Mangoceuticals, Inc. (NASDAQ: MGRX) (“MangoRx” or the “Company”), a

company focused on developing, marketing, and selling a variety of

men’s health and wellness products in the area of erectile

dysfunction (ED), hair growth and hormone replacement therapies,

today announced that the Company received written notification from

the Listing Qualification Department of The Nasdaq Stock Market LLC

(“Nasdaq”) granting the Company’s request for a 180-day extension

to regain compliance with Nasdaq’s minimum bid price requirement

under Nasdaq Listing Rule 5550(a)(2). The Company now has until

October 24, 2024 to meet the requirement. On the same date, Nasdaq

provided notice to the Company that based on the Company’s April

25, 2024, Current Report on Form 8-K filing, Nasdaq has determined

that the Company complies with Nasdaq Listing Rule 5550(b)(1) (the

“Rule”) which requires companies listed on the Nasdaq Capital

Market to maintain stockholders’ equity of at least $2,500,000.

However, Nasdaq also advised that if the Company fails to evidence

compliance with the Rule upon filing its next periodic report it

may be subject to delisting.

The Company was first notified by Nasdaq of its

failure to maintain a minimum bid price of $1.00 per share for 30

consecutive trading days under Nasdaq Listing Rule 5550(a)(2) on

November 1, 2023, and was given until April 29, 2024, to regain

compliance. At any time during the additional 180-day extension, if

the bid price of the Company’s common stock closes at, or above,

$1.00 per share for a minimum of ten consecutive business days, the

Nasdaq staff will provide the Company with a written confirmation

of compliance and the matter will be closed.

The Company will continue to monitor the closing

bid price of its common stock and will, if necessary, implement a

reverse stock split of its outstanding securities, to regain

compliance with the Minimum Bid Price Requirement. The stockholders

of the Company, at the March 25, 2024, special meeting of

stockholders previously approved an amendment to our Certificate of

Formation, as amended, to effect a reverse stock split of our

issued and outstanding shares of our common stock, by a ratio of

between one-for-two to one-for-fifty, inclusive, with the exact

ratio to be set at a whole number to be determined by our Board of

Directors or a duly authorized committee thereof in its discretion,

at any time after approval of the amendment and prior to March 25,

2025.

If the Company does not regain compliance within

the allotted compliance period, and/or if the Company does not

demonstrate compliance with the Rule as of the filing of its next

periodic report, Nasdaq will provide notice that the Company’s

common stock will be subject to delisting. The Company would then

be entitled to appeal that determination to a Nasdaq hearings

panel. There can be no assurance that the Company will regain

compliance with the minimum bid price requirement during this

180-day extension.

On May 1, 2024, the Board of Directors of the

Company determined that the Company’s 2024 Annual Meeting of

Stockholders (the “2024 Annual Meeting”) will be held on June 17,

2024, subject to extension for any comments the Company may receive

on the Annual Meeting Proxy. The time and location of the 2024

Annual Meeting will be set forth in the Company’s definitive proxy

statement for the Annual Meeting to be filed with the Commission

(the “Annual Meeting Proxy”).

Any stockholder proposal intended to be

considered for inclusion in the Company’s proxy materials for the

2024 Annual Meeting in accordance with Rule 14a-8 or pursuant to

the Company’s Bylaws (the “Bylaws”) must be delivered to, or mailed

to and received at, the Company’s principal executive offices at

15110 N. Dallas Parkway, Suite 600, Dallas, Texas, 75248,

Attention: Corporate Secretary, on or before the close of business

on May 13, 2024, which date the Company has determined to be a

reasonable time before it expects to begin to print and distribute

its proxy materials prior to the 2024 Annual Meeting. Additionally,

any stockholder who intends to submit a director nomination or who

intends to submit a proposal regarding any other matter of business

at the 2024 Annual Meeting other than in accordance with Rule 14a-8

or otherwise must similarly make sure that such nomination or

proposal is delivered to, or mailed and received at, the Company’s

principal executive offices on or before the close of business on

May 13, 2024.

In addition to complying with this deadline,

stockholder proposals intended to be considered for inclusion in

the Company’s proxy materials for the 2024 Annual Meeting must also

comply with all applicable Commission rules, including Rule 14a-8,

Texas law and the Company’s Bylaws. Any proposal submitted after

the above deadlines will be considered untimely and not properly

brought before the 2024 Annual Meeting.

About MangoRx

MangoRx is focused on developing a variety of

men’s health and wellness products and services via a secure

telemedicine platform. To date, the Company has identified men’s

wellness telemedicine services and products as a growing sector and

especially related to the area of erectile dysfunction (ED), hair

growth and hormone replacement therapies. Interested consumers can

use MangoRx’s telemedicine platform for a smooth experience.

Prescription requests will be reviewed by a physician and, if

approved, fulfilled and discreetly shipped through MangoRx’s

partner compounding pharmacy and right to the patient’s doorstep.

To learn more about MangoRx’s mission and other products, please

visit www.MangoRx.com or on social media @Mango.Rx.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements made in this press release

contain forward-looking information within the meaning of

applicable securities laws, including within the meaning of the

Private Securities Litigation Reform Act of 1995 (“forward-looking

statements”). These forward-looking statements represent the

Company’s current expectations or beliefs concerning future events

and can generally be identified using statements that include words

such as “estimate,” “expects,” “project,” “believe,” “anticipate,”

“intend,” “plan,” “foresee,” “forecast,” “likely,” “will,” “target”

or similar words or phrases. These forward-looking statements are

subject to risks, uncertainties and other factors, many of which

are outside of the Company’s control which could cause actual

results to differ materially from the results expressed or implied

in the forward-looking statements, our ability to meet Nasdaq’s

minimum bid price requirement; the Company’s stockholders’ equity

as of the Company’s next fiscal quarter end; our ability to

maintain the listing of our common stock on Nasdaq; our ability to

commercialize our patent portfolio; our ability to obtain Comisión

Federal para la Protección contra Riesgos Sanitarios for our ED

product in Mexico, the costs thereof and timing associated

therewith; our ability to obtain additional funding and generate

revenues to support our operations; risks associated with our ED

product which have not been, and will not be, approved by the U.S.

Food and Drug Administration (“FDA”) and have not had the benefit

of the FDA’s clinical trial protocol which seeks to prevent the

possibility of serious patient injury and death; risks that the FDA

may determine that the compounding of our planned products does not

fall within the exemption from the Federal Food, Drug, and Cosmetic

Act (“FFDCA Act”) provided by Section 503A; risks associated with

related party relationships and agreements; the effect of data

security breaches, malicious code and/or hackers; competition and

our ability to create a well-known brand name; changes in consumer

tastes and preferences; material changes and/or terminations of our

relationships with key parties; significant product returns from

customers, product liability, recalls and litigation associated

with tainted products or products found to cause health issues; our

ability to innovate, expand our offerings and compete against

competitors which may have greater resources; our significant

reliance on related party transactions; the projected size of the

potential market for our technologies and products; risks related

to the fact that our Chairman and Chief Executive Officer, Jacob D.

Cohen has significant voting control over the Company; risks

related to the significant number of shares in the public float,

our share volume, the effect of sales of a significant number of

shares in the marketplace, and the fact that the majority of our

shareholders paid less for their shares than the public offering

price of our common stock in our recent initial public offering;

dilution caused by recent offerings; conversion of outstanding

shares of preferred stock and the rights and preferences thereof,

the fact that we have a significant number of outstanding warrants

to purchase shares of common stock at $1.00 per share, the resale

of which underlying shares have been registered under the

Securities Act of 1933, as amended; our ability to build and

maintain our brand; cybersecurity, information systems and fraud

risks and problems with our websites; changes in, and our

compliance with, rules and regulations affecting our operations,

sales, marketing and/or our products; shipping, production or

manufacturing delays; regulations we are required to comply with in

connection with our operations, manufacturing, labeling and

shipping; our dependency on third-parties to prescribe and compound

our ED product; our ability to establish or maintain relations

and/or relationships with third-parties; potential safety risks

associated with our Mango ED product, including the use of

ingredients, combination of such ingredients and the dosages

thereof; the effects of changing rates of inflation and interest

rates, and economic downturns, including potential recessions, as

well as macroeconomic, geopolitical, health and industry trends,

pandemics, acts of war (including the ongoing Ukraine/Russian

conflict and war in Israel) and other large-scale crises; our

ability to protect intellectual property rights; our ability to

attract and retain key personnel to manage our business

effectively; overhang which may reduce the value of our common

stock; volatility in the trading price of our common stock; and

general consumer sentiment and economic conditions that may affect

levels of discretionary customer purchases of the Company’s

products, including potential recessions and global economic

slowdowns. Although we believe that our plans, intentions and

expectations reflected in or suggested by the forward-looking

statements we make in this release are reasonable, we provide no

assurance that these plans, intentions or expectations will be

achieved. Consequently, you should not consider any such list to be

a complete set of all potential risks and uncertainties.

More information on potential factors that could

affect the Company’s financial results is included from time to

time in the “Cautionary Note Regarding Forward-Looking Statements,”

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s filings with the SEC, including the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023. These

filings are available at www.sec.gov and at our website

at https://www.mangoceuticals.com/sec-filings. All subsequent

written and oral forward-looking statements attributable to the

Company or any person acting on behalf of the Company are expressly

qualified in their entirety by the cautionary statements referenced

above. Other unknown or unpredictable factors also could have

material adverse effects on the Company’s future results. The

forward-looking statements included in this press release are made

only as of the date hereof. The Company cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, the Company undertakes no

obligation to update these statements after the date of this

release, except as required by law, and takes no obligation to

update or correct information prepared by third parties that are

not paid for by the Company. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

Follow Mangoceuticals and MangoRx on

social

media:https://www.instagram.com/mango.rxhttps://twitter.com/Mangoceuticalshttps://www.facebook.com/MangoRxOfficial

FOR PUBLIC RELATIONSLucky Break

Public RelationsSahra SimpsonSahra@luckybreakpr.com(323) 602-0091

ext. 704

FOR INVESTOR

RELATIONSMangoceuticals Investor

RelationsEmail: investors@mangorx.com

SOURCE: Mangoceuticals

Inc.

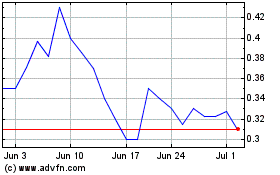

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Apr 2024 to May 2024

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From May 2023 to May 2024