | 50,622 | | |

$ | - | | |

$ | - | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Warrants to purchase Cell Cure ordinary shares (2) | |

$ | 2 | | |

$ | - | | |

$ | - | | |

$ | 2 | |

| Total liabilities measured at fair value | |

$ | 2 | | |

$ | - | | |

$ | - | | |

$ | 2 | |

Lineage’s

marketable equity securities includes the shares of stock of OncoCyte and Hadasit Bio-Holdings Ltd (“HBL”). Both securities

have readily determinable fair values and are measured at fair value and reported as current assets on the accompanying condensed consolidated

balance sheets based on the closing trading price of the security as of the date being presented.

The

carrying value of cash, restricted cash, accounts receivable, accounts payable, and accrued liabilities approximate their respective

fair values due to their relative short maturities.

10.

Related Party Transactions

In

connection with the putative shareholder class action lawsuits filed in February 2019 and October 2019 challenging the Asterias Merger

(see Note 14), Lineage agreed to pay the expenses for the legal defense of Neal Bradsher, a member of the Lineage board of directors,

Broadwood Partners, L.P., a shareholder of Lineage, and Broadwood Capital, Inc., which serves as the general partner of Broadwood Partners,

L.P., all of which were named defendants in the lawsuits, prior to being dismissed. Through June 30, 2023, Lineage has incurred approximately $625,000 in legal expenses on behalf of the foregoing parties.

11.

Shareholders’ Equity

Preferred

Shares

Lineage

is authorized to issue 2,000,000 preferred shares, no par value. The preferred shares may be issued in one or more series as the Lineage

board of directors may determine by resolution. The Lineage board of directors is authorized to fix the number of shares of any series

of preferred shares and to determine or alter the rights, preferences, privileges, and restrictions granted to or imposed on the preferred

shares as a class, or upon any wholly unissued series of any preferred shares. The Lineage board of directors may, by resolution, increase

or decrease (but not below the number of shares of such series then outstanding) the number of shares of any series of preferred shares

subsequent to the issue of shares of that series. As of June 30, 2023 and December 31, 2022, there were no preferred shares issued or

outstanding.

Common

Shares

Lineage

is authorized to issue 250,000,000 common shares, no par value. As of June 30, 2023 and December 31, 2022, there were 174,439,434 and

170,093,114 common shares issued and outstanding, respectively.

At

The Market Offering Program

In

May 2020, Lineage entered into a Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”) with Cantor

Fitzgerald & Co., as sales agent (“Cantor Fitzgerald”), pursuant to which Lineage may sell its common shares from time

to time through an “at the market offering” program under the Sales Agreement.

In

March 2021, Lineage filed a prospectus supplement with the SEC in connection with the offer and sale of $25.0 million of common shares

through the ATM program under the Sales Agreement (“March 2021 Prospectus Supplement”).

In

December 2021, Lineage filed a prospectus supplement with the SEC in connection with the offer and sale of up to $64.1 million of common

shares (which included $14.1 million of its common shares which then remained unsold under the March 2021 Prospectus Supplement) through

the ATM program under the Sales Agreement (“December 2021 Prospectus Supplement”). Following the filing of the December 2021

Prospectus Supplement, no further sales were made or will be made under the March 2021 Prospectus Supplement. The December 2021 Prospectus

Supplement was updated, amended and supplemented by a prospectus supplement filed with the SEC on May 18, 2023.

As

of June 30, 2023, Lineage had sold 4,345,596

common shares under the December 2021 Prospectus

Supplement at a weighted average price per share of $1.41

for gross proceeds of $6.1

million. As of June 30, 2023, $58.0

million remained available for sale under the

December 2021 Prospectus Supplement. During the three months ended June 30, 2023, 4,237,396 shares were sold under the December 2021

Prospectus Supplement for gross proceeds of $5.8 million and net proceeds of $5.7 million. No shares were sold in the three months ended

March 31, 2023, or the six months ended June 30, 2022.

The

shares offered under the December 2021 Prospectus Supplement are registered pursuant to Lineage’s effective shelf registration

statement on Form S-3 (File No. 333-254167), which was filed with the SEC on March 5, 2021 and declared effective on March 19, 2021.

Lineage

agreed to pay Cantor Fitzgerald a commission of 3.0% of the aggregate gross proceeds from the sale of shares under the Sales Agreement,

reimburse its legal fees and disbursements, and provide Cantor Fitzgerald with customary indemnification and contribution rights. The

Sales Agreement may be terminated by Cantor Fitzgerald or Lineage at any time upon notice to the other party, or by Cantor Fitzgerald

at any time in certain circumstances, including the occurrence of a material and adverse change in Lineage’s business or financial

condition that makes it impractical or inadvisable to market the shares or to enforce contracts for the sale of the shares.

Reconciliation

of Changes in Shareholders’ Equity

The

following tables document the changes in shareholders’ equity for the three and six months ended June 30, 2023 and 2022 (unaudited

and in thousands):

Schedule of Shareholder’s Equity

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Deficit | | |

Deficit | | |

Income / (Loss) | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| |

| | |