0001725872

false

0001725872

2023-11-20

2023-11-20

0001725872

us-gaap:CommonStockMember

2023-11-20

2023-11-20

0001725872

BMTX:WarrantsToPurchaseCommonStockMember

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 20, 2023

BM TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38633 |

|

82-3410369 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

201 King of Prussia Road, Suite 650

Wayne, PA 19087

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (877) 327-9515

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

BMTX |

|

NYSE American LLC |

| Warrants to purchase Common Stock |

|

BMTX.W |

|

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial

Condition.

On November 20, 2023, BM Technologies,

Inc. (the “Company”) issued a press release announcing its results of operations and financial condition for the third quarter

ended September, 2023. The press release is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

The foregoing (including the

information presented in Exhibit 99.1) is being furnished pursuant to Item 2.02 and will not be deemed to be filed for purposes of Section

18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference

in any filing under the Securities Act or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BM Technologies, Inc. |

| |

|

| Dated: November 20, 2023 |

By: |

/s/ Luvleen Sidhu |

| |

|

Luvleen Sidhu |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

BM

Technologies, Inc.

BM

Technologies Reports Third Quarter & Year-to-Date 2023 Results

Year-to-Date

2023 Revenue $41.2 Million

Transfer

of Higher Education Deposits to First Carolina Bank (“FCB”) in December Expected to Result in Increased

Revenue

Radnor,

PA, November 20, 2023 — BM Technologies, Inc. (NYSE American: BMTX) (“BM Technologies”, “BMTX”, “we”,

or the “Company”), one of the largest digital banking platforms and Banking-as-a-Service (BaaS) providers in the country,

today reported results for the three and nine months ended September 30, 2023.

Luvleen

Sidhu, BMTX’s Chair, CEO, and Founder, stated, “We have begun the process of transferring customer deposits in our Higher

Education vertical to our new partner bank, FCB, which is a Durbin-exempt bank. Deposit holder notifications have been sent and we expect

the transfer will be completed on or around December 1st. Once complete, we will begin earning Durbin-exempt interchange rates

on the majority of our deposit holder’s debit card spend. This is a critical milestone in significantly improving the Company’s operating

revenues and profitability.”

Ms.

Sidhu continued, “We have spent much of 2023 strengthening our foundation and positioning the Company for growth and profitability

in 2024 and beyond. In addition to the transfer of our Higher Education customer deposits to a Durbin-exempt bank, the Profit Enhancement

Plan (“PEP”) that we began implementing in early 2023 has been providing benefits throughout the year with a currently 15%

lower Core Operating Expense base as compared to the prior year. This reduction has been achieved despite the cost of ongoing investments

in technology, operational processes, and data initiatives that are generating both short and long term value for the Company. In addition,

we see untapped growth potential in our Higher Education vertical and are doubling down on our efforts to realize this growth in future

periods. We remain excited about the Company’s future and believe the foundation setting initiatives we have begun to execute will yield

meaningful and long-term benefits to the Company and its stakeholders.”

Financial

Highlights

| ● | Operating

revenues for the three and nine months ended September 30, 2023 totaled $14.7 million and

$41.2 million, respectively. |

| ● | Q3

2023 net loss totaled $(4.0) million, or $(0.34) per diluted share, which includes a $0.4

million non-cash gain on the revaluation of the private warrant liability. Net loss for the

nine months ended September 30, 2023 totaled $(13.4) million, or $(1.16) per diluted share,

which includes a $2.4 million non-cash gain on the revaluation of the private warrant liability. |

| ● | Q3

2023 Core EBITDA (Loss)1 totaled $(0.8) million. Core EBITDA (Loss)1

for the nine months ended September 30, 2023 totaled $(3.6) million. Q3 represents the third

sequential quarter of improvement in the Company’s Core EBITDA (Loss)1. |

| ● | Liquidity

remained strong at September 30, 2023 with $8.8 million of cash, $7.4 million of working

capital, and no debt. In addition, the Company anticipates monetizing approximately $2.0

million of additional tax receivables by the end of 2023. |

[1] | Metrics

such as Core EBITDA (Loss) and Core earnings (loss) are Non-GAAP measures which exclude certain items from or add certain items to the

comparable GAAP measure; a reconciliation appears on pages 8 and 9 of this release. |

Operating

Highlights

| ● | Average

serviced deposits totaled $853 million and ending serviced deposits totaled $994 million

at September 30, 2023. |

| ● | Debit

card spend totaled $737 million in Q3 2023 and $2.2 billion in the nine months

ended September 30, 2023. |

| ● | There

were approximately 200 thousand new account sign-ups in the third quarter 2023 and over 400

thousand new account sign-ups in the first nine months of 2023. In our Higher Education vertical,

new checking account sign-ups in the third quarter improved 85% over the second quarter. |

| ● | Higher

education Organic Deposits (deposits that are not part of a school disbursement and are indicative

of primary banking behavior) for the three and nine months ended September 30, 2023 totaled

$411 million and $1.3 billion, respectively. |

Financial

Summary Table

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | | |

Current Quarter Over Prior Quarter Change | |

| (dollars in thousands) | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

$ | | |

% | |

| Interchange and card revenue | |

$ | 2,652 | | |

$ | 1,804 | | |

$ | 3,079 | | |

$ | 5,035 | | |

$ | 5,325 | | |

$ | 848 | | |

| 47 | % |

| Servicing fees | |

| 8,658 | | |

| 7,700 | | |

| 6,632 | | |

| 6,931 | | |

| 10,163 | | |

| 958 | | |

| 12 | % |

| Account fees | |

| 1,931 | | |

| 1,910 | | |

| 2,140 | | |

| 2,120 | | |

| 2,110 | | |

| 21 | | |

| 1 | % |

| University fees | |

| 1,412 | | |

| 1,373 | | |

| 1,506 | | |

| 1,328 | | |

| 1,357 | | |

| 39 | | |

| 3 | % |

| Other revenue | |

| 88 | | |

| 200 | | |

| 127 | | |

| 270 | | |

| 903 | | |

| (112 | ) | |

| (56 | )% |

| Total GAAP Operating Revenue | |

$ | 14,741 | | |

$ | 12,987 | | |

$ | 13,484 | | |

$ | 15,684 | | |

$ | 19,858 | | |

$ | 1,754 | | |

| 14 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP Operating Expense | |

$ | 19,126 | | |

$ | 18,028 | | |

$ | 19,859 | | |

$ | 23,254 | | |

$ | 24,138 | | |

$ | 1,098 | | |

| 6 | % |

| Less: restructuring, merger and acquisition related expenses | |

| — | | |

| (274 | ) | |

| (719 | ) | |

| — | | |

| — | | |

| 274 | | |

| (100 | )% |

| Less: share-based compensation expense | |

| (176 | ) | |

| (723 | ) | |

| (635 | ) | |

| (2,641 | ) | |

| (2,743 | ) | |

| 547 | | |

| (76 | )% |

| Less: depreciation and amortization | |

| (3,420 | ) | |

| (3,138 | ) | |

| (3,130 | ) | |

| (3,004 | ) | |

| (2,995 | ) | |

| (282 | ) | |

| 9 | % |

| Total Core Operating Expense | |

$ | 15,530 | | |

$ | 13,893 | | |

$ | 15,375 | | |

$ | 17,609 | | |

$ | 18,400 | | |

$ | 1,637 | | |

| 12 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Core EBITDA (Loss) | |

$ | (789 | ) | |

$ | (906 | ) | |

$ | (1,891 | ) | |

$ | (1,925 | ) | |

$ | 1,458 | | |

$ | 117 | | |

| (13 | )% |

| Core EBITDA (Loss) Margin | |

| (5 | )% | |

| (7 | )% | |

| (14 | )% | |

| (12 | )% | |

| 7 | % | |

| | | |

| | |

Business

Update

Partner

Bank Transition

On

August 20, 2023, the Company and FCB entered into an amendment to the FCB Deposit Servicing Agreement (the “FCB DPSA First Amendment”).

The FCB DPSA First Amendment, among other things, and subject to certain closing conditions, enables the Company to accelerate the process

of transferring our Higher Education deposits from Customers Bank to FCB which is a Durbin-exempt bank. Deposit holder notifications

have been sent and we expect the transfer to FCB will be completed on or around December 1, 2023.

The

transfer of our Higher Education customer deposits to FCB is expected to result in an approximately 20 basis point increase in the interchange

fees earned by the Company on Higher Education vertical spend. For the trailing twelve months ending September 30, 2023, Higher Education

vertical spend totaled approximately $2.2 billion. Had a Durbin-exempt bank partnership been in place during the second and third quarters

of 2023, the interchange revenue for our Higher Education vertical would have been approximately 50% higher on a gross basis for these

periods.

Higher

Education Vertical

During

the third quarter of 2023, the Company retained 99% of its Higher Education institutional clients and disbursed over $3.6 billion in

refunds to students. Of the $3.6 billion disbursed, approximately 13% or $465 million, was disbursed into BankMobile Vibe checking accounts

(as powered by Customers Bank).

New

Higher Education checking account sign-ups during the third quarter increased 85% over the second quarter. In addition, we continue to

see higher education student enrollment numbers rebound in the community college segment post pandemic, which is increasing our student

application flow and customer acquisition opportunities.

Higher

Education average serviced deposits and ending serviced deposits totaled $466 million and $636 million, respectively, at September

30, 2023. Deposits and spend per 90-day active account at September 30, 2023 were $1,864 and $2,267, representing increases of 15% and

22%, respectively, as compared to the second quarter.

BaaS

Vertical

In

the Company’s BaaS vertical, our API platform design allows clients to consult and collaborate with the Company as they create,

implement, and execute their embedded finance vision. Our proprietary and flexible platform enables the Company to go to market quickly,

integrate with partners easily, and add features well ahead of our competition.

Annualized

debit card spend for highly active BaaS users (those with both direct deposit and a minimum of five customer driven transactions per

month) was $18,500, and the average deposit balance per account was $1,904 at September 30, 2023. This very attractive cohort makes up

approximately 21% of active accounts at September 30, 2023, as compared to 20% in the year-ago period.

BaaS

average serviced deposits totaled $387 million at September 30, 2023 and spend per 90-day active account at September 30, 2023 increased

8% year over year.

Profit

Enhancement Plan (PEP)

The

Company continues to actively execute upon its PEP, with initiatives completed during the first nine months of 2023 that are expected

to lead to the realization of over 60% of the targeted $15 million of Core Operating Expense savings for the full year. The Company expects

to achieve its full PEP target with continuation into the first half of 2024 as certain of its cost reduction efforts have been partially

offset by investments in its technology, operational processes, and data initiatives. The full costs believed necessary to achieve the

projected annual PEP savings are expected to range from $1 million to $2 million with approximately $1.1 million incurred through September

30, 2023.

Strategic

Growth Initiatives

The

Company is investing in enhancing and unifying its technology platforms, strengthening its systems and processes, and preparing for new

product and feature rollouts as it focuses on positioning the Company to grow in a dynamic market environment.

Within

its Higher Education vertical, the Company is uniquely positioned to provide financial services to over fifteen million students annually.

Through its existing university relationships, the Company is a market leader serving approximately one third of this market. Despite

its market leadership, there remains significant untapped growth potential for the Company. As an example, less than 15% of the $11-12

billion in refund disbursements processed annually by the Company are converted to active BankMobile Vibe checking accounts. The Company

is highly focused on the rollout of additional product and service enhancements to seize this growth opportunity with resulting increased

customer adoption and lifetime value.

Highlights

of select strategic growth initiatives in our Higher Education vertical include:

| ● | Enhanced

product features from our partnership with Kard, including cash-back reward programs to customers

with expected rollout in Q1 2024. |

| ● | A

new student identity verification service, BMTX Identity Verification (IDV), where universities

can control fraud vulnerabilities during student enrollment processes and choose risk level

preferences with expected rollout in Q1 2024. |

| ● | Robust

AI tools to improve employee productivity, fraud detection, and customer service. |

The

Company is confident that continued investment in these initiatives will lead to incremental revenue opportunities, enhanced customer

experiences, and continued value creation for our stakeholders.

Earnings

Webcast

The Company will host a conference call and webcast on Monday, November

20, 2023, at 5:00 pm ET to discuss its third quarter 2023 results. The webcast can be accessed via the Company’s investor relations

site (ir.bmtxinc.com) by clicking on “Events & Presentations”, then “Events Calendar,” and following the link

under “Upcoming Events;” or directly at 3Q23 Webcast Link. A replay will be available following the call.

An updated version of BMTX’s investor presentation will be posted

on the Company’s Investor Relations website at ir.bmtxinc.com.

Contact

Information

Investors:

Jim

Dullinger, Chief Financial Officer

BM

Technologies, Inc.

jdullinger@bmtx.com

Media

Inquiries:

Brigit

Hennaman

Rubenstein

Public Relations, Inc.

bhennaman@rubensteinpr.com

About

BM Technologies, Inc.

BM

Technologies, Inc. (NYSE American: BMTX) - formerly known as BankMobile - is among the largest digital banking platforms and Banking-as-a-Service

(BaaS) providers in the country, providing access to checking and savings accounts and financial wellness. It is focused on technology,

innovation, easy-to-use products, and education with the mission to financially empower millions of Americans by providing a more affordable,

transparent, and consumer-friendly banking experience. BM Technologies, Inc. (BMTX) is a technology company and is not a bank, which

means it provides banking services through its partner banks. More information can be found at www.bmtx.com.

Forward

Looking Statements

This press release contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. In general, forward-looking

statements may be identified through the use of words such as “anticipate,” “estimate,” “expect,”

“intend,” “plan,” will,” “should,” “plan,” “continue,” “potential”

and “project” or the negative of these terms or other similar words and expressions, and in this press release, include the

expected completion date of the deposit transfer to FCB and the expected margin improvement on Durbin-exempt interchange fees from that

transfer, achievement of our PEP target as a result of the expected cost savings from the PEP, and the timing of the expected rollouts

of our cash-back rewards program and BMTX IDV. Forward-looking statements are not guarantees of future results and conditions, but rather

are subject to various risks and uncertainties. Such statements are based on Management’s current expectations and are subject to

a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements.

Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected

or suggested in such forward-looking statements as a result of various factors.

These

risks and uncertainties include, but are not limited to, general economic conditions, consumer adoption, technology and competition,

continuing interest rate volatility, the ability to enter into new partnerships, regulatory risks, risks associated with the higher education

industry and financing, and the operations and performance of the Company’s partners, including bank partners and BasS partners.

Further information regarding additional factors which could affect the forward-looking statements contained in this press release can

be found in the cautionary language included under the headings “CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS” and

“Risk Factors” in the Company’s Annual Report on Form 10-K and other documents filed with the Securities and Exchange

Commission (“SEC”). The Company’s SEC filings are available publicly on the SEC website at www.sec.gov.

Many

of these factors are beyond the Company’s ability to control or predict. If one or more events related to these or other risks

or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking

statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking

statement speaks only as of the date of this communication, and BMTX undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise, unless required by law. BMTX qualifies all forward-looking

statements by these cautionary statements.

UNAUDITED

FINANCIAL STATEMENTS

BM

TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF (LOSS) INCOME - UNAUDITED

(amounts in thousands, except per share data)

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | |

| Operating revenues: | |

| | |

| | |

| | |

| | |

| |

| Interchange and card revenue | |

$ | 2,652 | | |

$ | 1,804 | | |

$ | 3,079 | | |

$ | 5,035 | | |

$ | 5,325 | |

| Servicing fees | |

| 8,658 | | |

| 7,700 | | |

| 6,632 | | |

| 6,931 | | |

| 10,163 | |

| Account fees | |

| 1,931 | | |

| 1,910 | | |

| 2,140 | | |

| 2,120 | | |

| 2,110 | |

| University fees | |

| 1,412 | | |

| 1,373 | | |

| 1,506 | | |

| 1,328 | | |

| 1,357 | |

| Other revenue | |

| 88 | | |

| 200 | | |

| 127 | | |

| 270 | | |

| 903 | |

| Total operating revenues | |

| 14,741 | | |

| 12,987 | | |

| 13,484 | | |

| 15,684 | | |

| 19,858 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Technology, communication, and processing | |

| 8,186 | | |

| 6,364 | | |

| 7,218 | | |

| 7,230 | | |

| 7,731 | |

| Salaries and employee benefits | |

| 4,773 | | |

| 6,139 | | |

| 6,425 | | |

| 9,231 | | |

| 10,773 | |

| Professional services | |

| 2,948 | | |

| 2,338 | | |

| 2,640 | | |

| 3,501 | | |

| 2,454 | |

| Provision for operating losses | |

| 2,138 | | |

| 1,813 | | |

| 1,677 | | |

| 1,793 | | |

| 1,564 | |

| Occupancy | |

| 9 | | |

| 10 | | |

| 14 | | |

| 187 | | |

| 160 | |

| Customer related supplies | |

| 227 | | |

| 222 | | |

| 228 | | |

| 218 | | |

| 225 | |

| Advertising and promotion | |

| 128 | | |

| 125 | | |

| 118 | | |

| 302 | | |

| 242 | |

| Restructuring, merger and acquisition related expenses | |

| — | | |

| 274 | | |

| 719 | | |

| — | | |

| — | |

| Other expense | |

| 717 | | |

| 743 | | |

| 820 | | |

| 792 | | |

| 989 | |

| Total operating expenses | |

| 19,126 | | |

| 18,028 | | |

| 19,859 | | |

| 23,254 | | |

| 24,138 | |

| Loss from operations | |

| (4,385 | ) | |

| (5,041 | ) | |

| (6,375 | ) | |

| (7,570 | ) | |

| (4,280 | ) |

| Non-operating income and expense: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) on fair value of private warrant liability | |

| 433 | | |

| 595 | | |

| 1,421 | | |

| 1,151 | | |

| (1,369 | ) |

| Loss before income tax | |

| (3,952 | ) | |

| (4,446 | ) | |

| (4,954 | ) | |

| (6,419 | ) | |

| (5,649 | ) |

| Income tax expense (benefit) | |

| — | | |

| 10 | | |

| 6 | | |

| (2,234 | ) | |

| (729 | ) |

| Net loss | |

$ | (3,952 | ) | |

$ | (4,456 | ) | |

$ | (4,960 | ) | |

$ | (4,185 | ) | |

$ | (4,920 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding - basic | |

| 11,570 | | |

| 11,563 | | |

| 11,602 | | |

| 11,942 | | |

| 11,940 | |

| Weighted average number of shares outstanding - diluted | |

| 11,570 | | |

| 11,563 | | |

| 11,602 | | |

| 11,942 | | |

| 11,940 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic loss per common share | |

$ | (0.34 | ) | |

$ | (0.39 | ) | |

$ | (0.43 | ) | |

$ | (0.35 | ) | |

$ | (0.41 | ) |

| Diluted loss per common share | |

$ | (0.34 | ) | |

$ | (0.39 | ) | |

$ | (0.43 | ) | |

$ | (0.35 | ) | |

$ | (0.41 | ) |

BM

TECHNOLOGIES, INC.

CONSOLIDATED

BALANCE SHEETS — UNAUDITED

(amounts

in thousands)

| | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | |

| ASSETS | |

| | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 8,802 | | |

$ | 11,524 | | |

$ | 10,931 | | |

$ | 21,108 | | |

$ | 26,433 | |

| Accounts receivable, net allowance for doubtful accounts | |

| 8,511 | | |

| 7,083 | | |

| 7,144 | | |

| 8,260 | | |

| 8,614 | |

| Prepaid expenses and other assets | |

| 6,088 | | |

| 10,742 | | |

| 10,465 | | |

| 9,076 | | |

| 6,951 | |

| Total current assets | |

| 23,401 | | |

| 29,349 | | |

| 28,540 | | |

| 38,444 | | |

| 41,998 | |

| Premises and equipment, net | |

| 534 | | |

| 531 | | |

| 530 | | |

| 508 | | |

| 575 | |

| Developed software, net | |

| 17,668 | | |

| 19,759 | | |

| 20,631 | | |

| 22,324 | | |

| 24,025 | |

| Goodwill | |

| 5,259 | | |

| 5,259 | | |

| 5,259 | | |

| 5,259 | | |

| 5,259 | |

| Other intangibles, net | |

| 4,189 | | |

| 4,269 | | |

| 4,349 | | |

| 4,429 | | |

| 4,509 | |

| Other assets | |

| — | | |

| — | | |

| — | | |

| 72 | | |

| — | |

| Total assets | |

$ | 51,051 | | |

$ | 59,167 | | |

$ | 59,309 | | |

$ | 71,036 | | |

$ | 76,366 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 12,513 | | |

$ | 11,624 | | |

$ | 13,314 | | |

$ | 12,684 | | |

$ | 10,503 | |

| Deferred revenue, current | |

| 3,440 | | |

| 8,209 | | |

| 2,653 | | |

| 6,647 | | |

| 11,264 | |

| Total current liabilities | |

| 15,953 | | |

| 19,833 | | |

| 15,967 | | |

| 19,331 | | |

| 21,767 | |

| Non-current liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liability for private warrants | |

| 378 | | |

| 811 | | |

| 1,406 | | |

| 2,847 | | |

| 3,997 | |

| Other non-current liabilities | |

| 480 | | |

| 480 | | |

| — | | |

| — | | |

| — | |

| Total liabilities | |

$ | 16,811 | | |

$ | 21,124 | | |

$ | 17,373 | | |

$ | 22,178 | | |

$ | 25,764 | |

| Commitments and contingencies | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| Common stock | |

| 1 | | |

| 1 | | |

| 1 | | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 71,092 | | |

| 70,943 | | |

| 70,380 | | |

| 72,342 | | |

| 69,901 | |

| Accumulated deficit | |

| (36,853 | ) | |

| (32,901 | ) | |

| (28,445 | ) | |

| (23,485 | ) | |

| (19,300 | ) |

| Total shareholders’ equity | |

$ | 34,240 | | |

$ | 38,043 | | |

$ | 41,936 | | |

$ | 48,858 | | |

$ | 50,602 | |

| Total liabilities and shareholders’ equity | |

$ | 51,051 | | |

$ | 59,167 | | |

$ | 59,309 | | |

$ | 71,036 | | |

$ | 76,366 | |

NON-GAAP

FINANCIAL RECONCILIATIONS - UNAUDITED

Certain

financial measures used in this Press Release are not defined by U.S. generally accepted accounting principles (“GAAP”),

and as such, are considered non-GAAP financial measures. Core expenses and EBITDA exclude the effects of items the Company does not consider

indicative of its core operating performance, including restructuring, merger and acquisition related expenses, fair value mark to market

income or expense associated with certain warrants, and non-cash share-based compensation. Management believes the use of core revenues,

expenses, and EBITDA are appropriate to provide investors with an additional tool to evaluate the Company’s ongoing business performance.

Investors are cautioned that these non-GAAP financial measures may not be defined in the same manner by other companies and, as a result,

may not be comparable to other similarly titled measures used by other companies. Also, these non-GAAP financial measures should not

be construed as alternatives, or superior, to other measures determined in accordance with GAAP.

Reconciliation

- GAAP Operating Expenses to Core Operating Expenses (in thousands)

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP total expenses | |

$ | 19,126 | | |

$ | 18,028 | | |

$ | 19,859 | | |

$ | 23,254 | | |

$ | 24,138 | | |

$ | 57,013 | | |

$ | 69,600 | |

| Less: restructuring, merger and acquisition related expenses | |

| — | | |

| (274 | ) | |

| (719 | ) | |

| — | | |

| — | | |

| (993 | ) | |

| (290 | ) |

| Less: share-based compensation expense | |

| (176 | ) | |

| (723 | ) | |

| (635 | ) | |

| (2,641 | ) | |

| (2,743 | ) | |

| (1,534 | ) | |

| (8,715 | ) |

| Core Operating Expenses inc Dep and Amort | |

$ | 18,950 | | |

$ | 17,031 | | |

$ | 18,505 | | |

$ | 20,613 | | |

$ | 21,395 | | |

$ | 54,486 | | |

$ | 60,595 | |

| Less: depreciation and amortization | |

| 3,420 | | |

| 3,138 | | |

| 3,130 | | |

| 3,004 | | |

| 2,995 | | |

| 9,688 | | |

| 9,060 | |

| Core Operating Expenses ex. Dep and Amort | |

$ | 15,530 | | |

$ | 13,893 | | |

$ | 15,375 | | |

$ | 17,609 | | |

$ | 18,400 | | |

$ | 44,798 | | |

$ | 51,535 | |

Reconciliation

- GAAP Net Loss to Core Net Loss (in thousands, except per share data)

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (3,952 | ) | |

$ | (4,456 | ) | |

$ | (4,960 | ) | |

$ | (4,185 | ) | |

$ | (4,920 | ) | |

$ | (13,368 | ) | |

$ | 3,406 | |

| Add: (gain) loss on fair value of private warrant | |

| (433 | ) | |

| (595 | ) | |

| (1,421 | ) | |

| (1,151 | ) | |

| 1,369 | | |

| (2,449 | ) | |

| (6,916 | ) |

| Add: restructuring, merger and acquisition related expenses | |

| — | | |

| 274 | | |

| 719 | | |

| — | | |

| — | | |

| 993 | | |

| 290 | |

| Add: share-based compensation expense | |

| 176 | | |

| 723 | | |

| 635 | | |

| 2,641 | | |

| 2,743 | | |

| 1,534 | | |

| 8,715 | |

| Less: tax (@ actual ETR) on taxable non-core | |

| — | | |

| — | | |

| 1 | | |

| — | | |

| — | | |

| 1 | | |

| (85 | ) |

| Core net loss | |

$ | (4,209 | ) | |

$ | (4,054 | ) | |

$ | (5,025 | ) | |

$ | (2,695 | ) | |

$ | (808 | ) | |

$ | (13,289 | ) | |

$ | 5,410 | |

| Core diluted shares | |

| 11,570 | | |

| 11,563 | | |

| 11,602 | | |

| 11,942 | | |

| 11,940 | | |

| 11,567 | | |

| 12,215 | |

| Core diluted (loss) earnings per common share | |

$ | (0.36 | ) | |

$ | (0.35 | ) | |

$ | (0.43 | ) | |

$ | (0.23 | ) | |

$ | (0.07 | ) | |

$ | (1.15 | ) | |

$ | 0.44 | |

| GAAP diluted (loss) earnings per common share | |

$ | (0.34 | ) | |

$ | (0.39 | ) | |

$ | (0.43 | ) | |

$ | (0.35 | ) | |

$ | (0.41 | ) | |

$ | (1.16 | ) | |

$ | 0.28 | |

Reconciliation

- GAAP Net Loss to Core EBITDA (Loss) (in thousands)

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (3,952 | ) | |

$ | (4,456 | ) | |

$ | (4,960 | ) | |

$ | (4,185 | ) | |

$ | (4,920 | ) | |

$ | (13,368 | ) | |

$ | 3,406 | |

| Add: (gain) loss on fair value of private warrant liability | |

| (433 | ) | |

| (595 | ) | |

| (1,421 | ) | |

| (1,151 | ) | |

| 1,369 | | |

| (2,449 | ) | |

| (6,916 | ) |

| Add: depreciation and amortization | |

| 3,420 | | |

| 3,138 | | |

| 3,130 | | |

| 3,004 | | |

| 2,995 | | |

| 9,688 | | |

| 9,060 | |

| Add: income tax expense (benefit) | |

| — | | |

| 10 | | |

| 6 | | |

| (2,234 | ) | |

| (729 | ) | |

| 16 | | |

| 1,823 | |

| Add: restructuring, merger and acquisition related expenses | |

| — | | |

| 274 | | |

| 719 | | |

| — | | |

| — | | |

| 993 | | |

| 290 | |

| Add: share-based compensation expense | |

| 176 | | |

| 723 | | |

| 635 | | |

| 2,641 | | |

| 2,743 | | |

| 1,534 | | |

| 8,715 | |

| Core EBITDA (Loss) | |

$ | (789 | ) | |

$ | (906 | ) | |

$ | (1,891 | ) | |

$ | (1,925 | ) | |

$ | 1,458 | | |

$ | (3,586 | ) | |

$ | 16,378 | |

Key

Performance Metrics

| | |

Q3 | | |

Q2 | | |

Q1 | | |

Q4 | | |

Q3 | | |

YoY Change | |

| | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

$ | | |

% | |

| Debit card POS spend ($ millions) | |

| | |

| | |

| | |

| |

| Higher education | |

$ | 567 | | |

$ | 490 | | |

$ | 616 | | |

$ | 517 | | |

$ | 524 | | |

$ | 43 | | |

| 8 | % |

| BaaS | |

| 171 | | |

| 168 | | |

| 171 | | |

| 162 | | |

| 158 | | |

| 13 | | |

| 8 | % |

| Total POS spend | |

$ | 737 | | |

$ | 658 | | |

$ | 787 | | |

$ | 679 | | |

$ | 683 | | |

$ | 54 | | |

| 8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Serviced deposits ($ millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Higher education | |

$ | 636 | | |

$ | 408 | | |

$ | 507 | | |

$ | 369 | | |

$ | 603 | | |

$ | 33 | | |

| 5 | % |

| BaaS | |

| 357 | | |

| 439 | | |

| 575 | | |

| 765 | | |

| 967 | | |

| (610 | ) | |

| (63 | )% |

| Total Ending Deposits | |

$ | 994 | | |

$ | 848 | | |

$ | 1,082 | | |

$ | 1,134 | | |

$ | 1,570 | | |

$ | (576 | ) | |

| (37 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Higher education | |

$ | 466 | | |

$ | 429 | | |

$ | 524 | | |

$ | 483 | | |

$ | 482 | | |

$ | (16 | ) | |

| (3 | )% |

| BaaS | |

| 387 | | |

| 494 | | |

| 655 | | |

| 874 | | |

| 1,133 | | |

| (746 | ) | |

| (66 | )% |

| Total Average Deposits | |

$ | 853 | | |

$ | 922 | | |

$ | 1,179 | | |

$ | 1,357 | | |

$ | 1,615 | | |

$ | (762 | ) | |

| (47 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Higher Education Metrics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Higher education retention | |

| 99 | % | |

| 98 | % | |

| 98 | % | |

| 98 | % | |

| 99 | % | |

| | | |

| | |

| FAR(1) disbursement amount ($B) | |

$ | 3.6 | | |

$ | 1.8 | | |

$ | 4.0 | | |

$ | 1.9 | | |

$ | 3.4 | | |

$ | 0.2 | | |

| 6 | % |

| Organic deposits(2) ($M) | |

$ | 411 | | |

$ | 400 | | |

$ | 485 | | |

$ | 398 | | |

$ | 410 | | |

$ | 1 | | |

| — | % |

| (1) | FAR

disbursements are Financial Aid Refund disbursements from a higher education institution. |

| (2) | Organic

Deposits are all deposits excluding any funds disbursed directly from the school. |

10

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BMTX_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

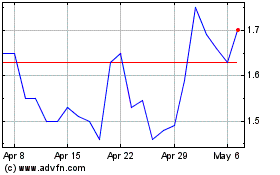

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Dec 2023 to Dec 2024