U.S. Futures Slightly Dip Amid Corporate Earnings and Quiet Economic Calendar, Oil Prices Fall

May 08 2024 - 8:29AM

IH Market News

U.S. index futures show slightly negative fluctuations on a day

with a limited economic agenda, as investors await statements from

key Federal Reserve officials. Throughout the day, figures such as

Vice Chairman Philip Jefferson, Boston Fed President Susan Collins,

and Fed Director Lisa Cook are expected to share their

perspectives, potentially influencing market expectations.

At 7:28 AM, Dow Jones futures (DOWI:DJI) fell by 25 points, or

-0.06%. S&P 500 futures declined by -0.17%, and Nasdaq-100

futures lost -0.23%. The yield on 10-year Treasury bonds was at

4.492%.

In the commodities market, June West Texas Intermediate crude

oil dropped -1.26%, to $77.39 per barrel. Brent crude oil for July

decreased by -1.18%, near $82.18 per barrel. Iron ore traded on the

Dalian exchange fell 2.91%, to $119.87 per metric ton.

On this Wednesday’s economic agenda, the Commerce Department

will release wholesale inventory data for March at 10:00 AM. At

10:30 AM, the Department of Energy (DoE) will share the position of

oil inventories until last Friday.

Most European markets are on the rise as investors assess new

corporate results in the region. Highlight for shares of

Siemens Energy (TG:SIE), up 13% after the company

raised its forecast for 2024, driven by the robust performance of

its electric grid segment.

Asian and Pacific stock markets ended the day with mixed

results, reflecting a cautious scenario in the face of recent

corporate earnings and technical adjustments. In Japan, the Nikkei

index recorded a significant drop of 1.63%, closing at 38,202.37

points, impacted by unfavorable profit projections from major

conglomerates, such as Nintendo (USOTC:NTDOY),

which saw its shares listed in Japan plunge 5.4%, and

Toyota (NYSE:TM), with a decline of 0.6%. Other

notable drops included Sony (NYSE:SONY), which

retreated 5%, and Nomura Holdings (NYSE:NMR),

which decreased 3.4%. Meanwhile, other indices in the region showed

divergent results: the Shanghai SE in China fell by 0.61%, and the

Hang Seng in Hong Kong dropped 0.90%. Conversely, the Kospi in

South Korea advanced 0.39%, and the ASX 200 in Australia posted a

modest gain of 0.14%.

During Tuesday’s trading session, U.S. stocks fluctuated but

closed narrowly. The Dow Jones rose slightly by 0.08%, marking its

fifth consecutive day of gains, while the S&P 500 increased by

0.13%. Conversely, the Nasdaq fell by -0.10%. Comments from

Minneapolis Federal Reserve President Neel Kashkari suggested the

need to see clear signs of disinflation before considering rate

cuts, adding that the possibility of raising rates again still

existed, although the threshold for this was high. Among individual

stocks, Disney (NYSE:DIS) stood out with a notable

decline, despite reporting higher-than-expected profits.

Companies are scheduled to present quarterly reports before the

market opens including Uber (NYSE:UBER),

Shopify (NYSE:SHOP), Affirm

(NASDAQ:AFRM), Toyota Motor (NYSE:TM),

Emerson (NYSE:EMR), Perion

Network (NASDAQ:PERI), ACM Research

(NASDAQ:ACMR), Avadel (NASDAQ:AVDL),

Editas Medicine (NASDAQ:EDIT), EchoStar

Corporation (NASDAQ:SATS), among others.

After the close, we will be awaiting numbers from

Arm (NASDAQ:ARM), Airbnb

(NASDAQ:ABNB), Robinhood Markets (NASDAQ:HOOD),

Beyond Meat (NASDAQ:BYND),

Applovin (NASDAQ:APP), Duolingo

(NASDAQ:DUOL), AMC Entertainment (NYSE:AMC),

TheTradeDesk (NASDAQ:TTD), Exact

Sciences (NASDAQ:EXAS), Energy Transfer

(NYSE:ET), and more.

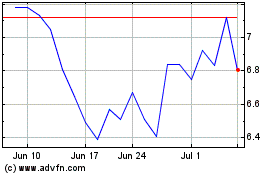

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2024 to May 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From May 2023 to May 2024