UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2018

Commission File Number:

001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No

x

|

Fourth Quarter

Results

2017

|

Azul Reports Net Income of R$304 Million in 4Q17 and R$529 Million for the Full Year

Operating margin was 13.9% in 4Q17 and 11.1% in 2017

São Paulo, March 8th, 2018 –

Azul S.A., “Azul” (B3:AZUL4, NYSE:AZUL) the largest airline in Brazil by number of cities and departures, announces today its results for the fourth quarter of 2017 (“4Q17”) and for the full year 2017. The following financial information, unless stated otherwise, is presented in Brazilian reais and in accordance with International Financial Reporting Standards (IFRS).

Financial and Operating Highlights for 4Q17

§

Operating income was R$305.6 million, representing a margin of 13.9% compared to R$170.0 million and a margin of 9.3% in 4Q16. This is a record fourth quarter operating result for Azul and was achieved even with the 16.0% increase in fuel prices year over year. Operating margin was 11.1% for the full year compared to 5.2% in 2016.

§

EBITDAR increased 27.9% to R$674.2 million, representing a margin of 30.7%, making us one of the most profitable carriers in South America.

§

Net income totaled R$303.7 million, representing an improvement of R$252.4 million over 4Q16. Net income in 2017 came in at R$529.0 million, compared to a net loss of R$126.3 million the year before.

|

Financial results (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

Operating revenues

|

2,194.3

|

1,820.6

|

20.5%

|

7,789.5

|

6,669.9

|

16.8%

|

|

Operating expenses

|

(1,888.7)

|

(1,650.6)

|

14.4%

|

(6,924.5)

|

(6,325.6)

|

9.5%

|

|

Operating income

|

305.6

|

170.0

|

79.8%

|

865.0

|

344.3

|

151.3%

|

|

Operating margin

|

13.9%

|

9.3%

|

+4.6 p.p.

|

11.1%

|

5.2%

|

+5.9 p.p.

|

|

EBITDAR

|

674.2

|

527.1

|

27.9%

|

2,346.5

|

1,806.4

|

29.9%

|

|

EBITDAR margin

|

30.7%

|

29.0%

|

+1.7 p.p.

|

30.1%

|

27.1%

|

+3.0 p.p.

|

|

Net income (loss)

|

303.7

|

51.3

|

491.9%

|

529.0

|

(126.3)

|

518.8%

|

|

Net income (loss) per PN share* (R$)

|

0.91

|

0.19

|

378.9%

|

1.68

|

(0.55)

|

405.5%

|

|

Net income (loss) per ADS (US$)

|

0.83

|

0.17

|

388.2%

|

1.52

|

(0.51)

|

398.0%

|

|

* One ADS equals three preferred shares (PNs)

|

|

|

|

|

|

§

Passenger traffic (RPKs) grew 12.7% on a capacity increase of 10.2% resulting in a load factor of 82.7%, 1.9 percentage points higher than in 4Q16.

§

Total revenue per ASK (RASK) increased 9.4% to 33.73 cents year over year even with a double-digit growth in capacity.

§

Net financial expenses decreased 34.4% from R$122.0 million to R$80.0 million.

§

At the end of 4Q17, our total cash

1

1

position totaled R$3.6 billion, representing 45.7% of the last twelve months’ revenues.

§

Azul ended the year with a total debt position of R$3.5 billion resulting in an adjusted net debt to EBITDAR leverage ratio of 3.9x compared to R$4.0 billion and a leverage of 5.7x in 2016.

1

1

Includes cash and cash equivalents

, short-term and long-term investments, restricted investments, and accounts receivables.

1

|

Fourth Quarter

Results

2017

|

§

Azul’s operating fleet totaled 122 aircraft at the end of the quarter, including 12 next-generation A320neo aircraft.

§

On October 19th, Azul Investments LLP priced an offering of US$400.0 million aggregate principal amount of 5.875% senior unsecured notes due 2024.

§

TudoAzul recorded a 33.7% increase in gross billings (ex-Azul) in 2017 compared to 2016.

§

In December, Azul signed an MoU with Correios, Brazil’s postal service, for the creation of a private integrated logistics company. Azul will own 50.01% of the new company after the agreement is approved by Brazilian authorities.

§

Azul ranked as the most on-time airline in Brazil and the most on-time low-cost carrier in the Americas in 2017 according to OAG’s Punctuality League, the industry's most comprehensive annual ranking of on-time performance.

|

Fourth Quarter

Results

2017

|

Management Comments

This was an outstanding year for Azul, and I would like to start by congratulating and thanking our crewmembers for their exceptional performance. We successfully achieved one of the highest margins in the region and remained committed to our industry-leading customer satisfaction and operating performance.

Throughout the year, we successfully executed our margin expansion plan consisting of three strategic pillars: replacing smaller aircraft with larger, more fuel-efficient next generation aircraft, growing our loyalty program TudoAzul, and expanding ancillary revenues. As a result, even with the increase in jet fuel starting in September, we ended the fourth quarter with an operating margin of 13.9% and delivered an 11.1% operating margin for the year, above the higher end of our guidance of 9% to 11% announced in early 2017.

Capacity grew 10.6% in 2017 mostly due to our upgauging strategy, and we were also able to increase RASK by a healthy 5.6%, resulting in a top line expansion of 16.8% year over year. In the fourth quarter, RASK grew 9.4% and revenue increased 20.5% year over year. Adjusting for the 10.3% increase in stage length, RASK went up by 15% in the last quarter of the year. We continued to have the highest average fare in Brazil of R$345 in the fourth quarter, an increase of 17.2% year over year.

The addition of next-generation aircraft to our fleet contributed to a 3.7% decrease in CASK ex-fuel, and as we move into 2018, we expect to continue seeing consistent margin expansion resulting from this fleet modernization process.

Our wholly-owned loyalty program TudoAzul maintained its strong growth pace, reaching over 9.0 million members. This represents an addition of two million members over the last twelve months, the fastest growth in our history. We have increased gross billings ex-Azul by 33.7% in 2017 compared to 2016, with the majority of this increase coming from sales to banking partners and direct sales to members, further increasing our share of the Brazilian loyalty market.

Our cargo division grew 49% year over year, as we continue to expand our network and capacity with the introduction of larger aircraft to our fleet. In December, Azul and Correios (Brazil’s Postal Service) signed a memorandum of understanding for the creation of a private integrated logistics solutions company to be controlled by Azul. Once approved by Brazilian authorities, both companies will have significant cost savings while increasing operating efficiency and maximizing revenue gains.

Our ancillary revenue growth also benefited from the implementation of new services to passengers, including a new baggage policy starting in mid-2017. We had minimum operational or customer disruption and are seeing baggage fee revenue ramping up as expected.

We continue to run Brazil’s most on-time airline operation. In 2017, our on-time rate was the highest among low cost carriers in the Americas according to OAG. Our superior customer experience was also attested by Skytrax’s award of Best Low-Cost Carrier in South America for the seventh year in a row and Best Airline Staff Service in the region for the second year in a row. In addition, TripAdvisor named Azul the third best airline in the world, a significant achievement on one of the world's most important travel sites.

In addition to delivering solid profits and the best operational performance in Brazil, we reduced our financial leverage and improved our debt profile through the successful conclusion of our IPO in April and the issuance of senior unsecured notes with favorable terms in October. Our total debt position decreased R$545 million or 13% at the end the year compared to 2016, while our liquidity position strengthened significantly to R$3.6 billion, representing 46% of our last twelve months’ revenue.

I thank you for your confidence in us. We will continue to strive to improve our financial results, operational performance and customer satisfaction levels beyond 2017 and remain focused on being the best airline for our crewmembers, customers and shareholders.

John Rodgerson, CEO of Azul S.A.

|

Fourth Quarter

Results

2017

|

Consolidated Financial Results

The following revised income statement and operating data should be read in conjunction with the quarterly results comments presented below.

|

Income statement (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

|

|

|

|

|

|

|

|

OPERATING REVENUES

|

|

|

|

|

|

|

|

Passenger

|

1,887.1

|

1,569.4

|

20.2%

|

6,695.3

|

5,786.8

|

15.7%

|

|

Other

|

307.2

|

251.2

|

22.3%

|

1,094.2

|

883.1

|

23.9%

|

|

Total operating revenues

|

2,194.3

|

1,820.6

|

20.5%

|

7,789.5

|

6,669.9

|

16.8%

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

Aircraft fuel

|

523.9

|

420.2

|

24.7%

|

1,848.2

|

1,560.2

|

18.5%

|

|

Salaries, wages and benefits

|

366.5

|

289.8

|

26.5%

|

1,296.2

|

1,091.9

|

18.7%

|

|

Aircraft and other rent

|

315.3

|

281.9

|

11.9%

|

1,181.7

|

1,160.9

|

1.8%

|

|

Landing fees

|

129.3

|

107.7

|

20.0%

|

490.6

|

442.7

|

10.8%

|

|

Traffic and customer servicing

|

97.4

|

86.4

|

12.8%

|

357.8

|

327.3

|

9.3%

|

|

Sales and marketing

|

89.5

|

78.0

|

14.8%

|

309.5

|

276.2

|

12.1%

|

|

Maintenance materials and repairs

|

134.0

|

181.7

|

-26.2%

|

568.1

|

708.7

|

-19.8%

|

|

Depreciation and amortization

|

53.2

|

75.3

|

-29.3%

|

299.8

|

301.2

|

-0.5%

|

|

Other operating expenses

|

179.5

|

129.7

|

38.4%

|

572.5

|

456.5

|

25.4%

|

|

Total operating expenses

|

1,888.7

|

1,650.6

|

14.4%

|

6,924.5

|

6,325.6

|

9.5%

|

|

Operating income

|

305.6

|

170.0

|

79.8%

|

865.0

|

344.3

|

151.3%

|

|

Operating Margin

|

13.9%

|

9.3%

|

+4.6 p.p.

|

11.1%

|

5.2%

|

+5.9 p.p.

|

|

|

|

|

|

|

|

|

|

FINANCIAL RESULT

|

|

|

|

|

|

|

|

Financial income

|

25.6

|

17.4

|

46.9%

|

94.8

|

51.1

|

85.6%

|

|

Financial expenses

|

(105.6)

|

(139.4)

|

-24.3%

|

(524.0)

|

(731.2)

|

-28.3%

|

|

Derivative financial instruments

|

(1.6)

|

2.4

|

-166.9%

|

(90.2)

|

10.8

|

-934.9%

|

|

Foreign currency exchange, net

|

4.2

|

(30.1)

|

114.0%

|

57.9

|

179.7

|

-67.8%

|

|

Result from related party transactions, net

|

149.7

|

92.0

|

62.7%

|

194.4

|

163.0

|

19.2%

|

|

Income (loss) before income taxes

|

378.0

|

112.3

|

236.6%

|

597.8

|

17.7

|

3284.2%

|

|

|

|

|

|

|

|

|

|

Income tax and social contribution

|

(3.6)

|

9.0

|

-139.7%

|

2.9

|

8.7

|

-67.1%

|

|

Deferred income tax

|

(70.7)

|

(70.0)

|

1.0%

|

(71.7)

|

(152.7)

|

-53.1%

|

|

Net income (loss)

|

303.7

|

51.3

|

491.9%

|

529.0

|

(126.3)

|

518.8%

|

|

Net margin

|

13.8%

|

2.8%

|

+11.0 p.p.

|

6.8%

|

-1.9%

|

+8.7 p.p.

|

|

Basic net income (loss) per PN share

1

(R$)

|

0.91

|

0.19

|

373.4%

|

1.68

|

(0.55)

|

403.9%

|

|

Diluted net income (loss) per PN share

1

(R$)

|

0.89

|

0.19

|

364.5%

|

1.64

|

(0.55)

|

398.1%

|

|

Basic net income (loss) per ADS (R$)

|

2.73

|

0.57

|

378.9%

|

5.04

|

(1.65)

|

405.5%

|

|

Diluted net income (loss) per ADS (R$)

|

2.67

|

0.57

|

368.4%

|

4.92

|

(1.65)

|

398.2%

|

|

|

|

|

|

|

|

|

|

1

Basic earnings per share reflects a weighted average of 315,586,842 equivalent preferred shares after applying a 75:1 common stock to preferred stock conversion ratio. Diluted earnings per share assumes a weighted average number of stock options of 9,253,991 that would have been issued at an average market price as of December 31, 2017. Each ADS is equivalent to three PNs.

|

|

Fourth Quarter

Results

2017

|

|

Dados Operacionais

|

4T17

|

4T16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

|

|

|

|

|

|

|

|

ASKs (milhões)

|

6,506

|

5,903

|

10.2%

|

25,300

|

22,869

|

10.6%

|

|

Doméstico

|

5,060

|

4,984

|

1.5%

|

20,458

|

19,431

|

5.3%

|

|

Internacional

|

1,446

|

919

|

57.3%

|

4,842

|

3,439

|

40.8%

|

|

RPK (milhões)

|

5,382

|

4,773

|

12.7%

|

20,760

|

18,236

|

13.8%

|

|

Doméstico

|

4,108

|

3,927

|

4.6%

|

16,424

|

15,232

|

7.8%

|

|

Internacional

|

1,274

|

846

|

50.5%

|

4,336

|

3,003

|

44.4%

|

|

Taxa de ocupação (%)

|

82.7%

|

80.9%

|

+1.9 p.p.

|

82.1%

|

79.7%

|

+2.3 p.p.

|

|

Doméstico

|

81.2%

|

78.8%

|

+2.4 p.p.

|

80.3%

|

78.4%

|

+1.9 p.p.

|

|

Internacional

|

88.1%

|

92.1%

|

-4.0 p.p.

|

89.5%

|

87.3%

|

+2.2 p.p.

|

|

|

|

|

|

|

|

|

|

Tarifa média (R$)

|

345

|

294

|

17.2%

|

304

|

281

|

8.4%

|

|

Passageiros pagantes (milhares)

|

5,474

|

5,337

|

2.6%

|

22,014

|

20,620

|

6.8%

|

|

Horas-bloco

|

101,630

|

103,284

|

-1.6%

|

407,416

|

403,888

|

0.9%

|

|

Utilização de Aeronaves (Horas/Dia)

|

10.2

|

10.1

|

1.5%

|

10.5

|

9.7

|

8.8%

|

|

Número de decolagens

|

63,665

|

66,767

|

-4.6%

|

259,966

|

261,611

|

-0.6%

|

|

Etapa média (Km)

|

942

|

854

|

10.3%

|

905

|

848

|

6.7%

|

|

Aeronaves operacionais final do período

|

122

|

123

|

-0.8%

|

122

|

123

|

-0.8%

|

|

Combustível de aviação (milhares litros)

|

244,426

|

227,526

|

7.4%

|

939,907

|

880,941

|

6.7%

|

|

Funcionários

|

10,878

|

10,311

|

5.5%

|

10,878

|

10,311

|

5.5%

|

|

Funcionários no final do período por aeronave

|

89

|

84

|

6.4%

|

89

|

84

|

6.4%

|

|

|

|

|

|

|

|

|

|

Yield por passageiro/quilômetro (centavos)

|

35.07

|

32.88

|

6.7%

|

32.25

|

31.73

|

1.6%

|

|

Receita operacional por ASK - RASK (centavos)

|

33.73

|

30.84

|

9.4%

|

30.79

|

29.17

|

5.6%

|

|

Receita de passageiros por ASK - PRASK (centavos)

|

29.01

|

26.59

|

9.1%

|

26.46

|

25.30

|

4.6%

|

|

Custo por ASK - CASK (centavos)

|

29.03

|

27.96

|

3.8%

|

27.37

|

27.66

|

-1.0%

|

|

Custo por ASK, excluindo combustível - CASK ex-fuel (centavos)

|

20.98

|

20.84

|

0.6%

|

20.06

|

20.84

|

-3.7%

|

|

Preço médio combustível / litro

|

2.14

|

1.85

|

16.0%

|

1.97

|

1.77

|

11.0%

|

|

Break-even

da taxa de ocupação (%)

|

71.2%

|

73.3%

|

-2.1 p.p.

|

72.9%

|

75.6%

|

-2.7 p.p.

|

|

|

|

|

|

|

|

|

|

Taxa de Câmbio Média

|

3.25

|

3.29

|

-1.4%

|

3.19

|

3.49

|

-8.5%

|

|

Taxa de Câmbio no fim do período

|

3.31

|

3.26

|

1.5%

|

3.31

|

3.26

|

1.5%

|

|

Inflação (IPCA - últimos 12 meses)

|

2.94

|

6.29

|

-53.3%

|

2.94

|

6.29

|

-53.3%

|

|

WTI (média por barril , US$)

|

55.30

|

49.27

|

12.2%

|

50.86

|

43.68

|

16.4%

|

|

Heating Oil (R$)

|

588.46

|

489.62

|

20.2%

|

520.04

|

459.84

|

13.1%

|

|

Fourth Quarter

Results

2017

|

Operating Revenue

In 4Q17 Azul recorded an operating revenue of R$2,194.3 million, 20.5% higher than the same period last year, due to a 20.2% increase in passenger revenue and a 22.3% increase in other revenue.

Passenger traffic (RPK) rose 12.7% on a capacity growth of 10.2%, leading to a load factor of 82.7%, 1.9 percentage points higher than 4Q16. Passenger revenue per ASK (PRASK) increased 9.1% year over year despite the strong growth in capacity and average stage length, mostly driven by a 6.7% increase in yields, as we continue to see stronger passenger demand.

Other revenue increased 22.3% or R$56.0 million in 4Q17 compared to 4Q16 mainly due to a 60% growth in cargo revenue, and increases also in passenger ancillary fees and bag fees.

|

R$ cents

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

Operating revenue per ASK

|

|

|

|

|

|

|

|

Passenger revenue

|

29.01

|

26.59

|

9.1%

|

26.46

|

25.30

|

4.6%

|

|

Other revenue

|

4.72

|

4.26

|

11.0%

|

4.32

|

3.86

|

12.0%

|

|

Operating revenue (RASK)

|

33.73

|

30.84

|

9.4%

|

30.79

|

29.17

|

5.6%

|

|

Operating expenses per ASK

|

|

|

|

|

|

|

|

Aircraft fuel

|

8.05

|

7.12

|

13.1%

|

7.31

|

6.82

|

7.1%

|

|

Salaries, wages and benefits

|

5.63

|

4.91

|

14.8%

|

5.12

|

4.77

|

7.3%

|

|

Aircraft and other rent

|

4.85

|

4.77

|

1.5%

|

4.67

|

5.08

|

-8.0%

|

|

Landing fees

|

1.99

|

1.82

|

8.9%

|

1.94

|

1.94

|

0.2%

|

|

Traffic and customer servicing

|

1.50

|

1.46

|

2.4%

|

1.41

|

1.43

|

-1.2%

|

|

Sales and marketing

|

1.38

|

1.32

|

4.1%

|

1.22

|

1.21

|

1.3%

|

|

Maintenance materials and repairs

|

2.06

|

3.08

|

-33.1%

|

2.25

|

3.10

|

-27.5%

|

|

Depreciation and amortization

|

0.82

|

1.28

|

-35.9%

|

1.18

|

1.32

|

-10.0%

|

|

Other operating expenses

|

2.76

|

2.20

|

25.6%

|

2.26

|

2.00

|

13.4%

|

|

Total operating expenses (CASK)

|

29.03

|

27.96

|

3.8%

|

27.37

|

27.66

|

-1.0%

|

|

|

|

|

|

|

|

|

|

Operating income per ASK (RASK - CASK)

|

4.70

|

2.88

|

63.1%

|

3.42

|

1.51

|

127.1%

|

Operating Expenses

Operating expenses totaled R$1,888.7 million, representing an increase of 14.4% over 4Q16. Cost per ASK (CASK) increased 3.8% to 29.03 cents. Excluding fuel, CASK rose 0.6%, mainly due to higher training expenses associated with the introduction of the A320neos and a profit sharing and bonus provision.

The breakdown of our operating expenses is as follows:

|

Fourth Quarter

Results

2017

|

§

Aircraft fuel

increased 24.7% year over year to R$523.9 million mostly due to

the 16.0% increase in fuel price per liter and a higher number of international flights. This increase was partially offset by the A320neos, which are more fuel-efficient. On a per-ASK basis, aircraft fuel increased 13.1%.

§

Salaries, wages and benefits

increased 26.5% or R$76.7 million year over year mostly due to (i) a R$27.0 million employee profit sharing and bonus provision, (ii) a 5.5% increase in the number of crewmembers mostly related to the introduction of the A320neo into our fleet and (iii) a 7.4% increase in salaries as a result of collective bargaining agreements with labor unions applicable to all airline employees in Brazil starting in December 2016. On a per-ASK basis, salaries, wages and benefits increased 14.8%.

§

Aircraft and other rent

expenses totaled R$315.3 million in 4Q17, 11.9% higher than in the same period last year mostly due to an increase of the number of aircraft under operating leases from 100 in 4Q16 to 120 in 4Q17. On a per-ASK basis, aircraft rent increased 1.5% over 4Q16.

§

Landing fees

increased 20.0% or R$21.6 million in 4Q17 mostly due to (i) the 10.3% increase in the average stage length year over year, leading to an increase in navigation fees, (ii) the introduction of larger sized aircraft to our fleet leading to higher airport fees and (iii) an increase in international departures, which have higher fees, partly offset by a decrease in the number of domestic departures. Landing fees per ASK increased 8.9%.

§

Traffic and customer servicing

expenses increased 12.8% or R$11.1 million mostly due to (i) the 2.6% increase in the number of passengers from 5.3 million in 4Q16 to 5.5 million in 4Q17, (ii) the 6.3% inflation rate in 2016 reflecting in higher fees in 2017 and (iii) an increase in international flights which have higher catering expenses than domestic flights. On a per-ASK basis, traffic and customer servicing expenses increased 2.4%.

§

Sales and marketing

increased 14.8% or R$11.5 million mostly due to (i) the 20.2% increase in passenger revenues leading to an increase in commissions, (ii) a stronger demand for international flights, which have higher distribution costs and (iii) an increase in cargo commissions as a result of the 60% increase in cargo revenue. On a per-ASK basis, sales and marketing increased 4.1%.

§

Maintenance materials and repairs

decreased 26.2% or R$47.7 million mostly due to contract renegotiations with suppliers resulting in lower maintenance operating expenses, and an appreciation in the average exchange rate to the US dollar. Maintenance materials and repairs per ASK decreased 33.1%.

§

Depreciation and amortization

decreased 29.3% or R$22.1 million mostly due to a 30.8% reduction in the number of aircraft under finance lease from 39 in 4Q16 to 27 in 4Q17. On a per-ASK basis, depreciation and amortization decreased 35.9%.

§

Other operating expenses

increased 38.4% or R$49.8 million mainly due to (i) a R$16.0 million in gains related to aircraft sale and leaseback transactions in 4Q16 and (ii) higher expenses related to A320neo training ramp up costs. On a per-ASK basis, other operating expenses increased 25.6%.

Non-Operating Results

Non-operating results include financial income, financial expenses, results from derivative and financial instruments, the impact of foreign currency exchange rate variations and results from related parties’ transactions.

Azul recorded a negative net financial result of R$77.4 million in 4Q17 compared to R$149.7 million in 4Q16.

|

Net financial results (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

|

|

|

|

|

|

|

|

Financial income

|

25.6

|

17.4

|

46.9%

|

94.8

|

51.1

|

85.6%

|

|

Financial expenses

|

(105.6)

|

(139.4)

|

-24.3%

|

(524.0)

|

(731.2)

|

-28.3%

|

|

Derivative financial instruments

|

(1.6)

|

2.4

|

-166.9%

|

(90.2)

|

10.8

|

-934.9%

|

|

Foreign currency exchange, net

|

4.2

|

(30.1)

|

114.0%

|

57.9

|

179.7

|

-67.8%

|

|

Net financial results

|

(77.4)

|

(149.7)

|

-48.3%

|

(461.5)

|

(489.7)

|

-5.7%

|

|

Fourth Quarter

Results

2017

|

Financial income

increased R$8.2 million, mostly due to the 73.4% increase in cash and cash equivalents from R$1,042.4 million as of December 31, 2016 to R$1,807.3 million as of December 31, 2017, partially offset by the reduction of the Brazilian risk-free rate (“CDI”) from an average of 13.6% in 4Q16 to 7.0% in 4Q17.

Financial expenses

decreased 24.3% to R$105.6 million as a result of (i) a 13.5% lower outstanding debt balance of R$3,489.9 million as of December 31, 2017 compared with R$4,034.5 million as of December 31, 2016, yielding lower interest expenses, (ii) lower credit spread charged to Azul as a result of the issuance of new loans with lower spreads and the repayment of more expensive ones, (iii) the reduction of the Brazilian risk-free rate (“CDI”) from an average of 13.6% in 4Q16 to 7.0% in 4Q17, and (iv)

the reduction in expenses related to advances from credit card receivables from R$25.9 million to R$3.3 million

.

Derivative financial instruments

resulted in a loss of R$1.6 million in 4Q17 compared to a gain of R$2.4 million in the same period last year due to the fair value adjustment of interest rate swaps as a result of a higher Libor rate, partially offset by gains in the oil and currency swaps as a result of higher foreign exchange and oil prices.

Azul recorded a

foreign currency exchange

gain of R$4.2 million, mainly due to the 8.5% appreciation of the Brazilian real from December 31, 2016 to December 31, 2017, resulting in a decrease in our foreign currency exposure related to aircraft finance leases and debt repayments. Approximately 63% of Azul’s total debt and 99% of its working capital debt are denominated in reais.

Results from related parties transactions, net.

In 4Q17, we recorded a gain of R$149.7 million, mostly due to a R$154.4 million gain related to the expiration of a call option on our TAP bonds. As a result of the call option expiration, Azul will now be the single beneficiary of this bond, which is convertible into 41.25% of the equity value of TAP.

Liquidity and Financing

Azul closed the quarter with R$3,557.7 million in cash, cash equivalents, short-term and long-term investments, receivables and restricted investments, 44.1% above the R$3,075.3 million recorded in 3Q17, representing 45.7% of its last twelve months’ revenue. As a result, the Company’s total cash position including receivables was R$67.8 million higher than its gross debt as of December 31, 2017.

|

Liquidity (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

3Q17

|

% ∆

|

|

Cash and cash equivalents

1

|

1,807.3

|

1,042.4

|

73.4%

|

1,457.5

|

24.0%

|

|

Long-term investments

|

836.0

|

753.2

|

11.0%

|

807.8

|

3.5%

|

|

Accounts receivable

|

914.4

|

673.3

|

35.8%

|

810.0

|

12.9%

|

|

Total

|

3,557.7

|

2,468.9

|

44.1%

|

3,075.3

|

15.7%

|

|

1

Includes short-term investments and restricted investments

|

|

|

|

|

|

Fourth Quarter

Results

2017

|

Since the conclusion of its IPO in April 2017, Azul has made significant progress on de-levering its business reaching an adjusted net debt to EBITDAR ratio of 3.9x as of December 31, 2017 compared to 5.7x in December 2016.

Compared to the previous quarter, total debt increased R$584.9 million to

R$3.5 billion, mostly due to the issuance of unsecured senior notes totaling US$400.0 million at 5.875% with a seven-year maturity. Part of the proceeds were used to amortize R$1,090.3 million of more expensive debt, in line with the Company’s strategy to improve its debt profile going forward.

To protect itself against currency risk associated with the U.S. dollar denominated notes, Azul entered a local currency swap agreement for 100% of the principal and interest payments resulting in a final rate of 99.1% of the CDI (Brazilian risk-free rate).

|

Loans and financing (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

3Q17

|

% ∆

|

|

|

|

|

|

|

|

|

Aircraft financing

|

1,491.1

|

2,142.1

|

-30.4%

|

1,492.0

|

-0.1%

|

|

Other loans, financing and debentures

|

1,998.8

|

1,892.4

|

5.6%

|

1,413.0

|

41.5%

|

|

% of non-aircraft debt in local currency¹

|

99.2%

|

95.9%

|

+3.3 p.p.

|

98.4%

|

+0.8 p.p.

|

|

Gross debt

|

3,489.9

|

4,034.5

|

-13.5%

|

2,905.0

|

20.1%

|

|

Short term

|

568.2

|

985.2

|

-42.3%

|

1,011.1

|

-43.8%

|

|

Long term

|

2,921.7

|

3,049.3

|

-4.2%

|

1,893.8

|

54.3%

|

|

% of total gross debt in local currency¹

|

62.9%

|

54.2%

|

+8.7 p.p.

|

54.9%

|

+8.0 p.p.

|

|

Operating leases (off-balance sheet)

|

8,272.1

|

8,126.4

|

1.8%

|

8,037.9

|

2.9%

|

|

Loans and financing adjusted for operating leases

|

11,762.0

|

12,160.9

|

-3.3%

|

10,942.8

|

7.5%

|

|

1

Considers the effect of currency swap instruments

|

|

|

|

|

|

Azul’s liability management initiatives combined with the reduction of the Brazilian risk free rate resulted in an extension of its average debt maturity to 4.3 years and a reduction of its average interest for local and dollar-denominated obligations to 7.6% and 5.2%, respectively as of December 31, 2017. Considering only working capital loans, the average debt maturity increased from 1.1 year to 5.2 years. In addition, considering currency swap agreements, approximately 63% of Azul’s total debt and 99% of non-aircraft debt were denominated in Brazilian reais at the end of the quarter.

|

Fourth Quarter

Results

2017

|

Azul’s key financial ratios and debt maturity is presented below:

|

Key financial ratios (R$ million)

|

4Q17

|

4Q16

|

% ∆

|

3Q17

|

% ∆

|

|

|

|

|

|

|

|

|

Cash

1

|

2,643.2

|

1,795.6

|

47.2%

|

2,265.3

|

16.7%

|

|

Cash

1

as % of LTM revenues

|

33.9%

|

26.9%

|

+7.0 p.p.

|

30.5%

|

+3.4 p.p.

|

|

Gross debt

|

3,489.9

|

4,034.5

|

-13.5%

|

2,905.0

|

20.1%

|

|

Adjusted

2

gross debt

|

11,762.0

|

12,160.9

|

-3.3%

|

10,942.8

|

7.5%

|

|

Net debt

|

846.7

|

2,238.9

|

-62.2%

|

639.7

|

32.4%

|

|

Adjusted

2

net debt

|

9,118.8

|

10,365.3

|

-12.0%

|

8,677.6

|

5.1%

|

|

Adjusted

2

net debt / EBITDAR (LTM)

|

3.9

|

5.7

|

-32.3%

|

3.9

|

-1.5%

|

|

1

Includes cash and cash equivalents, short-term and long-term investments, restricted investments

|

|

2

Adjusted to reflect the capitalization of operating leases corresponding to 7x of LTM rent

|

10

|

Fourth Quarter

Results

2017

|

Fleet and Capital Expenditures

As of December 31, 2017, Azul had a total operating fleet of 122 aircraft consisting of 70 E-jets, 33 ATRs, 12 A320neos, and seven A330s with an average age of 5.6 years. The Company’s contractual fleet totaled 147 aircraft, of which 27 were under finance leases and 120 under operating leases. The 25 aircraft not included in our operating fleet consisted of 15 aircraft subleased to TAP and 10 ATRs that were in the process of exiting the fleet.

|

Total contractual fleet

|

|

|

|

|

|

|

Aircraft

|

Number of seats

|

4Q17

|

4Q16

|

% ∆

|

3Q17

|

% ∆

|

|

A330

|

242-271

|

7

|

7

|

0.0%

|

7

|

0.0%

|

|

A320neo

|

174

|

12

|

5

|

140.0%

|

8

|

50.0%

|

|

E-Jets

|

106-118

|

79

|

81

|

-2.5%

|

79

|

0.0%

|

|

ATRs

|

70

|

49

|

46

|

6.5%

|

48

|

2.1%

|

|

Total

1

|

|

147

|

139

|

5.8%

|

142

|

3.5%

|

|

% Aircraft under operating leases

|

81.6%

|

71.9%

|

+9.7 p.p.

|

81.0%

|

+0.6 p.p.

|

|

|

|

|

|

|

|

|

|

1

Includes aircraft subleased to TAP

|

|

|

|

|

|

|

Total operating fleet

|

|

|

|

|

|

|

Aircraft

|

Number of seats

|

4Q17

|

4Q16

|

% ∆

|

3Q17

|

% ∆

|

|

A330

|

242-271

|

7

|

5

|

40.0%

|

6

|

16.7%

|

|

A320neo

|

174

|

12

|

5

|

140.0%

|

8

|

50.0%

|

|

E-Jets

|

106-118

|

70

|

74

|

-5.4%

|

70

|

0.0%

|

|

ATRs

|

70

|

33

|

39

|

-15.4%

|

34

|

-2.9%

|

|

Total

|

|

122

|

123

|

-0.8%

|

118

|

3.4%

|

|

|

|

|

|

|

|

|

11

|

Fourth Quarter

Results

2017

|

Fleet Plan

Azul expects to add eight A320neos and one A330neo to its fleet in 2018 and remove seven E-195s, ending the year with 124 operating aircraft. In addition, as a result of the significant growth of its cargo business, Azul intends to lease two used 737-400 freighter aircraft with deliveries expected for the second half of the year.

The following graph shows the expected profile of our operating fleet from December 31, 2017 through December 31, 2021:

Capex

Capital expenditures totaled R$119.3 million in 4Q17 and R$589.5 in 2017, mostly due to the acquisition of spare parts and the capitalization of engine overhaul events on owned aircraft.

|

(R$ million)

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

Acquisition of property and equipment

|

119.3

|

123.6

|

-3.5%

|

589.5

|

385.8

|

52.8%

|

|

Aircraft related

|

98.9

|

102.4

|

-3.5%

|

476.4

|

247.9

|

92.1%

|

|

Pre-delivery payments

|

5.0

|

9.8

|

-49.5%

|

53.8

|

53.7

|

0.1%

|

|

Other

|

15.4

|

11.3

|

36.3%

|

59.3

|

84.2

|

-29.5%

|

.

|

Fourth Quarter

Results

2017

|

2018 Outlook

We expect to grow total capacity by 17% to 20% in 2018, consisting of an 8% to 10% increase in domestic ASKs through the replacement of smaller aircraft with A320neos, and a 55% to 60% increase in international capacity mostly related to the introduction of two A330s during the second half of 2017.

The A320neos

represented 14%

of our ASKs in 2017 and are expected to represent 27% of our 2018 total capacity.

With the introduction of more seats to our network, we expect CASK ex-fuel to decrease between 2% and 4% year over year

We have a multi-year margin expansion strategy, and we expect to grow our EBIT margin by one to two points per year over the next few years. Consistent with this trend, our EBIT guidance for 2017 was 9 to 11%, and our guidance for 2018 will be 11% to 13%.

These preliminary estimates exclude the impact of aircraft sale transactions and a potential joint venture with Correios.

|

FY 2018 Expected Results

|

|

Total ASK growth

Domestic

International

|

17% to 20%

8% to 10%

55% to 60%

|

|

Departures

|

3% to 4%

|

|

CASK ex-fuel

|

-2% to -4%

|

|

Operating margin

|

11% to 13%

|

Share Count

As of December 31, 2017 Azul had 928,965,058 common shares and 321,753,720 preferred shares or 334,139,921 equivalent preferred shares after applying the 75:1 conversion ratio.

In 2017, the weighted average number of common and preferred shares was 928,965,058 and 303,200,642, respectively, or 315,586,842 equivalent preferred shares.

|

Fourth Quarter

Results

2017

|

Conference Call Details

Thursday, March 8th, 2018

9h00 am (EST) | 11h00 am (Brasília time)

USA: +1 646 843 6054

Brazil: +55 11 2188 0155

Code: AZUL

Webcast: www.voeazul.com.br/ir

Replay:

+55 11 2188 0400

Code: Azul

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by number of cities served, offers 766 daily flights to 104 destinations. With an operating fleet of 122 aircraft and more than 10,000 crewmembers, the company has a network of 223 non-stop routes as of December 31, 2017. Among other awards received in 2017, Azul was elected third best airline in the world by TripAdvisor Travelers' Choice and best low cost carrier in South America for the seventh consecutive time by Skytrax. Azul also ranked as most on-time airline in Brazil and most on-time low-cost carrier in the Americas in 2017 according to OAG’s Punctuality League, the industry's most comprehensive annual ranking of on-time performance. For more information visit

www.voeazul.com.br

/ir.

Contact:

|

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

|

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

|

|

Fourth Quarter

Results

2017

|

Balance Sheet – IFRS (Unaudited)

|

(R$ million)

|

12/31/17

|

12/31/16

|

09/30/17

|

|

Assets

|

10,316.6

|

8,400.4

|

9,009.8

|

|

Current assets

|

3,304.3

|

1,910.3

|

2,663.0

|

|

Cash and cash equivalents

|

762.3

|

549.2

|

485.9

|

|

Short-term investments

|

1,036.1

|

331.2

|

932.9

|

|

Restricted investments

|

8.8

|

53.4

|

38.8

|

|

Trade and other receivables

|

914.4

|

673.3

|

810.0

|

|

Inventories

|

150.4

|

107.1

|

134.4

|

|

Taxes recoverable

|

112.9

|

44.5

|

102.4

|

|

Derivative financial instruments

|

10.3

|

17.6

|

6.0

|

|

Prepaid expenses

|

109.8

|

97.5

|

88.5

|

|

Related Parties

|

73.2

|

-

|

-

|

|

Other current assets

|

126.0

|

36.5

|

64.1

|

|

Non-current assets

|

7,012.3

|

6,490.1

|

6,346.8

|

|

Related parties

|

9.7

|

9.2

|

9.2

|

|

Long-term investments

|

836.0

|

753.2

|

807.8

|

|

Restricted investments

|

-

|

108.6

|

-

|

|

Security deposits and maintenance reserves

|

1,259.1

|

1,078.0

|

1,164.2

|

|

Derivative financial instruments

|

410.5

|

4.1

|

0.7

|

|

Prepaid expenses

|

4.5

|

6.9

|

-

|

|

Other non-current assets

|

206.0

|

147.4

|

160.3

|

|

Property and equipment

|

3,325.5

|

3,440.0

|

3,254.4

|

|

Intangible assets

|

961.0

|

942.6

|

950.3

|

|

Liabilities and equity

|

10,316.6

|

8,400.4

|

9,009.8

|

|

Current liabilities

|

3,334.4

|

3,617.6

|

3,806.8

|

|

Loans and financing

|

568.2

|

985.2

|

1,011.1

|

|

Accounts payable

|

953.5

|

1,034.3

|

874.3

|

|

Air traffic liability

|

1,287.4

|

949.4

|

1,300.2

|

|

Salaries, wages and benefits

|

246.3

|

186.5

|

245.5

|

|

Insurance premiums payable

|

24.4

|

24.3

|

0.3

|

|

Taxes payable

|

44.4

|

64.8

|

31.4

|

|

Federal tax installment payment program

|

9.8

|

6.5

|

32.1

|

|

Derivative financial instruments

|

48.5

|

211.1

|

164.0

|

|

Financial liabilities at fair value through profit and loss

|

-

|

44.7

|

-

|

|

Other current liabilities

|

151.7

|

110.9

|

148.0

|

|

Non-current liabilities

|

4,148.6

|

3,780.8

|

2,685.4

|

|

Loans and financing

|

2,921.7

|

3,049.3

|

1,893.8

|

|

Derivative financial instruments

|

378.4

|

20.2

|

10.8

|

|

Deferred income taxes

|

326.9

|

181.5

|

249.1

|

|

Federal tax installment payment program

|

105.4

|

75.6

|

116.6

|

|

Provision for tax, civil and labor risk

|

73.2

|

76.4

|

76.1

|

|

Other non-current liabilities

|

343.0

|

377.9

|

339.0

|

|

Equity

|

2,833.6

|

1,002.0

|

2,517.6

|

|

Issued capital

|

2,163.4

|

1,488.6

|

2,156.3

|

|

Capital reserve

|

1,898.9

|

1,291.0

|

1,894.3

|

|

Treasury shares

|

(2.7)

|

-

|

(1.7)

|

|

Accumulated other comprehensive income (loss)

|

(11.2)

|

(33.8)

|

(12.9)

|

|

Accumulated losses

|

(1,214.8)

|

(1,743.8)

|

(1,518.4)

|

15

|

Fourth Quarter

Results

2017

|

Cash Flow Statement – IFRS (Unaudited)

|

(R$ million)

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Income (loss) for the quarter

|

303.7

|

51.3

|

491.9%

|

529.0

|

(126.3)

|

518.8%

|

|

Total non-cash adjustments

|

(49.6)

|

179.2

|

-127.7%

|

433.5

|

264.1

|

64.2%

|

|

Total working capital adjustments

|

(165.3)

|

126.9

|

-230.3%

|

(365.1)

|

259.0

|

-241.0%

|

|

Net cash flows used from operations

|

88.7

|

357.4

|

-75.2%

|

597.4

|

396.7

|

50.6%

|

|

Interest paid

|

(48.9)

|

(37.9)

|

29.1%

|

(301.9)

|

(342.8)

|

-11.9%

|

|

Net cash used by operating activities

|

39.8

|

319.5

|

-87.5%

|

295.5

|

54.0

|

447.5%

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Short-term investment

|

(94.2)

|

(274.0)

|

-65.6%

|

(629.6)

|

(301.8)

|

108.6%

|

|

Long-term investment

|

-

|

(1.1)

|

-100.0%

|

1.1

|

(361.9)

|

100.3%

|

|

Restricted investments

|

30.4

|

71.3

|

-57.3%

|

120.9

|

(70.6)

|

271.3%

|

|

Cash received on sale of property and equipment

|

-

|

53.7

|

-100.0%

|

177.3

|

532.0

|

-66.7%

|

|

Acquisition of intangible

|

(21.2)

|

(8.9)

|

137.8%

|

(56.1)

|

(56.3)

|

-0.3%

|

|

Acquisition of property and equipment

|

(119.3)

|

(123.6)

|

-3.5%

|

(589.5)

|

(385.8)

|

52.8%

|

|

Net cash used in investing activities

|

(204.2)

|

(282.6)

|

-27.7%

|

(975.8)

|

(644.3)

|

51.4%

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Loans

|

|

|

|

|

|

|

|

Proceeds

|

1,566.8

|

255.9

|

512.2%

|

1,750.1

|

833.0

|

110.1%

|

|

Repayment

|

(139.1)

|

(207.1)

|

-32.8%

|

(1,090.3)

|

(1,399.1)

|

-22.1%

|

|

Debentures

|

|

|

|

|

|

|

|

Proceeds

|

2.9

|

146.6

|

-98.0%

|

200.0

|

146.6

|

36.4%

|

|

Repayment

|

(953.0)

|

(74.7)

|

1175.7%

|

(1,153.2)

|

(150.0)

|

668.8%

|

|

Redemption of preferred shares

|

-

|

(35.7)

|

-100.0%

|

(44.7)

|

(346.3)

|

-87.1%

|

|

Related partie

|

-

|

(0.1)

|

-100.0%

|

-

|

(9.2)

|

-100.0%

|

|

Capital increase

|

(28.8)

|

(2.8)

|

928.2%

|

1,231.3

|

1,451.6

|

-15.2%

|

|

Treasury shares

|

(1.1)

|

-

|

n.a.

|

(2.7)

|

-

|

n.a.

|

|

Loan to shareholder

|

(47.2)

|

-

|

n.a.

|

(73.2)

|

-

|

n.a.

|

|

Sales and leaseback

|

-

|

-

|

n.a.

|

39.5

|

-

|

n.a.

|

|

Net cash provided by financing activities

|

400.5

|

82.2

|

387.1%

|

856.7

|

526.7

|

62.7%

|

|

|

|

|

|

|

|

|

|

Exchange gain and (losses) on cash and cash equivalents

|

40.4

|

0.2

|

24569.5%

|

36.8

|

(23.6)

|

255.9%

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

276.5

|

119.3

|

131.7%

|

213.2

|

(87.3)

|

344.0%

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

485.9

|

429.9

|

13.0%

|

549.2

|

636.5

|

-13.7%

|

|

Cash and cash equivalents at the end of the period

|

762.3

|

549.2

|

38.8%

|

762.3

|

549.2

|

38.8%

|

|

Fourth Quarter

Results

2017

|

EBITDAR Reconciliation

|

R$ million

|

4Q17

|

4Q16

|

% ∆

|

2017

|

2016

|

% ∆

|

|

Net income (loss)

|

303.7

|

51.3

|

491.9%

|

529.0

|

(126.3)

|

518.8%

|

|

Income taxes

|

(74.3)

|

(61.0)

|

-21.8%

|

(68.8)

|

(144.0)

|

52.2%

|

|

Net financial result

|

(77.4)

|

(149.7)

|

-48.3%

|

(461.5)

|

(489.7)

|

-5.7%

|

|

Related parties result

|

149.7

|

92.0

|

62.7%

|

194.4

|

163.0

|

19.2%

|

|

Operating income

|

305.6

|

170.0

|

79.8%

|

865.0

|

344.3

|

151.3%

|

|

Depreciation and amortization

|

53.2

|

75.3

|

-29.3%

|

299.8

|

301.2

|

-0.5%

|

|

Aircraft and other rent

|

315.3

|

281.9

|

11.9%

|

1,181.7

|

1,160.9

|

1.8%

|

|

EBITDAR

|

674.2

|

527.1

|

27.9%

|

2,346.5

|

1,806.4

|

29.9%

|

|

Fourth Quarter

Results

2017

|

Glossary

Aircraft Utilization

Average number of block hours per day per aircraft operated.

Available Seat Kilometers (ASK)

Number of aircraft seats multiplied by the number of kilometers flown.

Completion Factor

Percentage of accomplished flights.

Cost per ASK (CASK)

Operating expenses divided by available seat kilometers.

Cost per ASK ex-fuel (CASK ex-fuel)

Operating expenses divided by available seat kilometers excluding fuel expenses.

EBITDAR

Earnings before interest, taxes, depreciation, amortization, and aircraft rent. A common metric used in the airline industry to measure operating performance.

Load Factor

Number of passengers as a percentage of number of seats flown (calculated by dividing RPK by ASK).

Revenue Passenger Kilometers (RPK)

One-fare paying passenger transported one kilometer. RPK is calculated by multiplying the number of revenue passengers by the number of kilometers flown.

Passenger Revenue per Available Seat Kilometer (PRASK)

Passenger revenue divided by available seat kilometers (also equal to load factor multiplied by yield).

Revenue per ASK (RASK)

Operating revenue divided by available seat kilometers.

Stage Length

The average number of kilometers flown per flight.

Trip Cost

Average cost of each flight calculated by dividing total operating expenses by total number of departures.

Yield

Average amount paid per passenger to fly one kilometer. Usually, yield is calculated as average revenue per revenue passenger kilometer, or cents per RPK.

|

Fourth Quarter

Results

2017

|

This press release includes estimates and forward-looking statements within the meaning of the U.S. federal securities laws. These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our preferred shares, including in the form of ADSs. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us. In addition, in this release, the words “may,” “will,” “estimate,” “anticipate,” “intend,” “expect,” “should” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. Azul is not under the obligation to update publicly or to revise any forward-looking statements after we distribute this press release because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this release might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements.

In this press release, we present EBITDAR, which is a non-IFRS performance measure and is not a financial performance measure determined in accordance with IFRS and should not be considered in isolation or as alternatives to operating income or net income or loss, or as indications of operating performance, or as alternatives to operating cash flows, or as indicators of liquidity, or as the basis for the distribution of dividends. Accordingly, you are cautioned not to place undue reliance on this information.

This metric is included as supplemental disclosure because (i) we believe EBITDAR is traditionally used by aviation analysts and investors to determine the equity value of airlines and (ii) EBITDAR is one of the metrics used in our debt financing instruments for financial reporting purposes. We believe EBITDAR is useful for equity valuation purposes because (i) its calculation isolates the effects of financing in general, as well as the accounting effects of capital spending and acquisitions (primarily aircraft) which may be acquired directly subject to acquisition debt (loans and finance leases) or by operating leases, each of which is presented differently for accounting purposes and (ii) using a multiple of EBITDAR to calculate enterprise value allows for an adjustment to the balance sheet to recognize estimated liabilities arising from off-balance sheet operating leases. However, EBITDAR is not a financial measure in accordance with IFRS, and should not be viewed as a measure of overall performance or considered in isolation or as an alternative to net income, an alternative to operating cash flows, a measure of liquidity, or the basis for dividend distribution because it excludes the cost of aircraft and other rent and is provided for the limited purposes contained herein.

The valuation measure EBITDAR has limitations as an analytical tool. Some of these limitations are: (i) EBITDAR does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; (ii) EBITDAR does not reflect changes in, or cash requirements for, our working capital needs; (iii) EBITDAR does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debts; (iv) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and EBITDAR does not reflect any cash requirements for such replacements; and (v) is susceptible to varying calculations and therefore may differ materially from similarly titled measures presented by other companies in our industry, limiting their usefulness as comparative measures. Because of these limitations EBITDAR should not be considered in isolation or as a substitute for financial measures calculated in accordance with IFRS. Other companies may calculate EBITDAR differently than us.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 8, 2018

Azul S.A.

By: /s/

Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

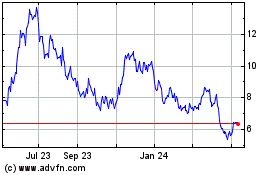

Azul (NYSE:AZUL)

Historical Stock Chart

From Aug 2024 to Sep 2024

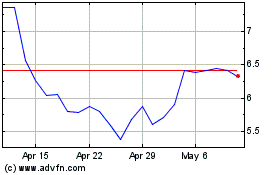

Azul (NYSE:AZUL)

Historical Stock Chart

From Sep 2023 to Sep 2024