0001320854falseQ1--12-31http://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTaxhttp://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTaxhttp://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTaxhttp://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTaxhttp://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTaxhttp://fasb.org/us-gaap/2023#ComprehensiveIncomeNetOfTax00013208542023-01-012023-03-310001320854rail:PartsSalesMember2024-01-012024-03-310001320854rail:GilFamilyMember2023-12-310001320854rail:PartsSalesMember2023-01-012023-03-3100013208542023-12-310001320854us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-03-310001320854rail:RestrictedCashToCollateralizeStandbyLettersOfCreditMember2023-12-310001320854us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001320854us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001320854rail:RestrictedCashToCollateralizeForeignCurrencyForwardContractsMember2024-03-3100013208542022-12-310001320854us-gaap:SeriesAPreferredStockMember2023-12-310001320854country:MXus-gaap:OperatingSegmentsMember2023-12-310001320854us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001320854us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001320854us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001320854us-gaap:SeriesCPreferredStockMember2024-03-310001320854rail:CommercialSpecialtyTruckHoldingsCsthMember2023-01-012023-03-310001320854rail:DerivativeInstrumentsDesignatedAsHedgesMember2024-03-310001320854us-gaap:RetainedEarningsMember2023-03-310001320854rail:RailcarSalesMember2023-01-012023-03-310001320854rail:CashSettledStockMember2024-03-310001320854us-gaap:OperatingSegmentsMember2024-01-012024-03-310001320854us-gaap:RetainedEarningsMember2024-03-310001320854us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001320854rail:RestrictedCashToCollateralizeForeignCurrencyForwardContractsMember2023-12-310001320854srt:MaximumMember2024-01-012024-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001320854us-gaap:RetainedEarningsMember2023-01-012023-03-3100013208542024-01-012024-03-310001320854us-gaap:FairValueInputsLevel2Member2024-03-310001320854us-gaap:AdditionalPaidInCapitalMember2023-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310001320854us-gaap:OperatingSegmentsMemberrail:ManufacturingMember2023-12-310001320854us-gaap:FairValueInputsLevel2Member2023-12-3100013208542024-03-310001320854us-gaap:OperatingSegmentsMemberrail:ManufacturingMember2023-01-012023-03-310001320854us-gaap:OperatingSegmentsMember2023-12-310001320854rail:TwoThousandTwentyWarrantMember2023-12-310001320854rail:CommercialSpecialtyTruckHoldingsCsthMember2024-01-012024-03-310001320854us-gaap:CommonStockMember2022-12-310001320854us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-01-012023-03-310001320854us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001320854us-gaap:AdditionalPaidInCapitalMember2024-03-310001320854us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001320854us-gaap:OperatingSegmentsMembercountry:US2024-01-012024-03-310001320854rail:RailcarSalesMember2024-01-012024-03-310001320854srt:MaximumMember2024-03-310001320854us-gaap:OperatingSegmentsMembercountry:US2024-03-310001320854rail:TwoThousandTwentyOneWarrantMember2024-03-310001320854rail:TwoThousandTwentyTwoWarrantMember2024-03-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310001320854us-gaap:SeriesBPreferredStockMember2023-12-310001320854us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310001320854rail:TheFreightcarAmericaIncMemberrail:InducementOptionsMember2023-06-012023-06-300001320854rail:TwoThousandTwentyWarrantMember2024-01-012024-03-310001320854rail:CommercialSpecialtyTruckHoldingsCsthMember2024-03-310001320854us-gaap:RetainedEarningsMember2024-01-012024-03-310001320854us-gaap:PreferredStockMember2023-01-012023-03-310001320854rail:TwoThousandTwentyWarrantMember2024-03-310001320854us-gaap:PreferredStockMemberus-gaap:SeriesCPreferredStockMember2024-03-310001320854us-gaap:LetterOfCreditMember2024-03-310001320854us-gaap:GainLossOnDerivativeInstrumentsMember2024-01-012024-03-310001320854country:US2024-01-012024-03-310001320854us-gaap:CommonStockMember2024-03-310001320854rail:DerivativeInstrumentsDesignatedAsHedgesMember2023-12-310001320854us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001320854rail:CustomerDepositMember2023-12-310001320854country:MXus-gaap:OperatingSegmentsMember2024-01-012024-03-310001320854us-gaap:SeriesCPreferredStockMemberus-gaap:RetainedEarningsMember2024-01-012024-03-310001320854us-gaap:FairValueMeasurementsRecurringMember2024-03-310001320854us-gaap:RestrictedStockMember2024-03-3100013208542024-04-120001320854rail:FasemexMember2024-01-012024-03-310001320854us-gaap:FairValueMeasurementsNonrecurringMember2024-03-310001320854us-gaap:OperatingSegmentsMemberrail:ManufacturingMember2024-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001320854us-gaap:AdditionalPaidInCapitalMember2022-12-310001320854us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-01-012024-03-310001320854us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001320854rail:RestrictedCashToCollateralizeStandbyLettersOfCreditMember2024-03-310001320854us-gaap:OperatingSegmentsMember2024-03-310001320854rail:TwoThousandTwentyTwoWarrantMember2024-01-012024-03-310001320854rail:TimeVestedStockOptionsMember2024-03-310001320854us-gaap:CommonStockMember2024-01-012024-03-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:PensionPlansDefinedBenefitMember2023-03-310001320854us-gaap:OperatingSegmentsMembercountry:US2023-12-310001320854us-gaap:OperatingSegmentsMember2023-01-012023-03-310001320854rail:InducementOptionsMember2024-03-310001320854us-gaap:FairValueMeasurementsRecurringMember2023-12-310001320854rail:TwoThousandTwentyThreeWarrantMember2024-03-310001320854us-gaap:SeriesCPreferredStockMember2023-05-310001320854us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001320854us-gaap:RetainedEarningsMember2023-12-310001320854us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2023-12-310001320854us-gaap:CommonStockMember2023-12-310001320854rail:GilFamilyMember2024-03-310001320854rail:CommercialSpecialtyTruckHoldingsCsthMember2023-12-310001320854us-gaap:OperatingSegmentsMemberus-gaap:CorporateAndOtherMember2024-03-310001320854us-gaap:PensionPlansDefinedBenefitMember2024-03-310001320854us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001320854us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100013208542023-03-310001320854us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001320854us-gaap:RetainedEarningsMember2022-12-310001320854us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:PensionPlansDefinedBenefitMember2024-03-310001320854country:MXus-gaap:OperatingSegmentsMember2023-01-012023-03-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001320854rail:GilFamilyMember2023-01-012023-03-310001320854rail:InducementOptionsMember2024-01-012024-03-310001320854us-gaap:SeriesCPreferredStockMember2023-12-310001320854us-gaap:PensionPlansDefinedBenefitMember2023-03-310001320854us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2024-03-310001320854us-gaap:OperatingSegmentsMemberrail:ManufacturingMember2024-01-012024-03-310001320854rail:TwoThousandTwentyOneWarrantMember2023-12-310001320854us-gaap:GainLossOnDerivativeInstrumentsMember2023-01-012023-03-310001320854us-gaap:CommonStockMember2023-01-012023-03-310001320854rail:TimeVestedStockOptionsMember2024-01-012024-03-310001320854us-gaap:RestrictedStockMember2024-01-012024-03-310001320854us-gaap:SeriesAPreferredStockMember2024-03-310001320854rail:TwoThousandTwentyThreeWarrantMember2023-05-310001320854us-gaap:SeriesCPreferredStockMember2024-01-012024-03-310001320854us-gaap:PreferredStockMemberus-gaap:SeriesCPreferredStockMember2023-12-310001320854us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001320854us-gaap:AdditionalPaidInCapitalMember2023-12-310001320854rail:CustomerDepositMember2024-03-310001320854rail:TwoThousandTwentyOneWarrantMember2024-01-012024-03-310001320854us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001320854us-gaap:CommonStockMember2023-03-310001320854us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001320854us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001320854us-gaap:PreferredStockMember2024-01-012024-03-310001320854rail:TwoThousandTwentyTwoWarrantMember2023-12-310001320854us-gaap:OperatingSegmentsMembercountry:MX2024-03-310001320854us-gaap:SeriesBPreferredStockMember2024-03-310001320854us-gaap:OperatingSegmentsMembercountry:US2023-01-012023-03-310001320854rail:GilFamilyMember2024-01-012024-03-310001320854us-gaap:PreferredStockMemberus-gaap:SeriesCPreferredStockMember2024-01-012024-03-31xbrli:purexbrli:sharesrail:Segmentiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly period ended March 31, 2024

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-51237

FREIGHTCAR AMERICA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

|

25-1837219 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

125 South Wacker Drive, Suite 1500 Chicago, Illinois |

|

60606 |

(Address of principal executive offices) |

|

(Zip Code) |

(800) 458-2235

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, par value $0.01 per share |

RAIL |

The Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

|

Accelerated filer |

|

Non-accelerated filer |

|

|

Smaller reporting company |

|

|

|

|

Emerging growth company |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

As of May 1, 2024, there were 18,710,586 shares of the registrant’s common stock outstanding.

FREIGHTCAR AMERICA, INC.

INDEX TO FORM 10-Q

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

FreightCar America, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except for share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Assets |

|

|

|

Current assets |

|

|

|

|

|

|

Cash, cash equivalents and restricted cash equivalents |

|

$ |

13,977 |

|

|

$ |

40,560 |

|

Accounts receivable, net of allowance for doubtful accounts of $82 and $18 respectively |

|

|

35,040 |

|

|

|

6,408 |

|

VAT receivable |

|

|

3,959 |

|

|

|

2,926 |

|

Inventories, net |

|

|

109,778 |

|

|

|

125,022 |

|

Assets held for sale |

|

|

629 |

|

|

|

— |

|

Related party asset |

|

|

902 |

|

|

|

638 |

|

Prepaid expenses |

|

|

6,533 |

|

|

|

4,867 |

|

Total current assets |

|

|

170,818 |

|

|

|

180,421 |

|

Property, plant and equipment, net |

|

|

30,673 |

|

|

|

31,258 |

|

Railcars available for lease, net |

|

|

— |

|

|

|

2,842 |

|

Right of use asset operating lease |

|

|

2,724 |

|

|

|

2,826 |

|

Right of use asset finance lease |

|

|

39,676 |

|

|

|

40,277 |

|

Other long-term assets |

|

|

4,778 |

|

|

|

1,835 |

|

Total assets |

|

$ |

248,669 |

|

|

$ |

259,459 |

|

Liabilities, Mezzanine Equity and Stockholders’ Deficit |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts and contractual payables |

|

$ |

75,918 |

|

|

$ |

84,417 |

|

Related party accounts payable |

|

|

2,394 |

|

|

|

2,478 |

|

Accrued payroll and other employee costs |

|

|

4,975 |

|

|

|

5,738 |

|

Accrued warranty |

|

|

1,468 |

|

|

|

1,602 |

|

Current portion of long-term debt |

|

|

30,002 |

|

|

|

29,415 |

|

Other current liabilities |

|

|

7,309 |

|

|

|

13,711 |

|

Total current liabilities |

|

|

122,066 |

|

|

|

137,361 |

|

Warrant liability |

|

|

52,454 |

|

|

|

36,801 |

|

Accrued pension costs |

|

|

1,106 |

|

|

|

1,046 |

|

Lease liability operating lease, long-term |

|

|

3,038 |

|

|

|

3,164 |

|

Lease liability finance lease, long-term |

|

|

41,084 |

|

|

|

41,273 |

|

Other long-term liabilities |

|

|

2,278 |

|

|

|

2,562 |

|

Total liabilities |

|

|

222,026 |

|

|

|

222,207 |

|

Commitments and contingencies |

|

|

|

|

|

|

Mezzanine equity |

|

|

|

|

|

|

Series C Preferred stock, $0.01 par value, 85,412 shares authorized, 85,412 shares issued and outstanding at each of March 31, 2024 and December 31, 2023, respectively. Liquidation value $99,285 and $95,048 at March 31, 2024 and December 31, 2023, respectively. |

|

|

83,602 |

|

|

|

83,458 |

|

Stockholders’ deficit |

|

|

|

|

|

|

Preferred stock, $0.01 par value, 2,500,000 shares authorized (100,000 shares each

designated as Series A voting and Series B non-voting, 0 shares issued and outstanding

at March 31, 2024 and December 31, 2023) |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value, 50,000,000 shares authorized, 18,345,488 and 17,903,437

shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively |

|

|

214 |

|

|

|

210 |

|

Additional paid-in capital |

|

|

94,783 |

|

|

|

94,067 |

|

Accumulated other comprehensive income |

|

|

2,607 |

|

|

|

2,365 |

|

Accumulated deficit |

|

|

(154,563 |

) |

|

|

(142,848 |

) |

Total stockholders' deficit |

|

|

(56,959 |

) |

|

|

(46,206 |

) |

Total liabilities, mezzanine equity and stockholders’ deficit |

|

$ |

248,669 |

|

|

$ |

259,459 |

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except for share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

Revenues |

|

$ |

161,058 |

|

|

$ |

80,999 |

|

Cost of sales |

|

|

149,655 |

|

|

|

73,514 |

|

Gross profit |

|

|

11,403 |

|

|

|

7,485 |

|

Selling, general and administrative expenses |

|

|

7,493 |

|

|

|

6,388 |

|

Operating income |

|

|

3,910 |

|

|

|

1,097 |

|

Interest expense |

|

|

(2,391 |

) |

|

|

(6,600 |

) |

(Loss) gain on change in fair market value of Warrant liability |

|

|

(15,653 |

) |

|

|

613 |

|

Other expense |

|

|

(14 |

) |

|

|

(36 |

) |

Loss before income taxes |

|

|

(14,148 |

) |

|

|

(4,926 |

) |

Income tax (benefit) provision |

|

|

(2,577 |

) |

|

|

111 |

|

Net loss |

|

$ |

(11,571 |

) |

|

$ |

(5,037 |

) |

Net loss per common share – basic |

|

$ |

(0.54 |

) |

|

$ |

(0.19 |

) |

Net loss per common share – diluted |

|

$ |

(0.54 |

) |

|

$ |

(0.19 |

) |

Weighted average common shares outstanding – basic |

|

|

29,580,182 |

|

|

|

26,545,463 |

|

Weighted average common shares outstanding – diluted |

|

|

29,580,182 |

|

|

|

26,545,463 |

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Condensed Consolidated Statements of Comprehensive Loss

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(11,571 |

) |

|

$ |

(5,037 |

) |

Other comprehensive income, net of tax: |

|

|

|

|

|

|

Unrealized gain on foreign currency derivatives |

|

|

207 |

|

|

|

— |

|

Pension and postretirement liability adjustments, net of tax |

|

|

35 |

|

|

|

41 |

|

Comprehensive loss |

|

$ |

(11,329 |

) |

|

$ |

(4,996 |

) |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Condensed Consolidated Statements of Stockholders’ Deficit

(In thousands, except for share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FreightCar America Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

Mezzanine Equity |

|

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

Total |

|

|

|

Series C Preferred Stock |

|

|

|

Common Stock |

|

|

Paid-In |

|

|

Comprehensive |

|

|

Retained |

|

|

Stockholders' |

|

|

|

Shares |

|

|

Amount |

|

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

(Loss) Income |

|

|

Deficit |

|

|

Deficit |

|

Balance, December 31, 2022 |

|

|

- |

|

|

$ |

- |

|

|

|

|

17,223,306 |

|

|

$ |

203 |

|

|

$ |

89,104 |

|

|

$ |

1,022 |

|

|

$ |

(118,913 |

) |

|

$ |

(28,584 |

) |

Net loss |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,037 |

) |

|

|

(5,037 |

) |

Other comprehensive income |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

41 |

|

|

|

- |

|

|

|

41 |

|

Restricted stock awards |

|

|

- |

|

|

|

- |

|

|

|

|

309,348 |

|

|

|

3 |

|

|

|

(3 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Employee stock settlement |

|

|

- |

|

|

|

- |

|

|

|

|

(31,888 |

) |

|

|

- |

|

|

|

(106 |

) |

|

|

- |

|

|

|

- |

|

|

|

(106 |

) |

Vesting of restricted stock units |

|

|

- |

|

|

|

- |

|

|

|

|

42,815 |

|

|

|

- |

|

|

|

145 |

|

|

|

- |

|

|

|

- |

|

|

|

145 |

|

Stock-based compensation recognized |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

492 |

|

|

|

- |

|

|

|

- |

|

|

|

492 |

|

Equity Fees |

|

|

- |

|

|

|

- |

|

|

|

|

158,878 |

|

|

|

2 |

|

|

|

533 |

|

|

|

- |

|

|

|

- |

|

|

|

535 |

|

Balance, March 31, 2023 |

|

|

- |

|

|

$ |

- |

|

|

|

|

17,702,459 |

|

|

$ |

208 |

|

|

$ |

90,165 |

|

|

$ |

1,063 |

|

|

$ |

(123,950 |

) |

|

$ |

(32,514 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2023 |

|

|

85,412 |

|

|

$ |

83,458 |

|

|

|

|

17,903,437 |

|

|

$ |

210 |

|

|

$ |

94,067 |

|

|

$ |

2,365 |

|

|

$ |

(142,848 |

) |

|

$ |

(46,206 |

) |

Net loss |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(11,571 |

) |

|

|

(11,571 |

) |

Other comprehensive income |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

242 |

|

|

|

- |

|

|

|

242 |

|

Issuance of Series C preferred shares, net of issuance costs |

|

|

- |

|

|

|

144 |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(144 |

) |

|

|

(144 |

) |

Restricted stock awards |

|

|

- |

|

|

|

- |

|

|

|

|

563,455 |

|

|

|

5 |

|

|

|

(5 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Employee stock settlement |

|

|

- |

|

|

|

- |

|

|

|

|

(14,615 |

) |

|

|

- |

|

|

|

(40 |

) |

|

|

- |

|

|

|

- |

|

|

|

(40 |

) |

Forfeiture of restricted stock awards |

|

|

- |

|

|

|

- |

|

|

|

|

(106,789 |

) |

|

|

(1 |

) |

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Stock-based compensation recognized |

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

760 |

|

|

|

- |

|

|

|

- |

|

|

|

760 |

|

Balance, March 31, 2024 |

|

|

85,412 |

|

|

$ |

83,602 |

|

|

|

|

18,345,488 |

|

|

$ |

214 |

|

|

$ |

94,783 |

|

|

$ |

2,607 |

|

|

$ |

(154,563 |

) |

|

$ |

(56,959 |

) |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities |

|

|

|

Net loss |

|

$ |

(11,571 |

) |

|

$ |

(5,037 |

) |

Adjustments to reconcile net loss to net cash flows used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,396 |

|

|

|

1,072 |

|

Non-cash lease expense on right-of-use assets |

|

|

703 |

|

|

|

731 |

|

Loss (gain) on change in fair market value for Warrant liability |

|

|

15,653 |

|

|

|

(613 |

) |

Stock-based compensation recognized |

|

|

760 |

|

|

|

(91 |

) |

Non-cash interest expense |

|

|

1,539 |

|

|

|

4,264 |

|

Other non-cash items, net |

|

|

207 |

|

|

|

(1 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(28,632 |

) |

|

|

904 |

|

VAT receivable |

|

|

(999 |

) |

|

|

2,960 |

|

Inventories |

|

|

16,963 |

|

|

|

(19,698 |

) |

Related party asset, net |

|

|

(348 |

) |

|

|

(362 |

) |

Accounts and contractual payables |

|

|

(7,884 |

) |

|

|

9,695 |

|

Income taxes payable, net |

|

|

(3,937 |

) |

|

|

(517 |

) |

Lease liability |

|

|

(1,057 |

) |

|

|

(1,191 |

) |

Other assets and liabilities |

|

|

(8,115 |

) |

|

|

180 |

|

Net cash flows used in operating activities |

|

|

(25,322 |

) |

|

|

(7,704 |

) |

Cash flows from investing activities |

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(966 |

) |

|

|

(1,960 |

) |

Net cash flows used in investing activities |

|

|

(966 |

) |

|

|

(1,960 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

Borrowings on revolving line of credit |

|

|

13,037 |

|

|

|

31,688 |

|

Repayments on revolving line of credit |

|

|

(12,450 |

) |

|

|

(31,884 |

) |

Employee stock settlement |

|

|

(40 |

) |

|

|

(106 |

) |

Financing lease payments |

|

|

(842 |

) |

|

|

(147 |

) |

Net cash flows used in financing activities |

|

|

(295 |

) |

|

|

(449 |

) |

Net decrease in cash and cash equivalents |

|

|

(26,583 |

) |

|

|

(10,113 |

) |

Cash, cash equivalents and restricted cash equivalents at beginning of period |

|

|

40,560 |

|

|

|

37,912 |

|

Cash, cash equivalents and restricted cash equivalents at end of period |

|

$ |

13,977 |

|

|

$ |

27,799 |

|

Supplemental cash flow information |

|

|

|

|

|

|

Interest paid |

|

$ |

852 |

|

|

$ |

2,340 |

|

Income taxes paid |

|

$ |

403 |

|

|

$ |

151 |

|

Non-cash transactions |

|

|

|

|

|

|

Change in unpaid construction in process |

|

$ |

(155 |

) |

|

$ |

539 |

|

Accrued PIK interest paid through issuance of PIK Note |

|

$ |

— |

|

|

$ |

1,658 |

|

Issuance of equity fee |

|

$ |

— |

|

|

$ |

535 |

|

|

|

|

|

|

|

|

See Notes to Condensed Consolidated Financial Statements (Unaudited).

FreightCar America, Inc.

(Unaudited)

(In thousands, except for share and per share data and unless otherwise noted)

Note 1 – Description of the Business

FreightCar America, Inc. (“FreightCar” or the “Company”) operates primarily in North America through its direct and indirect subsidiaries, and designs and manufactures a wide range of railroad freight cars, completes railcar rebody services and railcar conversions that repurpose idled rail assets back into revenue service, supplies railcar parts, and services freight cars. The Company designs and builds high-quality railcars, including bulk commodity cars, covered hopper cars, intermodal and non-intermodal flat cars, mill gondola cars, coil steel cars, coal cars and boxcars, and also specializes in railcar repairs, complete rebody services and the conversion of railcars for re-purposed use. The Company is headquartered in Chicago, Illinois and has facilities in the following locations: Johnstown, Pennsylvania; Shanghai, People’s Republic of China; and Castaños, Coahuila, Mexico (the “Castaños Facility”).

Note 2 – Basis of Presentation

The accompanying condensed consolidated financial statements include the accounts of FreightCar America, Inc. and its subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. The foregoing financial information has been prepared in accordance with the accounting principles generally accepted in the United States of America (“GAAP”) and rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for interim financial reporting. The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the full year. The accompanying interim financial information is unaudited; however, the Company believes the financial information reflects all adjustments (consisting of items of a normal recurring nature) necessary for a fair presentation of financial position, results of operations and cash flows in conformity with GAAP. The 2023 year-end balance sheet data was derived from the audited financial statements as of December 31, 2023. Certain information and note disclosures normally included in the Company’s annual financial statements prepared in accordance with GAAP have been condensed or omitted. Certain prior year amounts have been reclassified, where necessary, to conform to the current year presentation. These interim financial statements should be read in conjunction with the audited financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Note 3 – Revenue Recognition

The following table disaggregates the Company’s revenues by major source:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Railcar sales |

|

$ |

155,597 |

|

|

$ |

76,996 |

|

Parts sales |

|

|

5,330 |

|

|

|

3,400 |

|

Revenues from contracts with customers |

|

|

160,927 |

|

|

|

80,396 |

|

Leasing revenues |

|

|

131 |

|

|

|

603 |

|

Total revenues |

|

$ |

161,058 |

|

|

$ |

80,999 |

|

Contract Balances and Accounts Receivable

Contract assets represent the Company’s rights to consideration for performance obligations that have been satisfied but for which the terms of the contract do not permit billing at the reporting date. The Company had no contract assets as of March 31, 2024 and December 31, 2023. The Company may receive cash payments from customers in advance of the Company satisfying performance obligations under its sales contracts resulting in deferred revenue or customer deposits, which are considered contract liabilities. Deferred revenue and customer deposits are classified as either current or long-term in the condensed consolidated balance sheet based on the timing of when the Company expects to recognize the related revenue. There was no deferred revenue or customer deposits as of March 31, 2024. Deferred revenue and customer deposits included in other current liabilities in the Company’s condensed consolidated balance sheet was $5,686 as of December 31, 2023 and was recognized as revenue during the three months ended March 31, 2024. The Company has also not experienced significant historical credit losses.

Performance Obligations

The Company is electing not to disclose the value of the remaining unsatisfied performance obligations with a duration of one year or less as permitted by ASU 2014-09, Revenue from Contracts with Customers. The Company had remaining unsatisfied performance obligations as of March 31, 2024 with expected duration of greater than one year of $14,850.

Note 4 – Segment Information

The Company’s operations consist of two operating segments, Manufacturing and Parts, and one reportable segment, Manufacturing. The Company’s Manufacturing segment includes new railcar manufacturing, railcar repairs, complete railcar rebody services, railcar conversions for repurposed use, and servicing railcars. The Company’s Parts operating segment is not significant for reporting purposes and has been combined with corporate and other non-operating activities as Corporate and Other.

Segment operating income is an internal performance measure used by the Company’s Chief Operating Decision Maker to assess the performance of each segment in a given period. Segment operating income includes all external revenues attributable to the segments as well as operating costs and income that management believes are directly attributable to the current production of goods and services. The Company’s internal management reporting package does not include interest revenue, interest expense or income taxes allocated to individual segments and these items are not considered as a component of segment operating income. Segment assets represent operating assets and exclude intersegment accounts, deferred tax assets and income tax receivables. The Company does not allocate cash and cash equivalents and restricted cash and restricted cash equivalents to its operating segments as the Company’s treasury function is managed at the corporate level. Intersegment revenues were not material in any period presented.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

Manufacturing |

|

$ |

155,728 |

|

|

$ |

77,599 |

|

Corporate and Other |

|

|

5,330 |

|

|

|

3,400 |

|

Consolidated revenues |

|

$ |

161,058 |

|

|

$ |

80,999 |

|

|

|

|

|

|

|

|

Operating income (loss): |

|

|

|

|

|

|

Manufacturing |

|

$ |

8,279 |

|

|

$ |

5,628 |

|

Corporate and Other |

|

|

(4,369 |

) |

|

|

(4,531 |

) |

Consolidated operating income |

|

|

3,910 |

|

|

|

1,097 |

|

Consolidated interest expense |

|

|

(2,391 |

) |

|

|

(6,600 |

) |

(Loss) gain on change in fair market value of Warrant liability |

|

|

(15,653 |

) |

|

|

613 |

|

Consolidated other expense |

|

|

(14 |

) |

|

|

(36 |

) |

Consolidated loss before income taxes |

|

$ |

(14,148 |

) |

|

$ |

(4,926 |

) |

|

|

|

|

|

|

|

Depreciation and amortization: |

|

|

|

|

|

|

Manufacturing |

|

$ |

1,273 |

|

|

$ |

932 |

|

Corporate and Other |

|

|

123 |

|

|

|

140 |

|

Consolidated depreciation and amortization |

|

$ |

1,396 |

|

|

$ |

1,072 |

|

|

|

|

|

|

|

|

Capital expenditures: |

|

|

|

|

|

|

Manufacturing |

|

$ |

921 |

|

|

$ |

1,879 |

|

Corporate and Other |

|

|

45 |

|

|

|

81 |

|

Consolidated capital expenditures |

|

$ |

966 |

|

|

$ |

1,960 |

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets: |

|

|

|

|

|

|

Manufacturing |

|

$ |

215,570 |

|

|

$ |

207,093 |

|

Corporate and Other |

|

|

28,839 |

|

|

|

51,158 |

|

Total operating assets |

|

|

244,409 |

|

|

|

258,251 |

|

Consolidated income taxes receivable |

|

|

4,260 |

|

|

|

1,208 |

|

Consolidated assets |

|

$ |

248,669 |

|

|

$ |

259,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographic Information |

|

|

|

Revenues |

|

|

Long Lived Assets(a) |

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

|

|

March 31, |

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

United States |

|

$ |

161,058 |

|

|

$ |

80,999 |

|

|

$ |

4,358 |

|

|

$ |

7,377 |

|

Mexico |

|

|

- |

|

|

|

- |

|

|

|

68,715 |

|

|

|

69,826 |

|

Total |

|

$ |

161,058 |

|

|

$ |

80,999 |

|

|

$ |

73,073 |

|

|

$ |

77,203 |

|

(a) Long lived assets include property plant and equipment, net, railcars available for lease, net, and right-of-use (ROU) assets.

Note 5 – Fair Value Measurements

The following table sets forth by level within the fair value hierarchy the Company’s financial assets that were recorded at fair value on a recurring basis and the Company’s non-financial assets that were recorded at fair value on a non-recurring basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring Fair Value Measurements |

|

As of March 31, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability |

|

$ |

- |

|

|

$ |

52,454 |

|

|

$ |

- |

|

|

$ |

52,454 |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency derivative asset |

|

$ |

- |

|

|

$ |

813 |

|

|

$ |

- |

|

|

$ |

813 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring Fair Value Measurements |

|

As of December 31, 2023 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Warrant liability |

|

$ |

- |

|

|

$ |

36,801 |

|

|

$ |

- |

|

|

$ |

36,801 |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency derivative asset |

|

$ |

- |

|

|

$ |

606 |

|

|

$ |

- |

|

|

$ |

606 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-recurring Fair Value Measurements |

|

During the Three Months Ended March 31, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Assets held for sale |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

629 |

|

|

$ |

629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-recurring Fair Value Measurements |

|

During the Year Ended December 31, 2023 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Railcars available for lease, net |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,842 |

|

|

$ |

2,842 |

|

The fair value of the Company’s Warrant liability recorded in the Company’s financial statements, determined using the quoted price of the Company’s common stock, par value $0.01 per share (the “Common Stock”), in an active market, exercise prices of $0.01 per share and $3.57 per share, and number of shares exercisable at March 31, 2024 and December 31, 2023, is a Level 2 measurement.

The fair value of the Company’s foreign currency derivative asset determined using exit prices obtained from each counterparty, which are based on currency spot and forward rates at March 31, 2024 and December 31, 2023 in an active market, is a Level 2 measurement. See Note 15 - Derivatives.

The fair value of the Company's fleet of triple hopper aggregate railcars determined using a cost plus market approach for a portion of the assets and a market-based approach for the remainder of the assets at December 31, 2023, is a Level 3 measurement. In the first quarter of 2024, the Company gained possession of these railcars. The portion of railcars intended to be sold in their current condition were classified as assets held for sale, while the remaining railcars intended to be converted into a new car type were classified as inventory as of March 31, 2024.

Note 6 – Restricted Cash

The Company establishes restricted cash balances when required by customer contracts and to collateralize standby letters of credit. The carrying value of restricted cash approximates fair value.

The Company’s restricted cash balances are as follows:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Restricted cash from customer deposit |

|

$ |

282 |

|

|

$ |

282 |

|

Restricted cash to collateralize standby letters of credit |

|

|

103 |

|

|

|

103 |

|

Restricted cash to collateralize foreign currency derivatives |

|

|

700 |

|

|

|

320 |

|

Total restricted cash and restricted cash equivalents |

|

$ |

1,085 |

|

|

$ |

705 |

|

Note 7 – Inventories

Inventories, net of reserve for excess and obsolete items, consist of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Raw materials |

|

$ |

75,249 |

|

|

$ |

65,639 |

|

Work in process |

|

|

21,703 |

|

|

|

31,138 |

|

Finished railcars |

|

|

7,712 |

|

|

|

23,196 |

|

Parts inventory |

|

|

5,114 |

|

|

|

5,049 |

|

Total inventories, net |

|

$ |

109,778 |

|

|

$ |

125,022 |

|

Inventory on the Company’s condensed consolidated balance sheets includes reserves of $1,733 and $1,594 relating to excess or slow-moving inventory for parts and raw materials at March 31, 2024 and December 31, 2023, respectively.

Note 8 – Product Warranties

Warranty terms are based on the negotiated railcar sale, rebody or conversion contract, as applicable. The Company generally warrants that new railcars produced by it will be free from defects in material and workmanship under normal use and service identified for a period of up to five years from the time of sale. Changes in the warranty reserve for the three months ended March 31, 2024 and 2023 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at the beginning of the year |

|

|

$ |

1,602 |

|

|

|

$ |

1,940 |

|

|

Current year provision |

|

|

|

169 |

|

|

|

|

251 |

|

|

Reductions for payments, costs of repairs and other |

|

|

|

(173 |

) |

|

|

|

(186 |

) |

|

Adjustments to prior warranties |

|

|

|

(130 |

) |

|

|

|

(71 |

) |

|

Balance at the end of the year |

|

|

$ |

1,468 |

|

|

|

$ |

1,934 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to prior warranties include changes in the warranty reserve for warranties issued in prior periods due to expiration of the warranty period, revised warranty cost estimates and other factors.

Note 9 – Revolving Credit Facility

Total outstanding debt under the Company’s revolving credit facility consists of $30,002 as of March 31, 2024 and $29,415 as of December 31, 2023.

As of March 31, 2024, a revolving line of credit maturing on October 31, 2024 exists in the maximum aggregate principal amount of up to $45,000, secured by a standby letter of credit in the principal amount of $25,000 and the Company’s accounts receivable. In connection with the standby letter of credit, the Company has agreed to pay an affiliate of the lender a fee due and payable in cash of $375 per quarter.

The standby letter of credit bears interest at the prime rate of interest (“Prime”) plus 1.5%, or 10% as of March 31, 2024. Advances secured by the Company’s accounts receivable bear interest at Prime plus 2%, or 10.5% as of March 31, 2024.

The fair value of debt approximates its carrying value as of March 31, 2024 and December 31, 2023.

Note 10 – Warrants

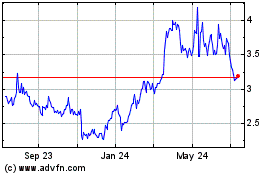

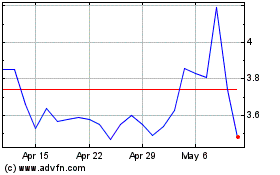

The Company issued warrants to OC III LFE II LP (“OC III LFE”) and various affiliates of OC III LFE (collectively, the “Warrantholder”) in previous years to purchase a number of shares of Common Stock equal to 23% (the “2020 Warrant”), 5% (the “2021 Warrant”), and 5% (the “2022 Warrant”) of the outstanding Common Stock (after giving effect to such issuance) on a fully-diluted basis at the time the warrants are exercised. The 2020 Warrant, 2021 Warrant, and 2022 Warrant each have a per share exercise price of $0.01 and a term of ten (10) years from date of issuance.

The 2020 Warrant, issued in November 2020, was exercisable for an aggregate of 8,644,388 and 8,712,618 shares of Common Stock as of March 31, 2024 and December 31, 2023, respectively. The 2021 Warrant, issued in December 2021, was exercisable for an aggregate of 1,879,215 and 1,894,047 shares of Common Stock as of March 31, 2024 and December 31, 2023, respectively. The 2022 Warrant, issued in April 2022, was exercisable for an aggregate of 1,879,215 and 1,894,047 shares of Common Stock as of March 31, 2024 and December 31, 2023, respectively. The Company also issued a warrant to the Warrantholder in May 2023 to purchase an aggregate of 1,636,313 shares of Common Stock (the “2023 Warrant”), exercisable for a term of ten (10) years from date of issuance with a per share exercise price of $3.57.

The 2020 Warrant, 2021 Warrant, 2022 Warrant and 2023 Warrant are collectively referred to herein as the “Warrant”. As of March 31, 2024, the Warrants is classified as a liability and subject to fair value remeasurement at each balance sheet date. The fair value of the Warrant at March 31, 2024 and December 31, 2023 was $52,454 and $36,801, respectively. The change in fair value of the Warrant is reported on a separate line in the condensed consolidated statements of operations.

Note 11 – Mezzanine Equity

In May 2023, the Company issued to OC III LFE 85,412 shares of non-convertible Series C Preferred Stock, $0.01 par value per share, with an initial stated and fair value of $85,412 or $1,000 per share (the “Preferred Stock”). As of March 31, 2024, 85,412 shares of the Preferred Stock remain issued and outstanding. The Company classifies the Preferred Stock as mezzanine equity (temporary equity outside of permanent equity) since a deemed liquidation event following a change of control may require redemption of the Preferred Stock that is not solely within the control of the Company.

The Preferred Stock ranks senior to the Common Stock with respect to payment of dividends and distribution of assets upon liquidation, dissolution and winding up. Dividends accrue at a rate of 17.5% per annum on the initial stated value of the Preferred Stock. Accrued dividends, whether or not declared, are cumulative. OC III LFE will not participate in any dividends paid to holders of Common Stock.

The Company may redeem outstanding shares of Preferred Stock at any time by payment of the initial stated value plus accrued dividends. If the Company has not redeemed all of the outstanding shares of Preferred Stock on or prior to the fourth anniversary of issuance, the dividend rate will increase by 0.5% for every quarter thereafter until redeemed in full (the “Dividend Rate Increase”). OC III LFE has the right to request the Company redeem all of the outstanding shares of Preferred Stock at any time after the sixth anniversary of issuance. If the Company does not redeem all of the outstanding shares of Preferred Stock within six months after receipt of a redemption request, OC III LFE will be entitled to certain limited voting rights.

The Preferred Stock has similar characteristics of an “Increasing Rate Security” as described by SEC Staff Accounting Bulletin Topic 5Q, Increasing Rate Preferred Stock. As a result, and as the Company has the ability to redeem all of the outstanding shares of the Preferred Stock before the occurrence of a Dividend Rate Increase, the discount on outstanding shares of Preferred Stock is considered an unstated dividend cost that is amortized over the period preceding commencement of the Dividend Rate Increase using the effective interest method, by charging imputed dividend cost against retained earnings, or additional paid in capital in the absence of retained earnings, and increasing the carrying amount of the outstanding shares of Preferred Stock by a corresponding amount. Accordingly, the discount is amortized over four years using the effective yield method. Issuance costs of $2,301 were allocated against the outstanding shares of the Preferred Stock upon issuance. The Company recognized discount amortization of $144 during the three months ended March 31, 2024. The Company did not recognize any discount amortization during the three months ended March 31, 2023.

Note 12 – Accumulated Other Comprehensive Income

The changes in accumulated other comprehensive income consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2024 |

|

Pre-Tax |

|

|

Tax |

|

|

After-Tax |

|

Pension liability activity: |

|

|

|

|

|

|

|

|

|

Reclassification adjustment for amortization of net loss (pre-tax other income) |

|

$ |

35 |

|

|

$ |

- |

|

|

$ |

35 |

|

Foreign currency derivative asset activity: |

|

|

|

|

|

|

|

|

|

Unrealized gain on foreign currency derivatives |

|

$ |

207 |

|

|

$ |

- |

|

|

$ |

207 |

|

|

|

$ |

242 |

|

|

$ |

- |

|

|

$ |

242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2023 |

|

|

|

|

|

|

|

|

|

Pension liability activity: |

|

|

|

|

|

|

|

|

|

Reclassification adjustment for amortization of net loss (pre-tax other income) |

|

$ |

41 |

|

|

$ |

- |

|

|

|

41 |

|

The components of accumulated other comprehensive income consist of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Unrecognized pension income, net of tax of $6,282 and $6,282, respectively |

|

$ |

1,794 |

|

|

$ |

1,759 |

|

Unrealized gain on foreign currency derivatives |

|

|

813 |

|

|

|

606 |

|

|

|

$ |

2,607 |

|

|

$ |

2,365 |

|

Note 13 – Stock-Based Compensation

Total stock-based compensation was $760 and $(91) for the three months ended March 31, 2024 and 2023, respectively. As of March 31, 2024, there was $2,129 of unearned compensation expense related to restricted stock awards, which will be recognized over the remaining weighted average requisite service period of 27 months. As of March 31, 2024, there was $2,057 of unearned compensation expense related to time-vested stock options, which will be recognized over the remaining requisite service period of 27 months. As of March 31, 2024, there was no unearned compensation expense related to cash settled stock appreciation rights.

In June 2023, the Company issued 300,000 inducement stock options (the “Inducement Options”) outside of The FreightCar America, Inc. 2022 Long Term Incentive Plan to one individual. As of March 31, 2024, there was $286 of unrecognized compensation expense related to the Inducement Options, which will be recognized over the remaining requisite service period of 27 months.

Note 14 – Employee Benefit Plans

The Company has a qualified, defined benefit pension plan (the “Plan”) that was established to provide benefits to certain employees. The Plan is frozen and participants are no longer accruing benefits. Generally, contributions to the Plan were not less than the minimum amounts required under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and not more than the maximum amount that can be deducted for federal income tax purposes. The Plan assets are held by an independent trustee and consist primarily of equity and fixed income securities.

The components of net periodic benefit cost (benefit) for the three months ended March 31, 2024 and 2023, are as follows:

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

Pension Benefits |

2024 |

|

|

2023 |

|

Interest cost |

$ |

135 |

|

|

$ |

151 |

|

Expected return on plan assets |

|

(75 |

) |

|

|

(81 |

) |

Amortization of unrecognized net income |

|

35 |

|

|

|

41 |

|

|

$ |

95 |

|

|

$ |

111 |

|

The Company made no contributions to its defined benefit pension plan for the three months ended March 31, 2024 and 2023. The Company expects to make no contributions to its pension plan in 2024.

The Company also maintains qualified defined contribution plans, which provide benefits to employees based on employee contributions and employee earnings with discretionary contributions allowed.

Note 15 – Derivatives

The Company’s operations and expenditures in its normal course of business are subject to opportunities and risks related to foreign currency fluctuations. The Company currently utilizes foreign currency forward contracts to protect against downward currency exposure by hedging Mexican Peso denominated expenses against the risk of volatility in foreign currency exchange rates between the Mexican Peso and the U.S. Dollar.

During 2023 and 2024, the Company entered into forward contracts to hedge the Company’s anticipated and probable Mexican Peso denominated expenses against the foreign currency rate exposure. The contracts have terms between one and 12 months and require the Company to exchange currencies at agreed-upon rates at each settlement date. The counterparties to the contracts consist of a limited number of major domestic and international financial institutions. The Company classifies these contracts as cash flow hedges in accordance with ASC 815, Derivatives and Hedging. The Company does not have any non-designated derivatives.

The Company assesses the assumed effectiveness of the contracts at each reporting period. The foreign currency derivatives are recorded on the balance sheet at fair value. The Company records unrealized gains or losses related to changes in the fair value of the forward contracts in other comprehensive income as long as the contracts are assumed to be effective. Amounts accumulated in other comprehensive income (loss) are reclassified to the condensed consolidated statements of operations on the same line as the items being hedged when the hedged item impacts earnings or upon determination that the contract is no longer assumed to be effective.

The notional amounts of outstanding foreign currency derivatives are as follows:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

Notional Amount |

|

2024 |

|

|

2023 |

|

Derivative instruments designated as hedges: |

|

|

|

|

|

|

Foreign currency derivatives |

|

$ |

10,815 |

|

|

$ |

11,562 |

|

The fair value of outstanding foreign currency derivatives designated as hedges are as follows:

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

Fair Value |

|

2024 |

|

|

2023 |

|

Prepaid expenses: |

|

|

|

|

|

|

Foreign currency derivatives |

|

$ |

813 |

|

|

$ |

606 |

|

The pre-tax realized gain on foreign currency derivatives is recognized in the condensed consolidated statements of operations as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of (Gain) Recognized |

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

Location of Realized (Gain) Recognized in the Condensed Consolidated Statements of Operations |

|

2024 |

|

|

2023 |

|

Derivative instruments designated as cash flow hedges: |

|

|

|

|

|

|

|

|

Foreign currency derivatives |

|

Cost of sales |

|

$ |

(231 |

) |

|

$ |

(3 |

) |

Note 16 – Earnings (Loss) Per Share

The weighted-average common shares outstanding are as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Numerator: |

|

|

|

|

|

|

Net loss |

|

$ |

(11,571 |

) |

|

$ |

(5,037 |

) |

Accretion of financing fees |

|

|

(144 |

) |

|

|

- |

|

Accrued dividends on Series C Preferred Stock |

|

|

(4,237 |

) |

|

|

- |

|

Net loss available to common stockholders - basic |

|

$ |

(15,952 |

) |

|

$ |

(5,037 |

) |

Net loss available to common stockholders - diluted |

|

$ |

(15,952 |

) |

|

$ |

(5,037 |

) |

Denominator: |

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

17,128,417 |

|

|

|

16,792,292 |

|

Issuance of Warrants |

|

|

12,451,765 |

|

|

|

9,753,171 |

|

Weighted average common shares outstanding - basic |

|

|

29,580,182 |

|

|

|

26,545,463 |

|

Weighted average common shares outstanding - diluted |

|

|

29,580,182 |

|

|

|

26,545,463 |

|

The Company computes earnings per share using the two-class method, which is an earnings allocation formula that determines earnings per share for Common Stock and participating securities. The Company’s participating securities are its grants of restricted stock which contain non-forfeitable rights to dividends. The Company allocates earnings between both classes; however, in periods of undistributed losses, they are only allocated to common shares as the unvested restricted stockholders do not contractually participate in losses of the Company. The Company computes basic earnings per share by dividing net income allocated to common shareholders by the weighted average number of shares outstanding during the period. Warrants issued in connection with the Company's long-term debt were issued at a nominal exercise price and are considered outstanding at the date of issuance. The 2023 Warrant was issued out-of-the money and the Company will apply the treasury stock method to the 2023 Warrant when computing earnings per share. Diluted earnings per share is calculated to give effect to all potentially dilutive common shares that were outstanding during the period. Weighted average diluted common shares outstanding include the incremental shares that would be issued upon the assumed exercise of stock options and the assumed vesting of nonvested share awards. For the three months ended March 31, 2024 and 2023, 4,781,274 and 2,086,898 shares, respectively, were not included in the weighted average common shares outstanding calculation as they were anti-dilutive.

Note 17 – Related Parties

The following persons are owners of Fabricaciones y Servicios de México, S.A. de C.V. (“Fasemex”): Jesús Gil, a director of the Company and former VP, Operations; and Alejandro Gil and Salvador Gil, siblings of Jesús Gil. Fasemex owns approximately 10.6% of the outstanding shares of Common Stock as of March 31, 2024 and provides steel fabrication services to the Company. The lessors of the Castaños Facility are Jesús Gil, Alejandro Gil, and Salvador Gil. Distribuciones Industriales JAS S.A. de C.V. (“DI”) is owned by Alejandro Gil and Salvador Gil and provides material and safety supplies to the Company. Maquinaria y equipo de transporte Jova S.A. de C.V (“METJ”) is owned by Jorge Gil, a sibling of Jesús Gil, and provides trucking services to the Company. Fasemex, DI, METJ, Jesús Gil, Alejandro Gil, Salvador Gil, and Jorge Gil are collectively referred to as the “Gil Family”.

The Company paid $7,647 and $5,636 to the Gil Family during the three months ended March 31, 2024 and 2023, respectively, related to steel fabrication services, rent and security deposit payments for the Castaños Facility, material and safety supplies, trucking services and royalty payments.

Commercial Specialty Truck Holdings, LLC (“CSTH”) is minority owned by James R. Meyer, a member of our Board, our former CEO, and beneficial owner of over 5% of our Common Stock. The Company sold specialty parts supplies in an amount equal to $208 to CSTH during the three months ended March 31, 2024. The Company sold no specialty parts supplies to CSTH during the three months ended March 31, 2023.

Related party asset on the condensed consolidated balance sheet of $902 as of March 31, 2024 includes other receivables of $188 from CSTH and other assets of $714 from the Gil Family. Related party accounts payable on the condensed consolidated balance sheet of $2,394 as of March 31, 2024 is payable to the Gil Family. Related party asset on the condensed consolidated balance sheet of $638 as of December 31, 2023 includes other receivables of $517 from the Gil Family and $121 from CSTH. Related party accounts payable on the condensed consolidated balance sheet of $2,478 as of December 31, 2023 is payable to the Gil Family.

Note 18 – Income Taxes

The Company’s tax provision for interim periods is determined using an estimate of its annual effective tax rate, adjusted for discrete items. The Company’s reported effective income tax rate was 18.2% and (2.3)% for the three months ended March 31, 2024 and 2023, respectively. The effective tax rate of 18.2% for the three months ended March 31, 2024 was higher than the effective tax rate for the three months ended March 31, 2023 primarily due to an increase in the mix of forecasted earnings and permanent items. The effective tax rate for the first quarter of 2024 varies from the U.S. statutory tax rate of 21% primarily due to earnings from international jurisdictions and permanent differences, predominantly Mexico, taxed at higher tax rates and a full valuation allowance in the U.S. The effective tax rate for the first quarter of 2023 was lower than the 21% U.S. statutory tax rate primarily due to earnings from international jurisdictions and permanent differences and discrete events, predominantly Mexico, taxed at higher tax rates and a full valuation allowance in the U.S.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS