Gencor Industries, Inc., (NASDAQ: GENC) announced today net revenue

for the quarter ended September 30, 2019 decreased 29.5% to $14.5

million compared to $20.5 million for the quarter ended September

30, 2018. Gross profit as a percentage of net revenue

decreased to 19.6% for the quarter ended September 30, 2019 from

31.8% for the quarter ended September 30, 2018. Gross profit in the

fourth quarter of fiscal 2019 was negatively impacted due to the

lower net revenues and reduced overhead absorption.

Operating loss for the quarter ended September

30, 2019 was ($0.5) million compared to operating income of $3.5

million for the quarter ended September 30, 2018. The Company had

non-operating income of $0.6 million for the quarter ended

September 30, 2019 compared to $1.2 million for the quarter ended

September 30, 2018. The Company’s tax expense was $0.1 million for

the quarter ended September 30, 2019 compared to $0.9 million for

the quarter ended September 30, 2018. Net income for the

quarter ended September 30, 2019 was breakeven compared to $3.9

million ($0.27 per basic and diluted share) for the quarter ended

September 30, 2018.

Net revenue for the year ended September 30,

2019 decreased 17.5% to $81.3 million compared to $98.6 million for

the year ended September 30, 2018. Gross profit as a percentage of

net revenue increased to 27.6% for the year ended September 30,

2019 from 27.2% for the year ended September 30, 2018. The Company

had operating income for the year ended September 30, 2019 of $9.5

million compared to $13.9 million for the year ended September 30,

2018. The Company had non-operating income of $3.4 million for the

year ended September 30, 2019 compared to $1.2 million for the year

ended September 30, 2018.

On December 22, 2017, the U.S. Tax Cuts and Jobs

Act (the “Tax Reform Act”) was signed into law by President Donald

Trump. The Tax Reform Act significantly lowered the U.S. corporate

federal income tax rate from 35% to 21% effective January 1, 2018,

while also implementing a territorial tax system and imposing

repatriation tax on deemed repatriated earnings of foreign

subsidiaries. Accounting principles generally accepted in the

United States of America (“GAAP”) require that the impact of tax

legislation be recognized in the period in which the law was

enacted. The effective income tax rate for fiscal 2019 was 20.5%

versus 15.7% in fiscal 2018.

The Company’s net income was $10.2 million

($0.70 per basic share and $0.69 per diluted share) for the year

ended September 30, 2019, compared to $12.7 million ($0.88 per

basic share and $0.86 per diluted share) for the year ended

September 30, 2018.

At September 30, 2019, the Company had $115.6

million in cash and marketable securities, an increase of $3.5

million over the September 30, 2018 balance of $112.1 million. Net

working capital was $150.4 million at September 30, 2019. The

Company has no short- or long-term debt.

The Company’s backlog was $27.3 million at December 1, 2019

compared to $28.0 million at December 1, 2018.

During the fourth quarter of fiscal 2019, the

Company changed its method for accounting for cost of inventories

from the last-in, first-out (“LIFO”) method to the first-in,

first-out (“FIFO”) method. The Company believes the FIFO method

will improve financial reporting by better reflecting the current

value of inventory on the condensed consolidated balance

sheets, by more closely aligning the flow of

physical inventory with the accounting for

the inventory, and by providing better matching of revenues

and expenses. As required by GAAP, the Company has reflected this

change in accounting principle on a retrospective basis, resulting

in changes to the historical periods presented. The retrospective

application of the change resulted in an increase in the Company’s

September 30, 2018 retained earnings of $2.8 million (net of $0.8

million in taxes) and an increase to the Company’s net income of

$130,000 (net of $45,000 in taxes) for the year ended September 30,

2018. This change did not affect our previously reported cash flows

from operating, investing or financing activities nor did it have a

material impact on the previously reported quarterly operating

results for fiscal 2019.

John E. Elliott, Gencor’s CEO, commented,

“Gencor’s fourth quarter results reflect a more typical level of

production, as the increase orders we enjoyed in recent years as a

result of the FAST Act have tempered. The FAST Act is

scheduled to expire in 2020. Currently, there is no approved

Federal infrastructure bill to replace the FAST Act although the

recently passed resolutions did include continued funding of the

FAST Act through 2020.

In the second half of fiscal 2019 we experienced

a normal ordering pattern where customers place large equipment and

plant orders in the latter part of the year, with the expectation

of delivery in the late winter and early spring months. We have

been able to respond to changes in the market place by ramping up

production when demand increased from 2016 to 2018 and reducing

production levels as demand has normalized. We plan to

continue cost improvements and to adjust production based on

demand, to maximize productivity and profitability.

Fourth quarter revenues of $14.5 million were

below fourth quarter fiscal 2018 record revenues of $20.5

million. Gross margin of 20% were also lower, due to the

lower net revenues and reduced overhead absorption.

After the fiscal year ended, we are benefitting

from an increase in orders for production and delivery in fiscal

2020. As we prudently increased stocking inventory in the

summer months, we have converted this inventory to revenue more

quickly which has allowed us to accelerate our typical lead time on

equipment.

We believe we are well-positioned to capitalize

on demand for asphalt plants and related components as we continue

to strategically invest in our business. We continue to take

action to reduce the impact of U.S. tariff policies, raw material

volatility and a continued tight labor market.”

Gencor Industries is a diversified heavy

machinery manufacturer for the production of highway construction

materials, synthetic fuels and environmental control machinery and

equipment used in a variety of applications.

|

GENCOR INDUSTRIES, INC.Consolidated Income

StatementsFor the Years Ended September 30, 2019

and 2018 |

| |

2019 |

2018 * |

| |

|

|

|

Net revenue |

$ |

81,329,000 |

$ |

98,614,000 |

|

|

Cost of goods sold |

|

58,917,000 |

|

71,818,000 |

|

| Gross profit |

|

22,412,000 |

|

26,796,000 |

|

| Operating expenses: |

|

|

|

Product engineering and development |

|

3,295,000 |

|

2,915,000 |

|

|

Selling, general and administrative |

|

9,647,000 |

|

9,991,000 |

|

| Total operating expenses |

|

12,942,000 |

|

12,906,000 |

|

| |

|

|

| Operating income |

|

9,470,000 |

|

13,890,000 |

|

| |

|

|

| Other income (expense), net: |

|

|

|

Interest and dividend income, net of fees |

|

2,307,000 |

|

1,535,000 |

|

|

Realized and unrealized gains (losses) on marketable securities,

net |

|

1,047,000 |

|

(363,000 |

) |

|

Other |

|

- |

|

2,000 |

|

| |

|

3,354,000 |

|

1,174,000 |

|

| |

|

|

| Income before income tax

expense |

|

12,824,000 |

|

15,064,000 |

|

| Income tax expense |

|

2,628,000 |

|

2,370,000 |

|

| Net income |

$ |

10,196,000 |

$ |

12,694,000 |

|

| |

|

|

| |

|

|

| Basic earnings per common

share |

$ |

0.70 |

$ |

0.88 |

|

| |

|

|

| Diluted earnings per common

share |

$ |

0.69 |

$ |

0.86 |

|

* The amounts for the year

ended September 30, 2018 have been adjusted to reflect the change

in inventory accounting method as described above.

|

GENCOR INDUSTRIES, INC.Consolidated

Balance SheetsAs of September 30, 2019 and

2018 |

| ASSETS |

2019 |

|

2018 * |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

10,302,000 |

|

$ |

8,012,000 |

|

Marketable securities at fair value (cost of $104,176,000 at

September 30, 2019 and $103,751,000 at September 30,

2018) |

|

105,322,000 |

|

|

104,058,000 |

|

Accounts receivable, less allowance for doubtful accounts of

$459,000 at September 30, 2019 and $313,000 at September 30,

2018 |

|

1,603,000 |

|

|

993,000 |

|

Costs and estimated earnings in excess of billings |

|

13,838,000 |

|

|

11,900,000 |

|

Inventories, net |

|

25,366,000 |

|

|

21,890,000 |

|

Prepaid expenses |

|

499,000 |

|

|

1,348,000 |

|

Total current assets |

|

156,930,000 |

|

|

148,201,000 |

| Property and equipment, net |

|

8,389,000 |

|

|

7,889,000 |

| Other assets |

|

53,000 |

|

|

53,000 |

|

Total Assets |

$ |

165,372,000 |

|

$ |

156,143,000 |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,907,000 |

|

$ |

1,838,000 |

|

Customer deposits |

|

1,918,000 |

|

|

4,563,000 |

|

Accrued expenses |

|

2,660,000 |

|

|

2,085,000 |

|

Total current liabilities |

|

6,485,000 |

|

|

8,486,000 |

| Deferred and other income

taxes |

|

3,372,000 |

|

|

2,640,000 |

|

Total liabilities |

|

9,857,000 |

|

|

11,126,000 |

|

Commitments and contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

|

Preferred stock, par value $.10 per share; 300,000 shares

authorized; |

|

|

|

|

|

|

none issued |

|

- |

|

|

- |

|

Common stock, par value $.10 per share; 15,000,000 shares

authorized; |

|

|

|

|

12,277,337 shares and 12,252,337 shares issued and outstanding at

September 30, 2019 and 2018, respectively |

|

1,228,000 |

|

|

1,225,000 |

|

Class B Stock, par value $.10 per share; 6,000,000 shares

authorized; |

|

|

|

|

2,308,857 shares and 2,288,857 shares issued and outstanding at

September 30, 2019 and 2018, respectively |

|

231,000 |

|

|

229,000 |

|

Capital in excess of par value |

|

12,159,000 |

|

|

11,862,000 |

|

Retained earnings |

|

141,897,000 |

|

|

131,701,000 |

|

Total shareholders’ equity |

|

155,515,000 |

|

|

145,017,000 |

| Total Liabilities and

Shareholders’ Equity |

$ |

165,372,000 |

|

$ |

156,143,000 |

* The amounts as of September 30, 2018 have

been adjusted to reflect the change in inventory accounting method

as described above.

Caution Concerning Forward Looking Statements -

This press release and our other communications and statements may

contain “forward-looking statement,” including statement about our

beliefs, plans, objectives, goals, expectations, estimates,

projections and intentions. These statements are subject to

significant risks and uncertainties and are subject to change based

on various factors, many of which are beyond our control. The

words “may,” “could,” “should,” “would,” “believe,” “anticipate,”

“estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and

similar expressions are intended to identify forward-looking

statements. All forward-looking statements, by their nature,

are subject to risks and uncertainties. Our actual future

results may differ materially from those set forth in our forward

looking statements. For information concerning these factors

and related matters, see our Annual Report on Form 10-K for the

year ended September 30, 2019: (a) “Risk Factors” in Part I, Item

1A and (b) “Management’s Discussion and Analysis of Financial

Position and Results of Operations” in Part II, Item 7.

However, other factors besides those referenced could

adversely affect our results, and you should not consider any such

list of factors to be a complete set of all potential risks or

uncertainties. Any forward-looking statements made by us

herein speak as of the date of the press release. We do not

undertake to update any forward-looking statement, except as

required by law.

Contact:

Eric Mellen

Chief Financial Officer

407-290-6000

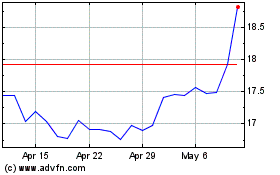

Gencor Industries (AMEX:GENC)

Historical Stock Chart

From Jun 2024 to Jul 2024

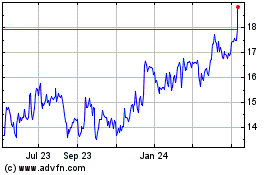

Gencor Industries (AMEX:GENC)

Historical Stock Chart

From Jul 2023 to Jul 2024