UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

Amendment No. 1

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023.

Commission File Number: 001-40673

Cybin Inc.

(Exact Name of Registrant as Specified in Charter)

100 King Street West, Suite 5600, Toronto, Ontario, M5X 1C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F □ Form 40-F ⊠

EXPLANATORY NOTE

Cybin Inc. (the "Company") is filing this Amendment No. 1 on Form 6-K/A (the "Amendment") solely to make certain corrections by adding Exhibits 99.7 through 99.16 to the version originally filed with the Securities and Exchange Commission on September 14, 2023.

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.7 through 99.16 of this Amendment of the Company are hereby incorporated by reference into the Registration Statement on Form F-10 (File No. 333-272706) of the Company, as amended or supplemented.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CYBIN INC.

|

|

|

(Registrant)

|

|

|

|

|

|

Date: November 13, 2023

|

By:

|

/s/ Doug Drysdale

|

|

|

Name:

|

Doug Drysdale

|

|

|

Title:

|

Chief Executive Officer

|

EXHIBIT INDEX

| 99.1* |

Notice of Annual and Special Meeting of Shareholders and Management Information Circular dated September 13, 2023 |

| 99.2* |

Notice of Annual and Special Meeting of Shareholders dated September 13, 2023 |

| 99.3* |

Form of Proxy |

| 99.4* |

Financial Statement Request Form |

| 99.5* |

Abridgement Certificate dated September 14, 2023 |

| 99.6* |

Notice of Meeting and Record Date |

| 99.7 |

Annual Information Form of Small Pharma Inc. for the year ended February 28, 2023, dated September 12, 2023 |

| 99.8 |

Audited Consolidated Financial Statements of Small Pharma Inc. for the financial years ended February 28, 2023 and 2022 |

| 99.9 |

Management's Discussion and Analysis of Small Pharma Inc. for the financial year ended February 28, 2023 |

| 99.10 |

Unaudited Interim Condensed Consolidated Financial Statements of Small Pharma Inc. for the three months ended May 31, 2023 and 2022 |

| 99.11 |

Management's Discussion and Analysis of Small Pharma Inc. for the three months ended May 31, 2023 and 2022 |

| 99.12 |

Material Change Report of Small Pharma Inc. dated September 7, 2023 |

| 99.13 |

Material Change Report of Small Pharma Inc. dated January 30, 2023 |

| 99.14 |

Management Information Circular of Small Pharma Inc. dated June 20, 2022 |

| 99.15 |

Consent of Zeifmans LLP |

| 99.16 |

Consent of MNP LLP |

| * |

Previously filed. |

SMALL PHARMA INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED FEBRUARY 28, 2023

SEPTEMBER 12, 2023

TABLE OF CONTENTS

GENERAL

In this annual information form (this "AIF") unless otherwise noted or the context indicates otherwise, references to the "Corporation", "we", "us" and "our" refer to Small Pharma Inc. and its affiliates and subsidiaries.

All financial information in this AIF is prepared in Canadian dollars and using International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board. Unless otherwise noted herein, this AIF applies to the business activities and operations of the Corporation for the fiscal year ended February 28, 2023. Unless otherwise indicated, the information in this AIF is given as of September 12, 2023.

All dollar amounts in this AIF are expressed in Canadian dollars, except as otherwise indicated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this AIF, and in certain documents incorporated by reference in this AIF, constitute forward-looking information and forward-looking statements within the meaning of Canadian securities legislation ("forward-looking statements"). All statements other than statements of historical fact contained in this AIF and in documents incorporated by reference in this AIF, including, without limitation, those regarding the Corporation's future financial position and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets where the Corporation participates or is seeking to participate, and any statements preceded by, followed by or that include the words "consider", "believe", "expect", "aim", "intend", "plan", "continue", "will", "may", "would", "anticipate", "budget", "estimate", "forecast", "predict", "project", "seek", "should", "objective", "assumes" or similar expressions or the negative thereof, are forward-looking statements.

These statements are not historical facts but instead represent only the Corporation's expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to, those discussed under "Risk Factors" and in other documents incorporated by reference in this AIF. Management provides forward-looking statements because it believes they provide useful information to readers when considering their investment objectives and cautions readers that the information may not be appropriate for other purposes. Consequently, all of the forward-looking statements made in this AIF and in documents incorporated by reference in this AIF are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Corporation. These forward-looking statements are made as of the date of this AIF and the Corporation assumes no obligation to update or revise them to reflect subsequent information, events or circumstances or otherwise, except as required by law.

The forward-looking statements in this AIF and in documents incorporated by reference in this AIF are based on numerous assumptions regarding the Corporation's present and future business strategies and the environment in which the Corporation will operate in the future, including assumptions regarding business and operating strategies, and the Corporation's ability to operate on a profitable basis.

Some of the risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking statements contained herein include:

Risks related to the Corporation's financial position and need for additional capital:

● limited operating history;

● clinical-stage biotechnology company with history of losses since inception;

● additional capital requirements;

● speculative nature of investment risk;

● costs of operating as a public company;

● use of funds;

Risks pertaining to the Corporation's business and industry:

● early stage of the industry and product development;

● negative operating cash flow and going concern;

● limited product scope;

● limited marketing and sales capabilities;

● research and development ("R&D") objectives and milestones;

● no assurance of commercial success;

● no profits or significant revenues;

● risk of partnering or out-licensing products; lack of commercialization experience;

● achieving publicly announced milestones;

● market access and acceptance;

● unfavourable publicity or consumer perception;

● pandemics, epidemics and other health risks;

● social media;

● biotechnology and pharmaceutical market competition;

● decriminalization of psychedelics;

● product liability;

● product and material recalls;

● distribution and supply chain interruption;

● difficulty to forecast;

● product viability;

● success of quality control systems;

● reliance on key inputs;

● enforcing contracts;

● business expansion, growth and business combinations;

● integration risk;

● reliance on key executives and scientists;

● employee misconduct;

● liability arising from fraudulent or illegal activity;

● conflicts of interest;

● operating risk and insurance coverage;

● computer system failures;

● foreign operations;

● dependence on foreign operating subsidiary;

● exchange rate fluctuations;

● estimates or judgments relating to critical accounting policies;

● effects of inflation;

● political and economic conditions

● cybersecurity and privacy risk;

● environmental regulation and risks;

● litigation;

● anti-corruption and anti-bribery laws;

Risks related to regulatory compliance:

● products subject to controlled substance laws and regulations;

● risks pertaining to legislation changes;

● nature of regulatory approvals;

● continued regulatory review and obligations;

● failure to comply with health and data protection laws and regulations;

● failure to comply with pharmaceutical industry standards;

Risks pertaining to clinical development:

● reliance on third parties for clinical development activities;

● risks related to third party relationships;

● reliance on contract manufacturers;

● commercial scale product manufacturing;

● safety and efficacy of products;

● clinical testing and commercialization of product candidates;

● clinical trial publications;

● completion of clinical trials;

● later stage clinical trials failure;

● negative results of external client trials or studies;

● lack of expedited status;

Risks related to intellectual property ("IP"):

● reliance on patents and other intellectual property rights;

● patent litigation;

● invalid or unenforceable patents;

● compliance with procedural requirements;

● trade secrets;

● trademark protection;

● intellectual property litigation costs;

● third-party licenses;

● failure to comply with potential future intellectual property or license agreements;

● intellectual property rights may fail to protect competitive advantage;

● employee patent claim liability;

● intellectual property rights of third parties;

● obtaining or maintaining necessary rights for current or future therapeutic candidates through acquisitions and in-licenses;

● patent law reforms;

● difficulties securing jurisdictional intellectual property rights;

Risks related to the common shares in the capital of the Corporation (the "Common Shares"):

● substantial number of authorized but unissued Common Shares;

● dilution;

● market for the Common Shares;

● volatile market price for Common Shares;

● significant sales of Common Shares;

● tax issues;

● discretion over the use of proceeds;

● no dividends;

● enforcement of legal rights; and

● principal shareholder risk.

Although the forward-looking statements contained in this AIF are based upon what management currently believes to be reasonable assumptions, the Corporation cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements. In particular, the Corporation has made assumptions regarding, among other things:

● substantial fluctuation of losses from quarter to quarter and year to year due to numerous external risk factors, and anticipation that we will continue to incur significant losses in the future;

● uncertainty as to the Corporation's ability to raise additional funding to support operations;

● the Corporation's ability to access additional funding;

● the fluctuation of foreign exchange rates;

● the impact of macro political and economic conditions;

● the risks associated with the development of the Corporation's product candidates which are at early stages of development;

● reliance upon industry publications as the Corporation's primary sources for third-party industry data and forecasts;

● reliance on third parties to plan, conduct and monitor the Corporation's preclinical studies and clinical trials;

● reliance on third party contract manufacturers to deliver quality clinical and preclinical materials;

● the Corporation's product candidates may fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or may not otherwise produce positive results;

● risks related to filing investigational new drug ("IND") applications to commence clinical trials and to conduct clinical trials, if approved;

● the risks of delays and inability to complete clinical trials due to difficulties enrolling patients;

● competition from other biotechnology and pharmaceutical companies;

● the Corporation's reliance on the capabilities and experience of the Corporation's key executives and scientists and the resulting loss of any of these individuals;

● the Corporation's ability to fully realize the benefits of potential acquisitions;

● the Corporation's ability to adequately protect the Corporation's intellectual property and trade secrets;

● the risk of patent-related or other litigation; and

● the risk of unforeseen changes to the laws or regulations in the United Kingdom ("UK"), the European Union ("EU"), the United States ("US") and other jurisdictions in which the Corporation operates or plans to operate.

Drug development involves long lead times, is very expensive and involves many variables of uncertainty. Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Corporation. Every subject treated in future studies can change those assumptions either positively (to indicate a faster timeline to new drug applications and other approvals) or negatively (to indicate a slower timeline to new drug applications and other approvals). This AIF and the documents incorporated by reference herein contain certain forward-looking statements regarding anticipated or possible drug development timelines. Such statements are informed by, among other things, regulatory guidelines for developing a drug with safety and tolerability studies, proof of concept studies, and pivotal studies for new drug application submission and approval, and assumes the success of implementation and results of such studies on timelines indicated as possible by such guidelines, other industry examples, and the Corporation's development efforts to date.

In addition to the factors set out above and those identified under the heading "Risk Factors" in this AIF, other factors not currently viewed as material could cause actual results to differ materially from those described in the forward-looking statements. Although the Corporation has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be anticipated, estimated or intended. Accordingly, readers should not place any undue reliance on forward-looking statements.

Many of these factors are beyond the Corporation's ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors that may affect the Corporation. The Corporation may note additional factors elsewhere in this AIF and in any documents incorporated by reference into this AIF. All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to the Corporation, or persons acting on the Corporation's behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, the Corporation undertakes no obligation to update any forward-looking statement.

The forward-looking statements contained in this AIF and the documents incorporated by reference herein are expressly qualified in their entirety by the foregoing cautionary statement. Investors should read this entire AIF and any documents incorporated by reference herein and consult their own professional advisers to ascertain and assess the income tax and legal risks and other aspects associated with holding Securities.

MARKET AND INDUSTRY DATA

Market and industry data contained and incorporated by reference in this AIF concerning economic and industry trends is based upon good faith estimates of our management or derived from information provided by industry sources. The Corporation believes that such market and industry data is accurate and that the sources from which it has been obtained are reliable. However, we cannot guarantee the accuracy of such information and we have not independently verified the assumptions upon which projections of future trends are based. While the Corporation is not aware of any misstatements regarding the industry data presented herein, the Corporation's estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under "Cautionary Note Regarding Forward-Looking Information" and "Risk Factors" in this AIF. For the avoidance of doubt, nothing stated in this paragraph operates to relieve the Corporation from liability for any misrepresentation contained in this AIF under applicable Canadian securities laws.

REGULATORY

The Corporation sponsors R&D on psychedelic molecules and is focused on developing and commercializing psychedelic-based regulated medicines.

The Corporation does not deal with psychedelic substances except indirectly within laboratory and clinical trial settings conducted within approved regulatory frameworks in order to identify and develop potential treatments for medical conditions and, further, does not have any direct or indirect involvement with illegal selling, production or distribution of any substances in jurisdictions in which it operates.

The Corporation oversees and monitors compliance with applicable laws in each jurisdiction in which it operates. In addition to the Corporation's senior executives and the employees responsible for overseeing compliance, the Corporation has local counsel engaged in every jurisdiction in which it operates. See "Compliance Program". Additionally, the Corporation has received legal advice in local jurisdictions where it currently operates regarding (a) compliance with applicable regulatory frameworks; and (b) potential exposure to, and implications arising from, applicable laws in jurisdictions in which the Corporation has operations, and will continue to review the need to seek such legal advice at the appropriate time in jurisdictions it intends to operate.

For these reasons, the Corporation may be (a) subject to heightened scrutiny by regulators, stock exchanges, clearing agencies and other authorities, (b) susceptible to regulatory changes or other changes in law, and (c) subject to risks related to drug development, among other things. There are a number of risks associated with the business of the Corporation. See "Risk Factors" herein.

No product will be commercialized prior to applicable legal or regulatory approval. The Corporation makes no medical, treatment or health benefit claims about the Corporation's proposed products. The efficacy of such products has not been confirmed by approved research. There is no assurance that the use of psychedelic compounds can diagnose, treat, cure or prevent any disease or condition. Vigorous scientific research and clinical trials are needed. The Corporation has not completed all of the clinical trials necessary for market authorization for the use of its proposed products. Any references to quality, consistency, efficacy and safety of potential products do not imply that the Corporation verified such in clinical trials or that the Corporation will complete such trials. If the Corporation cannot obtain the approvals or research necessary to commercialize its business, it may have a material adverse effect on the Corporation's performance and operations.

CORPORATE STRUCTURE

Name, Address and Incorporation

Unilock Capital Corp. ("Unilock") was incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") on January 23, 2018. On April 29, 2021, the Corporation changed its name to Small Pharma Inc. in connection with the completion of the Qualifying Transaction (defined below).

The Corporation's head office is 50 Featherstone Street, 1st Floor, London, UK, EC1Y 8RT and its registered office is 25th Floor, 700 West Georgia Street, P.O. Box 10026, Pacific Center, Vancouver, BC V7Y 1B3.

The Common Shares of Unilock were listed for trading on the TSX Venture Exchange (the "TSXV") under the symbol "UUU.P" on November 16, 2018. Pursuant to the TSXV's CPC policy ("TSXV Policy 2.4"), the Corporation did not carry on any business or operations other than identifying and evaluating business opportunities for the purpose of completing the Qualifying Transaction. The Qualifying Transaction constituted the Corporation's "qualifying transaction" as such term is defined in TSXV Policy 2.4.

On November 30, 2020, Unilock, Small Pharma Ltd. ("SPL") and certain shareholders of Unilock entered into an agreement, as amended on February 23, 2021 (the "Definitive Agreement") pursuant to which Unilock agreed to acquire all of the issued and outstanding ordinary shares of SPL (the "Qualifying Transaction").

The Common Shares commenced trading on the TSXV on May 6, 2021, under the symbol "DMT". Following completion of the Qualifying Transaction, and as of the date of this AIF, the Corporation carries on the business of SPL.

On October 20, 2021, the Corporation was upgraded from the OTC Pink to the OTCQB® Venture Market (the "OTCQB"). The Common Shares are trading on the OTCQB under the symbol "DMTTF".

For additional information in respect of the Qualifying Transaction and related matters, see "General Development of the Business - Three Year History - The Qualifying Transaction".

Intercorporate Relationships

As at the date of this AIF, the Corporation's corporate structure includes the following wholly-owned subsidiaries:

GENERAL DEVELOPMENT OF THE BUSINESS1

Summary of the Business

Small Pharma is a clinical-stage biotechnology company focused on developing short-duration psychedelic-assisted therapies for the treatment of mental health conditions. The Corporation has initiated programs across its "first-generation" and "second-generation" psychedelics portfolio. First-generation psychedelics refer to the well-known classic psychedelics such as psilocybin, N, N-dimethyltryptamine ("DMT") and Lysergic acid diethylamide (LSD). Second-generation psychedelics refer to those that have been chemically modified with the aim to optimize their therapeutic benefit. The Corporation is focused on the development of its pharmaceutical psychedelic assets with the inclusion of support therapy, anticipating this treatment paradigm to be important for optimizing beneficial patient outcomes.

__________________________________________

1 All quarter references in this section are based on calendar year-end.

The Corporation has pursued and anticipates continuing to pursue the early-stage clinical development of its programs in the UK. The Corporation anticipates its later stage clinical trials of its clinical programs to expand into the US and EU and potentially other jurisdictions.

Three Year History

Pre Qualifying Transaction

History of Small Pharma Ltd

SPL was incorporated on February 4, 2015 pursuant to the provisions of the UK Companies Act 2006.

On incorporation, SPL's focus was to identify profitable drug development opportunities based on known active ingredients via systematic IP-led candidate assessment in therapeutic areas of significant unmet need. Over the course of its history, SPL initiated a drug development program primarily focused on developing novel treatments for depression investigating psychedelic and non-psychedelic therapeutic candidates.

In 2019, SPL targeted its R&D focus to explore the drug development opportunities in psychedelic based therapies. Through a systematic analysis of the clinical and commercial potential of a range of tryptamine-based compounds, SPL selected DMT as its target therapeutic candidate. By completion of the Qualifying Transaction, SPL had developed a high-purity synthetic formulation of DMT fumarate, SPL026, and completed the necessary preclinical studies to advance into human clinical trials. In December 2020, SPL received approval from both the UK Medicines and Healthcare Products Regulatory Agency (the "MHRA") and the ethics committee to progress with its first clinical study. In February 2021, SPL, in collaboration with Imperial College London, initiated dosing in its Phase I/IIa clinical trial at a leading UK contract research organisation ("CRO"), Hammersmith Medicines Research Unit ("HMR"). SPL had also identified in-house a deuterium-enriching technology to modify the pharmacokinetics of DMT, and other tryptamine-based psychedelics. This technology enables SPL to develop a pipeline of DMT analogues with novel compositions of matter that are expected to offer additional clinical advantages and robust commercial IP protection. Up to the completion of the Qualifying Transaction, SPL had initiated preclinical progression of novel candidates developed from this technology.

Across its psychedelic-focused development programs, SPL had 17 patents pending at the time of completion of the Qualifying Transaction with expectations to continue to expand its portfolio.

On April 29, 2021, the Corporation completed the Qualifying Transaction, see "General Development of the Business - Three Year History - The Qualifying Transaction".

History of Unilock Capital Corp.

Unilock was incorporated under the BCBCA on January 23, 2018. The Common Shares were listed for trading on the TSXV under the symbol "UUU.P" on November 16, 2018. Pursuant to TSXV Policy 2.4, the Corporation was a capital pool corporation created pursuant to the policies of the TSXV and did not conduct any active business operations other than identifying and evaluating business opportunities for the purpose of completing a qualifying transaction until completion of the Qualifying Transaction. Unilock, at the completion of the Qualifying Transaction, did not own any assets, other than cash or cash equivalents.

On November 30, 2020, Unilock, SPL and certain shareholders of Unilock entered into the Definitive Agreement, as amended on February 23, 2021 pursuant to which Unilock agreed to acquire all of the issued and outstanding ordinary shares of SPL. On April 29, 2021, the Corporation changed its name to "Small Pharma Inc." in connection with the completion of the Qualifying Transaction.

On April 29, 2021, the Corporation completed the Qualifying Transaction with Unilock, see "General Development of the Business - History of Small Pharma Ltd", and "The Qualifying Transaction".

The Qualifying Transaction

Small Pharma Financing Inc. ("Finco") and 1292589 B.C. Ltd., a wholly-owned subsidiary of Unilock ("Subco"), were incorporated for the purposes of effecting the Amalgamation (as defined below).

In connection with the Qualifying Transaction, on March 9, 2021, Finco issued 60,416,667 subscription receipts (the "Subscription Receipts") at a price of $0.96 per Subscription Receipt for gross proceeds of $58,000,000 (the "Brokered Offering"). Upon satisfaction of certain escrow release conditions, including all conditions precedent to the Qualifying Transaction, the Subscription Receipts were converted into common shares of Finco (the "Finco Shares") immediately prior to the completion of the Qualifying Transaction on the basis of one Finco Share for each Subscription Receipt. In connection with the Brokered Offering, certain agents were issued an aggregate cash fee of $3,789,645 and 3,947,547 compensation warrants ("Compensation Warrants"). Each Compensation Warrant was exercisable into one Common Share at the Offering Price for a period of two years, and have since expired without exercise on April 29, 2023.

Concurrently upon completion of the Qualifying Transaction, the Corporation, Finco and Subco completed a three-cornered amalgamation under the laws of the Province of British Columbia, pursuant to which all Finco shareholders (including former holders of the Subscription Receipts) exchanged all the Finco Shares held for Common Shares on a one-for-one basis and Finco and Subco amalgamated (the "Amalgamation"), with the resulting entity ("Amalco") continuing as a wholly-owned subsidiary of the Corporation pursuant to the amalgamation agreement entered into among the Corporation, Subco and Finco dated March 9, 2021. As noted above, the Definitive Agreement was amended on February 23, 2021 to reflect the issuance of the Subscription Receipts by Finco and the Amalgamation. On October 7, 2021, Amalco was wound-up and dissolved, pursuant to which all of the assets of Amalco were distributed to the Corporation.

Pursuant to the terms of the Qualifying Transaction, on March 25, 2021 the Corporation made an offer (the "Offer") to the security holders of SPL to purchase all of their ordinary shares of SPL (the "Small Pharma Shares") currently held or to be held prior to the closing of the Qualifying Transaction. The consideration paid by the Corporation for each Small Pharma Share held was one (1) Common Share, being equal to the quotient which results when (i) the Subscription Receipt Price is divided by (ii) $0.21, being the deemed price per share of the Common Shares as agreed by the parties in the Definitive Agreement and then adjusted for the Consolidation (as defined below) (the "Exchange Ratio"). The Exchange Ratio was determined pursuant to arm's length negotiations between the management of each of the Corporation and SPL.

Prior to the completion of the Qualifying Transaction, the Corporation changed its name to "Small Pharma Inc." on April 29, 2021, the outstanding Common Shares were consolidated on the basis of 4.6 old Common Shares into one (1) new Common Share new Common Share (the "Consolidation") and the outstanding Small Pharma Shares were split on the basis of 100 Small Pharma Shares for each one (1) Small Pharma Share (the "Split"). The Exchange Ratio was one (1) Common Share after the Consolidation for each one (1) Small Pharma Share after the Split.

Upon the completion of the Qualifying Transaction, the Corporation issued an aggregate of 315,496,144 Common Shares at a deemed issuance price of $0.96 per Common Share and 22,548,947 options and warrants to purchase Common Shares.

In connection with the Qualifying Transaction, Ms. Lyne Fortin and Mr. Michael Wolfe were appointed as independent directors of the Corporation.

Upon completion of the Qualifying Transaction, the board of directors of the Corporation adopted a written insider trading policy which sets forth basic guidelines for trading in the Corporation's securities (including, without limitation, its Common Shares) to avoid any situation that might have the potential to damage the Corporation's reputation or which could constitute a violation of federal or provincial securities law by the Corporation, its officers, directors, employees, consultants, affiliates and certain family members of such individuals ("Insiders"). Under the policy, Insiders are prohibited from trading in Common Shares and other securities on the basis of material, non-public information relating to the Corporation until after the information has been disclosed to the public or during a blackout period.

Following completion of the Qualifying Transaction, and as of the date of this AIF, the Corporation carries on the business of SPL.

The Common Shares commenced trading on the TSXV on May 6, 2021 under the symbol "DMT".

Material Developments of the Corporation Subsequent to the Qualifying Transaction

In June 2021, the Corporation secured an additional clinical trial site with MAC Clinical Research ("MAC") at Prescott, Liverpool in the UK, increasing the recruitment rate for its Phase IIa clinical trial.

In July 2021, the Corporation launched its DMT with support therapy therapist training program to educate and train therapists on the protocols required to support treatment delivery in the Corporation's clinical trials. The initial training program was successfully completed at the University of Oxford.

In July 2021, the Corporation's UK patent number GB2585978 was granted for its UK patent application GB2008303.6, which provides protections relating to certain deuterated homologues of DMT, including the Corporation's preclinical candidate SPL028.

On August 26, 2021, Ms. Lyne Fortin was appointed as non-executive independent chair of the board of directors of the Corporation. Ms. Fortin had served as a director of the Corporation since April 29, 2021, and continues to serve in her roles as Chair of the Corporate Governance and Nominating Committee and as a member of the Audit Committee and the Compensation Committee.

In September 2021, the Corporation completed the Phase I part of its randomised, placebo-controlled, blinded Phase I/IIa clinical trial evaluating IV doses of SPL026 in healthy volunteers. The Phase IIa portion was initiated shortly thereafter, with the first patient dosed in October 2021.

In October 2021, the MHRA granted an Innovation Passport Designation (an "IPD") for SPL026. This designation provides access to the Innovative Licensing and Access Pathway (the "ILAP"), which accelerates time to market and facilitates patient access to emerging and novel treatments in the UK.

On October 20, 2021, the Corporation announced that its Common Shares had commenced trading on the OTCQB under the symbol "DMTTF".

On November 18, 2021, Mr. Paul Maier was appointed as a non-executive independent director of the board of directors of the Corporation. Mr. Maier was also appointed as Chair of the Compensation Committee and as a member of the Audit Committee and Corporate Governance and Nominating Committee.

On February 22, 2022, the Corporation announced the analysis of the Phase I data from the combined Phase I/IIa clinical trial of SPL026 with therapy for the treatment of MDD. The full dataset highlighted that IV administration of SPL026 offers a short-lived, well tolerated psychedelic experience of ~20 minutes, enabling a dosing session to last only ~30 minutes.

In March 2022, the Corporation announced it had completed preclinical profiling to select its final SPL028 candidate, allowing its SPL028 program to move into a Phase I clinical trial in H2 2022.

On March 29, 2022, the Corporation filed a base shelf prospectus (the "Base Shelf Prospectus") in each of the provinces and territories of Canada. The Base Shelf Prospectus qualifies for distribution, from time to time during the 25-month period from the date of the Base Shelf Prospectus, of up to $125,000,000 in the aggregate of Common Shares, warrants, units, debt securities and subscription receipts of the Corporation.

On May 18, 2022, the Corporation was granted European patent no.3826632 providing Composition of Matter protection of certain deuterated analogs of DMT, including the active ingredient in SPL028. This patent sits alongside the Corporation's UK patent for SPL028, strengthening its protection in European markets.

On May 25, 2022, the Corporation provided a clinical trial update on its active SPL026 Phase I/IIa clinical trial. The Corporation reported ongoing progress in the Phase IIa patient study with no safety concerns reported to date. The Corporation provided a revised study timeline with dosing expected to complete in the coming months. The revised study timeline was due in part to slower than anticipated patient recruitment following COVID-19 government restrictions in the UK.

On May 25, 2022, the Corporation appointed Dr. Alastair Riddell as Chief Operating Officer of the Corporation. In connection with Dr. Riddell's appointment, Ms. Marie Layzell, the former COO and Head of CMC, assumed the role of Chief Manufacturing and Development Officer. During July 2023, the Corporation announced that Dr. Riddell will be leaving his role as Chief Operating Officer and Ms. Layzell will assume the responsibilities of the Chief Operating Officer. See "General Development of the Business - Three Year History - Developments of the Corporation Subsequent to Period End" for additional information.

Effective as of July 20, 2022, Mr. George Tziras was appointed to succeed Mr. Peter Rands as the Chief Executive Officer of the Corporation. Mr. Rands was appointed as Chief Innovation & Intellectual Property Officer of the Corporation ("CIIPO"). As part of the planned succession and his relocation to the United States, the focus of Mr. Rands' new role was to better position the business for the later stages of clinical development and further establish the Corporation's footprint in the United States. Mr. Rands continued to serve on the Board following the transition.

On August 3, 2022, the Corporation announced that as of July 19, 2022, it had been granted patent no. 3104072 by the Canadian Intellectual Property Office (the "CIPO"). The Canadian patent protects Composition of Matter of certain deuterated analogues of DMT, including the active ingredient in SPL028.

On August 9, 2022, the Corporation was granted US patent no.11,406,619 from the United States Patent and Trademark Office ("USPTO"). This was the Corporation's first US patent grant within its psychedelic portfolio, providing protection for novel injectable formulations of DMT-based compounds, including the active ingredient in SPL026 and SPL028.

On August 15, 2022, the Corporation announced it had received approval from the MHRA and the Research Ethics Committee ("REC") to initiate a Phase Ib drug interaction clinical trial in the U.K. assessing the interaction between selective serotonin reuptake inhibitor ("SSRI") antidepressants and SPL026 in patients with MDD. The trial was initiated in Q3 2022. Dosing of the study completed in July 2023, with topline data expected in Q3 2023.

On September 14, 2022, the Corporation was granted European patent no. 3902541 which protects the use of a small group of deuterated compounds of DMT in therapy, effectively covering all therapeutic uses of the specified compounds. The patent provides expanded protection for the Corporation's pipeline of deuterated compounds.

On September 19, 2022, the Corporation completed enrollment in the Phase IIa clinical trial of its IV formulation of SPL026 with support therapy for the treatment of MDD.

On October 12, 2022, the Corporation received clinical trial application ("CTA") approval from the MHRA and REC for its SPL026 Phase I comparative pharmacokinetic clinical trial. This study assessed the comparative safety, tolerability, pharmacokinetics ("PK") and pharmacodynamics ("PD") (psychedelic experience) of an IM and an IV dose of SPL026.

On October 19, 2022, the Corporation was granted patent no. 11,471,417 by the USPTO, protecting a therapeutic composition of a small group of deuterated compounds of DMT, effectively covering all pharmaceutical formulations of the specified compounds.

On October 31, 2022, the Corporation announced it had received approval from the MHRA and REC to initiate a randomized, placebo-controlled, blinded, dose-escalating Phase I study of SPL028, with support therapy in healthy volunteers. The study, which initiated in February 2023, aims to evaluate the safety, tolerability, pharmacodynamics and pharmacokinetics of IM and IV administration of escalating doses of SPL028.

On December 14, 2022, the Corporation announced it will provide SPL026, an IV formulation of DMT, to support a University College London study investigating induced brain changes and neuroplasticity following IV DMT.

On December 15, 2022, the Corporation announced that the first patient had been dosed in the Corporation's Phase Ib SSRI-SPL026 drug interaction study.

On December 21, 2022, the Corporation was granted patent no. 3 873 883 by the European Patent Office. The European patent protects a novel manufacturing process for the preparation of synthetic DMT, DMT-related compounds and deuterated DMT analogs. The patent covers the preparation of SPL026 and SPL028.

On December 22, 2022, the Corporation announced the last patient had completed its final visit in the Corporation's Phase IIa clinical trial of SPL026, IV DMT, with support therapy, for the treatment of MDD.

On January 9, 2023, the Corporation announced that the first patient had been dosed in the Corporation's Phase I study comparing the profiles of IM and IV SPL026. The study aims to compare the safety, tolerability, pharmacokinetics and pharmacodynamics of SPL026 delivered via IM versus IV administration, in up to 14 healthy volunteers.

On January 25, 2023, the Corporation announced positive topline results of the Phase IIa trial, which demonstrated the study met its primary endpoint with a statistically significant reduction (-7.4) point difference between SPL026 (21.5mg) and placebo at two-weeks post-dose, as measured by the Montgomery-Asberg Depression Rating Scale ("MADRS") change from baseline (p=0.02). Antidepressant effect of SPL026 with support therapy demonstrated a rapid onset at one-week post-dose with a statistically significant difference in MADRS of -10.8 versus placebo (p=0.002). A durable antidepressant effect was demonstrated with a remission rate of 57% at 12-weeks following a single SPL026 dose with support therapy. No apparent differences were identified in antidepressant effect between a one and two dose regimen of SPL026. SPL026 also demonstrated a favourable safety and tolerability profile with no drug-related serious adverse events reported. All adverse events related to treatment were considered mild or moderate.

On February 1, 2023, the Corporation announced the receipt of a Notice of Allowance from the USPTO for US patent application no. 17/680,411. The application will provide Composition of Matter protection for a group of deuterated compounds of DMT, as well as protection for therapeutic compositions and uses of the specified compounds.

On February 14, 2023, the Corporation was granted patent no.11578039 by the USPTO. This patent provides Composition of Matter protection for certain deuterated homologues of certain tryptamine compounds, including the active ingredients currently being investigated in the SPL029 oral tryptamine series.

On February 15, 2023, the Corporation announced that the first subject had been dosed in the Corporation's Phase I study evaluating SPL028, which is the first-in-human trial investigating the profile of SPL028, the Corporation's proprietary molecule with Composition of Matter protection. The Phase I study is a randomized, blinded, placebo-controlled, dose-escalating study designed to evaluate the safety, tolerability, pharmacodynamics and pharmacokinetics of both IV and IM administration of SPL028 with support therapy in healthy volunteers. Topline data is expected in Q4 2023.

Material Developments of the Corporation Subsequent to Period End

On March 7, 2023, the Corporation announced further positive data from additional secondary and exploratory endpoints of the SPL026 Phase IIa clinical trial. Further analyses demonstrated that patient-reported depression scores corroborate the MADRS assessments conducted by independent clinical raters. Further, patients receiving at least a single dose of IV SPL026 with support therapy experienced clinically relevant improvements in wellbeing and anxiety across all study timepoints, further supporting previously announced topline efficacy results.

On April 4, 2023, the Corporation announced positive six month data from the SPL026 Phase IIa clinical trial, which showed that, among the patients who achieved remission within three months of treatment with SPL026, 64% sustained remission to six months.

On May 9, 2023, the Corporation was granted patent no.11643390 by the USPTO. This patent protects a novel manufacturing process for the preparation of synthetic DMT, DMT-related compounds and deuterated DMT analogs, including the preparation of SPL026 and SPL028.

On May 30, 2023, the Corporation was granted patent no.11660289 by the USPTO. This patent provides Composition of Matter protection for a group of deuterated compounds from the SPL028 program, as well as protection for therapeutic compositions and uses of the specified compounds.

On June 6, 2023, the Corporation was granted two UK patents nos.2586940 and.2592822. These patents provide further protection for certain deuterated analogues of DMT, including the active ingredient in SPL028.

On June 28, 2023, the Corporation announced completion of the Phase I SPL026 IM and IV clinical trial. The Corporation reported the IM route was well tolerated, with no safety concerns reported, a mean pharmacokinetic half life of approximately 40 minutes, and a mean psychedelic experience of approximately 45 minutes. The Corporation also announced preliminary findings from the first two cohorts of the SPL028 Phase I program in which IV administration elicited a mean psychedelic experience of < 1 hour.

Effective as of July 1, 2023, Mr. Peter Rands, co-founder, Chief Innovation & Intellectual Property Officer and former Chief Executive Officer of the Corporation, left his positions as an executive officer and Board director of the Corporation and its subsidiaries.

On July 3, 2023, it was determined that Dr. Alastair Riddell will leave his role as Chief Operating Officer and Ms. Marie Layzell will assume those responsibilities in addition to her current role as Chief Manufacturing and Development Officer.

On July 5, 2023, the Corporation announced an R&D strategy update regarding SPL028, its second-generation DMT program. The update included preliminary findings from the SPL028 Phase I trial indicating its potential to deliver a unique therapeutic profile. Further, the Corporation indicated the potential for an expedited route to an international, multi-site Phase II study with SPL028 in 2024.2

On July 5, 2023, the Corporation announced the implementation of operational efficiencies in an effort to focus on achieving key value-based milestones, which included a reduction in headcount of approximately one-third. The operational efficiencies are expected to generate material cost savings, a reduction in its historical annual cash burn, and provide anticipated cash runway extension from current resources to Q4 2024 (calendar year-end).3

__________________________________________

2 Within the next 12 months, the Corporation anticipates initiating a multi-site, international Phase II clinical trial of at least one of its candidate programs. The Corporation anticipates seeking regulatory approval in the UK, US and the EU for this trial, and may also seek regulatory approval in other jurisdictions. There is no assurance that the aforementioned timeline will be met or that any program will advance into a Phase II clinical trial. Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Company. Material assumptions underlying this forward-looking statement include, but are not limited to: (i) receipt of all regulatory authorization in the jurisdictions selected to conduct the clinical trial(s); (ii) the receipt by the selected clinical trial sites of the necessary licences to initiate the trial. Progression into an international Phase II study will also depend upon additional factors, including but not limited to, (i) data readout of its Phase I exploratory studies in SPL026 and SPL028; (ii) completion of the required preparatory steps in advance of formally applying for regulatory authorizations in the UK, US, the EU and other jurisdictions, if selected; in the case of the SPL028 program, this may include the completion of a Phase Ib patient study and completion of an IND-enabling non clinical package; (iii) the Company's ability to raise capital under future financing arrangements; and (iv) strategic discussions with Cybin (as defined herein) upon completion of the Arrangement (as defined herein), if completed. However, there can be no assurance that the Arrangement will be completed on the proposed terms of the Arrangement Agreement, or at all. Anticipated timelines may be impacted by a number of factors, including but not limited to: (i) obtaining required permits and applicable regulatory approvals; (ii) any significant changes in personnel and third-party providers; (iii) the outcome of active studies that the Corporation determines is necessary or advantageous for the advancement the clinical program; (iv) the Corporation having sufficient funds to initiate the trial; and (v) import/export delays or restrictions.

3 The anticipated cash runway extension assumes the completion of current active clinical trials and conducting ongoing operational activities consistent with the implemented operational efficiencies and revised Corporation budget. The revised timeline for the Corporation's cash runway may be impacted by a number of factors, including but not limited to: (i) increased expected costs of the active clinical trials due to delays to completion or modifications to the clinical trial design; (ii) decisions to initiate additional R&D activities including additional IND-enabling studies or other IND-related preparation; (iii) other business-related activities outside the Corporation's normal course of business; (iv) expenses, costs and fees associated with the Arrangement, whether completed or not; and (iv) other factors not currently known by the Corporation and outside of the Corporation's control.

On August 10, 2023, the Corporation received a Notice of Allowance from the USPTO for US patent application no. 16/890664. The patent provides Composition of Matter protection for certain deuterated analogues of DMT that pertain to the SPL028 programme.

On August 29, 2023, the Corporation was granted patent no. 3160337 by the CIPO. This patent protects a novel manufacturing process for the preparation of synthetic DMT, DMT-related compounds and deuterated DMT analogs, including the preparation of SPL026 and SPL028.

Arrangement Transaction with Cybin

On August 28, 2023, the Corporation entered into a definitive arrangement agreement (the "Arrangement Agreement") with Cybin Inc. ("Cybin") pursuant to which Cybin agreed to acquire all of the issued and outstanding Common Shares in an all-share transaction (the "Arrangement"). The Arrangement is expected to be effected by a court-approved plan of arrangement under the BCBCA. Cybin is a clinical-stage biopharmaceutical company committed to revolutionizing mental healthcare by developing new and innovative psychedelic-based treatment options.

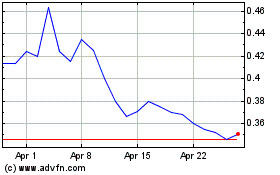

Pursuant to the terms of the Arrangement Agreement, if the Arrangement becomes effective, holders of Common Shares (other than dissenting holders of Common Shares) will receive 0.2409 of a common share in the capital of Cybin (each whole share, a "Cybin Share") for each Common Share held. The exchange ratio implies consideration of approximately $0.10 per Common Share based on the closing price of the Cybin Shares on the Cboe Canada exchange ("Cboe Canada") on August 25, 2023, representing a 43.64% premium based on the 30-day volume weighted average prices of the Cybin Shares on the Cboe Canada and the Common Shares on the TSXV for the period ended on August 25, 2023. As of the date of this AIF, it is currently expected that existing Cybin shareholders and the Corporation's securityholders will own approximately 74.3% and 25.7% of Cybin, respectively.

Completion of the Arrangement is subject to the approvals of the shareholders of both the Corporation and Cybin. The Arrangement requires the approval of at least 662/3% of the votes cast by the shareholders of the Corporation voting in person, virtually or by proxy at an annual and special shareholders' meeting to consider, in addition to certain annual business, the Arrangement (the "Corporation Meeting"). The issuance of Cybin Shares pursuant to the Arrangement will also require approval by a simple majority of the votes cast by the shareholders of Cybin voting virtually or by proxy at an annual and special meeting of Cybin shareholders, in accordance with the polices of the Cboe Canada. The shareholders' meetings are expected to occur on or about October 12, 2023.

In addition to shareholder approvals, the Arrangement is subject to approval by the Supreme Court of British Columbia, receipt of applicable stock exchange and regulatory approvals, including the approval of the TSXV, and the satisfaction of certain other closing conditions customary in transactions of this nature. It is currently expected that the Arrangement will close in late October 2023. Upon completion of the Arrangement, it is expected that the Common Shares will be delisted from the TSXV and removed from the OTCQB, and the Corporation will cease to be a reporting issuer in each of the provinces and territories in Canada.

Further details with respect to the Arrangement are included in the Arrangement Agreement, a copy of which can be found under the Corporation's profile on SEDAR+ at www.sedarplus.ca. Additional information regarding the Arrangement will also be included in the Corporation's management information circular, which will be mailed to shareholders in connection with the Corporation Meeting.

Significant Acquisitions

The Corporation has not completed any significant acquisitions or dispositions over the most recently completed financial year.

For a summary of the material terms of the Qualifying Transaction, see "General Development of the Business - Three Year History - The Qualifying Transaction".

On August 28, 2023, the Corporation entered into the Arrangement Agreement to complete the Arrangement. For additional information, see "General Development of the Business - Three-Year History - Arrangement Transaction with Cybin".

DESCRIPTION OF THE BUSINESS4

General

The Corporation is a biotechnology company progressing short-duration psychedelic-assisted therapies for the treatment of mental health conditions. The Corporation has initiated programs across its "first-generation" and "second-generation" psychedelics portfolio. It is focused on the development of pharmaceutical psychedelic assets with the inclusion of support therapy, anticipating this treatment paradigm to be important for optimizing beneficial patient outcomes.

The Corporation is focused on the R&D of pharmaceutical drugs, with an intention to further advance its current portfolio into and through clinical trials towards commercialization. This progression may also extend to the sales and marketing of any of its assets that receive marketing authorization. In addition, the Corporation may expand its R&D pipeline by initiating additional development programs.

As of the date of this AIF, the Corporation has initiated and progressed its R&D efforts on four therapeutic candidates across its psychedelic and non-psychedelic compounds, discussed in detail below. In line with its business model, the Corporation has ensured an IP strategy is embedded in the development of all its therapeutic candidates. Across its lead psychedelic-focused development programs, SPL026 and SPL028, the Corporation has 17 patents granted and 77 patent applications pending and is actively continuing to expand its portfolio. The Corporation also has additional patents granted and applications pending across its preclinical pipeline, SPL029 and SPL801B programs, as further described below.

. The Corporation's R&D strategy is targeted around the following core target value proposition:

● Rapid and durable efficacy: A treatment course that has the potential to result in rapid symptom relief, with improvements in patient health outcomes that extend for at least a few months.

● Strong commercial proposition: Short (~less than<~2.5hr) in-clinic treatments (includes dosing and support therapy) provided on an episodic "as required" basis in order to maximize convenience for both patients and physicians, as well as provide economic benefits for payers.

● Robust IP protection: Progressing a multi-layered IP strategy for each asset, including targeting Composition of Matter protection within the second-generation portfolio, in multiple jurisdictions.

__________________________________________

4 All quarter references in this section are based on calendar year-end.

SPL026: First-Generation DMT Asset

Small Pharma has advanced its first-generation short-duration psychedelic clinical program, SPL026, with the positive completion of a proof-of-concept study for an IV formulation of SPL026, as well as exploratory studies to evaluate additional formulations and treatment populations.

The Corporation's IV SPL026 Phase I/IIa study completed in Q1 2023 with positive results demonstrated the safety, tolerability and efficacy of DMT with support therapy for the treatment of MDD. To further inform the patient recruitment of future trials and ultimately facilitate broadening the treatable MDD populations, in H2 2022, the Corporation initiated a Phase I drug interaction study in the UK to investigate the potential interactions between SSRI antidepressants and IV SPL026 therapy in patients with MDD. The study completed dosing in July 2023 with data anticipated in Q3 2023. See "Description of the Business - Business Objectives and Milestones of the Corporation".

Further, the Corporation is investigating additional routes of administration that may offer improved treatment convenience to patients. The Corporation initiated a Phase I IM/IV SPL026 study in Q4 2022 to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics profiles of IM compared to IV SPL026 administration. The study completed in Q2 2023 and demonstrated that IM SPL026 meets the target treatment length, demonstrating the potential for IM administration as a convenient route for patients and physicians.

SPL028: Proprietary Second-Generation Deuterated DMT Asset

SPL028 is the Corporation's novel deuterated second-generation DMT compound targeting an extended DMT psychedelic experience. It offers a unique short-duration DMT drug profile that could provide optimized dose formulations for different administration routes and distinct therapeutic benefits for patients. The Corporation initiated a Phase I IV and IM healthy volunteer study in Q1 2023 to evaluate the safety, tolerability, pharmacodynamics and pharmacokinetics of both administration routes. Data is anticipated in Q4 2023. See "Description of the Business - Business Objectives and Milestones of the Corporation".

Future R&D Strategy

The Corporation anticipates that upcoming data from its active SPL026 and SPL028 trials will be informative to the progress of these clinical programs. As such, the development path of both assets will be determined upon the completion of the active Phase I trials. Over the next 12 months from the date hereof, the Corporation anticipates the potential expansion of at least one of these development programs into an international Phase II clinical trial, however such studies will be subject to a strategic review of all available clinical data of the SPL026 and SPL028 programs following the completion of the active clinical trials.5 The Corporation's plans over the next 12 months are also subject to strategic discussions with Cybin upon completion of the Arrangement, if completed. However, there can be no assurance that the Arrangement will be completed on the proposed terms of the Arrangement Agreement, or at all. See "Description of the Business - Business Objectives and Milestones of the Corporation".

Psychedelic-Based Medicines

The Corporation is developing psychedelic-based medicines with support therapy for the treatment of mental health disorders. The treatment potential of these therapies has been acknowledged internationally by regulatory drug agencies, including the FDA6 and the MHRA.7 Most recently, on June 26, 2023, the FDA further demonstrated its recognition for the therapeutic potential of psychedelic drugs and willingness to work with groups developing such drugs with the issuance on June 26, 2023, of its first draft guidance entitled Psychedelic Drugs: Considerations for Clinical Investigations Guidance for Industry (Guidance).8 The guidance highlights considerations for sponsors developing psychedelic drugs for the treatment of medical conditions and for clinical trials that will be conducted under an investigational new drug application (IND). The FDA recognises that additional considerations are required due to the unique characteristics of these drugs, and have outlined foundational constructs that sponsors should consider in areas including trial conduct, data collection and subject safety.

__________________________________________

5 Refer to footnote 2.

6 To date, the FDA has awarded breakthrough designation status to a number of psychedelic programs.

7 The MHRA has awarded an IPD to a number of companies, including the Corporation in October 2021, advancing psychedelic drug development programs. See "General Development of the Business - Three Year History" for additional information.

There has been a resurgence in scientific research highlighting the therapeutic opportunity of psychedelic compounds for treating mental health conditions through an alternative method of action to current available treatment options. Neuroimaging and behavioural research suggests that psychedelic compounds modulate certain neural circuits implicated in mood disorders, resulting in an acute psychedelic state and neuroplastic adaptations in certain brain networks. It is hypothesized that when such adaptations are supported by the integration of the psychedelic experience through support therapy, it may lead to long-term positive changes in an individual's emotional, cognitive and behavioural state.9

The Corporation is focused on the tryptamine family of psychedelic compounds, which includes DMT and psilocybin, which, at the time of initial exploration, portrayed promising data to suggest their therapeutic potential. The available literature exploring the mechanistic and therapeutic potential of these compounds has continued to expand and strengthen the evidence for their therapeutic use.DMT has been found through academic work to be endogenous in various plant species as well as in certain mammals.10 It was identified by the Corporation to possess a number of benefits relative to other tryptamine compounds on account of its rapid drug clearance within humans and the short, powerful psychedelic experience that it manifests.11 The pharmacokinetic profile appears well-adapted to clinical application in providing a short dosing session (including the drug administration and resolution of psychoactive effects) with the duration of IV DMT less than 30 minutes compared to oral psilocybin whose treatment duration typically lasts six hours12 and oral LSD that lasts 10 hours.13

"First-generation" and "Second-generation" Psychedelic Programs

The Corporation's drug development pipeline currently includes a number of programs across its investigational candidates that offer the potential for differentiated target treatment profiles.

The Corporation's first-generation DMT program, SPL026, is evaluating two target treatment profiles that have the potential to maximize the clinical scalability of psychedelic therapies: (1) an IV formulation that targets a short <30-minute psychedelic experience and (2) an IM formulation that targets approximately 45-minute subject-distinct psychedelic experience and offers improved convenience for patients.

The second-generation psychedelic programs incorporate a pipeline of chemically-modified DMT analogues that target an extended psychedelic experience. These candidates aim to offer a unique short-duration DMT drug profile that could provide optimized dose formulations for different administration routes and distinct therapeutic benefits for patients.

__________________________________________

8 https://www.fda.gov/regulatory-information/search-fda-guidance-documents/psychedelic-drugs-considerations-clinical-investigations

9 Vollenweider, F.X., Preller, K.H. Psychedelic drugs: neurobiology and potential for treatment of psychiatric disorders. Nat Rev Neurosci 21, 611-624 (2020). https://doi.org/10.1038/s41583-020-0367-2

10 Carbonaro, T. M., & Gatch, M. B. (2016). Neuropharmacology of N,N- dimethyltryptamine. Brain Research Bulletin, 126, 74-88. https://doi. org/10.1016/j.brainresbull.2016.04.01

12 Lowe H, Toyang N, Steele B, Valentine H, Grant J, Ali A, Ngwa W, Gordon L. The Therapeutic Potential of Psilocybin. Molecules. 2021 May 15;26(10):2948. doi: 10.3390/molecules26102948. PMID: 34063505; PMCID: PMC8156539.

13 Fuentes JJ, Fonseca F, Elices M, Farré M, Torrens M. Therapeutic Use of LSD in Psychiatry: A Systematic Review of Randomized-Controlled Clinical Trials. Front Psychiatry. 2020 Jan 21;10:943. doi: 10.3389/fpsyt.2019.00943. PMID: 32038315; PMCID: PMC6985449.

"First-Generation" Short Duration Psychedelic Programs

SPL026: IM and IV DMT

The Corporation has developed a proprietary medicine, SPL026, based on the fumarate salt form of DMT to be administered with support therapy in the treatment of MDD.

Chemistry, Manufacturing and Controls ("CMC")

The Corporation has optimized the synthesis of the Active Pharmaceutical Ingredient ("API") in SPL026. The proprietary synthesis developed has 99.9% purity by High Performance Liquid Chromatography (HPLC) and approximately 60% yield, representing a high yield to purity syntheses of DMT.

The Corporation has evaluated a number of potential delivery mechanisms and developed drug product formulations for IV and IM administration of SPL026.

Using third party providers, the Corporation has contracted the manufacture of good manufacturing practice ("GMP") compliant batches of drug product, together with a matching placebo, for use in clinical trials.

Intellectual Property

To date, 5 patents granted and 31 pending applications of the Corporation's Intellectual Property portfolio provide protection surrounding SPL026, including those providing combined protection to SPL026 and the Corporation's other molecules in development. Protection surrounding SPL026 includes a patent family to protect the synthetic GMP route of SPL026 and a patent family to protect optimized dosage forms of the active ingredient of SPL026. See "Description of the Business - Intellectual Property".

Clinical Development of IV SPL026

Phase I/IIa

In December 2020, the MHRA granted its Clinical Trial Approval for a Phase I/IIa clinical trial of IV SPL026. In February 2021, the Corporation initiated dosing in a randomised, placebo controlled, blinded, two-part Phase I/IIa clinical trial evaluating IV doses of SPL026 in combination with support therapy. Phase I, Part A, which was completed in September 2021, evaluated the safety, tolerability, pharmacokinetics and pharmacodynamics of different dose levels (9-21.5mg) of SPL026 (DMT fumarate) with therapy in 32 healthy psychedelic-naïve subjects when compared to placebo with therapy. The dose-escalating, placebo-controlled, blinded Phase I study demonstrated a favorable safety profile with no serious adverse events reported to-date. The Corporation's proprietary IV formulation of DMT proved to also be well-tolerated in individuals with no previous experience of psychedelics. The completion of the Phase I study also generated a robust dataset on the pharmacokinetics of SPL026 using Good Clinical Practice ("GCP"). This combined data enabled the Corporation to select a dose of SPL026, which elicits a breakthrough psychedelic experience and is well-tolerated, and allowed the Corporation to initiate Part B, the Corporation's Phase IIa study.

Key results from the Phase I study include:

● No drug-related serious adverse events ("SAEs") and minimal short-lived adverse events reported on dosing day.

● Of 22 drug-related adverse events, all were mild (100%) and resolved rapidly and independently.

● No statistically significant negative effects on anxiety and well-being identified at any point during the three-month follow-up.

● Data shows a correlation between intensity and quality of psychedelic experience and dose levels, starting at 9mg and up to 21.5mg, across four cohorts.

● In the majority of participants, there was a positive correlation between plasma levels of DMT and the quality and intensity of the psychedelic experience.

● IV administration of SPL026 offers a short-lived, well-tolerated psychedelic experience of approximately 20 minutes, enabling a dosing session to last only approximately 30 minutes.

● Pharmacokinetic sampling supported rapid clearance out of the body, showing near undetectable DMT levels in the blood by 60 minutes at all investigated doses.

In October 2021, the Corporation initiated dosing in the Phase IIa component (Part B) of the combined Phase I/IIa clinical trial, which was completed in December 2022. Part B, the patient proof-of-concept trial assessed the efficacy, safety and tolerability of one dose versus placebo as well as one dose versus two doses of IV 21.5mg SPL026 with support therapy in 34 patients with moderate/severe MDD.

The two-staged Phase IIa study included a blinded, randomized, placebo-controlled phase, where the primary endpoint was to assess the efficacy of a single dose of SPL026 with support therapy (N=17) versus placebo with support therapy (N=17) at two-weeks post-dose. All study participants were subsequently enrolled into an open-label phase of the study where they received a single dose of SPL026 with support therapy, and were followed-up for a further 12-weeks in study. This open-label trial design enabled the assessment of durability of antidepressant effect, as well as the comparative efficacy and safety of a one versus two dose regimen of SPL026.

Efficacy was assessed using MADRS to measure any potential change in patients' depression from baseline. MADRS was assessed by independent raters who were not present at dosing and were blinded to the overall treatment.

The Phase IIa study met the primary endpoint demonstrating a statistically significant and clinically relevant reduction in depressive symptoms two-weeks following a dose of SPL026 with support therapy, compared to placebo, demonstrating a -7.4 point difference in MADRS (p=0.02). Analysis of key secondary endpoints demonstrated a rapid onset of antidepressant effect one-week post-dose, with a statistically significant difference in MADRS score between the active and placebo groups of -10.8 (p=0.002).

Across the 12-week open-label phase, patients who received at least one active dose of SPL026 with support therapy reported a durable improvement in depression symptoms with a 57% remission14 rate at 12-weeks following a single SPL026 dose with support therapy. No apparent difference in antidepressant effect was observed between a one and two dose regimen of SPL026. Further a favourable safety and tolerability profile demonstrated with no drug-related SAEs reported. All adverse events related to treatment were considered mild or moderate. The most commonly reported adverse events were infusion site pain or reaction, nausea and mild to moderate anxiety. No clinically significant safety concerns were reported, including no concerns with vital signs, electrocardiogram (ECG) or clinical laboratory findings in any treatment group.

__________________________________________

14 Defined as patients achieving a MADRS score <= 10.

Analyses of additional secondary and exploratory endpoints, including effects on self-reported depression, anxiety and wellbeing, demonstrated that patients receiving at least a single dose of IV SPL026 with support therapy experienced clinically relevant improvements in function and mood (as determined through anxiety and wellbeing scales) and patient-reported depression scores corroborated the MADRS assessments. Analysis of the 25 participants who completed the out-of-study six month follow up showed that among the 14 patients who had achieved remission within three months with SPL026, 64% sustained remission to six months.

Phase Ib SSRI-SPL026 Drug Interaction Study

In Q4 2022, the Corporation initiated a Phase Ib patient study assessing the potential interaction between SSRIs and SPL026 in patients with MDD who experienced an inadequate response to existing SSRI antidepressant treatment, with dosing completed in July 2023. This open-label study is investigating the safety, tolerability, pharmacokinetics, pharmacodynamics, as well as exploratory efficacy of SPL026, alone or in combination with SSRIs. Results from the study are expected in Q3 2023.

The last visit for the last subject completed in August 2023. Data is expected to be analyzed and disclosed to the public in Q3 2023.

Phase I IM/IV SPL026

In Q4 2022, the Corporation initiated a Phase I study to compare the safety, tolerability, PK and PD profiles of IM and IV SPL026 administration in 14 healthy volunteers. The study completed in Q2 2023 and results from this study demonstrate that IM SPL026 is well tolerated. No SAEs, and a few mild to moderate adverse events, were reported in the trial. Further, the IM drug profile delivered a mean PK half-life of approximately 40 minutes and a mean psychedelic experience duration of approximately 45 minutes. This met the Corporation's target treatment length, demonstrating the potential for IM administration as a convenient route for patients and physicians.

Phase IIb SPL026

The Corporation has advanced preparation for a potential multi-jurisdiction multi-site Phase IIb clinical trial, including selection and onboarding of a clinical research organization (a "CRO"). In July 2023, following a review of the available data from its exploratory Phase I studies across its SPL026 and SPL028 program, the Corporation determined that decisions regarding the optimal development route for the SPL026 program will be further reviewed following the conclusion of the ongoing Phase I studies.15

Regulatory Development of SPL026

In October 2021, the MHRA granted an IPD for SPL026. This designation has provided access to the ILAP, which accelerates time to market and facilitates patient access to emerging and novel treatments. The ILAP provides a single integrated platform for sustained collaborative working among the MHRA and its partners, including the UK's public body responsible for evidence-based evaluations of novel treatments, the National Institute for Health and Care Excellence, as well as the NHS England, the Scottish Medicines Consortium, NHS Improvement Health Research Authority, and the National Institute for Health Research and the medicine developer. This closer engagement potentially allows for enhanced coordination and monitoring of important product development activities culminating in market authorization. The Corporation has initiated discussions regarding its target development profile with the ILAP partners and has access to the ILAP toolkit which will help support all stages of the design, development and approvals process, as well as identify key areas for future engagement.

__________________________________________

15 Refer to footnote 2.

In 2022, the Corporation requested an International Nonproprietary Name (INN) for SPL026. A response was received from the World Health Organization in January 2023 informing the Corporation that 'dimethyltryptamine' had been chosen as the INN for this substance.

"Second-Generation" Short Duration Psychedelic Programs

Deuterated DMT: IM/IV SPL028 program

Nonclinical: Through a range of in vivo and in vitro studies, SPL028 has shown a similar pharmacological and behavioural profile to SPL026, with a differentiated pharmacokinetic profile demonstrated in vitro, showing a reduction in clearance rate and significant extension in half-life compared to SPL026. Additionally, toxicological profiling demonstrated SPL028 to have a safe and well-tolerated profile in vivo at all doses tested, demonstrating significant safety margins for progressing into human clinical trials.

CMC: The Corporation has optimized the synthesis of the API in SPL028. The proprietary synthesis developed has 99.9% purity by HPLC and approximately 42% yield. The Corporation has developed drug product formulations for IV and IM administration of SPL028. Using third party providers, the Corporation has contracted the manufacture of GMP-compliant batches of drug product, together with a matching placebo, for use in clinical trials.

Clinical: The Corporation initiated dosing in Q1 2023, a Phase I study evaluating the safety, tolerability, pharmacodynamics and pharmacokinetics of both IV and IM routes of administration of SPL028 with support therapy in healthy volunteers. Preliminary findings from the first two cohorts of the study demonstrate that IV SPL028 elicits a psychedelic experience of <1 hour and is well-tolerated. The study is ongoing with topline data from healthy volunteer cohorts expected in Q4 2023.16