How to Find a Successful Investment Opportunity by Tracking an Industry Trend - Real Time Insight

September 26 2012 - 9:22AM

Zacks

Inside an economy’s churn, broad opportunities and equally broad

risks exist for any investor.

My colleagues have positioned their investors on bullish

opportunities. Picks from individual strategists in Homebuilders

(XHB), Financials (PNC), Energy (ERX), and Utilities-Water (AWK)

are just a few.

But be equally aware, churn includes significant downside

risks.

Here are five industry trends to think about…

(1) Momentum in U.S. housing markets helps the

Financials sector and Home Construction

industries the most.

For Zacks Rank industries, we see strong earnings ranks tied to

Housing such as Home Furnishing-Appliance, Real

Estate, Construction-Building Services, Banks-Major and Banks

&Thrifts.

(2) Rising oil prices mostly help the Energy

sector.

For Zacks Rank industries, we see strength in Oil-Misc.,

Pipelines, and Drilling. Also, we see a strong Zacks

Rank for Energy-Alternative Sources.

We see Zacks Rank weakness in Airlines, Oil &

Gas-Integrated and Coal.

(3) Fiscal Cliff. Coming tax sunsets could raise U.S.

personal income tax rates, or impose sequestration that cuts

spending. This appears to hurt the Industrials and

IT sectors the most.

We have seen weakness in capital goods spending and hiring

across all business sectors. For a Zacks Rank example, a weak

Misc.Tech industry is now apparent.

(4) The U.S. drought has negative effects on the upstream

Consumer Staples sector in such industries as Food

Distributors and Packaged Foods, who must pass on the

higher input prices.

We see strength in Zacks Rank downstream industries like

Utilities-Water, Ag. Products, Fertilizers, and Ag.

Chemicals.

(5) China slowdown shows up in weakness in Steel and

Metals-non-Ferrous.

Some questions most investors would like to ask?

Aside from a strong Zacks Rank, what makes one industry trend

MORE interesting to an investor than another industry trend?

What did you use as timing criteria to ENTER into an investment

position that chases a current industry trend? What you do

plan to use to time your EXIT from riding this industry trend?

AMER WATER WORK (AWK): Free Stock Analysis Report

DIR-EGY BULL 3X (ERX): ETF Research Reports

PNC FINL SVC CP (PNC): Free Stock Analysis Report

SPDR-SP HOMEBLD (XHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

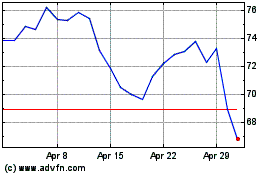

Direxion Daily Energy Bu... (AMEX:ERX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Direxion Daily Energy Bu... (AMEX:ERX)

Historical Stock Chart

From Dec 2023 to Dec 2024