As filed with the Securities and Exchange

Commission on August 24, 2023

Registration No. 333-272037 |

| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| |

| FORM S-3 |

| REGISTRATION STATEMENT UNDER |

| THE SECURITIES ACT OF 1933 |

| |

| ABRDN PALLADIUM ETF TRUST |

| (Exact name of Registrant as specified in its charter) |

| New York |

|

26-4733157 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

| |

|

c/o abrdn ETFs Sponsor LLC

1900 Market Street, Suite 200 |

| Philadelphia, PA 19103 |

| 844-383-7289 |

| (Address, including zip code, and telephone number, including area code, |

| of Registrant’s principal executive offices) |

| |

| c/o abrdn ETFs Sponsor LLC |

| 1900 Market Street, Suite 200 |

| Philadelphia, PA 19103 |

| (844) 383-7289 |

|

(Name, address, including zip code, and telephone

number, including area code,

of agent for service) |

| |

| Copies to: |

| Thomas C. Bogle, Esq. |

| Stephanie A. Capistron, Esq. |

| Dechert LLP |

| 1900 K Street, NW |

| Washington, DC 20006 |

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering.

☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box.

☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

| Non-accelerated filer |

☐

|

Smaller reporting company

Emerging growth company |

☐

☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

☐ |

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell, we are not soliciting offers to buy, these securities in

any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED

AUGUST 24, 2023

|

Shares of abrdn Physical Palladium Shares ETF |

| |

| abrdn Palladium ETF Trust |

The abrdn Palladium ETF Trust (Trust) issues abrdn

Physical Palladium Shares ETF (Shares) which represent units of fractional undivided beneficial interest in and ownership of the Trust.

Aberdeen Standard Investments ETFs Sponsor LLC is the sponsor of the Trust (Sponsor), The Bank of New York Mellon is the trustee of the

Trust (Trustee), and JPMorgan Chase Bank, N.A. is the custodian of the Trust (Custodian). The Trust intends to issue additional Shares

on a continuous basis.

The Shares may be purchased from the Trust only

in one or more blocks of 25,000 Shares (a block of 25,000 Shares is called a Basket). The Trust issues Shares in Baskets to certain authorized

participants (Authorized Participants) on an ongoing basis as described in “Plan of Distribution.” Baskets will be offered

continuously at the net asset value (NAV) for 25,000 Shares on the day that an order to create a Basket is accepted by the Trustee. The

Trust will not issue fractions of a Basket.

The Shares trade on the NYSE Arca under the symbol

“PALL”.

Investing in the Shares involves significant

risks. See “Risk Factors” starting on page 6.

Neither the Securities and Exchange Commission

(SEC) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Shares are neither interests in nor obligations

of the Sponsor or the Trustee.

The Trust issues Shares from time to time in Baskets,

as described in “Creation and Redemption of Shares.” It is expected that the Shares will be sold to the public at varying

prices to be determined by reference to, among other considerations, the price of palladium and the trading price of the Shares on the

NYSE Arca at the time of each sale.

The date of this prospectus is August [__],

2023.

TABLE OF CONTENTS

This prospectus, including the materials incorporated

by reference herein, contains information you should consider when making an investment decision about the Shares. You may rely on the

information contained in this prospectus. The Trust and the Sponsor have not authorized any person to provide you with different information

and, if anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to

sell the Shares in any jurisdiction where the offer or sale of the Shares is not permitted.

The Shares are not registered for public sale

in any jurisdiction other than the United States.

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, and within the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements

may relate to the Trust’s financial conditions, results of operations, plans, objectives, future performance and business. Statements

preceded by, followed by or that include words such as “may,” “should,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential” or similar expressions

are intended to identify some of the forward-looking statements. All statements (other than statements of historical fact) included in

this prospectus that address activities, events or developments that will or may occur in the future, including such matters as changes

in commodity prices and market conditions (for palladium and the Shares), the Trust’s operations, the Sponsor’s plans and

references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions.

Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor made based

on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in

the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however,

is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic,

market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or

regulatory bodies, and other world economic and political developments. See “Risk Factors.” Consequently, all the forward-looking

statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results

or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences

to, or have the expected effects on, the Trust’s operations or the value of the Shares. Neither the Trust nor the Sponsor is under

a duty to update any of the forward-looking statements to conform such statements to actual results or to reflect a change in the Sponsor’s

expectations or predictions.

GLOSSARY OF DEFINED TERMS

In this prospectus, each of the following quoted

terms have the meanings set forth after such term:

“Allocated Account Agreement”—The

agreement between the Trustee and the Custodian which establishes the Trust Allocated Account. The Allocated Account Agreement and the

Unallocated Account Agreement are sometimes referred to together as the “Custody Agreements.”

“ANAV”—Adjusted NAV. See “Description

of the Trust Agreement—Valuation of Palladium, Definition of Net Asset Value and Adjusted Net Asset Value” for a description

of how the ANAV of the Trust is calculated. The ANAV of the Trust is used to calculate the fees of the Sponsor.

“Authorized Participant”—A person

who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not

required to register as a broker-dealer to engage in securities transactions, (2) is a participant in DTC, (3) has entered into an Authorized

Participant Agreement with the Trustee and the Sponsor and (4) has established an Authorized Participant Unallocated Account. Only Authorized

Participants may place orders to create or redeem one or more Baskets.

“Authorized Participant Agreement”—An

agreement entered into by each Authorized Participant, the Sponsor and the Trustee which provides the procedures for the creation and

redemption of Baskets and for the delivery of palladium and any cash required for such creations and redemptions.

“Authorized Participant Unallocated Account”—An

unallocated palladium account, either loco London or loco Zurich, established with the Custodian or a palladium clearing bank by an Authorized

Participant. Each Authorized Participant’s Authorized Participant Unallocated Account is used to facilitate the transfer of palladium

deposits and palladium redemption distributions between the Authorized Participant and the Trust in connection with the creation and redemption

of Baskets.

“Authorized Participant Unallocated Bullion

Account Agreement”—The agreement between an Authorized Participant and the Custodian or a palladium clearing bank which establishes

the Authorized Participant Unallocated Account.

“Basket”—A block of 25,000 Shares

is called a “Basket.”

“Book Entry System”—The Federal

Reserve Treasury Book Entry System for United States and federal agency securities.

“CEA”—Commodity Exchange Act

of 1936, as amended.

“CFTC”—Commodity Futures Trading

Commission, an independent agency with the mandate to regulate commodity futures, options, swaps and derivatives markets in the United

States.

“Clearing Agency”—Any clearing

agency or similar system other than the Book Entry System or DTC.

“Code”—The United States Internal

Revenue Code of 1986, as amended.

“Creation Basket Deposit”—The

total deposit required to create a Basket. The deposit will be an amount of palladium and cash, if any, that is in the same proportion

to the total assets of the Trust (net of estimated accrued but unpaid fees, expenses and other liabilities) on the date an order to purchase

one or more Baskets is properly received as the number of Shares comprising the number of Baskets to be created in respect of the deposit

bears to the total number of Shares outstanding on the date such order is properly received.

“Custodian” or “JPMorgan”—JPMorgan

Chase Bank, N.A., a national banking association and a market maker, clearer and approved weigher under the rules of the LPPM. JPMorgan

is the custodian of the Trust’s palladium.

“Custody Agreements”—The Allocated

Account Agreement together with the Unallocated Account Agreement.

“Custody Rules”—The rules, regulations,

practices and customs of the LPPM or any applicable regulatory body which apply to palladium made available in physical form by the Custodian.

“DTC”—The Depository Trust Company.

DTC is a limited purpose trust company organized under New York law, a member of the US Federal Reserve System and a clearing agency registered

with the SEC. DTC acts as the securities depository for the Shares.

“DTC Participant”—A participant

in DTC, such as a bank, broker, dealer or trust company.

“Evaluation Time”—The time

at which the Trustee evaluates the palladium held by the Trust and determines both the NAV and the ANAV of the Trust, which is currently

as promptly as practicable after 4:00 p.m., New York time, on each day other than (1) a Saturday or Sunday or (2) any day on which the

NYSE Arca is not open for regular trading.

“Exchange” or “NYSE Arca”—NYSE

Arca, Inc., the venue where Shares are listed and traded.

“FCA”—The Financial Conduct

Authority, an independent non-governmental body which exercises statutory regulatory power under the FSM Act and which regulates the major

participating members of the LPPM in the United Kingdom.

“FINRA”—The Financial Industry

Regulatory Authority, Inc.

“FSM Act”—The Financial Services

and Markets Act 2000.

“Good Delivery”—Palladium Plate

or Ingot”—Palladium in plate or ingot form with a minimum fineness and purity of 99.95% weighing between 32.151 and 192.904

troy ounces. One troy ounce equals 31.103 grams meeting the London/Zurich Good Delivery Standards.

“Indirect Participants”—Those

banks, brokers, dealers, trust companies and others who maintain, either directly or indirectly, a custodial relationship with a DTC Participant.

“LBMA”—The London Bullion Market

Association. The LBMA is the trade association that acts as the coordinator for activities conducted on behalf of its members and other

participants in the London bullion market. In addition to coordinating market activities, the LBMA acts as the principal point of contact

between the market and its regulators. A primary function of the LBMA is its involvement in the promotion of refining standards by maintenance

of the “Good Delivery List,” which is the list of LBMA accredited refiners of gold and silver. Further, the LBMA coordinates

market clearing and vaulting, promotes good trading practices and develops standard documentation.

“LME”—The London Metal Exchange.

The LME, which is owned by Hong Kong Exchanges & Clearing Ltd., was founded in 1877 and is a leading venue for the trading of industrial

metals. More than 80% of all non-ferrous metal futures business is transacted on LME platforms. As a recognized investment exchange, the

LME is regulated by the FCA. The LME administers the determination of the LME PM Fix.

“LME PM Fix”—The afternoon session

of the twice daily fix of the price of an ounce of palladium which starts at 2:00 p.m. London, England time and is performed by an electronic

pricing system (LMEbullion) administered by the LME in London in which participating members of the LPPM directly and other market participants

indirectly through participating members of the LPPM submit buying and selling orders. See “Operation of the Palladium Market”

for a description of the operation of the LME PM Fix for palladium.

“London/Zurich Good Delivery Standards”

or “Good Delivery Standards”—The specifications for weight, dimensions, fineness (or purity), identifying marks and

appearance of palladium plates and ingots as set forth in “The Good Delivery Rules for Platinum and Palladium Plates and Ingots”

published by the LPPM. The London/Zurich Good Delivery Standards as of the date of this Prospectus are described in “Operation

of the Palladium Market—The Palladium Market”.

“LPPFCL” — The London Platinum

and Palladium Fixing Company Limited. The LPPFCL had the responsibility of establishing twice each London trading day, a clearing price

or “fix” for palladium bullion transactions. As of December 1, 2014, the LPPFCL transferred ownership of the historic and

future intellectual property of the twice daily “fix” for platinum and palladium bullion transactions to a subsidiary company

of the LBMA.

“LPPM”—The London Platinum and

Palladium Market. The LPPM is the trade association that acts as the coordinator for activities conducted on behalf of its members and

other participants in the London palladium markets. In addition to coordinating market activities, the LPPM acts as the principal point

of contact between the market and its regulators. A primary function of the LPPM is its involvement in the promotion of refining standards

by maintenance of the “London/Zurich Good Delivery Lists,” which are the lists of LPPM accredited refiners and assayers of

palladium. Further, the LPPM coordinates market clearing and vaulting, promotes good trading practices and develops standard documentation.

“Marketing Agent”— ALPS Distributors,

Inc., a Colorado corporation.

“NAV”—Net asset value. See “Description

of the Trust Agreement—Valuation of Palladium, Definition of Net Asset Value and Adjusted Net Asset Value” for a description

of how the NAV of the Trust and the NAV per Share are calculated.

“NFA”—The National Futures Association,

a futures association and self-regulatory organization organized under the CEA and CFTC regulations with the mandate to regulate intermediaries

trading in futures, swaps and options.

“OTC”—The global Over-the-Counter

market for the trading of palladium which consists of transactions in spot, forwards, and options and other derivatives.

“Securities Act”—The Securities

Act of 1933, as amended.

“Shareholders”—Owners of beneficial

interests in the Shares.

“Shares”—Units of fractional

undivided beneficial interest in and ownership of the Trust which are issued by the Trust and named “abrdn Physical Palladium Shares

ETF”.

“Sponsor”—abrdn ETFs Sponsor

LLC, a Delaware limited liability company.

“Sponsor’s Fee”—The remuneration

due to the Sponsor in exchange for which the Sponsor has agreed to assume the ordinary administrative and marketing expenses that the

Trust is expected to incur. The fee accrues daily and is payable in-kind in palladium monthly in arrears.

“tonne”—One metric tonne which

is equivalent to 1,000 kilograms or 32,150.7465 troy ounces.

“Trust”—The abrdn Palladium

ETF Trust, a common law trust, formed on December 30, 2009 under New York law pursuant to the Trust Agreement.

“Trust Agreement”—The Depositary

Trust Agreement between the Sponsor and the Trustee under which the Trust is formed and which sets forth the rights and duties of the

Sponsor, the Trustee and the Custodian.

“Trust Allocated Account”—The

allocated palladium account of the Trust established with the Custodian by the Allocated Account Agreement. The Trust Allocated Account

is used to hold the palladium deposited with the Trust in allocated form (i.e., as individually identified plates and ingots of

palladium).

“Trustee” or “BNYM”—The

Bank of New York Mellon, a banking corporation organized under the laws of the State of New York with trust powers. BNYM is the trustee

of the Trust.

“Trust Unallocated Account”—The

unallocated palladium account of the Trust established with the Custodian by the Unallocated Account Agreement. The Trust Unallocated

Account is used to facilitate the transfer of palladium deposits and palladium redemption distributions between Authorized Participants

and the Trust in connection with the creation and redemption of Baskets and the sale of palladium made by the Trustee for the Trust.

“Unallocated Account Agreement”—The

agreement between the Trustee and the Custodian which establishes the Trust Unallocated Account. The Allocated Account Agreement and the

Unallocated Account Agreement are sometimes referred to together as the “Custody Agreements.”

“Zurich Sub-Custodian”—The Zurich

Sub-Custodian is any firm selected by the Custodian to hold the Trust’s palladium in the Trust Allocated Account in the firm’s

Zurich vault premises on a segregated basis and whose appointment has been approved by the Sponsor. The Custodian will use reasonable

care in selecting the Zurich Sub-Custodian. As of the date of the Custody Agreements, the Zurich Sub-Custodian selected by the Custodian

was UBS AG.

“US Shareholder”—A Shareholder

that is (1) an individual who is a citizen or resident of the United States; (2) a corporation (or other entity treated as a corporation

for US federal tax purposes) created or organized in or under the laws of the United States or any political subdivision thereof; (3)

an estate, the income of which is includible in gross income for US federal income tax purposes regardless of its source; or (4) a trust,

if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more US persons

have the authority to control all substantial decisions of the trust.

PROSPECTUS SUMMARY

This is only a summary of the prospectus and,

while it contains material information about the Trust and its Shares, it does not contain or summarize all of the information about the

Trust and the Shares contained in this prospectus which is material and/or which may be important to you. You should read this entire

prospectus, including “Risk Factors” beginning on page 6, and the materials incorporated by reference herein, before making

an investment decision about the Shares.

Trust Structure

The Trust is a common law trust, formed on December

30, 2009 under New York law pursuant to the Trust Agreement. The name of the Trust is abrdn Palladium ETF Trust (known as Aberdeen Standard

Palladium ETF Trust prior to March 31, 2022 and ETFS Palladium Trust prior to October 1, 2018). The name of the Trust’s Shares is

abrdn Physical Palladium Shares ETF (known as Aberdeen Standard Physical Palladium Shares ETF prior to March 31, 2022 and ETFS Physical

Palladium Shares prior to October 1, 2018). The Trust holds palladium and from time to time issues Baskets in exchange for deposits of

palladium and distributes palladium in connection with redemptions of Baskets. The investment objective of the Trust is for the Shares

to reflect the performance of the price of physical palladium, less the Trust’s expenses. The Sponsor believes that, for many investors,

the Shares represent a cost-effective investment in palladium. The material terms of the Trust Agreement are discussed in greater detail

under the section “Description of the Trust Agreement.” The Shares represent units of fractional undivided beneficial interest

in and ownership of the Trust and are traded under the ticker symbol “PALL” on the NYSE Arca.

The Trust’s Sponsor is abrdn ETFs Sponsor

LLC (known as Aberdeen Standard Investments ETFs Sponsor LLC prior to March 1, 2022 and ETF Securities USA LLC prior to October 1, 2018),

a Delaware limited liability company formed on June 17, 2009. Prior to April 27, 2018, the Sponsor was wholly-owned by ETF Securities

Limited, a Jersey, Channel Islands based company. Effective April 27, 2018, ETF Securities Limited sold its membership interest in the

Sponsor to abrdn Inc. (known as Aberdeen Standard Investments Inc. prior to January 1, 2022), a Delaware corporation. As a result of the

sale, abrdn Inc. became the sole member of the Sponsor. abrdn Inc. is a wholly-owned indirect subsidiary of abrdn plc, which together

with its affiliates and subsidiaries, is collectively referred to as “abrdn.” The Trust is governed by the Trust Agreement.

Under the Delaware Limited Liability Company Act and the governing documents of the Sponsor, abrdn Inc., the sole member of the Sponsor,

is not responsible for the debts, obligations and liabilities of the Sponsor solely by reason of being the sole member of the Sponsor.

The Sponsor arranged for the creation of the Trust

and is responsible for the ongoing registration of the Shares for their public offering in the United States and the listing of the Shares

on the NYSE Arca. The Sponsor has agreed to assume the organizational expenses of the Trust and the following administrative and marketing

expenses incurred by the Trust: the Trustee’s monthly fee and out-of-pocket expenses, the Custodian’s fee and expenses reimbursable

under the Custody Agreements, Exchange listing fees, SEC registration fees, printing and mailing costs, audit fees and up to $100,000

per annum in legal expenses.

The Trustee is The Bank of New York Mellon. The

Trustee is generally responsible for the day-to-day administration of the Trust. This includes (1) transferring the Trust’s palladium

as needed to pay the Sponsor’s Fee in palladium (palladium transfers for payment of the Sponsor’s Fee are expected to occur

approximately monthly in the ordinary course), (2) calculating the NAV of the Trust and the NAV per Share, (3) receiving and processing

orders from Authorized Participants to create and redeem Baskets and coordinating the processing of such orders with the Custodian and

The Depository Trust Company (“DTC”) and (4) selling the Trust’s palladium as needed to pay any extraordinary Trust

expenses that are not assumed by the Sponsor. The general role, responsibilities and regulation of the Trustee are further described in

“The Trustee.”

The Custodian is JPMorgan Chase Bank, N.A. The

Custodian is responsible for the safekeeping of the Trust’s palladium deposited with it by Authorized Participants in connection

with the creation of Baskets. The Custodian also facilitates the transfer of palladium in and out of the Trust through palladium accounts

it maintains for Authorized Participants and the Trust. The Custodian is a market maker, clearer and approved weigher of palladium under

the rules of the London Platinum and Palladium Market (“LPPM”). The Custodian holds the Trust’s loco London allocated

palladium in its London, England vaulting premises on a segregated basis and has selected the Zurich Sub-Custodian to hold the Trust’s

loco Zurich allocated palladium on the Custodian’s behalf at the Zurich Sub-Custodian’s Zurich, Switzerland vaulting premises

on a segregated basis. The general role, responsibilities and regulation of the Custodian are further described in “The Custodian”

and “Custody of the Trust’s Palladium.”

Detailed descriptions of certain specific rights

and duties of the Trustee and the Custodian are set forth in “Description of the Trust Agreement” and “Description of

the Custody Agreements.”

Trust Overview

The investment objective of the Trust is for the

Shares to reflect the performance of the price of physical palladium, less the Trust’s expenses. The Shares are designed for investors

who want a cost-effective and convenient way to invest in palladium with minimal credit risk.

The Trust is one of several exchange-traded products

(“ETPs”) that seek to track the price of physical palladium bullion (“Palladium ETPs”). Some of the distinguishing

features of the Trust and its Shares include holding of physical palladium, vaulting of Trust palladium in London or Zurich, the experience

of the Sponsor’s management team, the use of JPMorgan Chase Bank, NA as Custodian, third-party vault inspection and the allocation

of almost all of the Trust’s palladium. See “Business of the Trust.”

Investing in the Shares does not insulate the

investor from certain risks, including price volatility. See “Risk Factors.”

Principal Offices

The Trust’s office is located at 1900 Market

Street, Suite 200, Philadelphia, PA 19103 and its telephone number is 844-383-7289. The Sponsor’s office is c/o abrdn ETFs Sponsor

LLC, 1900 Market Street, Suite 200, Philadelphia, PA 19103 and its telephone number is 844-383-7289. The Trustee has a trust office at

240 Greenwich Street, New York, NY 10286. The Custodian is located at 25 Bank Street, Canary Wharf, London, E14 5JP, United Kingdom. As

of the date of this Prospectus, the Zurich Sub-Custodian that the Custodian currently uses is UBS AG, which is located at 45 Bahnhofstrasse,

8001 Zurich, Switzerland.

THE OFFERING

| |

|

|

| Offering |

The Shares represent units of fractional undivided beneficial interest in and ownership of the Trust. |

| |

|

| Use of proceeds |

Proceeds received by the Trust from the issuance and sale of Baskets, including the Shares (as described on the front page of this prospectus), consist of palladium deposits and, possibly from time to time, cash. Pursuant to the Trust Agreement, during the life of the Trust such proceeds will only be (1) held by the Trust, (2) distributed to Authorized Participants in connection with the redemption of Baskets or (3) disbursed to pay the Sponsor’s Fee or sold as needed to pay the Trust’s expenses not assumed by the Sponsor. |

| |

|

| Exchange symbol |

PALL |

| |

|

| CUSIP |

26923A106 |

| |

|

| Creation and redemption |

The Trust expects to create and redeem Shares from time to time, but only in one or more Baskets (a Basket equals a block of 25,000 Shares). The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of palladium and any cash represented by the Baskets being created or redeemed, the amount of which will be based on the combined NAV of the number of Shares included in the Baskets being created or redeemed. On December 30, 2009, the Trust’s formation date, the initial amount of palladium required for deposit with the Trust to create Shares was 5,000 ounces per Basket. The number of ounces of palladium required to create a Basket or to be delivered upon the redemption of a Basket gradually decreases over time, due to the accrual of the Trust’s expenses and the sale or delivery of the Trust’s palladium to pay the Trust’s expenses. See “Business of the Trust—Trust Expenses.” Baskets may be created or redeemed only by Authorized Participants, who pay a transaction fee to the Trustee for each order to create or redeem Baskets and may sell the Shares included in the Baskets they create to other investors. The Trust will not issue fractions of a Basket. See “Creation and Redemption of Shares” for more details. |

| |

|

| Net Asset Value |

The NAV of the Trust is the aggregate value of the Trust’s assets less its liabilities (which include estimated accrued but unpaid fees and expenses). In determining the NAV of the Trust, the Trustee values the palladium held by the Trust on the basis of the price of a troy ounce of palladium as set by the afternoon session of the twice daily fix of the price of a troy ounce of palladium which starts at 2:00 p.m. London, England time (LME PM Fix) and is performed by an electronic pricing system (LMEbullion) administered by the LME in London in which participating members of the LPPM directly and other market participants indirectly through participating members of the LPPM submit buying and selling orders. See “Operation of the Palladium Market” for a description of the operation of the LME PM Fix for palladium. The Trustee determines the NAV of the Trust on each day the NYSE Arca is open for regular trading, as promptly as practicable after 4:00 p.m. New York time. If no LME PM Fix is made on a particular evaluation day or has not been announced by 4:00 p.m. New York time on a particular evaluation day, the next most recent LME PM Fix will be used in the determination of the NAV of the Trust, unless the Sponsor determines that such price is inappropriate to use as basis for such determination. The Trustee also determines the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. |

| |

|

|

| Trust expenses |

The Trust’s only ordinary recurring charge is expected to be the remuneration due to the Sponsor (“Sponsor’s Fee”). In exchange for the Sponsor’s Fee, the Sponsor has agreed to assume the ordinary administrative and marketing expenses that the Trust is expected to incur. The Sponsor pays the costs of the Trust’s sale of the Shares, including the applicable SEC registration fees. |

| |

|

| Secondary Market Trading |

While the Trust’s investment objective is for the Shares to reflect the performance of the price of physical palladium, less the Trust’s expenses, only Authorized Participants can buy or sell Shares at NAV per Share. Shares may trade in the secondary market on the NYSE Arca at prices that are lower or higher relative to their NAV. The amount of the discount or premium in the trading price relative to the NAV per Share may be influenced by non-concurrent trading hours between the NYSE Arca and the London and Zurich palladium markets. While the Shares trade on the NYSE Arca until 4:00 p.m. New York time, liquidity in the palladium market is reduced after the close of the Commodity Exchange, Inc. (“COMEX”), a member of the CME Group of exchanges (CME Group) at 1:30 p.m. New York time. As a result, during this time, trading spreads, and the resulting premium or discount, on the Shares may widen. |

| Sponsor’s Fee |

The Sponsor’s Fee accrues daily at an annualized rate equal to 0.60% of the adjusted NAV (“ANAV”) of the Trust and is payable in-kind in palladium monthly in arrears. The Sponsor, from time to time, may waive all or a portion of the Sponsor’s Fee at its discretion for stated periods of time. The Sponsor is under no obligation to continue a waiver after the end of such stated period, and, if such waiver is not continued, the Sponsor’s Fee will thereafter be paid in full. Presently, the Sponsor does not intend to waive any of its fee. The Trustee, from time to time, delivers palladium in such quantity as may be necessary to permit payment of the Sponsor’s Fee and sells palladium in such quantity as may be necessary to permit payment in cash of Trust expenses not assumed by the Sponsor. The Trustee is authorized to sell palladium at such times and in the smallest amounts required to permit such cash payments as they become due, it being the intention to avoid or minimize the Trust’s holdings of assets other than palladium. Accordingly, the amount of palladium to be sold varies from time to time depending on the level of the Trust’s expenses and the market price palladium. See “Business of the Trust—Trust Expenses.” |

| |

|

|

| |

Each delivery or sale of palladium by the Trust to pay the Sponsor’s Fee or other expenses will be a taxable event to Shareholders. See “United States Federal Income Tax Consequences—Taxation of US Shareholders.” |

| |

|

| Termination events |

The Trustee will terminate and liquidate the Trust if one of the following events occurs: |

| • |

the Shares are delisted from the NYSE Arca and are not approved for listing on another national securities exchange within five business days of their delisting; |

| • |

Shareholders acting in respect of at least 75% of the outstanding Shares notify the Trustee that they elect to terminate the Trust; |

| • |

60 days have elapsed since the Trustee notified the Sponsor of the Trustee’s election to resign and a successor trustee has not been appointed and accepted its appointment; |

| • |

the SEC determines that the Trust is an investment company under the Investment Company Act of 1940 and the Trustee has actual knowledge of that determination; |

| • |

the aggregate market capitalization of the Trust, based on the closing price for the Shares, was less than $350 million (as adjusted for inflation by reference to the US Consumer Price Index) at any time after the first anniversary after the Trust’s formation and the Trustee receives, within six months after the last trading date on which the aggregate market capitalization of the Trust was less than $350 million, notice from the Sponsor of its decision to terminate the Trust; |

| • |

the CFTC determines that the Trust is a commodity pool under the CEA and the Trustee has actual knowledge of that determination; |

| • |

the Trust fails to qualify for treatment, or ceases to be treated, for US federal income tax purposes, as a grantor trust, and the Trustee receives notice from the Sponsor that the Sponsor determines that, because of that tax treatment or change in tax treatment, termination of the Trust is advisable; |

| • |

60 days have elapsed since DTC ceases to act as depository with respect to the Shares and the Sponsor has not identified another depository which is willing to act in such capacity; or |

| • |

the Trustee elects to terminate the Trust after the Sponsor is deemed conclusively to have resigned effective immediately as a result of the Sponsor being adjudged bankrupt or insolvent, or a receiver of the Sponsor or of its property being appointed, or a trustee or liquidator or any public officer taking charge or control of the Sponsor or of its property or affairs for the purpose of rehabilitation, conservation or liquidation. |

| |

Upon the termination of the Trust,

the Trustee will sell the Trust’s palladium and, after paying or making provision for the Trust’s liabilities, distribute

the proceeds to Shareholders surrendering Shares. See “Description of the Trust Agreement—Termination of the Trust.” |

| Authorized Participants |

Baskets may be created or redeemed only by Authorized Participants. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in DTC, (3) have entered into an agreement with the Trustee and the Sponsor (Authorized Participant Agreement) and (4) have established an unallocated palladium account with the Custodian or a physical palladium clearing bank (Authorized Participant Unallocated Account). The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of palladium and any cash required for such creations or redemptions. A list of the current Authorized Participants can be obtained from the Trustee or the Sponsor. See “Creation and Redemption of Shares” for more details. |

| |

|

| Clearance and settlement |

The Shares are evidenced by one or more global certificates that the Trustee issues to DTC. The Shares are available only in book entry form. Shareholders may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. |

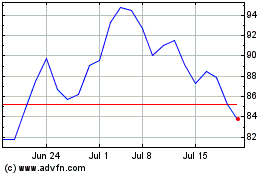

Summary of Financial Condition

As of the close of business on July 31, 2023,

the NAV of the Trust, which represents the value of the palladium deposited into and held by the Trust, was $228.959 million and the

NAV per Share was $117.415.

RISK FACTORS

You should consider carefully the risks described

below before making an investment decision. You should also refer to the other information included in this prospectus, including the

Trust’s financial statements and the related notes, as reported in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 and our subsequent Quarterly Reports on Form 10-Q, which are incorporated by reference herein.

RISKS RELATED TO PALLADIUM

The value of the Shares relates directly to

the value of the palladium held by the Trust and fluctuations in the price of palladium could materially adversely affect an investment

in the Shares.

The Shares are designed to mirror as closely

as possible the performance of the price of physical palladium, and the value of the Shares relates directly to the value of the palladium

held by the Trust, less the Trust’s liabilities (including estimated accrued but unpaid expenses). The price of physical palladium

has fluctuated widely over the past several years, as discussed below. Several factors may affect the price of palladium, including:

| • | Global palladium supply, which is influenced by such factors as production and cost levels in major palladium-producing

countries such as Russia and South Africa. Recycling, autocatalyst demand, industrial demand, jewelry demand and investment

demand are also important drivers of palladium supply and demand. Sales of existing stockpiles of palladium have been a key source of

supply in the past decade and could potentially soon be exhausted, placing a higher burden on new mine supply; |

| • | Investors’ expectations with respect to the rate of inflation; |

| • | Currency exchange rates; |

| • | Investment and trading activities of hedge funds and commodity funds; |

| • | Global or regional political, economic or financial events and situations; and |

| • | A significant change in investor interest, including in response to online campaigns or other activities

specifically targeting investments in palladium. |

In addition, investors should be aware that there

is no assurance that palladium will maintain its long-term value in terms of purchasing power in the future. In the event that the price

of palladium declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

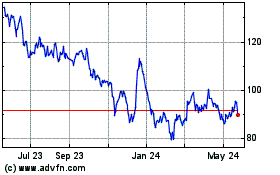

The price of physical palladium has fluctuated

widely over the past several years.

Price movements of palladium and other platinum

group metals (see “Overview of the Palladium Industry - Platinum Group Metals” for a discussion of platinum group metals)

during the first half of 2022 largely reflected the extent of exposure to Russian supply, with palladium the most affected. Over the past

five years, around 28% of combined primary and secondary palladium supplies originated from Russia, whereas this proportion is below 10%

for all the other metals. As 2022 began, palladium moved swiftly through the $2,000 per ounce level, spiking above $2,600 per ounce when

Russian troops entered Ukraine on February 24th. As the situation in Ukraine deteriorated, and widespread economic sanctions

were imposed on Russia by the West, concerns about palladium availability intensified, driving the price to new all-time records. It peaked

at $3,339 per ounce on March 7, 2022, as prices of a range of Russia-exposed commodities surged higher. Although it retreated below $2,200

per ounce later that month as concerns about liquidity abated, the delisting of Russian refiners by the LPPM on April 8th reignited

availability fears and spurred the price back above $2,500 per ounce. As a result of the LPPM decision, ingot and sponge produced by Russian

refineries since April 8, 2022 has no longer been accepted for ‘Good Delivery’ into the London and Zurich bullion market.

As availability fears began to ease, palladium fell back to trade between $1,800 and $2,200 per ounce for most of the second half of 2022.

Sentiment was affected by an increasingly gloomy economic picture, with surging inflation, rising interest rates, and slack palladium

demand from the automotive sector, although constrained primary and secondary supplies provided some support. The mood turned more negative

during December, with palladium falling through $1,800 at the year end.*

* Preceding discussion is derived from

the Johnson Matthey PGM market report May 2023.

This downward trend continued into 2023, with

the price of palladium at $1,274 per ounce as of July 31, 2023. Given palladium’s dependency on auto sales, investor fears of a

future recession have weighed on sentiment. In addition, interest rate rises have dampened investor sentiment in most precious metals.

Several factors may have the effect of causing

a decline in the prices of palladium and a corresponding decline in the price of Shares. Among them:

| • | A significant increase in palladium hedging activity by palladium producers. Should there be an increase

in the level of hedge activity of palladium producing companies, it could cause a decline in world palladium prices, adversely affecting

the price of the Shares. |

| • | A significant change in the attitude of speculators and investors towards palladium. Should the speculative

community take a negative view towards palladium, it could cause a decline in world palladium prices, negatively impacting the price of

the Shares. |

| • | A widening of interest rate differentials between the cost of money and the cost of palladium could negatively

affect the price of palladium which, in turn, could negatively affect the price of the Shares. |

| • | A combination of rising money interest rates and a continuation of the current

low cost of borrowing palladium could improve the economics of selling palladium forward. This could result in an increase in hedging

by palladium mining companies and short selling by speculative interests, which would negatively affect the price of palladium. Under

such circumstances, the price of the Shares would be similarly affected. |

Conversely, several factors may trigger a temporary

increase in the price of palladium prior to your investment in the Shares. For example, sudden increased investor interest in palladium

may cause an increase in world palladium prices, increasing the price of the Shares. If that is the case, you will be buying Shares at

prices affected by the temporarily high prices of palladium, and you may incur losses when the causes for the temporary increase disappear.

A decline in the automobile industry may have

the effect of causing a decline in the price of palladium and a corresponding decline in the price of Shares.

Autocatalysts, automobile components for emissions

control that use palladium, accounted for approximately 85% of the net global demand in palladium in 2022. Reduced automotive industry

sales may result in a decline in autocatalyst demand which may impact the price of palladium and the price of Shares.

Crises may motivate large-scale sales of palladium

which could decrease the price of palladium and adversely affect an investment in the Shares.

The possibility of large-scale distress sales

of palladium in times of crisis may have a short-term negative impact on the price of palladium and adversely affect an investment in

the Shares. For example, the 2008 financial credit crisis resulted in significantly depressed prices of palladium largely due to forced

sales and deleveraging from institutional investors such as hedge funds and pension funds as expectations of economic growth slumped.

Crises in the future may impair palladium’s price performance which would, in turn, adversely affect an investment in the Shares.

The price of palladium may be affected by the

sale of ETVs tracking the palladium markets.

To the extent existing exchange traded vehicles

(“ETVs”) tracking palladium markets represent a significant proportion of demand for physical palladium bullion, large redemptions

of the securities of these ETVs could negatively affect physical palladium bullion prices and the price and NAV of the Shares.

RISKS RELATED TO THE SHARES

The Shares and their value could decrease if

unanticipated operational or trading problems arise.

There may be unanticipated problems or issues

with respect to the mechanics of the Trust’s operations and the trading of the Shares that could have a material adverse effect

on an investment in the Shares. In addition, although the Trust is not actively “managed” by traditional methods, to the extent

that unanticipated operational or trading problems or issues arise, the Sponsor’s past experience and qualifications may not be

suitable for solving these problems or issues.

Discrepancies, disruptions or unreliability

of the LME PM Fix could impact the value of the Trust’s palladium and the market price of the Shares.

The Trustee values the Trust’s palladium

pursuant to the LME PM Fix. In the event that the LME PM Fix proves to be an inaccurate benchmark, or the LME PM Fix varies materially

from the prices determined by other mechanisms for valuing palladium, the value of the Trust’s palladium and the market price of

the Shares could be adversely impacted. Any future developments in the LME PM Fix, to the extent it has a material impact on the LME PM

Fix, could adversely impact the value of the Trust’s palladium and the market price of the Shares. It is possible that electronic

failures or other unanticipated events may occur that could result in delays in the announcement of, or the inability of the benchmark

to produce, the LME PM Fix on any given date. Furthermore, any actual or perceived disruptions that result in the perception that the

LME PM Fix is vulnerable to actual or attempted manipulation could adversely affect the behavior of market participants, which may have

an effect on the price of palladium. If the LME PM Fix is unreliable for any reason, the price of palladium and the market price for the

Shares may decline or be subject to greater volatility.

If the process of creation and redemption of

Baskets encounters any unanticipated difficulties, the possibility for arbitrage transactions intended to keep the price of the Shares

closely linked to the price of palladium may not exist and, as a result, the price of the Shares may fall.

If the processes of creation and redemption of

Shares (which depend on timely transfers of palladium to and by the Custodian) encounter any unanticipated difficulties, potential market

participants who would otherwise be willing to purchase or redeem Baskets to take advantage of any arbitrage opportunity arising from

discrepancies between the price of the Shares and the price of the underlying palladium may not take the risk that, as a result of those

difficulties, they may not be able to realize the profit they expect. If this is the case, the liquidity of Shares may decline and the

price of the Shares may fluctuate independently of the price of palladium and may fall. Additionally, redemptions could be suspended in

any period during which (1) the NYSE Arca is closed (other than customary weekend or holiday closings) or trading on the NYSE Arca is

suspended or restricted, or (2) an emergency exists as a result of which delivery, disposal or evaluation of the palladium is not reasonably

practicable.

A possible “short squeeze” due

to a sudden increase in demand of Shares that largely exceeds supply may lead to price volatility in the Shares.

Investors may purchase Shares to hedge existing

palladium exposure or to speculate on the price of palladium. Speculation on the price of palladium may involve long and short exposures.

To the extent aggregate short exposure exceeds the number of Shares available for purchase (for example, in the event that large redemption

requests by Authorized Participants dramatically affect Share liquidity), investors with short exposure may have to pay a premium to repurchase

Shares for delivery to Share lenders. Those repurchases may in turn, dramatically increase the price of the Shares until additional Shares

are created through the creation process. This is often referred to as a “short squeeze.” A short squeeze could lead to volatile

price movements in Shares that are not directly correlated to the price of palladium.

The liquidity of the Shares may be affected

by the withdrawal from participation of one or more Authorized Participants.

In the event that one or more Authorized Participants

having substantial interests in Shares or otherwise responsible for a significant portion of the Shares’ daily trading volume on

the Exchange withdraw from participation, the liquidity of the Shares will likely decrease which could adversely affect the market price

of the Shares and result in Shareholders incurring a loss on their investment.

Shareholders do not have the protections associated

with ownership of shares in an investment company registered under the Investment Company Act of 1940 or the protections afforded by the

CEA.

The Trust is not registered as an investment company

under the Investment Company Act of 1940 and is not required to register under such act. Consequently, Shareholders do not have the regulatory

protections provided to investors in investment companies. The Trust does not and will not hold or trade in commodity futures contracts,

“commodity interests” or any other instruments regulated by the CEA, as administered by the CFTC and the NFA. Furthermore,

the Trust is not a commodity pool for purposes of the CEA, and neither the Sponsor nor the Trustee is subject to regulation by the CFTC

as a commodity pool operator or a commodity trading advisor in connection with the Trust or the Shares. Consequently, Shareholders do

not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools operated by registered commodity

pool operators or advised by registered commodity trading advisors.

The Trust may be required to terminate and

liquidate at a time that is disadvantageous to Shareholders.

If the Trust is required to terminate and liquidate,

such termination and liquidation could occur at a time which is disadvantageous to Shareholders, such as when palladium prices are lower

than the palladium prices at the time when Shareholders purchased their Shares. In such a case, when the Trust’s palladium is sold

as part of the Trust’s liquidation, the resulting proceeds distributed to Shareholders will be less than if palladium prices were

higher at the time of sale.

The lack of an active trading market for the

Shares may result in losses on investment at the time of disposition of the Shares.

Although Shares are listed for trading on the

NYSE Arca, it cannot be assumed that an active trading market for the Shares will be maintained. If an investor needs to sell Shares at

a time when no active market for Shares exists, such lack of an active market will most likely adversely affect the price the investor

receives for the Shares (assuming the investor is able to sell them).

Shareholders do not have the rights enjoyed

by investors in certain other vehicles.

As interests in an investment trust, the Shares

have none of the statutory rights normally associated with the ownership of shares of a corporation (including, for example, the right

to bring “oppression” or “derivative” actions). In addition, the Shares have limited voting and distribution rights

(for example, Shareholders do not have the right to elect directors or approve amendments to the Trust Agreement and do not receive dividends).

An investment in the Shares may be adversely

affected by competition from other methods of investing in palladium.

The Trust competes with other financial vehicles,

including traditional debt and equity securities issued by companies in the palladium industry and other securities backed by or linked

to palladium, direct investments in palladium and investment vehicles similar to the Trust. Market and financial conditions, and other

conditions beyond the Sponsor’s control, may make it more attractive to invest in other financial vehicles or to invest in palladium

directly, which could limit the market for the Shares and reduce the liquidity of the Shares.

The amount of palladium represented by each

Share will decrease over the life of the Trust due to the recurring deliveries of palladium necessary to pay the Sponsor’s Fee in-kind

and potential sales of palladium to pay in cash the Trust expenses not assumed by the Sponsor. Without increases in the price of palladium

sufficient to compensate for that decrease, the price of the Shares will also decline proportionately over the life of the Trust.

The amount of palladium represented by each Share

decreases each day by the Sponsor’s Fee. In addition, although the Sponsor has agreed to assume all organizational and certain administrative

and marketing expenses incurred by the Trust (the Trustee’s monthly fee and out-of-pocket expenses, the Custodian’s fee and

reimbursement of the Custodian’s expenses under the Custody Agreements, Exchange listing fees, SEC registration fees, printing and

mailing costs, audit fees and up to $100,000 per annum in legal expenses), in exceptional cases certain Trust expenses may need to be

paid by the Trust. Because the Trust does not have any income, it must either make payments in-kind by deliveries of palladium (as is

the case with the Sponsor’s Fee) or it must sell palladium to obtain cash (as in the case of any exceptional expenses). The result

of these sales of palladium and recurring deliveries of palladium to pay the Sponsor’s Fee in-kind is a decrease in the amount of

palladium represented by each Share. New deposits of palladium, received in exchange for new Baskets issued by the Trust, will not reverse

this trend.

A decrease in the amount of palladium represented

by each Share results in a decrease in each Share’s price even if the price of palladium does not change. To retain the Share’s

original price, the price of palladium must increase. Without that increase, the lesser amount of palladium represented by the Share will

have a correspondingly lower price. If this increase does not occur, or is not sufficient to counter the lesser amount of palladium represented

by each Share, Shareholders will sustain losses on their investment in Shares.

An increase in Trust expenses not assumed by the

Sponsor, or the existence of unexpected liabilities affecting the Trust, will require the Trustee to sell larger amounts of palladium,

and will result in a more rapid decrease of the amount of palladium represented by each Share and a corresponding decrease in its value.

The sale of the Trust’s palladium to

pay expenses not assumed by the Sponsor, or unexpected liabilities affecting the Trust, at a time of low palladium prices could adversely

affect the value of the Shares.

The Trustee sells palladium held by the Trust

to pay Trust expenses not assumed by the Sponsor on an as-needed basis irrespective of then-current palladium prices. The Trust is not

actively managed and no attempt will be made to buy or sell palladium to protect against or to take advantage of fluctuations in the price

of palladium. Consequently, the Trust’s palladium may be sold at a time when the palladium price is low, resulting in the sale of

more palladium than would be required if the Trust sold when prices were higher. The sale of the Trust’s palladium to pay expenses

not assumed by the Sponsor, or unexpected liabilities affecting the Trust, at a time of low Bullion prices could adversely affect the

value of the Shares.

The value of the Shares will be adversely affected

if the Trust is required to indemnify the Sponsor or the Trustee under the Trust Agreement.

Under the Trust Agreement, each of the Sponsor

and the Trustee has a right to be indemnified from the Trust for any liability or expense it incurs without gross negligence, bad faith,

willful misconduct, willful malfeasance or reckless disregard on its part. That means the Sponsor or the Trustee may require the assets

of the Trust to be sold in order to cover losses or liability suffered by it. Any sale of that kind would reduce the NAV of the Trust

and the value of the Shares.

The Shares may trade

at a price which is at, above or below the NAV per Share and any discount or premium in the trading price relative to the NAV per Share

may widen as a result of non-concurrent trading hours between the NYSE Arca and London, Zurich and COMEX.

The Shares may trade

at, above or below the NAV per Share. The NAV per Share fluctuates with changes in the market value of the Trust’s assets. The trading

price of the Shares fluctuates in accordance with changes in the NAV per Share as well as market supply and demand. The amount of the

discount or premium in the trading price relative to the NAV per Share may be influenced by non-concurrent trading hours between the NYSE

Arca and the major palladium markets. While the Shares trade on the NYSE Arca until 4:00 p.m. New York time, liquidity in the market for

palladium will be reduced after the close of the major world palladium markets, including London, Zurich and the COMEX. As a result, during

these periods, trading spreads, and the resulting premium or discount on the Shares, may widen.

Purchasing activity

in the palladium market associated with Basket creations or selling activity following Basket redemptions may affect the price of palladium

and Share trading prices. These price changes may adversely affect an investment in the Shares.

Purchasing activity

associated with acquiring the palladium required for deposit into the Trust in connection with the creation of Baskets may temporarily

increase the market price of palladium, which will result in higher prices for the Shares. Temporary increases in the market price of

palladium may also occur as a result of the purchasing activity of other market participants. Other market participants may attempt to

benefit from an increase in the market price of palladium that may result from increased purchasing activity of palladium connected with

the issuance of Baskets. Consequently, the market price of palladium may decline immediately after Baskets are created. If the price

of palladium declines, the trading price of the Shares may also decline.

Selling activity associated

with sales of palladium withdrawn from the Trust in connection with the redemption of Baskets may temporarily decrease the market price

of palladium, which will result in lower prices for the Shares. Temporary decreases in the market price of palladium may also occur as

a result of the selling activity of other market participants. If the price of palladium declines, the trading price of the Shares may

also decline.

The Sponsor is unable

to ascertain whether the palladium price movements since the commencement of the Trust’s initial public offering on January 8, 2010

were attributable to the Trust’s Basket creation and redemption process or independent metal market forces or both. Nevertheless,

the Trust and the Sponsor cannot assure Shareholders that future Basket creations or redemptions will have no effect on the palladium

metal prices and, consequently, Share trading prices.

RISKS RELATED TO THE CUSTODY OF PALLADIUM

The Trust’s palladium may be

subject to loss, damage, theft or restriction on access.

There is a risk that part or all of the Trust’s palladium

could be lost, damaged or stolen. Access to the Trust’s palladium could also be restricted by natural events (such as an earthquake)

or human actions (such as a terrorist attack). Any of these events may adversely affect the operations of the Trust and, consequently,

an investment in the Shares.

The Trust’s lack of insurance protection

and the Shareholders’ limited rights of legal recourse against the Trust, the Trustee, the Sponsor, the Custodian, the Zurich Sub-Custodian

and any other sub-custodian exposes the Trust and its Shareholders to the risk of loss of the Trust’s palladium for which no person

is liable.

The Trust does not insure its palladium. The Custodian

maintains insurance with regard to its business on such terms and conditions as it considers appropriate in connection with its custodial

obligations and is responsible for all costs, fees and expenses arising from the insurance policy or policies. The Trust is not a beneficiary

of any such insurance and does not have the ability to dictate the existence, nature or amount of coverage. Therefore, Shareholders cannot

be assured that the Custodian maintains adequate insurance or any insurance with respect to the palladium held by the Custodian on behalf

of the Trust. In addition, the Custodian and the Trustee do not require the Zurich Sub-Custodian or any other direct or indirect sub-custodians

to be insured or bonded with respect to their custodial activities or in respect of the palladium held by them on behalf of the Trust.

Further, Shareholders’ recourse against the Trust, the Trustee and the Sponsor under New York law, the Custodian, the Zurich Sub-Custodian

and any other sub-custodian under English law, and any other sub-custodian under the law governing their custody operations is limited.

Consequently, a loss may be suffered with respect to the Trust’s palladium which is not covered by insurance and for which no person

is liable in damages.

The Custodian’s limited liability under

the Custody Agreements and English law may impair the ability of the Trust to recover losses concerning its palladium and any recovery

may be limited, even in the event of fraud, to the market value of the palladium at the time the fraud is discovered.

The liability of the Custodian is limited under

the Custody Agreements. Under the Custody Agreements between the Trustee and the Custodian which establish the Trust Unallocated Account

and the Trust Allocated Account, the Custodian is only liable for losses that are the direct result of its own negligence, fraud or willful

default in the performance of its duties. Any such liability is further limited to the market value of the palladium lost or damaged at

the time such negligence, fraud or willful default is discovered by the Custodian provided the Custodian notifies the Trust and the Trustee

promptly after the discovery of the loss or damage. Under each Authorized Participant Unallocated Bullion Account Agreement (between the

Custodian and an Authorized Participant establishing an Authorized Participant Unallocated Account), the Custodian is not contractually

or otherwise liable for any losses suffered by any Authorized Participant or Shareholder that are not the direct result of its own gross

negligence, fraud or willful default in the performance of its duties under such agreement, and in no event will its liability exceed

the market value of the balance in the Authorized Participant Unallocated Account at the time such gross negligence, fraud or willful

default is discovered by the Custodian. For any Authorized Participant Unallocated Bullion Account Agreement between an Authorized Participant

and another palladium clearing bank, the liability of the palladium clearing bank to the Authorized Participant may be greater or lesser

than the Custodian’s liability to the Authorized Participant described in the preceding sentence, depending on the terms of the

agreement. In addition, the Custodian will not be liable for any delay in performance or any non-performance of any of its obligations

under the Allocated Account Agreement, the Unallocated Account Agreement or the Authorized Participant Unallocated Bullion Account Agreement

by reason of any cause beyond its reasonable control, including acts of God, war or terrorism. As a result, the recourse of the Trustee

or a Shareholder, under English law, is limited. Furthermore, under English common law, the Custodian, the Zurich Sub-Custodian, or any

other sub-custodian will not be liable for any delay in the performance or any non-performance of its custodial obligations by reason

of any cause beyond its reasonable control.

The obligations of the Custodian, the Zurich

Sub-Custodian and any other sub-custodians are governed by English law, which may frustrate the Trust in attempting to seek legal redress

against the Custodian, the Zurich Sub-Custodian or any other sub-custodian concerning its palladium.

The obligations

of the Custodian under the Custody Agreements are, and the Authorized Participant Unallocated Bullion Account Agreements may be, governed

by English law. The Custodian has entered into arrangements with the Zurich Sub-Custodian and may enter into arrangements with any other

sub-custodians for the temporary custody of the Trust’s palladium, which arrangements may also be governed by English law. The Trust

is a New York common law trust. Any United States, New York or other court situated in the United States may have difficulty interpreting

English law (which, insofar as it relates to custody arrangements, is largely derived from court rulings rather than statute), LPPM rules

or the customs and practices in the London custody market. It may be difficult or impossible for the Trust to sue the Zurich Sub-Custodian

or any other sub-custodian in a United States, New York or other court situated in the United States. In addition, it may be difficult,

time consuming and/or expensive for the Trust to enforce in a foreign court a judgment rendered by a United States, New York or other

court situated in the United States.

Although the relationship between the Custodian

and the Zurich Sub-Custodian concerning the Trust’s allocated palladium is expressly governed by English law, a court hearing any

legal dispute concerning their arrangement may disregard that choice of law and apply Swiss law, in which case the ability of the Trust

to seek legal redress against the Zurich Sub-Custodian may be frustrated.

The obligations of the Zurich Sub-Custodian under

its arrangement with the Custodian with respect to the Trust’s allocated palladium is expressly governed by English law. Nevertheless,

a court in the United States, England or Switzerland may determine that English law should not apply and, instead, apply Swiss law to

that arrangement. Not only might it be difficult or impossible for a United States or English court to apply Swiss law to the Zurich Sub-Custodian’s

arrangement, but application of Swiss law may, among other things, alter the relative rights and obligations of the Custodian and the

Zurich Sub-Custodian to the extent that a loss to the Trust’s palladium may not have adequate or any legal redress. Further, the

ability of the Trust to seek legal redress against the Zurich Sub-Custodian may be frustrated by application of Swiss law.

The Trust may not have adequate sources of

recovery if its palladium is lost, damaged, stolen or destroyed.

If the Trust’s palladium is lost, damaged,

stolen or destroyed under circumstances rendering a party liable to the Trust, the responsible party may not have the financial resources

sufficient to satisfy the Trust’s claim. For example, as to a particular event of loss, the only source of recovery for the Trust

might be limited to the Custodian, the Zurich Sub-Custodian or any other sub-custodian or, to the extent identifiable, other responsible

third parties (e.g., a thief or terrorist), any of which may not have the financial resources (including liability insurance coverage)

to satisfy a valid claim of the Trust.

Shareholders and Authorized Participants lack

the right under the Custody Agreements to assert claims directly against the Custodian, the Zurich Sub-Custodian, and any other sub-custodian.

Neither the Shareholders nor any Authorized Participant

have a right under the Custody Agreements to assert a claim of the Trust against the Custodian, the Zurich Sub-Custodian or any other

sub-custodian. Claims under the Custody Agreements may only be asserted by the Trustee on behalf of the Trust.

The Custodian is reliant on the Zurich Sub-Custodian

for the safekeeping of all or a substantial portion of the Trust’s palladium. Furthermore, the Custodian has limited obligations

to oversee or monitor the Zurich Sub-Custodian. As a result, failure by any Zurich Sub-Custodian to exercise due care in the safekeeping

of the Trust’s palladium could result in a loss to the Trust.

Palladium generally trades on a loco London or

loco Zurich basis whereby the physical palladium is held in vaults located in London or Zurich or is transferred into accounts established

in London or Zurich. The Custodian does not have a vault in Zurich and is reliant on the Zurich Sub-Custodian for the safekeeping of all

or a substantial portion of the Trust’s allocated palladium. Other than obligations to (1) use reasonable care in appointing the

Zurich Sub-Custodian, (2) require any Zurich Sub-Custodian to segregate the palladium held by it for the Trust from any other palladium

held by it for the Custodian and any other customers of the Custodian by making appropriate entries in its books and records and (3) ensure

that the Zurich Sub-Custodian provides confirmation to the Trustee that it has undertaken to segregate the palladium held by it for the

Trust, the Custodian is not liable for the acts or omissions of the Zurich Sub-Custodian. Other than as described above, the Custodian

does not undertake to monitor the performance by the Zurich Sub-Custodian of its custody functions. The Trustee’s obligation to

monitor the performance of the Custodian is limited to receiving and reviewing the reports of the Custodian. The Trustee does not monitor

the performance of the Zurich Sub-Custodian or any other sub-custodian. In addition, the ability of the Trustee and the Sponsor to monitor

the performance of the Custodian may be limited because under the Custody Agreements, the Trustee and the Sponsor have only limited rights

to visit the premises of the Custodian or the Zurich Sub-Custodian for the purpose of examining the Trust’s palladium and certain

related records maintained by the Custodian or Zurich Sub-Custodian.

As a result of the above, any failure by any Zurich

Sub-Custodian to exercise due care in the safekeeping of the Trust’s palladium may not be detectable or controllable by the Custodian,

the Sponsor or the Trustee and could result in a loss to the Trust.

The Custodian relies on its Zurich Sub-Custodian

to hold the palladium allocated to the Trust Allocated Account and used to settle redemptions. As a result, settlement of palladium in

connection with redemptions loco London may require more than two business days.

The Custodian is reliant on its Zurich Sub-Custodian

to hold the palladium allocated to the Trust Allocated Account in order to effect redemption of Shares. As a result, in the case for redemption

orders electing palladium deliveries to be received loco London, it may take longer than two business days for palladium to be credited

to the Authorized Participant Unallocated Account, which may result in a delay of settlement of the redemption order that is settled loco

London.

Because the Trustee does not, and the Custodian

has limited obligations to, oversee or monitor the activities of sub-custodians who may hold the Trust’s palladium, failure by the

sub-custodians to exercise due care in the safekeeping of the Trust’s palladium could result in a loss to the Trust.

Under the Allocated Account Agreement, the Custodian