Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, is pleased to provide its Q3-2023

production results.

- Q3-2023 consolidated attributable silver production rose 17%

totalling approximately 0.39 million ounces compared with

approximately 0.33 million ounces in Q3-2022.

- Consolidated attributable silver equivalent1 production in

Q3-2023 was approximately 1.0 million ounces compared with

approximately 1.3 million ounces in Q3-2022. The reported silver

equivalent production was impacted by higher silver prices and

lower zinc prices in Q3-2023 versus Q3-2022 as the Company uses

realized quarterly prices in its calculations. These price changes

negatively impacted the silver equivalent production calculation by

approximately 0.3 million ounces in Q3-2023 compared to

Q3-2022.

- Production was negatively impacted early in the quarter by a

5-day electrical shutdown at the Galena Complex to allow necessary

hoist switchgear upgrades, as well as mobile equipment

availability. The Cosalá Operations had various mill outages

totalling 14 days due to heavy rain and tailings work.

- The Cosalá Operations has grown its ore stockpile to

approximately 25,000 tonnes from zero at the beginning of the year.

Further, mining has begun in the transition zone between the San

Rafael Upper Zone and Zone 120 with approximately 10,000 tonnes

mined to-date. The Company expects to realize an increase in silver

production in the near term due the higher-grade silver areas in

the Upper Zone and the transition zone.

- Production is expected to be the highest in Q4-2023 for

calendar 2023 with both operations now accessing their highest

silver grades for the year.

- Production guidance for 2023 remains unchanged but the Company

expects to be at lower end of both the consolidated attributable

silver production range of 2.2 and 2.6 million ounces and

consolidated attributable silver equivalent production range of 5.5

and 6.0 million ounces.

“October production has started out strongly and the Company is

confident that Q4-2023 will be its strongest silver production

quarter following a challenging operating quarter in Q3-2023,”

stated Americas President and CEO Darren Blasutti. “The Company is

undertaking numerous operating decisions to increase both its

overall silver production and its percentage of revenue generated

from silver at the two operations in the coming quarters as it is

anticipating much stronger silver prices in 2024.”

Consolidated Attributable Production*

Q3-2023

Q3-2022

% Increase (Decrease)

(Y-over-Y)

Silver Production (ounces)

0.39 Moz

0.33 Moz

17%

Zinc Production (pounds)

9.0 Mlbs

9.4 Mlbs

(5%)

Lead Production (pounds)

4.7 Mlbs

5.9 Mlbs

(20%)

Silver Equivalent Production

(ounces)

1.0 Moz

1.3 Moz

(26%)

* Silver equivalent ounces for Q3-2023 and

Q3-2022 were calculated based on silver, zinc and lead realized

prices during each respective period throughout this press release.

Guidance numbers were based on $22.00/oz silver, $1.45/lb zinc and

$1.00/lb lead.

Attributable production from the 60% owned Galena Complex was

approximately 209,000 ounces of silver and 1.8 million pounds of

lead in Q3-2023, compared to approximately 145,000 ounces of silver

and 2.1 million pounds of lead in Q3-2022. Towards the end of

Q3-2023, the Galana Complex was unable to maintain targeted ore

production due to mine mobile equipment availability. The issue has

been largely resolved and, while improvements were too late to

positively impact Q3-2023 results, October has had a strong start.

The Company has found a specialized contractor that it will engage

in November to repair the badly damaged few hundred feet of the

Galena shaft.

The Cosalá Operations produced approximately 178,000 ounces of

silver, 2.8 million pounds of lead and 9.0 million pounds of zinc

in Q3-2023, compared with approximately 186,000 ounces of silver,

3.8 million pounds of lead and 9.4 million pounds of zinc in

Q3-2022. Production during the quarter was negatively impacted by a

cumulative 14 days of lost mill operating time due to heavy

rainfall and tailings maintenance. The majority of the decrease in

silver equivalent production compared to the prior year period is a

result of 25% higher realized silver prices and 25% lower realized

zinc prices, impacting the calculation by 0.3 million ounces.

Production is expected to increase in Q4-2023 benefiting from the

higher-grade silver areas in the Upper Zone of the San Rafael mine

and stockpiled production from the Zone 120 deposit.

The Company’s production is expected to come in at the lower of

end of 2023 guidance of attributable consolidated silver equivalent

production between 5.5 and 6.0 million ounces and attributable

consolidated silver production between 2.2 and 2.6 million

ounces.

In connection with contemplated amendments to the existing

convertible debentures held by funds managed by Delbrook Capital

Advisors (“Debentures”) to provide an additional $2,000,000 in

principal amount, the Company has agreed to amend the terms of its

existing warrants held by funds managed by Delbrook Capital

Advisors and affiliates (an aggregate of 3,500,000 common share

purchase warrants, “Warrants”) to amend the exercise price from

C$0.80 per warrant to C$0.55 per Warrant, a premium of 25% to

October 27, 2023 closing price of C$0.44. The Warrants expire on

June 21, 2026, and contain customary anti-dilution provisions, as

well as customary blocker language regarding becoming a control

person without required shareholder and TSX approvals. The

amendments will be effective upon the entry into definitive

documentation, and no earlier than November 13, 2023.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%-owned Galena Complex in Idaho, USA, and is

re-evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Daren Dell,

P.Eng., Chief Operating Officer of the Company. The Company’s

current Annual Information Form and the NI 43-101 Technical Reports

for its other material mineral properties, all of which are

available on SEDAR at www.sedar.com, and EDGAR at www.sec.gov,

contain further details regarding mineral reserve and mineral

resource estimates, classification and reporting parameters, key

assumptions and associated risks for each of the Company’s material

mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ from the

requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas expectations,

intentions, plans, assumptions and beliefs with respect to, among

other things, estimated and targeted production rates and results

for gold, silver and other metals, the expected prices of gold,

silver and other metals, as well as the related costs, expenses and

capital expenditures; production from the Galena Complex, including

the expected production levels and potential additional mineral

resources thereat; the expected timing and completion of the Galena

Hoist project and the expected operational and production results

therefrom, including the anticipated improvements to the cash costs

per silver ounce and all-in sustaining costs per silver ounce at

the Galena Complex following completion; and mining and processing

operations at the Cosalá Operations continuing, including expected

production levels and the continuity of legal access for employees

and contractors; Guidance and outlook references contained in this

press release were prepared based on current mine plan assumptions

with respect to production, development, costs and capital

expenditures, the metal price assumptions disclosed herein, and

assumes no adverse impacts to operations from the COVID-19

pandemic, no further adverse impacts to the Cosalá Operations from

blockades or work stoppages for any reason, and completion of the

Galena Hoist project on its expected schedule and budget, and the

realization of the anticipated benefits therefrom, and is subject

to the risks and uncertainties outlined below. The ability to

maintain cash flow positive production at the Cosalá Operations

through meeting production targets and at the Galena Complex

through implementing the Galena Recapitalization Plan, including

the completion of the Galena Hoist project on its expected schedule

and budget, allowing the Company to generate sufficient operating

cash flows while facing market fluctuations in commodity prices and

inflationary pressures, are significant judgments in the

consolidated financial statements with respect to the Company’s

liquidity. Should the Company experience negative operating cash

flows in future periods, the Company may need to raise additional

funds through the issuance of equity or debt securities. Often, but

not always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume”

and “will” or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions,

or statements about future events or performance. Forward-looking

information is based on the opinions and estimates of Americas as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas , these risks and uncertainties include risks

relating to widespread epidemics or pandemic outbreak including the

COVID-19 pandemic, including the emergence of new strains and/or

the resurgence of COVID-19, actions that have been and may be taken

by governmental authorities to contain the COVID-19 pandemic or to

treat its impact and/or the availability, effectiveness and use of

treatments and vaccines (including the effectiveness of boosters);

the impact of COVID-19 on our workforce, suppliers and other

essential resources and what effect those impacts, if they occur,

would have on our business, including our ability to access goods

and supplies, the ability to transport our products and impacts on

employee productivity, the risks in connection with the operations,

cash flow and results of the Company relating to the unknown

duration and impact of the COVID-19 pandemic; interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

potential litigation; fluctuating mineral and commodity prices; the

ability to obtain necessary future financing on acceptable terms or

at all; the ability to operate the Company’s projects; and risks

associated with the mining industry such as economic factors

(including future commodity prices, currency fluctuations and

energy prices), ground conditions, illegal blockades and other

factors limiting mine access or regular operations without

interruption, failure of plant, equipment, processes and

transportation services to operate as anticipated, environmental

risks, government regulation, actual results of current exploration

and production activities, possible variations in ore grade or

recovery rates, permitting timelines, capital and construction

expenditures, reclamation activities, labor relations or

disruptions, social and political developments, risks associated

with generally elevated inflation and inflationary pressures, risks

related to changing global economic conditions, and market

volatility, risks relating to geopolitical instability, political

unrest, war, and other global conflicts may result in adverse

effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas filings with the Canadian

Securities Administrators on SEDAR and with the SEC. Americas does

not undertake any obligation to update publicly or otherwise revise

any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas does not give any

assurance (1) that Americas will achieve its expectations, or (2)

concerning the result or timing thereof. All subsequent written and

oral forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

1 Silver equivalent ounces for the 2023 guidance references were

calculated based on $22.00/oz silver, $1.00/lb lead and $1.45/lb

zinc throughout this press release. Silver equivalent ounces for

production in Q3-2023 and Q3-2022 were calculated based on silver,

zinc and lead realized prices during the period throughout this

press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231030280568/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708 Darren Blasutti President and CEO Americas

Gold and Silver Corporation 416‐848‐9503

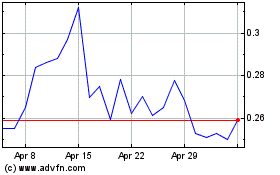

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

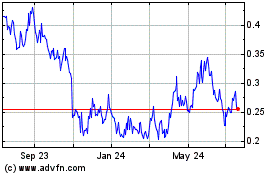

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Nov 2023 to Nov 2024