New Top-Down Targets for 2012 - Analyst Blog

September 28 2012 - 11:08AM

Zacks

Summary of the September Zacks Market Strategy

Report

In September and October, it’s a “forward look” to a 2013 earnings

world.

Top-down S&P 500 earnings from ZRS indicate our top-down models

are pessimistic, saying S&P 500 earnings will be up +5% in 2012

and may grow +3% to +7% in 2013 versus bottom-up consensus near

+12%.

Top-Down S&P 500 End-Of-Year Targets by Zacks In-House

Strategists...

We believe that holding or raising new S&P 500 highs above 1470

is possible, but it is also possible we are in a range-bound market

until a firm resolution of ‘fiscal cliff’ issues. 1390-1400 is our

low end.

In late September, some Zacks experts think equity markets have

reached a phase when stocks stall out, and investors move money

from one group to another, creating big winners and big

losers. The very next day they switch places. Some

days, a stock gets crushed and investors can’t figure out why. The

next day the same stock is zooming higher while the market is

flat. Don’t look for logic or a trend that can be

traded. There are-head fakes during these times. Stay focused

on fundamentals, which means rising earnings estimates and

attractive valuations.

S&P 500? We view the S&P 500 as a

balanced global index, where 45% of company revenues are earned

abroad. With Europe’s economy in a shallow recession and

growth slowing in China, the remaining 55% of U.S. earnings raises

the outlook for the U.S. S&P 500 above foreign indexes with

heavier international exposure. Macro risks are less within

the massive U.S.A. economy at this moment. We like large cap

U.S. stocks.

DJIA? Ditto the S&P story.

NASDAQ? We like the IT sector

long-term. But we keep the NASDAQ-100 at a market perform at

the moment, as foreign revenue growth and domestic business

spending on IT have slowed considerably. We would add to a

position here, though among stronger growing IT companies who have

recently beaten estimates. Apple keeps things interesting and

keeps the index up.

Zacks Large Cap/Small Cap Style Boxes show a “Muddle Through”

stock-pickers regime lingering. Faster growing, richly

priced, and smaller market cap companies offer investors higher

expected returns. But the market isn’t buying it. Instead,

investors have bid up quality large cap value and blend stocks.

However, a contrarian view here may be the right one.

Finally, how do you find a successful investment opportunity by

tracking industry trends? In debates, we at Zacks note a firm

consensus for a steady "Muddle Through Economy." That’s

misleading. Inside a +2% GDP growth rate, industry trends

churn this economy. And inside an economy’s churn, broad

opportunities and equally broad risks exist for any investor.

Zacks strategists have positioned their investors on bullish

opportunities. Picks from individual strategists in

Homebuilders (XHB), Financials

(PNC), Energy (ERX) and

Utilities-Water (AWK) are just a few. But be

equally aware, churn includes significant downside risks.

Here are five industry trends to think about:

(1) Momentum in U.S. housing markets helps the Financials sector

and Home Construction industries the most.

For Zacks Rank industries, we see strong earnings ranks tied to

Housing such as Home Furnishing-Appliance, Real

Estate, Construction-Building Services,

Banks-Major and Banks &Thrifts.

(2) Rising oil prices mostly help the Energy sector.

For Zacks Rank industries, we see strength in Oil-Misc.,

Pipelines and Drilling. Also, we see a

strong Zacks Rank for Energy-Alternative Sources.

We see Zacks Rank weakness in Airlines, Oil &

Gas-Integrated and Coal.

(3) Fiscal Cliff. Coming tax sunsets could raise U.S.

personal income tax rates, or impose sequestration that cuts

spending. This appears to hurt the Industrials and IT sectors

the most.

We have seen weakness in capital goods spending and hiring across

all business sectors. For a Zacks Rank example, a weak

Misc.Tech industry is now apparent.

(4) The U.S. drought has negative effects on the upstream Consumer

Staples sector in such industries as Food Distributors and

Packaged Foods, who must pass on the higher input

prices.

We see strength in Zacks Rank downstream industries like

Utilities-Water, Ag. Products,

Fertilizers, and Ag. Chemicals.

(5) China slowdown shows up in weakness in Steel and

Metals-non-Ferrous.

Happy Investing!

READ THE FULL MARKET STRATEGY REPORT by clicking here: New

Top-Down Targets for 2012

AMER WATER WORK (AWK): Free Stock Analysis Report

DIR-EGY BULL 3X (ERX): ETF Research Reports

PNC FINL SVC CP (PNC): Free Stock Analysis Report

(XRH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

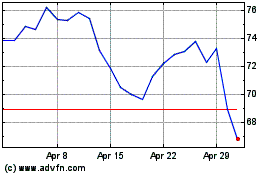

Direxion Daily Energy Bu... (AMEX:ERX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Direxion Daily Energy Bu... (AMEX:ERX)

Historical Stock Chart

From Dec 2023 to Dec 2024